Radial Forging Machine Market

Radial Forging Machine Market Size, Share & Trends Analysis Report by Type (Hot Forging, and Cold Forging), and by Application (Automotive Industry, Hardware Tools, Engineering Machinery, and Others), Forecast Period (2025-2035)

Industry Overview

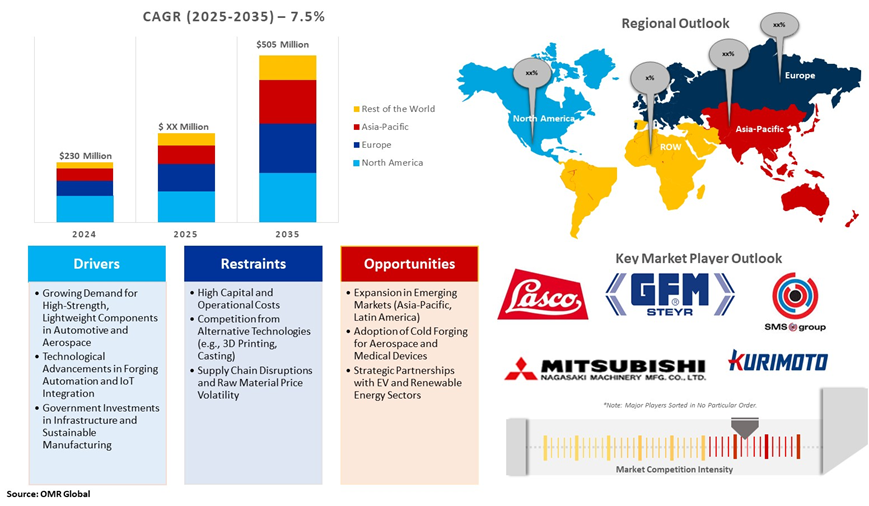

Radial forging machine market, estimated at $230 million in 2024, is projected to grow to $505 million with a CAGR of 7.5% during the forecast period (2025–2035). This growth is primarily driven by increasing demand from the automotive industry and other end-user sectors seeking high-quality components with precise dimensions and excellent surface finish. Radial forging technology has gained significant traction due to its ability to handle large forgings and produce components with superior material properties, particularly in super alloys and high-alloyed steel grades, making these machines essential for heavy engineering applications.

Market Dynamics

Increasing Demand for Precision Components in Automotive Manufacturing

The automotive sector has become a major growth driver for the radial forging machine industry. The machines are extensively used in automotive production since they provide high production rates, enhanced accuracy, improved surface finish, and higher versatility over conventional forging techniques. The growing global vehicle output, especially in emerging markets like India and China, is generating high demand for high-quality forged parts, thus driving the radial forging machine market.

Further, the increasing emphasis of the automotive sector on the use of lightweight parts to enhance fuel efficiency and diminish emissions has contributed to the greater adoption of advanced materials that necessitate intricate forging methods. Radial forging machines offer the ability to process such materials without compromising on structural integrity and performance parameters.

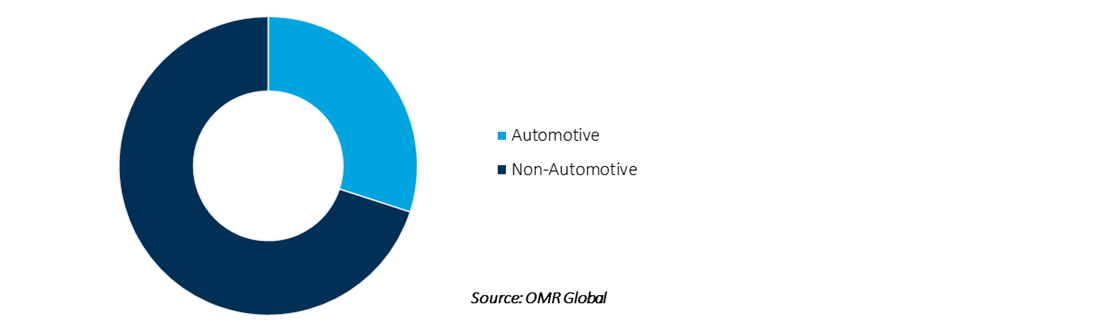

Radial Forging Machine Market Share by Applications, 2024

Technological Advancements in Radial Forging Machines, Enhancing Market Growth

Simultaneously, continuous technological improvements in radial forging equipment have been a major driver of market expansion. Equipment costs have been reduced, reliability improved, and flexibility increased by manufacturers to meet changing needs in diverse industries. For instance, SMS Group offers Camfrog and ForgeBase Forging Technology Suites are technologies to optimize production by calculating the optimal process parameters, e.g., pass schedules and furnace temperature set points, depending on the individual process. While the general functionality is similar, ComForge is dedicated to radial forging, and ForgeBase specializes in open-die forging. Additionally, the company offers various technologies such as intelligent data analytics with SMS-Metrics, an intelligent alarm management system, maintenance advisor, and electronic document management.

