Monoclonal Antibodies Market

Global Monoclonal Antibodies Market Size, Share & Trends Analysis Report, By Source (Murine, Chimeric, Human, and Humanized), By Application (Cancer, Infectious Diseases, Auto-Immune Diseases, Inflammatory Diseases, and Others) and Forecast, 2020-2026

The global monoclonal antibodies market is estimated to grow at a CAGR of 8.6% during the forecast period. The increasing prevalence of cancer and auto-immune diseases and increasing research on monoclonal antibodies are some crucial factors accelerating market growth. There are more than 80 autoimmune diseases and some of them are well known, including multiple sclerosis, type 1 diabetes, rheumatoid arthritis, and lupus, while others are difficult and rare to diagnose. National Institutes of Health (NIH) estimates that auto-immune diseases affect over 24 million people in the US and a further eight million people have autoantibodies, blood molecules which show an individual’s possibility of developing an autoimmune disease.

Type 1 diabetes is a kind of autoimmune disease. In type 1 diabetes, the immune system attacks and destroys the cells that produce insulin, and thereby, the pancreas are not able to produce insulin. As per the International Diabetes Federation (IDF), nearly 10% of all people suffering from diabetes have type 1 diabetes. Anti-CD3 monoclonal antibodies are a novel class of drugs that are indicated to support preserve function of beta-cell if used early in the onset of type 1 diabetes mellitus. Preserving beta-cell function might delay the requirement for exogenous insulin treatment, which in turn, minimizes the risks of low blood sugar (hypoglycemic) events that are associated with insulin treatment.

Some monoclonal antibodies for type-1 diabetes are in clinical phases. For instance, in May 2019, GeNeuro declared positive phase IIa trial outcomes for temelimab. It is a monoclonal antibody targeting protein involved in the inception and development of type 1 diabetes, which makes the drug an effective disease-modifying therapy for type-1 diabetes. A 30% decrease in hypoglycemic events has been reported by research among adults suffering from type 1 diabetes treated with temelimab. Such kinds of monoclonal antibody therapies are expected to deliver hope for patients with type-1 diabetes to reduce the possibility of hypoglycemia.

Market Segmentation

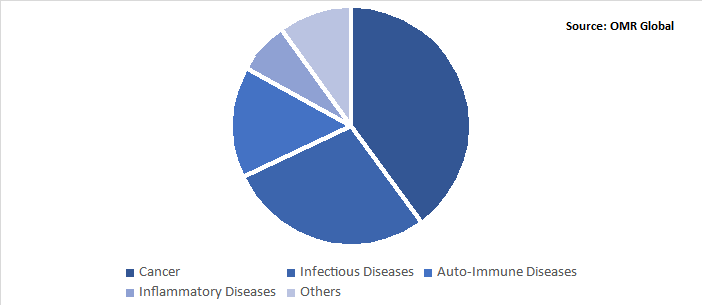

The global monoclonal antibodies market is segmented based on source and application. Based on the source, the market is classified into murine, chimeric, human, and humanized. Based on the application, the market is classified into cancer, infectious diseases, auto-immune diseases, inflammatory diseases, and others.

Cancer Held the Largest Share in the Application Segment

The increasing prevalence of cancer and the rising preference of monoclonal antibody drugs as targeted and immunotherapy are some crucial factors accelerating market growth. As per the World Health Organization (WHO), in 2018, 18.1 million new cancer incidences were reported globally. Monoclonal antibodies served as one of the established therapeutic strategies for both solid tumors and hematologic malignancies. It is a type of immunotherapy that stimulates the immune system of cancer patients and works to find and attack cancer cells. Some monoclonal antibody drugs that are available for cancer treatment include trastuzumab (Herceptin), rituximab (Mabthera), pertuzumab (Perjeta), and bevacizumab (Avastin).

Global Monoclonal Antibodies Market Share by Application, 2019 (%)

