OTC Drugs Market

OTC Drugs Market Size, Share & Trends Analysis Report by Product Type (Cough, Cold, and Flu, Analgesics, Gastrointestinal, Dermatology, Vitamins & Dietary Supplements, Sleep Aids, Ophthalmic, Smoking Cessation Aids, Weight Loss/Diet, and Others), by Form (Tablets & Capsules, Liquids, Ointments & Creams, Drops, Powders, and Sprays), and by Distribution Channel (Pharmacies/Drug Stores, Supermarkets/Hypermarkets, Online Pharmacies, Convenience Stores and Others), Forecast Period (2025-2035)

Industry Overview

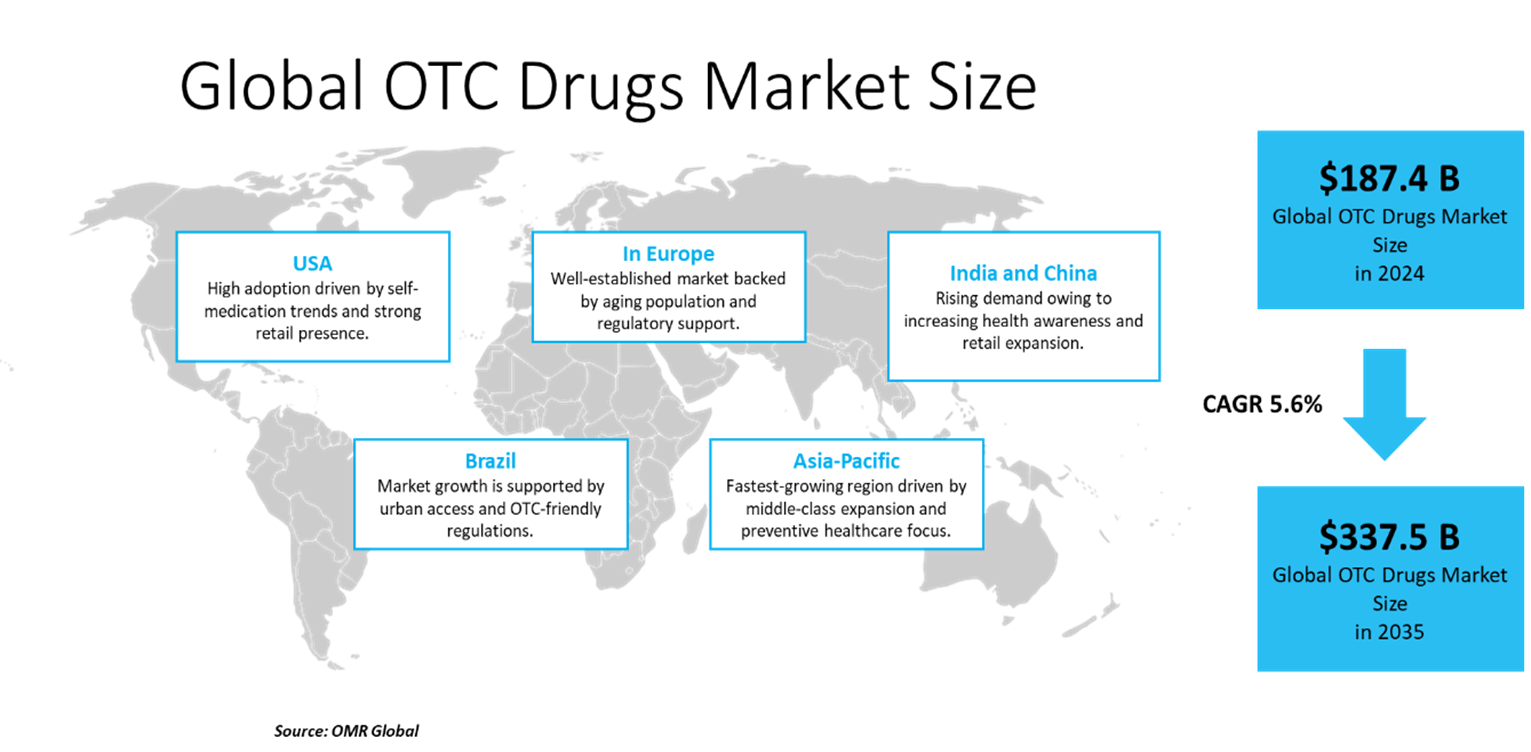

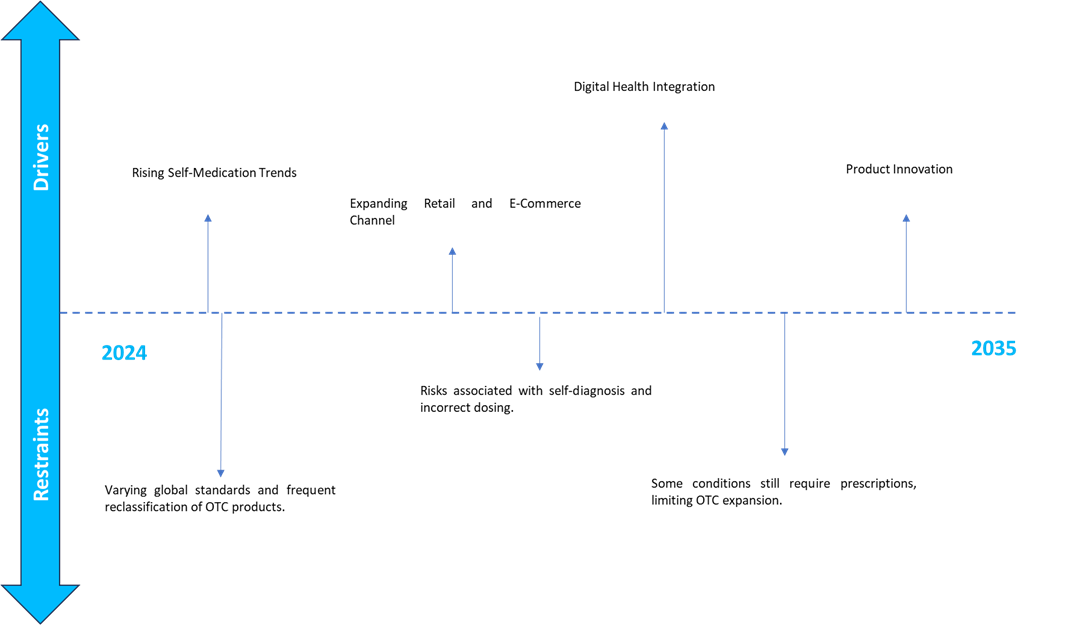

OTC drugs market was valued at $187.4 billion in 2024 and is projected to grow at a CAGR of 5.6% during the forecast period (2025-2035). Factors such as shifting consumer habits and improved access to healthcare have contributed to a favorable environment for the growth of the global OTC drugs market. A significant increase in self-medication, particularly for minor health issues, has prompted consumers to seek out OTC drugs (and exclude prescriptions). OTC drugs have an edge in availability, convenience, and cost to the patient and consumer, exhibited across developed and developing economies. The healthcare system has also encouraged individuals to engage in responsible self-care to reduce and limit the burden on clinical facilities. Ongoing advancements in formulations and packaging within the OTC category support modern consumer lifestyles. It is easier than ever for consumers to access product content, availability, and information through digital channels.

Market Dynamics

Increasing Demand for Natural & Herbal Products

The growing consumer trend towards wellness and clean-label products is driving new demand for natural and herbal OTC drugs. Many people are increasingly switching to plant-based products instead of synthetic products for common ailments like colds, digestive issues, and some minor skin conditions. The increase in health awareness and the perception that herbal remedies are safer and less likely to have side effects are factors in this shift. Traditional medicine is becoming more mainstream, aided by new packaging and branding, and consumers' liking for herbal formulations derived from historical ethnomedicinal practices such as Ayurveda and Traditional Chinese Medicine, among others. Nowadays, retailers and pharmacies are adding more product lines to accommodate this changing aspect of products.

