Pharmaceutical Contract Manufacturing Market

Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis by Category (Human-Based Drugs and Animals Based Drugs), By Type (Sterile Manufacturing and Non-Sterile Manufacturing,), by Product (Over-The-Counter (OTC) Drugs, Active Pharmaceutical Ingredients (API), Finished Dosage Formulation and Others) and by Services (Manufacturing Services, Non-Clinical Services, and Research & Development) Forecast Period (2025-2035)

Industry Overview

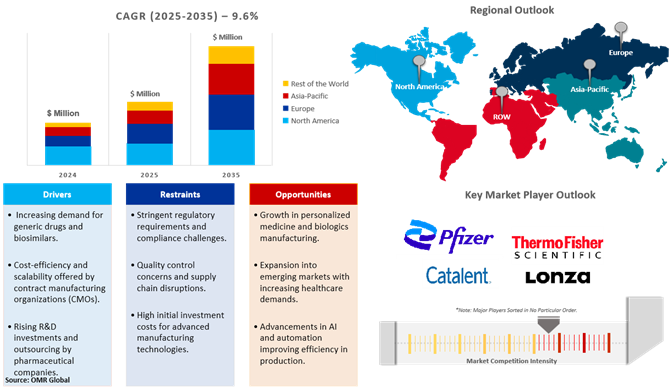

Pharmaceutical contract manufacturing market was valued at $201 billion in 2024 and is projected to reach $549 billion by 2035, growing at a CAGR of 9.6% from 2025 to 2035. Pharmaceutical companies operate as outsourcing companies, dealing with the development and manufacturing of drugs, which leads to business scalability and revenue, which allows for the development of new drugs. The growing need for state-of-the-art processes and production technologies, which have proven highly effective in meeting regulatory requirements, is the most important factor driving the growth of CMOs in the pharmaceutical industry. The increasing number of cell therapy candidates, combined with their steady growth through the various stages of clinical development and their complicated manufacturing process, drives up demand for manufacturing services for these therapies. Therefore, this factor creates an opportunity for market growth. However, the dynamic changes seen in this sector, combined with extreme margin pressure, are expected to restrict growth significantly.

Market Dynamics

The Growing Adoption of Biologics and Biosimilars

The growing consumption of biologics and biosimilars is highly impacting the pharmaceutical contract manufacturing business. Biologics, including monoclonal antibodies, vaccines, and gene therapies, are highly complex molecules produced from living organisms, so their manufacture is specialized and capital-intensive. Drug makers focus on R&D and drug development, the majority of them are having their manufacturing outsourced to contract manufacturing organizations (CMOs) that have the capability, infrastructure, and regulatory expertise needed for bulk biologics production. In addition, biosimilars, lower-cost, near-identical copies of biologic drugs, are growing in popularity as patents expire on top-selling biologics. Health systems and governments worldwide are encouraging biosimilar use as a means to control healthcare costs and increase access for patients to innovative therapies.

Growth in Biopharmaceuticals & Advanced Therapies

The fast growth of biopharmaceuticals and advanced therapies is one of the key factors for the expansion of the pharmaceutical contract manufacturing industry. Biopharmaceuticals such as monoclonal antibodies, recombinant proteins, and vaccines have witnessed a growth in demand as they are highly effective in treating chronic diseases like cancer, autoimmune diseases, and genetic disorders. Additionally, the development of cell and gene therapies (CGTs) and targeted medicines has created a massive need for specialty manufacturing capacity. Many pharma firms, especially small and medium-sized biotech companies, lack the experience, facilities, and regulatory compliance infrastructures to manufacture biopharmaceuticals. As a result, increased outsourcing to Contract Development and Manufacturing Organizations (CDMOs) with advanced biologics manufacturing facilities has taken place.

Market Segmentation

- Based on the category, the market is segmented into human-based drugs and animal-based drugs.

