Menstrual Health Apps Market

Menstrual Health Apps Market Size, Share & Trends Analysis Report by Application (Period Cycle Tracking, Fertility & Ovulation Management, Menstrual Health Management, and Others), and by Platform (Android, and iOS) Forecast Period (2024-2031)

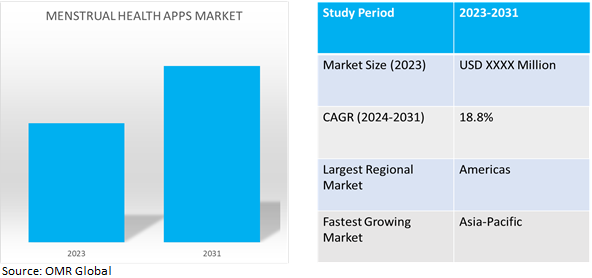

Menstrual health apps market is anticipated to grow at a CAGR of 18.8% during the forecast period (2024-2031). The market expansion is driven by rising health awareness among women, digital literacy, smartphone usage, higher disposable income, improved internet connectivity, and the emergence of new market players.

Market Dynamics

Increasing Awareness and Acceptance

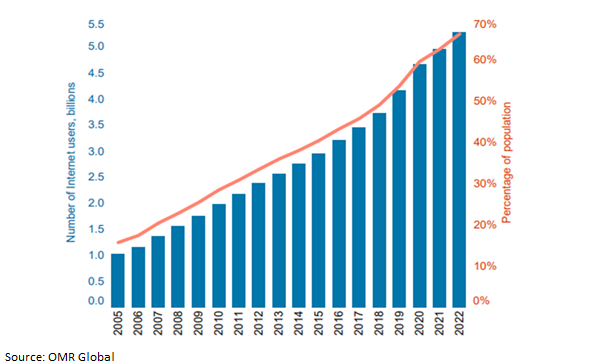

The potential to effectively track menstrual cycles, symptoms, and general reproductive health has led to an increase in the utilization of menstrual health apps.According to the International Telecommunication Union (ITU) in 2022, it estimates $5.3 billion individual, or 66% of the global population, are expected to utilize the Internet globally. It represents an increase in growth from 5.1% for 2020–2021 to 6.1% for 2021, however it continues to be modest compared to the 11% for 2019–2020 observed at the start of the COVID-19. That implies that $2.7 billion individuals globally continue to be offline, highlighting the significant amount of productivity that has to be accomplished in order to achieve the global goal of meaningful and universal connectivity by 2030.

Internet usage (Individuals using the Internet)

Source: International Telecommunication Union (ITU)

Market Segmentation

Our in-depth analysis of the global menstrual health apps market includes the following segments by application and platform:

- Based on application, the market is augmented into period cycle tracking, fertility & ovulation management, menstrual health management, and others (symptom monitoring, and health education and information).

- Based on platform, the market is sub-segmented into android, and iOS.

Period Cycle Tracking is Projected to Emerge as the Largest Segment

Based on the application, the menstrual health apps market is sub-segmented into period cycle tracking, fertility & ovulation management, menstrual health management, and others. Among these, the period cycle tracking sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing demand for the increasing awareness and initiatives to de-stigmatize menstruation have been partially responsible for the acceptability and adoption of menstrual health applications across the globe. For instance, in June 2022, Sirona launched WhatsApp chatbot for period tracking.The tool aids menstruators globally by tracking periods, promoting menstrual health and hygiene, and providing a range of feminine hygiene products to address period, intimate, and toilet hygiene issues.

iOS Providers Sub-segment to Hold a Considerable Market Share

Technological advancements in mobile platforms, including iOS, have enabled the development of advanced menstrual health apps, making it more accessible and convenient for women.According the National Center for Biotechnology Information (NCBI) report, in April 2022, the period tracker apps are popular, with 7% of Apple's 90,088 health apps focusing on women's health and pregnancy. However, users choose apps that provide accurate information, predict periods effectively, and are beneficial to lifestyle.

