Pipe Coatings Market

Global Pipe Coatings Market Size, Share & Trends Analysis Report by Material Type (Thermoplastic, Fusion Bonded Epoxy, Concrete Coatings, Bituminous Coatings, and Others), By End-User Industry (Non-Residential and Residential) Forecast 2021-2027

The global pipe coatings market is anticipated to grow at a CAGR of around 5% during the forecast period (2021-2027). The coating assists in providing a protective layer to the pipe for preventing it from damaging effects of corrosion. The global pipe coatings market is driven by the growing demand for pipeline infrastructure in the various end-user industry such as oil & gas, water & wastewater treatment, chemical processing industries, agriculture, mining, and others. Increasing industrialization and urbanizations in Asia-Pacific, the growing agriculture sector in South Asia, growing energy demand in European countries, and increasing oil & gas projects across the globe are some of the prominent factors driving the market growth.

The shale gas production activities in North America are also the factor driving the global pipe coating industry. Natural gas is produced from onshore and offshore natural gas and oil wells and coal beds. In 2020, the US dry natural gas production was about 10% greater than US total natural gas consumption as per the US Energy Information Administration. In line with this, by 2035, the Canada Energy Regulator (CER, formerly the National Energy Board) expects tight and shale gas production together will represent 80% of Canada’s natural gas production. This is the reason oil and gas production companies are expanding their business in the region, which in turn, further creates a large scope for pipe coatings.

The upcoming oil & gas and petrochemical projects are also projected to escalate the pipeline infrastructure growth across the globe. For an instance, the South Asian nation is likely to witness the operational commencement of 647 oil & gas projects between 2021 and 2025. Downstream (refineries) and petrochemical projects are set to combine to make up about 69% of all upcoming oil & gas projects in India between 2021 and 2025. Moreover, the high price associated with the coating due to variation in raw material price, and oversupply of crude oil are the factors expected to hamper the market growth during the forecast period.

Impact of COVID-19 on Global Pipe Coatings Market

The global pipe coatings market is hit hardly by the impact of the COVID-19 pandemic. Restrictions on mobility imposed by the government of various economies resulted in a halt in production and operational facilities. In addition, during the pandemic, the new and upcoming oil & gas, and chemical projects were paused due to which the demand for pipe coatings decreased. On the other hand, disruption in logistic and supply chain owing to the delay in new projects led to the significant reduction in the pipe coatings demand from end-user industries. However, post-COVID-19, the market is expected to pick up the pace at a lethargic rate.

Segmental Outlook

The global pipe coatings market is segmented based on material type and end-user industry. Based on material type, the market is segmented into thermoplastic, fusion bonded epoxy, concrete coatings, bituminous coatings, and others. Based on the end-user industry, the market is further categorized into residential and non-residential (industrial and commercial)

The Industrial Segment is Projected to be on Dominant Position in the Global Pipe Coatings Market

Among end-users, the industrial segment held the largest share in the market in 2020, and it is anticipated to lead the market during the forecast period. The industrial sub-segment includes the oil & gas industry, water & wastewater treatment industry, chemical processing industry, and other pipe coatings found their major application in pipeline infrastructure in the above end-users. The growing oil & gas and petrochemical projects globally due to the increasing energy demand along with higher technology developments are the major factor leading to the rising demand for pipe coatings.

In Asia-Pacific, there will be 1,979 oil & gas projects are expected to start operation from 2021-2025, under which 278 upstream production projects and midstream projects constitute 442, followed by 182 refineries, and 1,077 chemical projects. Hence, these upcoming projects will increase the development of pipeline infrastructure, which will further augment the demand for pipe coatings in the oil & gas industry in Asia-Pacific. Moreover, the spending on infrastructure development by the major economies of the Asia-Pacific is also likely to boost the market for pipe coatings.

Regional Outlook

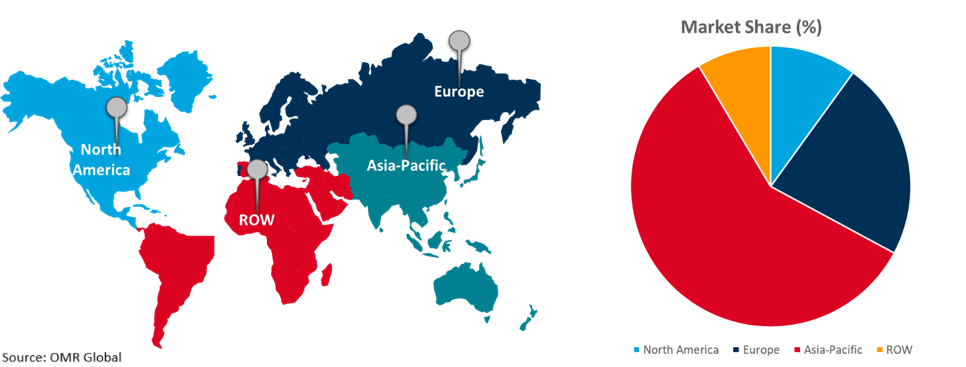

Geographically, the global Pipe Coatings market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is expected to show considerable growth in the global pipe coatings market during the forecast period. The US in North America is projected to contribute the highest in terms of revenue in the market growth. The presence of various manufacturing and construction facilities, growing chemical industries, and availability and easy access to shale gas are the factors driving the growth of the market in North America. For instance, as per the American Chemistry Council (ACC), chemical production will rise a similar 3.9% in 2021, along with 3.7% growth in the US economy. With the rise in chemical production, the demand for pipe coatings from chemical industries will be expected to grow more, which in turn, will drive the growth of the market during the forecast period. In addition, the government's support of oil & gas projects also boosts their expansion in the region, that further drives the market growth.