- Based on the type, the market is segmented into sterile manufacturing and non-sterile manufacturing.

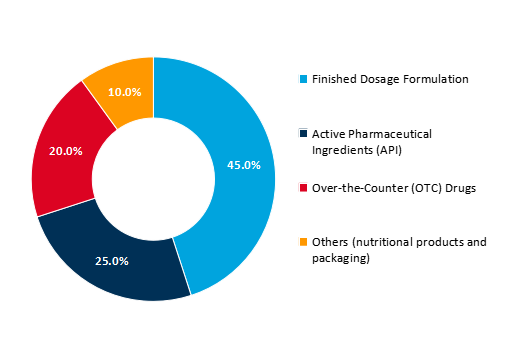

- Based on the product, the market is segmented into over-the-counter (OTC) drugs, active pharmaceutical ingredients (API), finished dosage formulation, and others (nutritional products and packaging)

- Based on the services, the market is segmented into manufacturing services, non-clinical services, and research and development.

Active Pharmaceutical Ingredients (API) to Lead the Market with the Largest Share

The Active Pharmaceutical Ingredients (API) segment will dominate the market for pharmaceutical contract manufacturing worldwide and have the highest share in the market. The reason for this segment's growth is primarily the increased demand for good-quality, low-cost drug ingredients, an increasing number of chronic diseases, and pharma companies' rising trend of outsourcing. With greater complexity in drug product formulations, most firms are turning to specialized contract manufacturers with better API synthesis, scale-up, and conformity to strict worldwide regulations (such as FDA, EMA, and ICH standards). For instance, in February of 2025, Eli Lilly intended to spend $27 billion to build four new plants for manufacturing in the US, with a target to improve local production against the looming import tariffs on drugs under the Trump administration. Three of the facilities will manufacture Active Pharmaceutical Ingredients (APIs), while the fourth will manufacture sterile injectable pharmaceuticals, like the blockbuster weight-loss drug Mounjaro. The growth is expected to create 3,000 high-skilled jobs and 10,000 construction jobs and aligns with the drive to restore pharma manufacturing and reduce reliance on foreign sources, particularly from China and India.

Global Pharmaceutical Contract Manufacturing Market Share by Product, 2024 (%)

Human-Based Drugs: A Key Segment in Market Growth

The human-derived drugs category is becoming the key growth driver of the pharma contract manufacturing sector globally, driven by the rapidly growing need for biopharmaceuticals, personalized medicine, and emerging medicines like monoclonal antibodies, gene therapy, and mRNA vaccines. The rising prevalence of long-term conditions, rare genetic disorders, and cancer has further driven the demand for highly advanced and scaleable manufacturing of medicines. For example, in December 2024, the US FDA granted GSK's request to review Nucala (mepolizumab) for add-on treatment in patients with a COPD eosinophilic phenotype, following positive results from the MATINEE trial. The trial demonstrated that the addition of Nucala to conventional inhaled therapy significantly decreased moderate to severe COPD exacerbations.

Regional Outlook

The global pharmaceutical contract manufacturing market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Production Facility for CMOs in Europe

As demand for complex and high-potency drugs rises, especially in oncology and biologics, contract manufacturing organizations (CMOs) are expanding and upgrading their facilities across Europe to meet stringent quality standards and growing client needs. These investments enhance capacity, enable the production of specialized drugs like HPAPIs and antibody-drug conjugates (ADCs), and reduce time-to-market for pharmaceutical companies. The creation of such infrastructure places Europe at the forefront of high-quality, large-scale pharma production, which also adds to the attractiveness of outsourcing on the continent. In June 2022, for instance, Merck inaugurated a new €59 million, 70,000-square-meter CDMO facility in Verona, Wisconsin, and doubled its capacity for producing high-potent active pharmaceutical ingredients (HPAPIs). These blocks are important in cancer treatments like antibody drug conjugates (ADCs) due to their high activity at low doses, reducing side effects. With over 30 years of experience in handling complicated and highly active molecules, Merck is today one of the largest HPAPI manufacturers globally with extremely low occupational exposure levels. The facility enables faster development and production of life-saving therapies, underpinned by Merck's technology strengths and extensive testing services.

