Payment Processing Solutions Market

Payment Processing Solutions Market Size, Share & Trends Analysis Report by Payment Method (Credit Card, Debit Card, E-Wallet, and Others), by Vertical (Retail and E-Commerce, Hospitality, Business Enterprises, and Others) and Forecasts, 2019 – 2025 Update Available - Forecast 2025-2035

The global payment processing solutions market is expected to garner significant growth over the forecast period. Factors such as high penetration of smartphones, various government initiatives for the promotion of digital and online payments across the globe, and significant investment in online payment solutions globally are driving the market growth. As per the World Bank estimation, in 2016, the total value of business-to-business (B2B) retail payments across the globe by micro, small and medium retailers (MSMRs) to immediate suppliers were $13.3 trillion. Of the total transaction, 53% (approximately $7 trillion) are made electronically, and the remaining is in cash and checks. Moreover, the total value of business-to-consumer (B2C) retail payments across the globe by MSMRs were $2 trillion, 50% of which are made electronically. Electronic payments are more widely used by non-grocery retailers compared to grocery retailers, regardless of the mode of business (B2B, B2C) transactions. These facts and figures reflect the need for payment processing solutions across various verticals; thereby, augmenting the market growth in near future.

Significant Investment in Online Payment Solutions Will Drive the Market

Realizing the potential of online payment in various fields such as retail and BFSI, investments are being pouring which R&D and expansion. For instance, Mobeewave, a contactless payment company closed a big Series B funding of $16.5 million round led by NewAlpha Asset Management, Mastercard and Forestay Capital in 2018. The investment fund allowed Mobeewave to continue the deployment of its patented solution across the globe. Further, Mobeewave also announced that its Samsung Venture Investment Corporation has officially joined the round, bringing its total to around $20 million. This enables the company to expand its presence by offering innovative products across the globe. Currently, Mobeewave platform in collaboration with Mastercard is available in Australia, Canada, and Poland through partnerships with Commonwealth Bank, National Bank, and PolskieePlatnosci (PeP). Such activities performed by the market players are expected to surge widespread adoption of digital payment across the globe.

Segmental Outlook

The global payment processing solutions market is segmented on the basis of the payment method and verticals. On the basis of payment methods, the market is classified into a credit card, debit card, e-wallet, and others. Whereas, on the basis of verticals, the report analyzes retail and e-commerce, hospitality, business enterprises, and other verticals. Within the service industry, the hospitality vertical is a broad category that includes food and beverages, event planning, theme parks, hotels, traveling, and many more fields within the tourism industry. The immense growth in any of the above sectors augments the demand for payment processing solutions in the hospitality vertical.

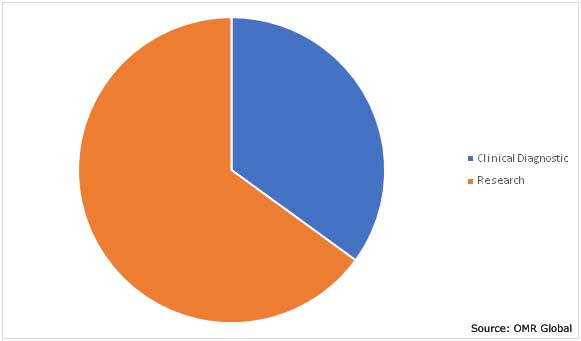

Global Payment Processing Solution Market Opportunity by Payment Method, 2018 (%)

E-Wallet Segment to Garner Significant Growth Owing to Increasing Smartphone Penetration

Peak rise in transactions through e-wallet has been observed in recent times owing to increasing usage of smartphones coupled with higher internet penetration. International Telecommunication Union (ITU), estimated that economies such as the US, France, and Germany have mobile-phone subscriptions (per inhabitants) as 122, 106, and 129 respectively in 2017. Majority of the people in developed economies owns more than one smart device; thereby, high mobile subscriptions reflect the increased use of smartphones in these economies which give rise to online money transfer through e-wallet. Mobile phone subscription in emerging economies such as India, China, Indonesia, Brazil, and South Korea is on rise owing to growing disposable income and growing internet users. Thereby, reflecting ample potential for the growth of e-wallet payment transaction across the globe.

Regional Outlook

The report analyzes the global payment processing solutions market on the basis of region into North America, Europe, Asia-Pacific, and Rest of the World. Europe is expected to have a significant market size along with North America in 2018. Asia-Pacific is expected to be the fastest growing region over the forecast period. Rapidly evolving e-commerce, tourism, food & beverages sector across major economies of the region such as China, India, Thailand, South Korea, Japan, and Australia among others are augmenting the growth of the market.