Global Pipe Coatings Market Growth By Region 2021-2027

Asia-Pacific to Contribute Prominent Share in the Global Pipe Coatings Market

Geographically, Asia-Pacific is projected to hold a prominent share in the market during the forecast period. The growing pipeline infrastructure in the oil & gas, water & wastewater treatment industry, chemical industry, agriculture, mining, and commercial and residential sectors is the major factor creating the demand for pipe coatings in the Asia-Pacific. The growth in the construction sector in emerging economies such as China, India, Indonesia, Singapore, Vietnam, and others driving the high demand for construction pipes, that further creating the scope for pipe coatings. In addition, gas projects are likely to be built in Indonesia and Malaysia, with pipeline projects in these countries projected to rise. In addition, water treatment facilities in Asia-Pacific are risen due to growing stringent regulations on water pollution, increasing shortages in the availability of freshwater, and increasing demand for water for industrial use.

The upcoming oil & gas projects in the region are also expected to create a huge demand for pipeline infrastructure along with pipe coatings. According to the India Brand Equity Foundation, primary energy demand is expected to nearly double to 1,123 million tonnes of oil equivalent, as the country's gross domestic product (GDP) is expected to increase to USD 8.6 trillion by 2040. This will be led to an increase in the number of new oil & gas projects across the country. Besides, 676 projects are set to begin operations between 2021 and 2025, 512 will be in the petrochemical sector in China. With developments in these industries, the global market for pipe coatings will show fast growth during the forecast period.

Market Players Outlook

Some of the key players operating in the global pipe coatings market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include The Sherwin-Williams Co., Akzo Nobel N. V., Axalta Coating Systems Ltd., BASF SE, PPG Industries Inc., Shawcor Ltd., and Wasco Energy Group of Co., among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For an instance, in September 2019, Axalta Coating Systems Ltd. acquired Capital Paints LLC, a UAE-based thermosetting powder coatings manufacturer with having specialization in architectural powder coatings. With this acquisition, Axalta expanded its footprint in the Middle East and North Africa (MENA) region. In addition, the main objective of the acquisition was to provide better support and technical services to local customers in the oil & gas and architectural segments.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Pipe Coatings market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Trade Analysis

2.2.3. Recommendations

2.2.4. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. PPG Industries Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. The Sherwin-Williams Co.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. BASF SE

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. AkzoNobel NV

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

4. Market Segmentation

4.1. Global Pipe Coatings Market by Material Type

4.1.1. Thermoplastics

4.1.2. Fusion Bonded Epoxy

4.1.3. Concrete Coatings

4.1.4. Bituminous Coatings

4.1.5. Others

4.2. Global Pipe Coatings Market by End-User Industry

4.2.1. Residential

4.2.2. Non-Residential (Industrial and Commercial)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3M Co.

6.2. A.W. Chesterton Co.

6.3. Arkema SA

6.4. The Arabian Pipecoating Co. Ltd.

6.5. Axalta Coating Systems Ltd.

6.6. Bauhuis BV

6.7. Borusan Mannesmann

6.8. Cabot Corp.

6.9. Carboline Co.

6.10. Celanese Corp

6.11. Corinth Pipeworks (Cenergy Holdings SA)

6.12. DowChemical Co

6.13. Dura-Bond (DBB Acquisition LLC)

6.14. E.I. Dupont De Nemours & Co.

6.15. GBA Products Co. Ltd

6.16. Hempel Coatings

6.17. Kansai Paint Co., Ltd.

6.18. Lyondellbasell Industries Holdings B.V.

6.19. Mutares AG

6.20. Nippon Paint Holdings Co., Ltd.

6.21. Shawcor Ltd.

6.22. Tenaris SA

6.23. Wasco Energy Group of Companies

1. GLOBAL PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

2. GLOBAL THERMOPLASTIC PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL FUSION BONDED EPOXY PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CONCRETE PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL BITUMINOUS PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHER PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

8. GLOBAL RESIDENTIAL PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL NON-RESIDENTIAL PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. NORTH AMERICAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

12. NORTH AMERICAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

13. EUROPEAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. EUROPEAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

15. EUROPEAN PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION

16. ASIA-PACIFIC PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

19. REST OF THE WORLD PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

20. REST OF THE WORLD PIPE COATINGS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2020-2027 ($ MILLION)

1. GLOBAL PIPE COATINGS MARKET SHARE BY MATERIAL TYPE, 2020 VS 2027 (%)

2. GLOBAL PIPE COATINGS MARKET SHARE BY END-USE INDUSTRY, 2020 VS 2027 (%)

3. GLOBAL PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL THERMOPLASTIC PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL FUSION BONDED EPOXY PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL CONCRETE PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL BITUMINOUS PIPE COATINGS SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL OTHER PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL RESIDENTIAL PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL NON-RESIDENTIAL PIPE COATINGS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. US PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

12. CANADA PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

13. UK PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

14. FRANCE PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

15. GERMANY PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

16. ITALY PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

17. SPAIN PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF EUROPE PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

19. INDIA PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

20. CHINA PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

21. JAPAN PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF ASIA-PACIFIC PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD PIPE COATINGS MARKET SIZE, 2020-2027 ($ MILLION)