Penicillin and Streptomycin Market

Penicillin and Streptomycin Market By Product, By Manufacturing Process, By Route of Administration, By End-User- Global Industry Share, Growth, Competitive Analysis and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Global penicillin and streptomycin market is expected to grow with a CAGR of 0.3% during the forecast period. Penicillin and streptomycin are defined as a class of antibiotics that are used to kill bacterial infection and restrict bacterial growth. World Health Organization (WHO) included it in its list of essential medicines which are the most effective and safe medicines that are required in the healthcare system. Penicillin has been significantly used to treat infection, meningitis and so on. Streptomycin has been significantly used for the treatment of tuberculosis. Rising use of antibiotics in cell culture is offering an opportunity for the growth of the market. Antibiotics are frequently added to cell culture media as it suppresses contamination. The most common antibiotics for the cultivation of cells include a combination of penicillin and streptomycin. Many cell culture laboratories routinely add antibiotics and antimycotics to all cell culture media during the establishment of a primary culture, or while propagating specific valuable stocks or to eliminate any contamination.

Several pharmaceutical companies have started to specifically introduce penicillin and streptomycin solutions for cell culture applications, such as Lonza AG and Thermo Fisher Scientific, Inc. Thermo Fisher Scientific, Inc. offers an antibiotic solution that contains Penicillin-Streptomycin-Glutamine and µg/mL of streptomycin that are used to prevent bacterial contamination of cell cultures due to their efficient combined action against gram-negative and gram-positive bacteria. As the cell culture researches are growing significantly, the demand for penicillin and streptomycin in cell culture is anticipated to grow in the near future. However, patent expiration and availability of substitute products are creating hurdles in the growth of the market.

Segment Outlook

The global penicillin and streptomycin market are segmented on the basis of product, manufacturing process, route of administration, and end-user. Based on the product, the market is further classified into penicillin and streptomycin. Based on the manufacturing process, the market is further segmented into natural, synthesis, and semi-synthesis process. Based on the route of administration, the market is further segmented into oral, intramuscular, and intravenous. Based on end-user, the market is further segmented into hospitals, clinics, and others.

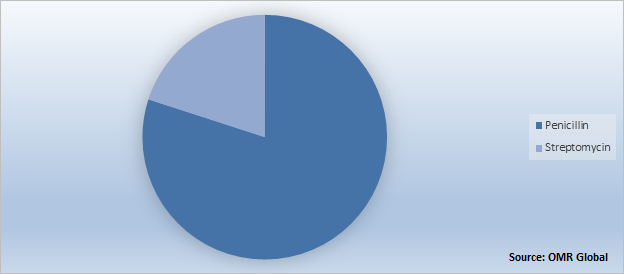

Global Penicillin and Streptomycin Market: By Product

Penicillin is anticipated to hold the major share in 2018 due to significant demand for penicillin for the treatment of bacterial infections, such as ear infections, skin infections, and urinary tract infection. It works to kill and prevent the growth of bacteria. In addition, the shortage of penicillin was reported due to the rising prevalence of infectious diseases which created significant demand for penicillin in the global market. According to the WHO, the shortage of Benzathine Penicillin G (BPG) occurred which is the only recommended treatment to prevent mother-to-child transmission of syphilis. Among sexually transmitted diseases (STD), syphilis is unique that can be curable with a penicillin single dose. According to WHO, 930,000 pregnant women annually have probable active syphilis (transmissible during pregnancy) which results in nearly 350,000 adverse birth outcomes, such as organ deformities and prematurity annually. Of 114 countries, 95 countries (41%) reported a shortage of BPG and 56 (59%) reported no BPG shortage during the period, 2014-2016. The drug is sold at a very low cost. As per Clinton Health Access Initiative (CHAI) estimation, BPG is sold on average at a cost of $0.11 for a 1.2 million international unit (IU) dose and $0.20 for 2.4 million IU does in low-and-middle-income countries. However, some countries set an additional cap on the price at which the drug can be sold that also keep the price low. This, in turn, shows a rising demand for penicillin for the treatment and prevention of infectious disease. However, the shortage of these drugs may also a major restraining factor for the market growth which would result in shifting towards other antibiotic alternatives, such as erythromycin, amoxicillin, and ceftriaxone.

Global Penicillin and Streptomycin Market Share by Product, 2018 (%)

Regional Outlook

Geographically, the global penicillin and streptomycin market is further segmented on the basis of the major regions including North America, Europe, Asia-Pacific, and rest of the world (RoW). The market is segmented on the basis of regions including North America, Europe, Asia-Pacific, and Rest of the world. North America region includes the US and Canada. Europe includes the UK, Germany, France, Italy, Spain, and the rest of Europe. Further, Asia-Pacific includes Japan, China, India and the rest of Asia-Pacific. Furthermore, the rest of the world includes the Middle East and Africa and Latin America. Rising prevalence and incidence of infectious disease and government initiatives for the treatment of infectious disease are encouraging the market growth in these regions.

Global Penicillin and Streptomycin Market Growth by Region, 2019-2025

Asia-Pacific is estimated to witness lucrative growth in the market during the forecast period

Rising prevalence of infectious disease and government initiatives for the prevention and treatment of bacterial infections are encouraging the market growth in the region. For instance, according to WHO, in 2017, 10 million people fell ill with TB, and 1.6 million mortality was caused due to the disease (including 0.3 million among people with HIV). In 2017, the largest number of new TB cases occurred in the South-East Asia and Western Pacific regions, with 62% of new cases, followed by the African region, with 25% of new cases. Likewise, there is a significant prevalence of STD and pneumonia in the region. This, in turn, may influence the growth of the market in the region.