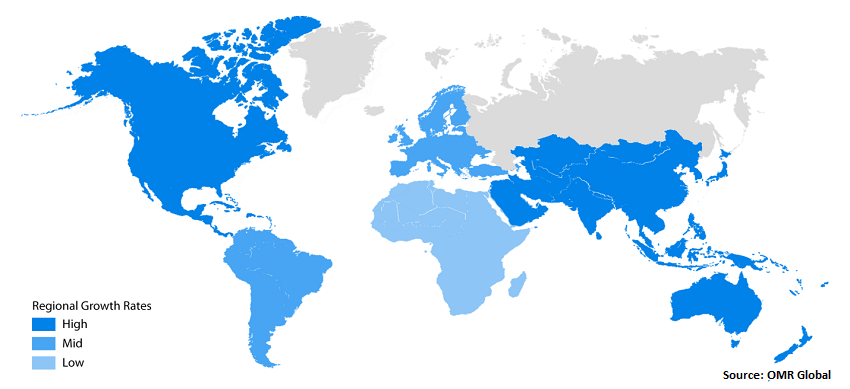

Regional Analysis

Geographically, North America held the largest share in the market owing to the increasing launches of new monoclonal antibody therapies and the significant prevalence of cancer and inflammatory diseases in the region. As per the Centers for Disease Control and Prevention (CDC), in 2015, nearly 3 million or 1.3% of the US adults were reported being diagnosed with inflammatory bowel disease (either ulcerative colitis or Crohn’s disease). This was a considerable rise from 1999 (0.9% or 2 million adults). Monoclonal antibody agents currently approved for use in inflammatory bowel disease include adalimumab, infliximab (IFX), certolizumab, and natalizumab. Infliximab (IFX) is a therapeutic monoclonal antibody against TNF-? that is utilized to stimulate and maintain remission among patients suffering from moderate to severe Crohn's disease. Adalimumab is a completely humanized monoclonal antibody to TNFa which is provided subcutaneously on a biweekly basis. Natalizumab is used against integrin molecules, which are associated with attracting inflammatory cells to tissues.

Global Monoclonal Antibodies Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Amgen Inc., Eli Lilly & Co., F. Hoffman-La Roche AG, Pfizer Inc., and Novartis AG. These players are using some potential strategies such as product launches and partnerships and collaborations to increase their position in the marketplace. For instance, In January 2020, Roche declared that the European Commission has permitted conditional marketing authorization for Polivy (polatuzumab vedotin), along with bendamustine plus MabThera (rituximab) (BR), to treat adult patients with relapsed or refractory (R/R) diffuse large B-cell lymphoma (DLBCL) who are not candidates for a haematopoietic stem cell transplant.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global monoclonal antibodies market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amgen Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Eli Lilly and Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. F. Hoffmann-La Roche AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pfizer Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Novartis AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Monoclonal Antibodies Market by Source

5.1.1. Murine

5.1.2. Chimeric

5.1.3. Human

5.1.4. Humanized

5.2. Global Monoclonal Antibodies Market by Application

5.2.1. Cancer

5.2.2. Infectious Diseases

5.2.3. Auto-Immune Diseases

5.2.4. Inflammatory Diseases

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie, Inc.

7.2. Amgen, Inc.

7.3. AstraZeneca plc

7.4. Aytu BioScience, Inc.

7.5. Bayer AG

7.6. Biocon, Ltd.

7.7. Biogen, Inc.

7.8. Bristol Myers Squibb Co.

7.9. Cadila Pharmaceuticals, Ltd.

7.10. Daiichi Sankyo Company, Ltd.

7.11. Dr. Reddy's Laboratories, Inc.

7.12. Eli Lilly and Co.

7.13. F. Hoffmann-La Roche AG

7.14. Genmab A/S

7.15. Gilead Sciences, Inc.

7.16. GlaxoSmithKline plc

7.17. Innate Pharma S.A.

7.18. Intas Biopharmaceuticals, Ltd.

7.19. Johnson & Johnson Services, Inc.

7.20. Lupin, Ltd.

7.21. Merck & Co., Inc.

7.22. Mylan N.V.

7.23. Novartis AG

7.24. Oncologie, Inc.

7.25. Orchard Therapeutics plc

7.26. Pfizer, Inc.

7.27. Sanofi S.A.

7.28. Spectrum Pharmaceuticals, Inc.

7.29. Sun Pharmaceutical Industries, Ltd.

7.30. Takeda Pharmaceutical Co., Ltd.

1. GLOBAL MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

2. GLOBAL MURINE MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CHIMERIC MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HUMAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL HUMANIZED MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. GLOBAL MONOCLONAL ANTIBODIES IN CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL MONOCLONAL ANTIBODIES IN INFECTIOUS DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL MONOCLONAL ANTIBODIES IN AUTO-IMMUNE DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL MONOCLONAL ANTIBODIES IN INFLAMMATORY DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL MONOCLONAL ANTIBODIES IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. EUROPEAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

18. EUROPEAN MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. REST OF THE WORLD MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY SOURCE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL MONOCLONAL ANTIBODIES MARKET SHARE BY SOURCE, 2019 VS 2026 (%)

2. GLOBAL MONOCLONAL ANTIBODIES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL MONOCLONAL ANTIBODIES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD MONOCLONAL ANTIBODIES MARKET SIZE, 2019-2026 ($ MILLION)