Global Payment Processing Solution Market Growth, 2019-2025

UK to Drive European Market Growth Over the Forecast Period

UK is one of the major economies of Europe that is shaping the online and digital payment scenario of Europe. The digitalization of banking, insurance and business services in the country are some of the major drivers for the growth of its economy. The country with a well-developed ICT infrastructure, recorded around 90% of the adult population using the internet in 2018, up from 89% in 2017, as per an estimation by Office for National Statistics. Online shopping in UK is more popular than any other major country, with a total e-commerce sale of $626 billion (including sales via electronic data interchange and sales over the website) in 2016, as per Office for National Statistics. Online shopping during 2016, continued to grow in terms of popularity in UK, with debit cards being the most popular way of paying for goods and services online. There were 38.7 billion payments made in UK in 2016, with 86% of the payments being made by the consumers for spontaneous purchase. The debit card is the most common methods for making a payment, which is responsible for transacting 11.6 billion payment in 2016. Most of the population in the UK holds a debit card and using it as a mode of payments comfortably. Almost all the UK-based online business allows their customers for using credit or debit cards, with MasterCard and Visa being universally accepted.

Market Players Outlook

The global payment processing solutions market consists of several players that are operating in the market. Visa Inc. is one of the major players in the market. Visa Inc. offers payment solutions globally and operates its business through transferring of money and information among merchants, financial institutions, business, strategic partners, consumers, and government. Furthermore, the company offers many digital payments and online payments technology through which payment can be done. Visa’s payment credentials include traditional cards, card numbers stored on file at online business, and card numbers stored on mobile devices, that were used nearly 182 billion times in 2018. This extensive usage of the company’s payment credentials resulted in double-digit growth in all three primary drivers which include payments volume, cross-border volume, and processed transactions. Apart from Visa Inc., the market also includes other major players including Adyen N.V., PayPal Holdings, Inc., BlueSnap Inc., and MasterCard International Inc.

Recent Developments

- In July 2018, Visa Inc., formed a strategic partnership with WEX, a leading provider of corporate payment solutions. The partnership allows WEX and their corporate payment customers to use a Visa virtual card to make global B2B payments.

- In June 2018, PayPal completed the acquisition of Hyperwallet for $400 million. This acquisition is aimed at strengthening the company’s payout capabilities and enhancing its ability to provide an integrated suite of payment solutions to eCommerce platforms and marketplaces across the globe.

- In March 2018, Visa Inc. acquired Fraedom Holdings Ltd., a software-as-a-service company that provides products and services such as expense management and accounts payable to financial institutions and their corporate customers. The acquisition enabled financial institutions to deliver an enhanced and differentiated corporate card experience to business clients—allowing them to better track corporate expenses and eliminate traditionally manual processes.

- In 2018, Visa Inc. expanded its Visa Token Services (VTS) to 11 new countries. The company now offers the service to issuers in 40 countries, representing more than 75% of Visa’s global payment volume.

- In September 2018, Global Payments Inc. collaborated with Ingenico Group to deliver an advanced terminal to enhance the consumer payment experience.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global payment processing solutions market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Adyen N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. Swot Analysis

3.3.1.4. Recent Developments

3.3.2. PayPal Holdings, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. Swot Analysis

3.3.2.4. Recent Developments

3.3.3. BlueSnap Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. Swot Analysis

3.3.3.4. Recent Developments

3.3.4. Visa Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. Swot Analysis

3.3.4.4. Recent Developments

3.3.5. MasterCard International Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. Swot Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Payment Processing Solutions Market by Payment Method

5.1.1. Credit Card

5.1.2. Debit Card

5.1.3. E-Wallet

5.1.4. Others (Gift Cards)

5.2. Global Payment Processing Solutions Market by Vertical

5.2.1. Retail & E-Commerce

5.2.2. Hospitality

5.2.3. Business Enterprises

5.2.4. Others (Healthcare)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adyen N.V.

7.2. Alibaba Group (Alipay)

7.3. BlueSnap Inc.

7.4. CCBill LLC

7.5. Due Inc.

7.6. First Data Corp.

7.7. Global Payments Inc.

7.8. Jack Henry & Associates Inc.

7.9. MasterCard International Inc.

7.10. One97 Communications Ltd.

7.11. PayGarden, Inc.

7.12. PayPal Holdings, Inc.

7.13. Paysafe Group Ltd.

7.14. PayU

7.15. Square Inc.

7.16. Stripe Inc.

7.17. The PNC Financial Services Group, Inc.

7.18. Visa Inc.

7.19. Wirecard AG

7.20. Worldpay, LLC

1. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2018-2025 ($ MILLION)

2. GLOBAL CREDIT CARD PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL DEBIT CARD PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL E-WALLET PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

7. GLOBAL PAYMENT PROCESSING SOLUTIONS FOR RETAIL AND E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL PAYMENT PROCESSING SOLUTIONS FOR HOSPITALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PAYMENT PROCESSING SOLUTIONS FOR BUSINESS ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL PAYMENT PROCESSING SOLUTIONS FOR OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2018-2025 ($ MILLION)

14. NORTH AMERICAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

15. EUROPEAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2018-2025 ($ MILLION)

17. EUROPEAN PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

21. REST OF THE WORLD PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY PAYMENT METHOD, 2018-2025 ($ MILLION)

22. REST OF THE WORLD PAYMENT PROCESSING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

1. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET SHARE BY PAYMENT METHOD, 2018 VS 2025 (%)

2. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

3. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD PAYMENT PROCESSING SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)