Rise of Personalized OTC Solutions

The growing interest in personalized care is influencing the OTC drugs market significantly. Consumers are looking for solutions relevant to their specific health journeys, preferences, and lifestyles. In response to this demand, companies are increasingly developing OTC products for specific scenarios, connected to digital health tools and data reports. Specialized vitamin packs, symptom-driven formulations, personalized products through quizzes, and retailer or online platform links to individualized products using AI and analytical tracking are all helping to support this demand. This positive position is situated in a cultural shift toward active self-care and empowerment around individual health.

Market Segmentation

- Based on the product type, the market is segmented into cough, cold, and flu, analgesics, gastrointestinal, dermatology, vitamins & dietary supplements, sleep aids, ophthalmic, smoking cessation aids, weight loss/diet, and others.

- Based on the form, the market is segmented into tablets & capsules, liquids, ointments & creams, drops, powders, and sprays.

- Based on the distribution channel, the market is segmented into pharmacies/drug stores, supermarkets/hypermarkets, online pharmacies, convenience stores, and others (hospitals, clinics).

Tablets & Capsules Segment to Lead the Market with the Largest Share

The large volume of tablets and capsules within the OTC drugs market is a major contributor to growth. Tablets and capsules are easy to digest, accurate in dosing, and easy to carry. In addition, most consumers reach for a tablet or capsule for any number of common issues, including sinus discomfort, allergy issues, general pain, migraines, digestive issues, and more. Their long shelf life and compatibility with additional formulations are an incentive for OTC marketing, as the easy ability to mass production of each dosage form. Tablets and capsules are popular with self-care and OTC, resulting in potential health ailments that are only increasing globally. Most of the urban populations appear to have a thirst for self-care and associated issues that may arise from bad lifestyles. For instance, the most well-known brands in the OTC industry are Bayer AG, whose OTC pharmaceutical is a more recognizable name than aspirin (in a tablet form).

Pharmacies/Drug Stores: A Key Segment in Market Growth

A key contributor to the market growth of the OTC drugs segment is the growth and increased availability of pharmacies and drug stores. These outlets are typically the first point of purchase for a wide range of non-prescription drugs, with their ability to offer immediate access to consumers. In many cases, pharmacists also provide a recommendation to consumers, driving additional consumer reliance and purchases. Drug stores have extensive geographic coverage, where they can be accessed by both urban and rural consumers, to be able to reach a large segment of consumers. In many countries, regulatory systems allow for the OTC product space to exclusively occupy pharmacies, further aiding in the expansion of the segment.

Regional Outlook

The global OTC drugs market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Health Awareness in Asia-Pacific

The growth of the OTC drugs market in Asia-Pacific is rapid, owing to the increasing number of middle-class consumers and the rise in health awareness. The growing purchasing power of consumers is allowing those who are health-conscious to spend money on preventive health products and move toward self-medication. Urbanization in countries such as India, China, and Indonesia has led to many more people accessing pharmacies and retail outlets. Government initiatives to enhance health care systems and distribution for OTC drugs are growing more than ever. Consumer culture around self-treatment for minor ailments continues to aid product uptake along with the steady increase of technology within digital health, that are making it easier for potential customer to find their required product easily. For instance, Taisho Pharmaceutical Co., Ltd., a Japanese-based company, offers a range of OTC products such as its well-known Lipovitan D energy drink and Pabron cold treatment across the Asia-Pacific.

North America Region Dominates the Market with Major Share

The OTC drug market in North America is growing owing to the greater emphasis on self-care and consumer health independence in the region. Consumers are better equipped with information and can treat minor health problems independently, without a physician. The abundance of established retail chains and pharmacies across the region allows for product distribution to be widespread. In addition to this, regulatory factors are involved with organizations such as the FDA, encouraging the switch from prescription drugs to OTC products. The increasingly older population continues to spur demand for pain relief, digestive relief, and vitamins. Digital ease of access, along with e-commerce convenience, is improving accessibility to these products. Additionally, the strong advertising campaigns and branding considerations continue to drive products amongst consumers. For instance, Johnson & Johnson has a broad range of OTC drug products in North America with the widely recognized Tylenol name, which is used frequently for pain and fever relief.