Market Segmentation

- Based on the type, the market is segmented into hot forging and cold forging.

- Based on the components, the market is segmented into indoor units and outdoor units.

- Based on the application, the market is segmented into the automotive industry, hardware tools, engineering machinery, and others.

Automotive Industry Sub-Segment is Anticipated to hold a Prominent Share of the Global Radial Forging Machine Market

Among the applications, the automotive industry sub-segment is anticipated to hold a prominent share of the global radial forging machine market. Radial forging machines are widely used in the automotive industry as they offer high production speeds, improved accuracy, better surface finish, and greater versatility than bar or needle-type forged parts. The automotive sector is expected to witness significant growth owing to increasing demand for vehicles from countries such as India, China, Japan, and Germany among others. Additionally, the increasing global automotive production, especially in developing economies like India and China, is generating huge demand for high-quality forged parts. As automobile manufacturers remain committed to enhancing vehicle performance, fuel efficiency, and emissions, the demand for accurately engineered parts is likely to increase, thus driving the expansion of the radial forging machine market in the automotive industry.

Regional Outlook

The global radial forging machine is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

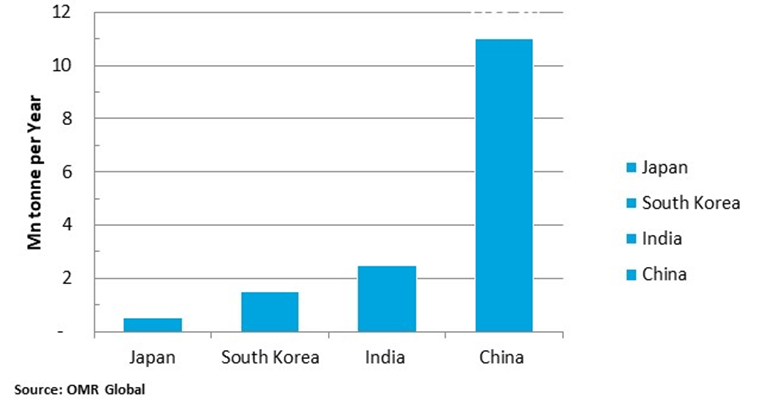

The Asia-Pacific Region is expected to Hold a Prominent Share of the Global Radial Forging Machine Market

Among all regions, the Asia-Pacific regional market is expected to hold a prominent share of the global radial forging machine market during the forecast period. The region has witnessed a surge in demand from China, India, Japan, South Korea, and Taiwan among other countries owing to their rapidly expanding manufacturing sector. China is considered the key manufacturing hub of machinery and equipment across the globe. As per the Bureau of Energy Efficiency (BEE), India forging industry contributed to around 5-6% in the global forging Industry. Among this, forging exports from India contributed to over 24% of the total forging revenue. The present export market includes mainly the US and Europe. Additionally, China produced around 11 Mn tonnes of forged products during 2019-2020, while India produced 2.4 Mn tonnes during the same financial year. India is the second largest producer of forging components in Asia as below figure.

Comparison of the Asian Forging Industry

Market Players Outlook

The major companies operating in the global radial forging machine market include GFM GmbH Steyr, Kurimoto, Ltd., LASCO Umformtechnik GmbH, Mitsubishi Nagasaki Machinery Mfg.Co., Ltd, and SMS group GmbH, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2025, Ramkrishna Forgings began commercial production using its new NATIONAL 5 UPSETTER and DEFRIS 2% UPSETTER machines, adding 14,250 Metric Tonnes Per Annum (MTPA) to its production capacity. This expansion is designed to meet increasing demand from customers, enhancing the company’s total production capacity to 243,400 MTPA for hot and warm forgings and 25,000 MTPA for cold forgings. The Trent XWB-84 program that powers the Airbus A350-900 fleet in 2008, the Trent XWB-97 program that powers the Airbus A350-1000 fleet in 2013, and the Trent 7000 program that powers the Airbus A330neo fleet in 2015.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global radial forging machine market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Radial Forging Machines Market Sales Analysis – Type | Application ($ Million)

• Radial Forging Machines Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Radial Forging Machines Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers for Global Radial Forging Machines Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Radial Forging Machines Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Radial Forging Machines Market Revenue and Share by Manufacturers

• Radial Forging Machines Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. GFM GmbH Steyr

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. KURIMOTO, LTD.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. LASCO Umformtechnik GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Mitsubishi Nagasaki Machinery Mfg.Co., Ltd

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. SMS Group GmbH

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Radial Forging Machines Market Sales Analysis By Type ($ Million)

5.1. Hot Forging

5.2. Cold Forging

6. Global Radial Forging Machines Market Sales Analysis By Application ($ Million)

6.1. Automotive Industry

6.2. Hardware Tools

6.3. Engineering Machinery

6.4. Others

7. Regional Analysis

7.1. North American Radial Forging Machines Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Radial Forging Machines Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Radial Forging Machines Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Radial Forging Machines Market Sales Analysis – Type | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Ajax CECO

8.1.1. Quick Facts `

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Bharat Forge Ltd.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Beckwood Press.