North America Region Dominates the Market with Major Share

Geographically, North America is forecast to have a large market share in the pharmaceutical contract manufacturing market across the world. This growth is being driven by a rise in the number of firms outsourcing projects in the developing economies of this region. Moreover, the increase in the incidence of chronic diseases such as diabetes and cancer has augmented the need for injectable drug delivery in the US driving the growth of the pharmaceutical contract manufacturing industry. Based on the American Cancer Society, in 2025, the US is expected to experience around 2 million new cases of cancer and 618,120 mortalities due to cancer. While the overall cancer death rate has fallen—preventing nearly 4.5 million since 1991 through improved prevention, early detection, and treatment. Cancer incidence in men has fallen but risen in women, particularly those under the age of 50, where rates are currently 82% higher than men's. In April 2024, Ferring Pharmaceuticals and SK Pharmteco agreed to scale up commercial manufacturing capacity for the drug substance of Ferring’s intravesical gene therapy Adstiladrin to ensure long-term future supply. Following technology transfer, SK Pharmteco, a contract development manufacturing organization (CDMO), qualified as another source for manufacturing, testing, and release of the medicine, subject to regulatory approval by the U.S. FDA.

Market Players Outlook

The major companies operating in the global pharmaceutical contract manufacturing market include Thermo Fisher Scientific, Inc., Pfizer CentreOne (Pfizer, Inc.), and Catalent, Inc. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In April 2025, Lonza implemented a simplified and streamlined operating model as part of its "One Lonza" strategy to enhance efficiency, scalability, and customer experience. The previous divisional structure has been replaced by three CDMO Business Platforms: Integrated Biologics, Advanced Synthesis, and Specialized Modalities. This restructuring aims to strengthen Lonza’s multimodality capabilities and execution excellence.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global pharmaceutical contract manufacturing market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Pharmaceutical Contract Manufacturing Market Sales Analysis – Category| Type| Product| Service ($ Million)

• Pharmaceutical Contract Manufacturing Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Pharmaceutical Contract Manufacturing Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Pharmaceutical Contract Manufacturing Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Pharmaceutical Contract Manufacturing Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Pharmaceutical Contract Manufacturing Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Pharmaceutical Contract Manufacturing Market Revenue and Share by Manufacturers

• Pharmaceutical Contract Manufacturing Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Thermo Fisher Scientific, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Pfizer CentreOne (Pfizer, Inc.)

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Catalent, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Lonza Group AG

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Pharmaceutical Contract Manufacturing Market Sales Analysis by Category ($ Million)

5.1. Human-Based Drugs

5.2. Animals Based Drugs

6. Global Pharmaceutical Contract Manufacturing Market Sales Analysis by Type ($ Million)

6.1. Sterile Manufacturing

6.2. Non-Sterile Manufacturing

7. Global Pharmaceutical Contract Manufacturing Market Sales Analysis by Product ($ Million)

7.1. Over-the-counter (OTC) Drugs

7.2. Active Pharmaceutical Ingredients (API)

7.3. Finished Dosage Formulation

7.4. Others (nutritional products and packaging)

8. Global Pharmaceutical Contract Manufacturing Market Sales Analysis by Services ($ Million)

8.1. Manufacturing Services

8.2. Non-Clinical Services

8.3. Research and Development

9. Regional Analysis

9.1. North American Pharmaceutical Contract Manufacturing Market Sales Analysis – Category| Type| Product| Service |Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Pharmaceutical Contract Manufacturing Market Sales Analysis – Category| Type| Product| Service |Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Pharmaceutical Contract Manufacturing Market Sales Analysis – Category| Type| Product| Service |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Pharmaceutical Contract Manufacturing Market Sales Analysis – Category| Type| Product| Service |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Aenova Group