Regional Outlook

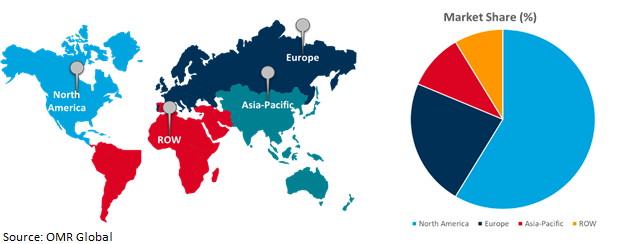

The global menstrual health apps market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Importance of Government Support and Policy Advocacy in Menstrual Health Initiatives in Asia-Pacific Region

Government support and policy advocacy are essential for enhancing menstrual health initiatives, addressing systemic barriers, mobilizing resources, and ensuring sustainable funding and support for programs. For instance, in May 2020, Essar Foundation launched the Sahej app to raise awareness about menstrual hygiene and distribute over 400,000 sanitary napkins to women in Mumbai slums and the Mumbai Police. The app, developed in consultation with NGOs such as, Rotaract Club, Kavach A Movement, and Ghar Bachao Ghar Banao Andolan, offers a one-stop solution for women to menstruate with dignity, a unique e-store of menstrual products, and interactive game-based learning.

Global Menstrual Health Apps Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the growing demand for the demand for resources is rising as a result of activities that support education and empowerment regarding women's health, particularly menstrual health, prosperity, and contraception.According to the National Center for Biotechnology Information (gov.) in April 2022, the FemTech apps encompass a wide range of technologies designed to support women's health, including apps for fertility tracking, contraception, and menstrual cycle monitoring. These apps have gained significant popularity, with over 200 million downloads, making them one of the top health app categories for adults. The FemTech market is projected to reach a value of $50 billion by 2025, reflecting its continuous growth and potential influence.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving the global menstrual health apps market include, Apple Inc.,Clue,Flo Health Inc.,NaturalCycles AG, Ovuline, Inc., and others. and others. and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, Froedtert Health and ThedaCare merged and aimed to improve health care in Wisconsin. The combined system focused on predicting, preventing, and adding value to communities' health, providing exceptional safety, reliability, equity, coordination, and accessibility, and enhancing the Medical College of Wisconsin's mission by advancing new therapies and evidence-based approaches.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global menstrual health apps market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Apple Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Clue

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Flo Health Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Menstrual Health Apps Market by Application

4.1.1. Period Cycle Tracking

4.1.2. Fertility & Ovulation Management

4.1.3. Menstrual Health Management

4.1.4. Others(Symptom Monitoring, and Health Education and Information)

4.2. Global Menstrual Health Apps Market by Platform

4.2.1. Android

4.2.2. iOS

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Eve by Glow

6.2. FemCy

6.3. FEMOMETER INC

6.4. Kindara Inc.

6.5. NaturalCycles AG

6.6. Ovuline, Inc.

6.7. Period Tracker by Leap Fitness Group

6.8. Planned Parenthood Federation of America, Inc.

6.9. Playtex

6.10. Sasha Cayward ’22

6.11. Sevenlogics, Inc

6.12. Simple Design.Ltd

6.13. Sirona App

6.14. SOFTONIC INTERNATIONAL S.A.

1. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL MENSTRUAL HEALTH APPS IN PERIOD CYCLE TRACKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MENSTRUAL HEALTH APPS IN FERTILITY & OVULATION MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MENSTRUAL HEALTH APPS IN MENSTRUAL HEALTH MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL MENSTRUAL HEALTH APPS IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

7. GLOBAL MENSTRUAL HEALTH APPS FOR ANDROID MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MENSTRUAL HEALTH APPS FOR IOS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MENSTRUAL HEALTH APPS FOR SOCIAL MEDIA PLATFORMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL MENSTRUAL HEALTH APPS FOR OTHER PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

15. EUROPEAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

18. ASIA- PACIFIC MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA- PACIFIC MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

20. ASIA- PACIFIC MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

21. REST OF THE WORLD MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. REST OF THE WORLD MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

1. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL MENSTRUAL HEALTH APPS IN PERIOD CYCLE TRACKING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL MENSTRUAL HEALTH APPS IN FERTILITY & OVULATION MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL MENSTRUAL HEALTH APPS IN MENSTRUAL HEALTH MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL MENSTRUAL HEALTH APPS IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023 VS 2031 (%)

7. GLOBAL MENSTRUAL HEALTH APPS FOR ANDROID MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL MENSTRUAL HEALTH APPS FOR IOS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL MENSTRUAL HEALTH APPS FOR SOCIAL MEDIA PLATFORMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL MENSTRUAL HEALTH APPS FOR OTHER PLATFORM MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL MENSTRUAL HEALTH APPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. US MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

14. UK MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)

26. THE MIDDLE EAST & AFRICA MENSTRUAL HEALTH APPS MARKET SIZE, 2023-2031 ($ MILLION)