Market Players Outlook

The major companies operating in the global OTC drugs market include Abbott Laboratories, GlaxoSmithKline plc, Johnson & Johnson Services, Inc., Procter & Gamble Co., and Sanofi S.A., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In April 2024, Amneal Pharmaceuticals, Inc. launched an OTC Naloxone Hydrochloride (Naloxone HCI) Nasal Spray, USP, 4mg, upon approval of their Abbreviated New Drug Application (“ANDA”) by the US Food and Drug Administration (“FDA”). Amneal's Naloxone HCI Nasal Spray, manufactured in the US, is a generic equivalent to OTC NARCAN HCI Nasal Spray, a well-known drug used to help treat a drug overdose caused by opioids, including heroin, fentanyl, and prescription opioid medications.

- In August 2023, Emergent BioSolutions Inc. announced NARCAN Naloxone HCl Nasal Spray 4 mg available on shelves nationwide and online beginning in September. OTC access to NARCAN Nasal Spray provides more people with the potential to respond in an opioid emergency, helping to save lives and keep loved ones and community members safe. Expanding access and awareness is necessary when considering the staggering toll of the epidemic, which is predominantly fueled by synthetic opioids, such as fentanyl.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global OTC drugs market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global OTC Drugs Market Sales Analysis – Product Type | Form | Distribution Channel | ($ Million)

• OTC Drugs Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key OTC Drugs Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the OTC Drugs Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global OTC Drugs Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global OTC Drugs Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For the Global OTC Drugs Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – OTC Drugs Market Revenue and Share by Manufacturers

• OTC Drugs Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Abbott Laboratories

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. GlaxoSmithKline plc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Johnson & Johnson Services, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Procter & Gamble Co.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Sanofi S.A.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global OTC Drugs Market Sales Analysis by Product Type ($ Million)

5.1. Cough, Cold, and Flu Products

5.2. Analgesics

5.3. Gastrointestinal Products

5.4. Dermatology Products

5.5. Vitamins & Dietary Supplements

5.6. Sleep Aids

5.7. Ophthalmic Products

5.8. Smoking Cessation Aids

5.9. Weight Loss/Diet Products

5.10. Others (Allergy relief, Antiseptics)

6. Global OTC Drugs Market Sales Analysis by Form ($ Million)

6.1. Tablets & Capsules

6.2. Liquids

6.3. Ointments & Creams

6.4. Drops

6.5. Powders

6.6. Sprays

7. Global OTC Drugs Market Sales Analysis by Distribution Channel ($ Million)

7.1. Pharmacies/Drug Stores

7.2. Supermarkets/Hypermarkets

7.3. Online Pharmacies

7.4. Convenience Stores

7.5. Others (Hospitals, Clinics)

8. Regional Analysis

8.1. North American OTC Drugs Market Sales Analysis – Product Type | Form | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European OTC Drugs Market Sales Analysis – Product Type | Form | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific OTC Drugs Market Sales Analysis – Product Type | Form | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World OTC Drugs Market Sales Analysis – Product Type | Form | Distribution Channel | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Achelios Therapeutics

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. AstraZeneca plc

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Aytu Biopharma (Aytu Consumer Health)

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Bayer AG

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Boehringer Ingelheim International GmbH

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Cipla Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Dr. Reddy’s Laboratories

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. GlaxoSmithKline plc

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Haleon plc

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Johnson & Johnson Services, Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. McKesson Corp.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Merck & Co., Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Mylan N.V.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Novartis AG

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Perrigo Company plc

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Pfizer Inc.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Piramal Enterprises Ltd.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Prestige Consumer Healthcare Inc.

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Procter & Gamble Co.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. PT Kalbe Farma Tbk

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Reckitt Benckiser Group plc

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Rohto Pharmaceutical Co., Ltd.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Sanofi S.A.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Sun Pharmaceutical Industries Ltd.