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Ajinomoto Co., Inc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Almac Group Ltd.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Amgen Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Aurobindo Pharma Ltd.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Baxter International Inc.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. BDR Pharmaceuticals International Pvt. Ltd.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Boehringer Ingelheim International GmbH

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Cadence Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Charles River Laboratories

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Chunghwa Chemical & Pharmaceutical Co., Ltd.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Ciron Drugs & Pharmaceuticals Pvt. Ltd.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Confab Laboratories Inc.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Daito Pharmaceutical Co., Ltd.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Eli Lilly And Co.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. F. Hoffmann-La Roche Ltd.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. GlaxoSmithKline PLC

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Hisamitsu Pharmaceutical Co., Inc.,

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Ligand Pharmaceuticals, Inc.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Merck KGaA

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. Novartis International AG

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Outlook Therapeutics, Inc.

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Piramal Enterprises Ltd.

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. Sanofi S.A.

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

1. Global Pharmaceutical Contract Manufacturing Market Research And Analysis By Category, 2024-2035 ($ Million)

2. Global Pharmaceutical Contract Manufacturing For Human-Based Drugs Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Pharmaceutical Contract Manufacturing For Animals Based Drugs Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Pharmaceutical Contract Manufacturing Market Research And Analysis By Type, 2024-2035 ($ Million)

5. Global Pharmaceutical Contract Manufacturing For Sterile Manufacturing Market Research And Analysis By Region 2024-2035 ($ Million)

6. Global Pharmaceutical Contract Manufacturing For Non-Sterile Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Pharmaceutical Contract Manufacturing Market Research And Analysis By Product, 2024-2035 ($ Million)

8. Global Pharmaceutical Contract Manufacturing For Over-The-Counter (OTC) Drugs Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Pharmaceutical Contract Manufacturing For Active Pharmaceutical Ingredients (API) Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Pharmaceutical Contract Manufacturing For Finished Dosage Formulation Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Pharmaceutical Contract Manufacturing For Others (Nutritional Products And Packaging) Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Pharmaceutical Contract Manufacturing Market Research And Analysis By Service, 2024-2035 ($ Million)

13. Global Pharmaceutical Contract Clinical Manufacturing Services Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Pharmaceutical Contract Non-Clinical Services Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Pharmaceutical Contract Research And Development Services Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Pharmaceutical Contract Manufacturing Market Research And Analysis By Geography, 2024-2035 ($ Million)

17. North American Pharmaceutical Contract Manufacturing Market Research And Analysis By Country, 2024-2035 ($ Million)

18. North American Pharmaceutical Contract Manufacturing Market Research And Analysis By Category, 2024-2035 ($ Million)

19. North American Pharmaceutical Contract Manufacturing Market Research And Analysis By Type, 2024-2035 ($ Million)

20. North American Pharmaceutical Contract Manufacturing Market Research And Analysis By Product, 2024-2035 ($ Million)

21. North American Pharmaceutical Contract Manufacturing Market Research And Analysis By Services, 2024-2035 ($ Million)

22. European Pharmaceutical Contract Manufacturing Market Research And Analysis By Country, 2024-2035 ($ Million)

23. European Pharmaceutical Contract Manufacturing Market Research And Analysis By Category, 2024-2035 ($ Million)

24. European Pharmaceutical Contract Manufacturing Market Research And Analysis By Type, 2024-2035 ($ Million)

25. European Pharmaceutical Contract Manufacturing Market Research And Analysis By Product, 2024-2035 ($ Million)

26. European Pharmaceutical Contract Manufacturing Market Research And Analysis By Services, 2024-2035 ($ Million)

27. Asia-Pacific Pharmaceutical Contract Manufacturing Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific Pharmaceutical Contract Manufacturing Market Research And Analysis By Category, 2024-2035 ($ Million)

