Rapid Test Market

Rapid Test Market Size, Share & Trends Analysis Report by Product (Laboratory Rapid Test and Over-the-counter (OTC) Rapid Test), by Technology (Immunoassay, Chromatography, Spectroscopy, and Polymerase Chain Reaction (PCR)), by Application (Infectious Disease, Pregnancy Test, Glucose Test, and Others), and by End-Users (Hospitals and Clinics, Diagnostic Laboratories, and Home Care), Forecast Period (2024-2031)

Rapid test market is anticipated to grow at a CAGR of 8.2% during the forecast period (2024-2031). The rising awareness regarding early and reliable diagnosis of disease, prevalence of infectious diseases, introduction of technologically advanced products and need for low cost as well as accurate diagnostic testing. Additionally, rapid tests provide accurate results in a short time and these benefits have led to a surge in adoption of rapid tests in point-of-care testing, wherein results are obtained on the same day which is boosting the market growth.

Segmental Outlook

The global rapid test market is segmented by the product, technology, application, and end-users. Based on the product, the market is sub-segmented into laboratory rapid test and over-the-counter rapid test products. Based on the technology, the market is sub-segmented into immunoassay, chromatography, spectroscopy, and polymerase chain reaction. Based on the application, the market is sub-segmented into infectious disease, pregnancy test, glucose test and others. Further, based on end-users, the market is sub-segmented into hospitals and clinics, diagnostic laboratories, and home care. Among the product, the laboratory rapid test sub-segment is anticipated to hold a considerable share of the market. Rapid laboratory testing can be done at the site of care, which includes clinics, hospitals, and medical offices. They are perfect for bulk population testing because they are affordable and easy to use.

The Infectious Disease Sub-Segment is Anticipated to Hold a Considerable Share of the Global Rapid test Market

Among the application, the infectious disease sub-segment is expected to hold a considerable share of the global rapid test market. The COVID-19 positively impacted the rapid diagnostics market. For instance, in April 2021, the Federal Government of Germany made it mandatory for employers in Germany to offer free COVID-19 self-testing kits to all employees who do not exclusively work from home. Furthermore, in March 2022, Brain Chemistry Labs, a non-profit research institute, and Arlington Scientific, announced the development of an easy-to-use rapid test kit. This kit will detect the presence of ?-methylamino-L-Alanine (BMAA), a toxin in cyanobacterial blooms, which causes a fatal paralytic disease called Amyotrophic Lateral Sclerosis (ALS). Thus, such developments, the penetration of rapid diagnostic assays is expected to increase further, driving the market's growth. According to the World Health Organization (WHO), globally, 3.1 billion rapid diagnostic tests (RDTs) for malaria were sold by manufacturers in 2010–2020, with almost 81% of these sales being in sub-Saharan African countries. In the same period, National Malaria Programme (NMPs) distributed 2.2 billion RDT. In 2020, 419 million RDTs were sold by manufacturers and 275 million were distributed by NMPs. There were an estimated 241 million malaria cases and 627,000 malaria deaths globally in 2020. This represents about 14 million more cases in 2020 compared to 2019, and 69000 more deaths.

Regional Outlook

The global Rapid test market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to increase in disposable incomes, high population base, and growth in awareness about advance rapid tests. Additionally, the rapid test market is growing due to an increase in R&D spending in developing nations such as India, and China.

Global Rapid Test Market Growth, by Region 2024-2031

The North America Region is Expected to Grow at a Significant CAGR in the Global Rapid test Market

Among all regions, the North American region is anticipated to grow at a considerable CAGR over the forecast period. The high prevalence of chronic and infectious diseases, high investments in the research and diagnosis of infectious diseases and recent development by the market players. Apart from this rising construction of hospitals and specialized clinics to offer effective healthcare solutions. And increasing healthcare expenditure among the masses is contributing to the growth of the market. Disease such as cancer if diagnosed early can be treated easily. Early cancer detection increases the probability of successful treatment. Many obstacles to the early diagnosis of cancer may be addressed by this quick and affordable test, particularly in patients who do not have specific symptoms that lead research to target a particular organ. According to American Cancer Society, over 18 million Americans were reported to have cancer in 2022. They stated that over 1.9 million new cancer cases are estimated to be diagnosed in the US in 2023.