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Takeda Pharmaceutical Co, Ltd.

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

9.27. Teva Pharmaceutical Industries Ltd.

9.27.1. Quick Facts

9.27.2. Company Overview

9.27.3. Product Portfolio

9.27.4. Business Strategies

1. Global OTC Drugs Market Research and Analysis by Product Type, 2024–2035 ($ Million)

2. Global Cough, Cold, and Flu OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

3. Global Analgesics OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

4. Global Gastrointestinal OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

5. Global Dermatology OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

6. Global Vitamins & Dietary Supplements OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

7. Global Sleep Aids OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

8. Global Ophthalmic OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

9. Global Smoking Cessation Aids OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

10. Global Weight Loss/Diet OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

11. Global Other OTC Drugs Product Market Research and Analysis by Region, 2024–2035 ($ Million)

12. Global OTC Drugs Market Research and Analysis by Form, 2024–2035 ($ Million)

13. Global OTC Drugs Tablets & Capsules Market Research and Analysis by Region, 2024–2035 ($ Million)

14. Global OTC Drugs Liquids Market Research and Analysis by Region, 2024–2035 ($ Million)

15. Global OTC Drugs Ointments & Creams Market Research and Analysis by Region, 2024–2035 ($ Million)

16. Global OTC Drugs Drops Market Research and Analysis by Region, 2024–2035 ($ Million)

17. Global OTC Drugs Powders Market Research and Analysis by Region, 2024–2035 ($ Million)

18. Global OTC Drugs Sprays Market Research and Analysis by Region, 2024–2035 ($ Million)

19. Global OTC Drugs Market Research and Analysis by Distribution Channel, 2024–2035 ($ Million)

20. Global OTC Drugs Via Pharmacies/Drug Stores Market Research and Analysis by Region, 2024–2035 ($ Million)

21. Global OTC Drugs Via Supermarkets/Hypermarkets Market Research and Analysis by Region, 2024–2035 ($ Million)

22. Global OTC Drugs Via Online Pharmacies Market Research and Analysis by Region, 2024–2035 ($ Million)

23. Global OTC Drugs Via Convenience Stores Market Research and Analysis by Region, 2024–2035 ($ Million)

24. Global OTC Drugs Via Other Distribution Channel Market Research and Analysis by Region, 2024–2035 ($ Million)

25. Global OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

26. North American OTC Drugs Market Research and Analysis by Country, 2024–2035 ($ Million)

27. North American OTC Drugs Market Research and Analysis by Product Type, 2024–2035 ($ Million)

28. North American OTC Drugs Market Research and Analysis by Form, 2024–2035 ($ Million)

29. North American OTC Drugs Market Research and Analysis by Distribution Channel, 2024–2035 ($ Million)

30. European OTC Drugs Market Research and Analysis by Country, 2024–2035 ($ Million)

31. European OTC Drugs Market Research and Analysis by Product Type, 2024–2035 ($ Million)

32. European OTC Drugs Market Research and Analysis by Form, 2024–2035 ($ Million)

33. European OTC Drugs Market Research and Analysis by Distribution Channel, 2024–2035 ($ Million)

34. Asia-Pacific OTC Drugs Market Research and Analysis by Country, 2024–2035 ($ Million)

35. Asia-Pacific OTC Drugs Market Research and Analysis by Product Type, 2024–2035 ($ Million)

36. Asia-Pacific OTC Drugs Market Research and Analysis by Form, 2024–2035 ($ Million)

37. Asia-Pacific OTC Drugs Market Research and Analysis by Distribution Channel, 2024–2035 ($ Million)

38. Rest of the World OTC Drugs Market Research and Analysis by Region, 2024–2035 ($ Million)

