Network Packet Broker Market

Global Network Packet Broker Market Size, Share & Trends Analysis Report by Bandwidth (1 Gbps and 10 Gbps, 40 Gbps, and 100 Gbps), By End-User (Service Providers, Enterprises and Government Organization) and Forecast 2019-2025

The global network packet broker market is projected to grow at a significant CAGR of over 7% during the forecast period. The market-driven by the increasing adoption of cloud-based services coupled with the growing application of network security tools across various enterprises and government organizations. Rising adoption of the cloud platform is attributed to the faster deployment of new capabilities to drive innovative business solutions.

Enterprises across the globe are adopting cloud-based platforms for storing data as large storage space is required by the commercial data generated by small & medium-sized enterprises and large enterprises. Further, with the increasing amount of data generated through IoT, many enterprises have shifted their data to the cloud storage by choosing service providers. Therefore, increasing demand for cloud data requires network security tools that contribute to the growth of the network packet broker market.

Segmental Outlook

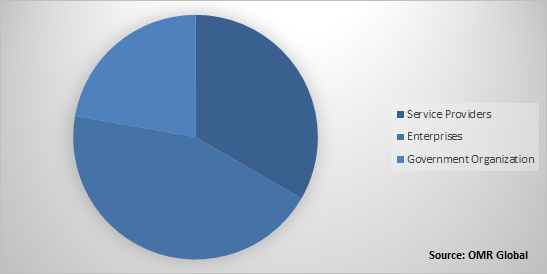

The global network packet broker market is classified on the basis of bandwidth and application. Based on the bandwidth, the market is classified into 1 Gbps & 10 Gbps, 40 Gbps, and 100 Gbps. The 1 Gbps & 10 Gbps network packet broker segment is projected to have significant growth in the market. On the basis of end-user, the market is segregated into service providers, enterprises, and government organization

Global Foldable display Market Share by End-User, 2018(%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global network packet broker market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cisco Systems, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Gigamon Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Ixia, a Keysight Technologies, Inc. company

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. NETSCOUT Systems, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. VIAVI Solutions Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Network Packet Broker Market by Bandwidth

5.1.1. 1 Gbps and 10 Gbps

5.1.2. 40 Gbps

5.1.3. 100 Gbps

5.2. Global Network Packet Broker Market by End-User

5.2.1. Service Providers

5.2.2. Enterprises

5.2.3. Government Organization

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. APCON, Inc.

7.2. Big Switch Networks, Inc.

7.3. Broadcom Inc.

7.4. Calient Technologies, Inc.

7.5. Cisco Systems, Inc.

7.6. Corvil Ltd.

7.7. Cubro Acronet GesmbH

7.8. Datacom Systems Inc.

7.9. Garland Bandwidth LLC

7.10. Gigamon Inc.

7.11. Ixia (a Keysight Technologies, Inc. Company)

7.12. Juniper Networks, Inc.

7.13. Mindarray Systems Pvt. Ltd.

7.14. NETGEAR Inc.,

7.15. NETSCOUT Systems, Inc.

7.16. Network Critical Solutions Ltd.

7.17. Niagara Networks, Inc.

7.18. Profitap HQ B.V.

7.19. VIAVI Solutions Inc.

7.20. Zenoss Inc.

1. GLOBAL NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2018-2025 ($ MILLION)

2. GLOBAL 1 GBPS AND 10 GBPS NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL 40 GBPS NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL 100 GBPS NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

6. GLOBAL NETWORK PACKET BROKER IN SERVICE PROVIDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL NETWORK PACKET BROKER IN ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL NETWORK PACKET BROKER IN GOVERNMENT ORGANIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2018-2025 ($ MILLION)

12. NORTH AMERICAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

13. EUROPEAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2018-2025 ($ MILLION)

15. EUROPEAN NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

19. REST OF THE WORLD NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY BANDWIDTH, 2018-2025 ($ MILLION)

20. REST OF THE WORLD NETWORK PACKET BROKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL NETWORK PACKET BROKER MARKET SHARE BY BANDWIDTH, 2018 VS 2025 (%)

2. GLOBAL NETWORK PACKET BROKER MARKET SHARE BY END-USER, 2018 VS 2025 (%)

3. GLOBAL NETWORK PACKET BROKER MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

6. UK NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD NETWORK PACKET BROKER MARKET SIZE, 2018-2025 ($ MILLION)