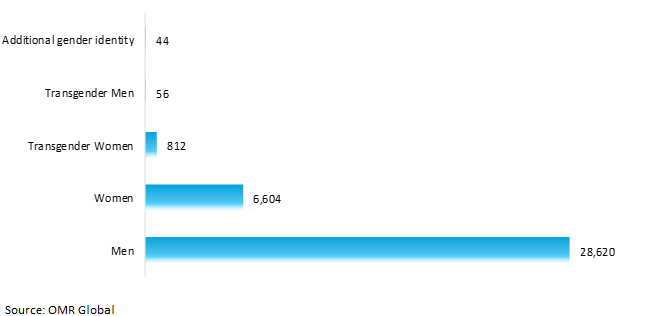

The rise in HIV diagnosis in North America has also led to an increase in use of rapid test kits. A rapid HIV self-test uses a sample of fluid from mouth to check for antibodies to HIV. According to the Food and Drug Administration (FDA), the OraQuick in-home HIV test measured at about 92 percent accuracy at detecting HIV. About 1 out of 5,000 people test positive when they don’t have HIV. Men continue to be heavily affected by HIV, accounting for 79% of new HIV diagnoses in 2021.

Differences in HIV Diagnoses by Gender in US, among people aged 13 and older, 2021

Source: Centers for Disease Control and Prevention (CDC)

Market Players Outlook

The major companies serving the global rapid test market include Thermo Fisher Scientific Inc., ACON Laboratories, Inc., Abbott Laboratories, F. Hoffmann-La Roche Ltd, Alfa Scientific Designs Inc., Becton, Dickinson and Company, and BioMerieux, among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, Becton, Dickinson and Co. (BD) Accelerate Diagnostics, announced commercial collaboration. Under the collaboration, BD will provide Accelerate’s rapid testing solutions for antibiotic resistance and susceptibility. The tests are said to provide results within hours, while traditional laboratory methods take one to two days for results. BD will market the Accelerate Pheno system and Accelerate Arc module and related test kits through its global network, where the products have been approved for use.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global rapid test market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ACON Laboratories, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Becton, Dickinson and Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thermo Fisher Scientific Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Rapid Test Market by Product

4.1.1. Laboratory Rapid Test

4.1.2. Over-the-Counter (OTC) Rapid Test

4.2. Global Rapid Test Market by Technology

4.2.1. Powder Immunoassay

4.2.2. Chromatography

4.2.3. Spectroscopy

4.2.4. Polymerase Chain Reaction (PCR)

4.3. Global Rapid Test Market by Application

4.3.1. Infectious Disease

4.3.2. Pregnancy Test

4.3.3. Glucose Test

4.3.4. Others (Cholesterol Test, Diabetes)

4.4. Global Rapid Test Market by End-Users

4.4.1. Hospitals & Clinics

4.4.2. Diagnostic Laboratories

4.4.3. Home Care

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.4. Rest of Asia-Pacific

5.5. Rest of the World

6. Company Profiles

6.1. Alfa Scientific Designs Inc.

6.2. Artron Laboratories Inc

6.3. BioMerieux

6.4. BTNX Inc.

6.5. Cenogenics Corporation

6.6. Cepheid

6.7. Danaher Corporation

6.8. DiaSorin S.p.A

6.9. F. Hoffmann-La Roche Ltd

6.10. HemoCue America

6.11. Hologic, Inc.

6.12. Meridian Bioscience, Inc.

6.13. NuLife

6.14. OraSure Technologies, Inc.

6.15. Siemens Healthcare GmbH

1. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL LABORATORY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL OVER-THE-COUNTER RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL IMMUNOASSAY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CHROMATOGRAPHY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SPECTROSCOPY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL PCR RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

10. GLOBAL RAPID TEST FOR INFECTIOUS DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL RAPID TEST FOR PREGNANCY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL RAPID TEST FOR GLUCOSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL RAPID TEST FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

15. GLOBAL RAPID TEST FOR HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL RAPID TEST FOR DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL RAPID TEST FOR HOME CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

21. NORTH AMERICAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION INDUSTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

24. EUROPEAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. EUROPEAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

26. EUROPEAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

27. EUROPEAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. EUROPEAN RAPID TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC RAPID TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. ASIA- PACIFIC RAPID TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

34. REST OF THE WORLD RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

35. REST OF THE WORLD RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

36. REST OF THE WORLD RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

37. REST OF THE WORLD RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL LABORATORY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL OVER-THE-COUNTER RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL IMMUNOASSAY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL CHROMATOGRAPHY RAPID TEST GRAINS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL SPECTROSCOPY RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL PCR RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

10. GLOBAL RAPID TEST FOR INFECTIOUS DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. GLOBAL RAPID TEST FOR PREGNANCY MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL RAPID TEST FOR GLUCOSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL RAPID TEST FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023 VS 2031 (%)

15. GLOBAL RAPID TEST FOR HOSPITALS & CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL RAPID TEST FOR DIAGNOSTIC LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL RAPID TEST FOR HOME CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

18. GLOBAL RAPID TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. US RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

21. UK RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

32. LATIN AMERICA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)

33. THE MIDDLE EAST & AFRICA RAPID TEST MARKET SIZE, 2023-2031 ($ MILLION)