Mobile Substation Market

Global Mobile Substation Market Size, Share & Trends Analysis Report by Application (Utilities and Industrial (Oil & Gas, Metals & Mining, and Others)) Forecast Period (2021-2027)

The global mobile substation market is anticipated to grow at a CAGR of around 7.8% during the forecast period. The mobile substation is the backup unit of energy requirements during emergencies. Additionally, it is used for temporary power transmission and distribution. This mobile substation is majorly used during disasters and wars for continuous power supply, and to reduce electricity outages when conventional substations are faulted. The wide application of mobile substations in industrial, utilities, and residential sectors is the major factor driving the growth of the mobile substation market. In the emerging economies, remote areas are not connected to the power supply grid that generates opportunities for the mobile substations to fulfil the requirements of those locations.

The maintenance of mobile substations is a major challenging factor for the market growth as sudden failure of substations may halt the operations at the location of deployment. Additionally, lack of product awareness about mobile substations is another restraining factor that may hinder the market growth during the forecast period.

Impact of COVID-19 Pandemic on Global Mobile Substation Market

The COVID-19 pandemic had disrupted the normal operations of automotive, chemicals, oil & gas, energy & power, mining, and manufacturing. The pandemic had also impacted the supply of raw materials, including components, equipment, and systems that are necessary for the manufacturing of mobile substations. Thus, the reduction in the production and demand of mobile substations had greatly reduced the revenue of the mobile substation market players.

Segmental Outlook

The global mobile substation market is segmented based on application into utilities and industrial, oil & gas, metals & mining, and others. Based on application, the utility segment holds a prominent share in the mobile substation market as the mobile substation serves as a bridge between the utility demands of energy, especially in the emerging economic nations. The expansion of sustainable power generation sources including solar, wind, and hydro are giving momentum to the growth of this segment.

Regional Outlooks

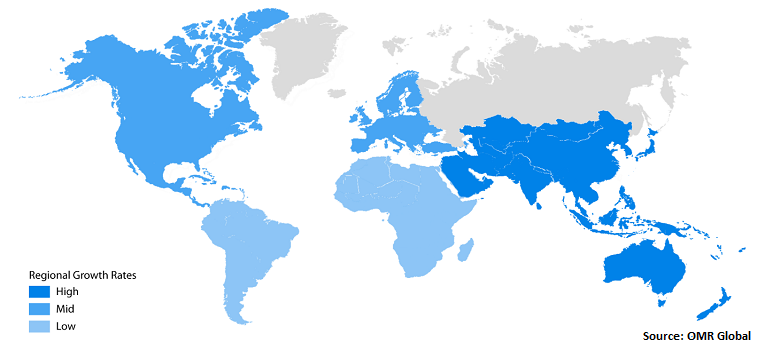

The global mobile substation market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, and the Rest of Asia-Pacific), and the Rest of the World.

Global Mobile Substation Market Growth by Region, 2021-2027

North America Holds a Prominent Share in the Global Mobile Substation Market

North America is projected to hold a prominent share in the global mobile substation market. The rising demand for continuous, reliable, and advanced solutions for transmission and distribution of power supply is the major factor driving the regional growth of the market. Moreover, the development of data centers, ports, and construction sites is propelling the growth of the market.

The rising mining activities in the Asia-Pacific is the major reason for the increasing demand for mobile substations in the region, as mining activities need a continuous supply of electricity. The Middle East and African governments are actively promoting infrastructural development and electrification activities which will drive the mobile substation market in the region. For instance, the UAE government had established the Emirates Tourism Council in January 2021 for the strengthening of the tourism industry of the country.

Market Players Outlook

Some of the companies operating in the global mobile substation market include ABB Ltd., AZZ Inc., CG Power, and Industrial Solution Ltd., General Electric Co., Siemens AG, Delta Star AG, Atlas Electric Inc., Unit Electrical Engineering Ltd., and others. The market players are considerably contributing to the market growth by adopting various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, ABB had received a contract from Iraq in June 2018, for the supply of 5 fixed and 15 mobile 132 kV substations. These substations had been used there for the strengthening of the power grid of central Iraq.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global mobile substation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. ABB Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. General Electric Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Siemens AG

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Toyota Tsusho Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Hitachi ABB Power Grids Ltd.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Mobile Substation Market by Application

5.1.1. Utilities

5.1.2. Industrial (Oil & Gas, Metals & Mining, and Others)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Aktif Group

7.3. Atlas Electric Inc.

7.4. AZZ Inc.

7.5. CG Power and Industrial Solution Ltd.

7.6. Delta Star Inc.

7.7. EATON Corp.

7.8. EKOSinerji

7.9. Elgin Power Solutions

7.10. ELSEWEDY ELECTRIC S.A.E.

7.11. Enerset Power Solutions

7.12. General Electric Co.

7.13. Hitachi ABB Power Grids Ltd.

7.14. Jacobsen Elektro AS

7.15. Qingdao TGOOD Electric

7.16. Matelec Group

7.17. Meidensha Corp.

7.18. Nari Group Corp.

7.19. Siemens AG

7.20. Tadeo Czerweny S.A.

7.21. Toyota Tsusho Corp.

7.22. Unit Electrical Engineering Ltd.

7.23. WEG

1. GLOBAL MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

2. GLOBAL MOBILE SUBSTATION FOR UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL MOBILE SUBSTATION FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

5. NORTH AMERICAN MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

6. NORTH AMERICAN MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

7. EUROPEAN MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

8. EUROPEAN MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

9. ASIA-PACIFIC MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. ASIA-PACIFIC MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

11. REST OF THE WORLD MOBILE SUBSTATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. GLOBAL MOBILE SUBSTATION MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

2. GLOBAL MOBILE SUBSTATION FOR UTILITIES MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

3. GLOBAL MOBILE SUBSTATION FOR INDUSTRIAL MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL MOBILE SUBSTATION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. US MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

6. CANADA MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

7. UK MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

8. FRANCE MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

9. GERMANY MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

10. ITALY MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

11. SPAIN MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

12. REST OF EUROPE MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

13. INDIA MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

14. CHINA MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

15. JAPAN MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

16. REST OF ASIA-PACIFIC MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)

17. REST OF THE WORLD MOBILE SUBSTATION MARKET SIZE, 2020-2027 ($ MILLION)