39. Rest of the World OTC Drugs Market Research and Analysis by Product Type, 2024–2035 ($ Million)

40. Rest of the World OTC Drugs Market Research and Analysis by Form, 2024–2035 ($ Million)

41. Rest of the World OTC Drugs Market Research and Analysis by Distribution Channel, 2024–2035 ($ Million)

1. Global OTC Drugs Market Share by Product Type, 2024 Vs 2035 (%)

2. Global Cough, Cold, and Flu OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

3. Global Analgesics OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

4. Global Gastrointestinal OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

5. Global Dermatology OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

6. Global Vitamins & Dietary Supplements OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

7. Global Sleep Aids OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

8. Global Ophthalmic OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

9. Global Smoking Cessation Aids OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

10. Global Weight Loss/Diet OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

11. Global Other OTC Drugs Product Market Share by Region, 2024 Vs 2035 (%)

12. Global OTC Drugs Market Share by Form, 2024 Vs 2035 (%)

13. Global OTC Drugs Tablets & Capsules Market Share by Region, 2024 Vs 2035 (%)

14. Global OTC Drugs Liquids Market Share by Region, 2024 Vs 2035 (%)

15. Global OTC Drugs Ointments & Creams Market Share by Region, 2024 Vs 2035 (%)

16. Global OTC Drugs Drops Market Share by Region, 2024 Vs 2035 (%)

17. Global OTC Drugs Powders Market Share by Region, 2024 Vs 2035 (%)

18. Global OTC Drugs Sprays Market Share by Region, 2024 Vs 2035 (%)

19. Global OTC Drugs Market Share by Distribution Channel, 2024 Vs 2035 (%)

20. Global OTC Drugs Via Pharmacies/Drug Stores Market Share by Region, 2024 Vs 2035 (%)

21. Global OTC Drugs Via Supermarkets/Hypermarkets Market Share by Region, 2024 Vs 2035 (%)

22. Global OTC Drugs Via Online Pharmacies Market Share by Region, 2024 Vs 2035 (%)

23. Global OTC Drugs Via Convenience Stores Market Share by Region, 2024 Vs 2035 (%)

24. Global OTC Drugs Via Other Distribution Channel Market Share by Region, 2024 Vs 2035 (%)

25. Global OTC Drugs Market Share by Region, 2024 Vs 2035 (%)

26. US OTC Drugs Market Size, 2024–2035 ($ Million)

27. Canada OTC Drugs Market Size, 2024–2035 ($ Million)

28. UK OTC Drugs Market Size, 2024–2035 ($ Million)

29. France OTC Drugs Market Size, 2024–2035 ($ Million)

30. Germany OTC Drugs Market Size, 2024–2035 ($ Million)

31. Italy OTC Drugs Market Size, 2024–2035 ($ Million)

32. Spain OTC Drugs Market Size, 2024–2035 ($ Million)

33. Russia OTC Drugs Market Size, 2024–2035 ($ Million)

34. Rest of Europe OTC Drugs Market Size, 2024–2035 ($ Million)

35. India OTC Drugs Market Size, 2024–2035 ($ Million)

36. China OTC Drugs Market Size, 2024–2035 ($ Million)

37. Japan OTC Drugs Market Size, 2024–2035 ($ Million)

38. South Korea OTC Drugs Market Size, 2024–2035 ($ Million)

39. Australia and New Zealand OTC Drugs Market Size, 2024–2035 ($ Million)

40. ASEAN Economies OTC Drugs Market Size, 2024–2035 ($ Million)

41. Rest of Asia-Pacific OTC Drugs Market Size, 2024–2035 ($ Million)

42. Latin America OTC Drugs Market Size, 2024–2035 ($ Million)

43. Middle East and Africa OTC Drugs Market Size, 2024–2035 ($ Million)

FAQS

The size of the OTC Drugs market in 2024 is estimated to be around $187.4 billion.

North America holds the largest share in the OTC Drugs market.

Leading players in the OTC Drugs market include Abbott Laboratories, GlaxoSmithKline plc, Johnson & Johnson Services, Inc., Procter & Gamble Co., and Sanofi S.A., among others.

OTC Drugs market is expected to grow at a CAGR of 5.6% from 2025 to 2035.

Increasing self-medication, easy drug accessibility, and rising health awareness are driving OTC drugs market growth.