Oilfield Auxiliary Rental Equipment Market

Oilfield Auxiliary Rental Equipment Market Size, Share & Trends Analysis Report byEquipment (Drilling Equipment, Pressure and Flow Control Equipment, Fishing Equipment and Others), and by Application (Onshore and Offshore) Forecast Period (2024-2031)

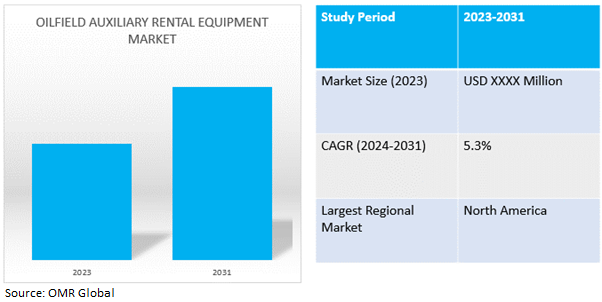

Oilfield auxiliary rental equipment market is anticipated to grow at a CAGR of 5.3% during the forecast period (2024-2031). Oilfield auxiliary equipment are machines and instruments that are used to supplement the drilling process at oilfields. The equipment used less frequently on the oilfield are availed on rent by various oil extraction companies.

Market Dynamics

Emerging Offshore Opportunities

Offshore exploration, drilling, and production activities necessitate different environmental and technical considerations than onshore oil and gas activities. Despite the challenges posed by such harsh offshore environmental conditions, advances in exploration and production technology for use in ice-prone regions such as the Grand Banks, Bohai Sea, Caspian Sea, Cook Inlet, and Sakhalin Island have developed economically viable production solutions. The global slowdown in oil prices has resulted in a decrease in drilling activity in recent years, putting additional pressure on offshore drillers and service providers. However, opportunities for offshore drillers are expected to grow as the industry gradually recovers.

Technological Advancement in Oilfield Equipment

Oil and gas companies are shifting their exploration focus to unconventional and deep hydrocarbon reservoirs such as shale gas, coal bed methane, tight gas, and heavy oil. To perform operations in various unconventional and deep reservoir conditions, the petroleum industry now has advanced IT-based machinery and software. This paves the way for new age technology to be used as a tool to carry out difficult operations. For instance, an advanced Radio Frequency Identification (RFID) circulation sub that aids in drilling and hole-clean-up operations. The RFID circulation sub allows operators to reduce non-productive time. The use of advanced drilling and completion technologies has made drilling in shale formations financially viable. Traditional equipment is not fully equipped to meet new challenges.

Market Segmentation

Our in-depth analysis of the global oilfieldauxiliary rental equipmentmarket includes the following segments by equipment, and application:

- Based on equipment, the market is sub-segmented into drilling equipment, pressure and flow control equipment, fishing equipment and others.

- Based on application, the market is bifurcated into onshore andoffshore.

Drilling Equipment is Projected to Emerge as the Largest Segment

Based on equipment, the drilling equipment segment hold the largest share of oilfield auxiliary rental equipment market . This is attributed to rise in number of oil & gas exploration and production activities in the countries, including North America, Asia-Pacific, and Africa. In addition, rise in awareness of maintenance and recovery of aged & abandoned oil wells to enhance production propels the growth of oilfield auxiliary rental equipment market.

Onshore Sub-segment to Hold a Considerable Market Share

The onshore segment hold a considerbale market share. This is attributed to increase in efficiency of onshore exploration & production compared to offshore wells and rise in number of developed onshore oil wells across the globe. In addition, presence of large number of onshore sites in the countries, including the U.S., Middle East, and Southeast Asia propels the market growth, as onshore sites are easily operatable and take less years for production in comparison to offshore. Moreover, 70% of the world’s oil & gas come from onshore sites, which notably contribute to the growth of the oilfield auxiliary rental equipment market.

Regional Outlook

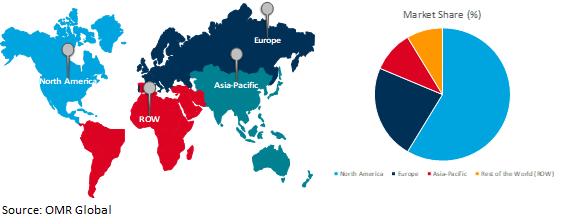

The global oilfield auxiliary rental equipment market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Oilfield Auxiliary Rental Equipment Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share and is expected to have the largest oilfield equipment rental services market share due to higher unconventional hydrocarbon production than other regions. Furthermore, the Gulf of Mexico is currently focusing on expanding its offshore exploration and production activities. As a result of increased production activities, these regions are gaining traction. During the forecast period, Canada is expected to increase its production rate. North America is the fourth-largest producer of crude oil, accounting for more than 31.0% of global production. This prospect has prompted mature market players to increase their investment in the region. The oil and gas industry in the US is projected to provide a huge impetus to the oilfield equipment rental services market on account of widespread investments lined up in oil and gas projects for the coming years.Western Canada accounts for about 95.0% of the country's total production with conventional oil (including pentanes & condensates) representing more than 1 million barrels per day, in terms of volume.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global oilfieldauxiliary rental equipment market include Superior Energy Services, Inc., Parker Drilling Company, Halliburton Company, and Schlumberger Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global oilfield auxiliary rental equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Halliburton Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Parker Drilling Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Schlumberger Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Superior Energy Services, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Oilfield Auxiliary Rental Equipment Market by Equipment

4.1.1. Drilling Equipment

4.1.2. Pressure and Flow Control Equipment

4.1.3. Fishing Equipment

4.1.4. Others

4.2. Global Oilfield Auxiliary Rental Equipment Market by Application

4.2.1. Onshore

4.2.2. Offshore

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Aker Solutions ASA

6.2. Ashtead technology Ltd.

6.3. Baker Hughes

6.4. B&B Oilfield Equipment, Corp.

6.5. China Oilfield Services Ltd.

6.6. Ensign Energy Services, Inc.

6.7. Key Energy Services, Inc.

6.8. Nabors Industries Ltd.

6.9. National Oilwell Varco (NOV) Inc.

6.10. Odfjell Drilling

6.11. Oil States International

6.12. Seadrill Ltd.

6.13. TechnipFMC

6.14. Transocean Ltd.

6.15. Weatherford International, Plc

1. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENTMARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

2. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET OF DRILLING EQUIPMENT RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET PRESSURE AND FLOW CONTROL EQUIPMENT RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET OF FISHING EQUIPMENT RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBALOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL ONSHOREOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBALOFFSHORE OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

11. NORTH AMERICAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. EUROPEAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. EUROPEAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

14. EUROPEAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. ASIA-PACIFICOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

17. ASIA-PACIFICOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. REST OF THE WORLD OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2023-2031 ($ MILLION)

20. REST OF THE WORLD OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SHARE BY EQUIPMENT, 2023 VS 2031 (%)

2. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET OF DRILLING EQUIPMENTSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET OFPRESSURE AND FLOW CONTROL EQUIPMENTSHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET OFFISHING EQUIPMENTSHARE BY REGION, 2023 VS 2031 (%)

5. GLOBALOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL ONSHOREOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBALOFFSHORE OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. US OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

11. UK OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC OILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICAOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. MIDDLE EAST AND AFRICAOILFIELD AUXILIARY RENTAL EQUIPMENT MARKET SIZE, 2023-2031 ($ MILLION)