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Ficep S.p.A.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. GFM GmbH Steyr

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.5.5. KURIMOTO, LTD.

8.5.6. Quick Facts

8.5.7. Company Overview

8.5.8. Product Portfolio

8.5.9. Business Strategies

8.6. LASCO Umformtechnik GmbH

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Linamar Corporation

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Mitsubishi Nagasaki Machinery Mfg.Co., Ltd

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Nippon Steel Corporation.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Qingdao HDMECH Intelligent Equipment Co. Ltd.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. SMS group GmbH

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Sumitomo Heavy Industries Ltd.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

1. Global Radial Forging Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Hot Radial Forging Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Cold Radial Forging Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Radial Forging Market Research And Analysis By Application, 2024-2035 ($ Million)

5. Global Radial Forging For Automotive Industry Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Radial Forging For Hardware Tools Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Radial Forging For Engineering Machinery Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Radial Forging For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Radial Forging Market Research And Analysis By Region, 2024-2035 ($ Million)

10. North America Radial Forging Market Research And Analysis By Country, 2024-2035 ($ Million)

11. North America Radial Forging Market Research And Analysis By Type, 2024-2035 ($ Million)

12. North America Radial Forging Market Research And Analysis By Application, 2024-2035 ($ Million)

13. European Radial Forging Market Research And Analysis By Country, 2024-2035 ($ Million)

14. European Radial Forging Market Research And Analysis By Type, 2024-2035 ($ Million)

15. European Radial Forging Market Research And Analysis By Application, 2024-2035 ($ Million)

16. Asia-Pacific Radial Forging Market Research And Analysis By Country, 2024-2035 ($ Million)

17. Asia-Pacific Radial Forging Market Research And Analysis By Type, 2024-2035 ($ Million)

18. Asia-Pacific Radial Forging Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Rest Of The World Radial Forging Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Rest Of The World Radial Forging Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Rest Of The World Radial Forging Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Radial Forging Market Share Analysis By Type, 2024 Vs 2035 (%)

2. Global Hot Radial Forging Market Share Analysis By Region 2024 Vs 2035 (%)

3. Global Cold Radial Forging Market Share Analysis By Region 2024 Vs 2035 (%)

4. Global Radial Forging Market Share Analysis By Application, 2024 Vs 2035 (%)

5. Global Radial Forging For Automotive Industry Market Share Analysis By Region 2024 Vs 2035 (%)

6. Global Radial Forging For Hardware Tools Market Share Analysis By Region 2024 Vs 2035 (%)

7. Global Radial Forging For Engineering Machinery Market Share Analysis By Region 2024 Vs 2035 (%)

8. Global Radial Forging For Other Applications Market Share Analysis By Region 2024 Vs 2035 (%)

9. Global Radial Forging Market Share Analysis By Region 2024 Vs 2035 (%)

10. US Radial Forging Market Size, 2024-2035 ($ Million)

11. Canada Radial Forging Market Size, 2024-2035 ($ Million)

12. UK Radial Forging Market Size, 2024-2035 ($ Million)

13. France Radial Forging Market Size, 2024-2035 ($ Million)

14. Germany Radial Forging Market Size, 2024-2035 ($ Million)

15. Italy Radial Forging Market Size, 2024-2035 ($ Million)

16. Spain Radial Forging Market Size, 2024-2035 ($ Million)

17. Rest of Europe Radial Forging Market Size, 2024-2035 ($ Million)

18. India Radial Forging Market Size, 2024-2035 ($ Million)

19. China Radial Forging Market Size, 2024-2035 ($ Million)

20. Japan Radial Forging Market Size, 2024-2035 ($ Million)

21. South Korea Radial Forging Market Size, 2024-2035 ($ Million)

22. ASEAN Economies Radial Forging Market Size, 2024-2035 ($ Million)

23. Rest of Asia-Pacific Radial Forging Market Size, 2024-2035 ($ Million)

24. Rest Of The World Radial Forging Market Size, 2024-2035 ($ Million)

25. Latin America Radial Forging Market Size, 2024-2035 ($ Million)

26. Middle East and Africa Radial Forging Product Market Size, 2024-2035 ($ Million)

FAQS

The size of the Radial Forging Machine market in 2024 is estimated to be around $230 million.

Asia Pacific holds the largest share in the Radial Forging Machine market.

Leading players in the Radial Forging Machine market include GFM GmbH Steyr, Kurimoto, Ltd., LASCO Umformtechnik GmbH, Mitsubishi Nagasaki Machinery Mfg.Co., Ltd, and SMS group GmbH, among others.

Radial Forging Machine market is expected to grow at a CAGR of 7.5% from 2025 to 2035.

Rising demand for high-strength forged components in automotive and aerospace industries, along with advancements in forging technology, is driving the radial forging machine market.