Competitive Landscape

Some players in the market include GlaxoSmithKline PLC, Thermofisher Scientific, Inc., Merck & Co., Inc., Lonza AG, Dr. Reddy Laboratories, Inc., and Pfizer, Inc. Some companies are selling their antibiotics manufacturing facilities to focus on other pharmaceutical areas. For instance, in October 2018, Dr. Reddy Laboratories, Inc. sold the US antibiotics manufacturing facility to Neopharma, a UAE firm. This plant focused on the production and packaging of Amoxicillin-based products, such as semi-synthetic penicillin. The sale is in line with the company’s priority to optimize and streamline the global cost structure and supports to focus on other business priorities for driving the growth. Furthermore, in August 2016, AstraZeneca has sold its small molecule antibiotics business to Pfizer. Under the agreement, AstraZeneca has entered into an agreement with Pfizer, Inc. for selling the commercialization and development rights to its business in most markets across the globe, outside the US. This may be one of the major causes of the shortage of penicillin across countries.

The Report Covers

- Annualized market revenues ($ million) for each market segment.

- Market value data analysis from 2018 to 2019 and forecast to 2025.

- Company share and market share data for the global penicillin and streptomycin market.

- Global corporate-level profiles of key companies operating within the global penicillin and streptomycin market. Based on the availability of data for the category and country, information related to pipeline products and relevant news are also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Investment strategies by identifying the key market segments expected to register strong growth in the near future.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Penicillin and Streptomycin Market by Product

5.1.1. Penicillin

5.1.2. Streptomycin

5.2. Global Penicillin and Streptomycin Market by Manufacturing Process

5.2.1. Penicillin

5.2.1.1. Natural Process

5.2.1.2. Synthetic Process

5.2.1.3. Semi-Synthetic Process

5.2.2. Streptomycin

5.2.2.1. Natural Process

5.2.2.2. Synthetic Process

5.2.2.3. Semi-Synthetic Process

5.3. Global Penicillin and Streptomycin Market by Route of Administration

5.3.1. Oral

5.3.2. Intramuscular

5.3.3. Intravenous

5.4. Global Penicillin and Streptomycin Market by End-User

5.4.1. Hospitals

5.4.2. Clinics

5.4.3. Others (Clinical Laboratories)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories, Inc.

7.2. Alembic Pharmaceuticals, Ltd.

7.3. Astellas Pharma, Inc.

7.4. Bayer AG

7.5. Biogen International GmbH

7.6. Bristol-Myers Squibb Co.

7.7. Corden Pharma GmbH

7.8. Eli Lilly & Co.

7.9. F. Hoffmann La Roche, Ltd.

7.10. GlaxoSmithKline PLC

7.11. Jiangxi Dongfeng Pharmaceutical Co., Ltd.

7.12. Lonza AG

7.13. Merck & Co., Inc.

7.14. MODASA Pharmaceuticals Pvt. Ltd.

7.15. Novartis AG

7.16. Pfizer, Inc.

7.17. Sanofi-Aventis Group

7.18. Takeda Pharmaceutical Co., Ltd.

7.19. Thermofisher Scientific, Inc.

1. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL PENICILLIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2018-2025 ($ MILLION)

5. GLOBAL PENICILLIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

8. GLOBAL ORAL PENICILLIN AND STREPTOMYCIN SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL INTRAMUSCULAR PENICILLIN AND STREPTOMYCIN SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL INTRAVENOUS PENICILLIN AND STREPTOMYCIN SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

12. GLOBAL PENICILLIN AND STREPTOMYCIN IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL PENICILLIN AND STREPTOMYCIN IN CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL PENICILLIN AND STREPTOMYCIN IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

18. NORTH AMERICAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2018-2025 ($ MILLION)

19. NORTH AMERICAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

20. NORTH AMERICAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. EUROPEAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

23. EUROPEAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2018-2025 ($ MILLION)

24. EUROPEAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

25. EUROPEAN PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY END-USER 2018-2025 ($ MILLION)

31. REST OF THE WORLD PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

32. REST OF THE WORLD PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS, 2018-2025 ($ MILLION)

33. REST OF THE WORLD PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2018-2025 ($ MILLION)

34. REST OF THE WORLD PENICILLIN AND STREPTOMYCIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET SHARE BY MANUFACTURING PROCESS, 2018 VS 2025 (%)

3. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET SHARE BY ROUTE OF ADMINISTRATION, 2018 VS 2025 (%)

4. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET SHARE BY END-USER, 2018 VS 2025 (%)

5. GLOBAL PENICILLIN AND STREPTOMYCIN MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

6. US PENICILLIN AND STREPTOMYCIN SIZE, 2018-2025 ($ MILLION)

7. CANADA PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

8. UK PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

9. FRANCE PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

10. GERMANY PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

11. ITALY PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

12. SPAIN PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

13. ROE PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

15. CHINA PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

16. JAPAN PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF ASIA-PACIFIC PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD PENICILLIN AND STREPTOMYCIN MARKET SIZE, 2018-2025 ($ MILLION)