Plastic Bottles Market

Global Plastic Bottles Market Size, Share & Trends Analysis Report, By Raw Material (PET, PP, HDPE, LDPE, and Others), By Application (Food and Beverages, Cosmetics, Pharmaceutical, Household, and Others) and Forecast, 2020-2026

The global plastic bottles market is estimated to grow at a CAGR of nearly 4.5% during the forecast period. Some major factors contributing to the market growth include rising demand for plastic packaging and emerging application in the pharmaceutical and cosmetics industry. Plastic resins are used in a range of container and packaging products, including high-density polyethylene (HDPE) bottles for milk and water and polyethylene terephthalate (PET) beverage bottles. In addition, a comprehensive range of other resins is used in other plastic containers, wraps, bags, sacks, and lids. Plastics are found in all major Municipal Solid Waste (MSW) categories. As per the US Environmental Protection Agency (US EPA), in 2017, the packaging and containers category had the most plastic tonnage at more than 14 million tons in the US. This category comprises sacks and wraps, bags, HDPE natural bottles, PET bottles and jars; and other containers.

As per the London Borough of Hounslow (UK Government), nearly 35.8 million plastic bottles are used every day in UK, however, only 19.8 million of these bottles are recycled. Plastic is the major contributor of waste generation. As a result, several countries are taking initiatives to collect all plastic for recycling purpose and develop technologies for plastic recycling. New technology is developed by the Indian Institute of Technology, Hyderabad (IIT-H) for recycling of waste polystyrene (PS) with the use of citrus peel extract, an agriculture waste and develop it into a non-woven fabric. Polystyrene is a non-biodegradable material that has a severe impact on the environment and health as a waste. This fabric is hydrophobic and can selectively absorb oil.

As a result, it can be used for a comprehensive range of applications including kitchen napkins, oil spillage remediation, flexible packaging, and others. PET and HDPE bottles are recyclable. HDPE plastics consists of the heavier containers used for the storage of everyday goods as it has properties of strength, stiffness, and toughness. In UK, it is extensively used for shampoo, fresh milk bottles, and detergent bottles. Rising focus on the development of technology for plastic waste recycling and emerging launches of 100% recycled plastic bottles is expected to offer an opportunity for market growth.

Market Segmentation

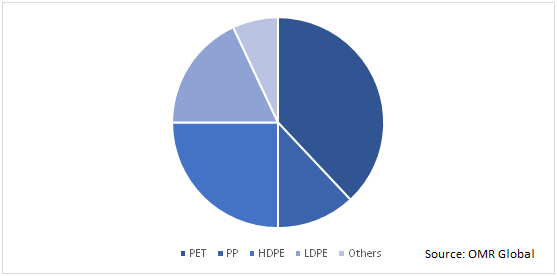

The global plastic bottles market is segmented based on raw material and application. Based on raw material, the market is classified into PET, Polypropylene (PP), HDPE, low-density polyethylene (LDPE), and others. Based on application, the market is classified into food and beverages, cosmetics, pharmaceutical, household, and others.

PET Bottles Finds Significant Applications in End-Use Sectors

Plastic bottles normally consist of PET or HDPE. PET has some essential features including gas barrier, strength, transparency, and thermo-stability properties. PET is extensively used for alcoholic beverages, mineral water, juice, cooking oil, and carbonated beverage. PET is used by several bottle production companies for packaging. It is developed by polymerization of terephthalic acid and ethylene glycol. Major properties comprise recyclable, lightweight, high strength to weight ratio, resistance to water, and is virtually shatterproof. PET bottles are extremely impact-proof and durable. These bottles require less protection during transportation compared to glass bottles. This can enable manufacturers to save cost in terms of additional packaging needs. PET bottles provide infinite possibilities in terms of design. These bottles offer superior flexibility over their glass counterparts and can be molded into any form, shape, and size. PET plastic is 100% recyclable and is the most recycled plastic across the globe. These bottles are extremely easy to recycle as the polymer chain breaks down at low temperature. As per the PET Resin Association (PETRA), PET is hygienic, strong, preserves freshness and is the world’s packaging choice for several foods and beverages. This, in turn, is contributing to the potential demand for PET in plastic bottles.

Global Plastic Bottles Market Share by Raw Material, 2019 (%)

Regional Outlook

Geographically, Asia-Pacific is estimated to witness potential growth during the forecast period. Significant rise in the packaging industry is primarily contributing to the market growth in the region. As per the Federation of Indian Chambers of Commerce and Industry, the Indian packaging industry is valued at more than $32 billion and consists of over 10,000 firms. Booming e-commerce and organized retail is the major contributor to the growth of the packaging industry. Plastics are the major choice for packaging in several sectors including FMCG and pharmaceuticals. This contributes to the adoption of plastic bottles across these industries for high-performance packaging and maintain the freshness of products.

Global Plastic Bottles Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Amcor plc, Berry Global Group, Inc., Gerresheimer AG, Plastipak Holdings, Inc., and Graham Packaging Co. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in April 2020, Amcor plc declared that it has designed a family of stock PET bottles, OmniPack that will enable co-packers to fulfil the increasing needs for e-commerce ready packaging. It will enhance capacity and minimize downtime as they have the same diameter with the same finish, however, there is a change in height to accommodate the variable fill volumes.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global plastic bottles market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amcor plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Berry Global Group, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Gerresheimer AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Plastipak Holdings, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Graham Packaging Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Plastic Bottles Market by Raw Material

5.1.1. Polyethylene Terephthalate (PET)

5.1.2. Polypropylene (PP)

5.1.3. High-density Polyethylene (HDPE)

5.1.4. Low-density Polyethylene (LDPE)

5.1.5. Others

5.2. Global Plastic Bottles Market by Application

5.2.1. Food and Beverages

5.2.2. Cosmetics

5.2.3. Pharmaceutical

5.2.4. Household

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AG Poly Packs Pvt. Ltd.

7.2. Alpha Packaging

7.3. Alpla Werke Alwin Lehner GmbH & Co KG

7.4. Altium Packaging

7.5. Amcor plc

7.6. BERICAP Holding GmbH

7.7. Berry Global Group, Inc.

7.8. Chemco Group of Companies

7.9. Comar, LLC

7.10. Cospack America Corp.

7.11. Gerresheimer AG

7.12. Gil Plastic Products Ltd.

7.13. Graham Packaging Co.

7.14. Greiner Packaging GmbH

7.15. Hitech Group

7.16. Ningbo Jazz Packaging Co., Ltd.

7.17. Plastipak Holdings, Inc.

7.18. RESILUX NV

7.19. Star Plastic Industries

7.20. Takemoto Packaging. Inc.

7.21. Unilever Group

7.22. YuHuan Kang-Jia Enterprise Co., Ltd.

7.23. Zhenghao Plastic & Mold Co., Ltd.

1. GLOBAL PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL PET BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PP BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HDPE BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LDPE BOTTLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

7. GLOBAL PLASTIC BOTTLES IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PLASTIC BOTTLES IN COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL PLASTIC BOTTLES IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PLASTIC BOTTLES IN HOUSEHOLD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL PLASTIC BOTTLES IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

15. NORTH AMERICAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

16. EUROPEAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

18. EUROPEAN PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. REST OF THE WORLD PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

23. REST OF THE WORLD PLASTIC BOTTLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL PLASTIC BOTTLES MARKET SHARE BY RAW MATERIAL, 2019 VS 2026 (%)

2. GLOBAL PLASTIC BOTTLES MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL PLASTIC BOTTLES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD PLASTIC BOTTLES MARKET SIZE, 2019-2026 ($ MILLION)