29. Asia-Pacific Pharmaceutical Contract Manufacturing Market Research And Analysis By Type, 2024-2035 ($ Million)

30. Asia-Pacific Pharmaceutical Contract Manufacturing Market Research And Analysis By Product, 2024-2035 ($ Million)

31. Asia-Pacific Pharmaceutical Contract Manufacturing Market Research And Analysis By Services, 2024-2035 ($ Million)

32. Rest Of The World Pharmaceutical Contract Manufacturing Market Research And Analysis By Country, 2024-2035 ($ Million)

33. Rest Of The World Pharmaceutical Contract Manufacturing Market Research And Analysis By Category, 2024-2035 ($ Million)

34. Rest Of The World Pharmaceutical Contract Manufacturing Market Research And Analysis By Type, 2024-2035 ($ Million)

35. Rest Of The World Pharmaceutical Contract Manufacturing Market Research And Analysis By Product, 2024-2035 ($ Million)

36. Rest Of The World Pharmaceutical Contract Manufacturing Market Research And Analysis By Services, 2024-2035 ($ Million)

1. Global Pharmaceutical Contract Manufacturing Market Share By Category, 2024 Vs 2035 (%)

2. Global Pharmaceutical Contract Manufacturing Market Share By Type, 2024 Vs 2035 (%)

3. Global Pharmaceutical Contract Manufacturing Market Share By product, 2024 Vs 2035 (%)

4. Global Pharmaceutical Contract Manufacturing Market Share By Services, 2024 Vs 2035 (%)

5. Global Pharmaceutical Contract Manufacturing Market Share By Region, 2024 Vs 2035 (%)

6. Global Human-Based Drugs Market Share By Region, 2024 Vs 2035 (%)

7. Global Animals Based Drugs Market Share By Region, 2024 Vs 2035 (%)

8. Global Sterile Manufacturing Market Share By Region, 2024 Vs 2035 (%)

9. Global Non-Sterile Manufacturing Market Share By Region, 2024 Vs 2035 (%)

10. Global Over-The-Counter (OTC) Drugs Market Share By Region, 2024 Vs 2035 (%)

11. Global Active Pharmaceutical Ingredients (API) Market Share By Region, 2024 Vs 2035 (%)

12. Global Finished Dosage Formulation Market Share By Region, 2024 Vs 2035 (%)

13. Global Others (Nutritional Products And Packaging) Market Share By Region, 2024 Vs 2035 (%)

14. Global Manufacturing Services Market Share By Region, 2024 Vs 2035 (%)

15. Global Non-Clinical Services Market Share By Region, 2024 Vs 2035 (%)

16. Global Research And Development Market Share By Region, 2024 Vs 2035 (%)

17. Global Pharmaceutical Contract Manufacturing Market Share By Region, 2024 Vs 2035 (%)

18. US Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

19. Canada Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

20. UK Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

21. France Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

22. Germany Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

23. Italy Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

24. Spain Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

25. Russia Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

26. Rest Of Europe Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

27. India Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

28. China Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

29. Japan Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

30. South Korea Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

31. ASEAN Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

33. Rest Of Asia-Pacific Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

34. Latin America Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

35. Middle East And Africa Pharmaceutical Contract Manufacturing Market Size, 2024-2035 ($ Million)

FAQS

The size of the Pharmaceutical Contract Manufacturing market in 2024 is estimated to be around $201 billion.

North America holds the largest share in the Pharmaceutical Contract Manufacturing market.

Leading players in the Pharmaceutical Contract Manufacturing market include Thermo Fisher Scientific, Inc., Pfizer CentreOne (Pfizer, Inc.), and Catalent, Inc. among others.

Pharmaceutical Contract Manufacturing market is expected to grow at a CAGR of 9.6% from 2025 to 2035.

Rising drug demand, high R&D costs, and increased outsourcing are driving the growth of the pharmaceutical contract manufacturing market.