Smart Buildings Market

Smart Buildings Market Size, Share & Trends Analysis Report by Building Type (Residential, Commercial, and Industrial), by Solution (Safety & Security Management System, Energy Management System, Building Infrastructure Management System, Network Management, and Integrated Workplace Management System (IWMS)), and by Service (Consulting, Implementation, and Support & Maintenance), Forecast Period (2025-2035)

Industry Overview

Smart buildings market was valued at $110.4 billion in 2024 and is projected to reach $535.6 billion in 2035, growing at a CAGR of 15.5% during the forecast period (2025-2035). The smart buildings market globally is witnessing rapid growth as a result of technological advancements and growing urbanization. Enhanced demand for energy-efficient solutions is inducing the utilization of intelligent building systems. Integration of IoT devices and sensors is enabling real-time monitoring and enhanced management of building operations. Machine learning and artificial intelligence are increasingly enhancing building performance through data-driven decision-making. Environmental concerns and sustainability are driving the adoption of smart infrastructure. The smart buildings market globally is growing fast, owing to technological innovation and increased urbanization.

Market Dynamics

Increasing Demand for AI-Driven Building Automation

The smart building market is growing rapidly, with a large part of the growth fueled by the augmented demand for AI-based building automation systems. As companies have been focusing more on digitalization to increase the efficiency of operations and decrease power consumption, artificial intelligence (AI)--based solutions are critical to making data-driven decisions in real-time. Such systems, which include features such as climate control, light adjustment, and predictive maintenance, save on the cost of operation without compromising functionality. Artificial intelligence integration helps bring full automation of buildings by making communication between different building systems easier. Increased levels of automation of IoT sensors and devices allow AI applications to continuously feed insights, leading to smart decision-making. It is spearheaded by regulatory requirements and an increased focus on sustainability.

Growing Adoption of IoT & Sensor Integration

The smart buildings market is showing strong growth owing to the growing adoption of IoT and sensor implementations. The technologies provide real-time monitoring and control of building functions such as lighting, HVAC, security, and energy management. Through data collection and analysis from networked devices, building operators can make logical decisions to achieve peak performance and minimize energy usage. The continuous integration of sensors increases the responsiveness of building systems, and that in turn leads to better occupant comfort and safety. IoT-enabled infrastructure also allows for predictive maintenance, minimizing downtime and maximizing equipment life. The necessity for efficient and automated facility management solutions is driving investments in IoT technology.

Market Segmentation

- Based on the building type, the market is segmented into residential, commercial, and industrial.

- Based on the solution, the market is segmented into safety & security management systems, energy management systems, building infrastructure management systems, network management, and integrated workplace management systems (IWMS).

- Based on the service, the market is segmented into consulting, implementation, and support & maintenance.

Energy Management System Segment to Lead the Market with the Largest Share

The smart buildings market is exhibiting strong growth with increasing energy management system (EMS) adoption. EMS ensures better optimization of energy consumption, minimizes operational expenditures, and aids in sustainability programs. The growing concern over energy efficiency, the environment, and building owners spending on smart technologies. EMS offers real-time monitoring, data analysis, and automated control of heating, ventilation, lighting, and other systems. Government regulations and green building certifications are pushing EMS implementation ahead. AI and IoT integration enhance EMS performance and predictive maintenance. Commercial and industrial uses, especially, are highly sought after through cost savings over the long term. As a result, the smart buildings market is poised to continue its upward trend. For instance, Schneider Electric offers advanced energy management systems through its EcoStruxure building platform that enables intelligent and efficient energy consumption and building performance.

Implementation: A Key Segment in Market Growth

The smart buildings business is led by strong growth through the adoption of advanced digital technology and automation solutions. It contributes to driving the rise in operational efficiency, occupant comfort, and building security. Through the integration of building systems, including HVAC, lighting, and access control, smart buildings enable centralized monitoring and management. Urbanization and the need for green building practices are driving urban centers to move towards intelligent infrastructure. The installation of smart solutions helps lower energy consumption and maintenance costs. Advances in technology, such as IoT, AI, and cloud computing, are at the center of enabling such changes. Developers and building owners are spending more on smart technologies to future-proof their buildings. For instance, Johnson Controls provides end-to-end smart building solutions via its Metasys Building Automation System, which helps integrate smoothly and implement building operations effectively.

Regional Outlook

The global smart buildings market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Smart Building Automation Systems in North America

The North American market for smart buildings is developing rapidly, supported by advanced technology infrastructure and the early adoption of cutting-edge building automation systems. The availability of top-notch smart building solution providers makes a big contribution to market innovation and competitiveness. Increased interest in converged security and access control systems is driving investment in smart infrastructure. Cloud-based building management platform development enables real-time monitoring and decision-making of data. Increased emphasis on occupant comfort and indoor air quality is driving the adoption of smart HVAC and ventilation systems. Aging infrastructure throughout the region is initiating a wave of retrofit projects with smart technologies. Smart renovations in public buildings are being driven by government incentives and funding initiatives. Increasing interest in working away from the office is shaping demand for smart, flexible workplaces.

Asia-Pacific Region Dominates the Market with Major Share

The Asia-Pacific smart building market is expanding as a result of a chain of significant drivers. Urbanization in the leading economies of China and India is proceeding at an accelerated pace, and it is increasing the need for smart infrastructure solutions. Government-sponsored smart city initiatives are speeding up to implementation of smart technology in urban development strategies. Increased energy prices, as in sustainability, are promoting the utilization of energy-efficient building solutions. The area is experiencing substantial investment in the Internet of Things (IoT) and automated technology to control buildings. Growing awareness among developers and building owners about long-term operating cost reductions is driving demand in the market. Expansion of the commercial real estate market is fuelling market growth. Regulatory policies and environmental policies conducive to regulations are promoting the use of smart solutions in new developments.

Market Players Outlook

The major companies operating in the global smart buildings market include ABB Ltd., Honeywell International Inc., Johnson Controls International plc, Schneider Electric SE, and Siemens AG, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In April 2025, Johnson Controls, for intelligent, healthy, safe, and sustainable buildings, published a new commissioned study by Forrester Consulting that measured the Total Economic Impact and benefits of its OpenBlue platform. Forrester discovered in the research that a model company with a composite of interviewed customers from across several industries deploying OpenBlue, including FM Systems solutions, would be able to make as much as a 155.0% ROI within three years.

- In September 2024, Hitachi, Ltd. and Hitachi Building Systems, Co., Ltd. announced that they have newly developed a new model of BuilMirai building IoT solution for small and medium-sized 1 buildings. The solutions are part of the Lumada, which enhances building management efficiency, maintains and enhances operational quality, and enhances user comfort. Through the release of the solutions, Hitachi and Hitachi Building Systems reinforce their green & smart building business.

- In November 2023, ABB and Samsung C&T signed an agreement to increase smart building potential. To enhance the livability and energy efficiency of massive residential, commercial, and multi-dwelling residential buildings, ABB Smart Buildings and Samsung C&T Corporation Engineering & Construction Group ('Samsung C&T') today signed a new global partnership to provide integrated, end-to-end building automation, dependable energy distribution, and energy management solutions together.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart buildings market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Smart Buildings Market Sales Analysis – Building Type| Solution| Service| ($ Million)

• Smart Buildings Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Smart Buildings Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Smart Buildings Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

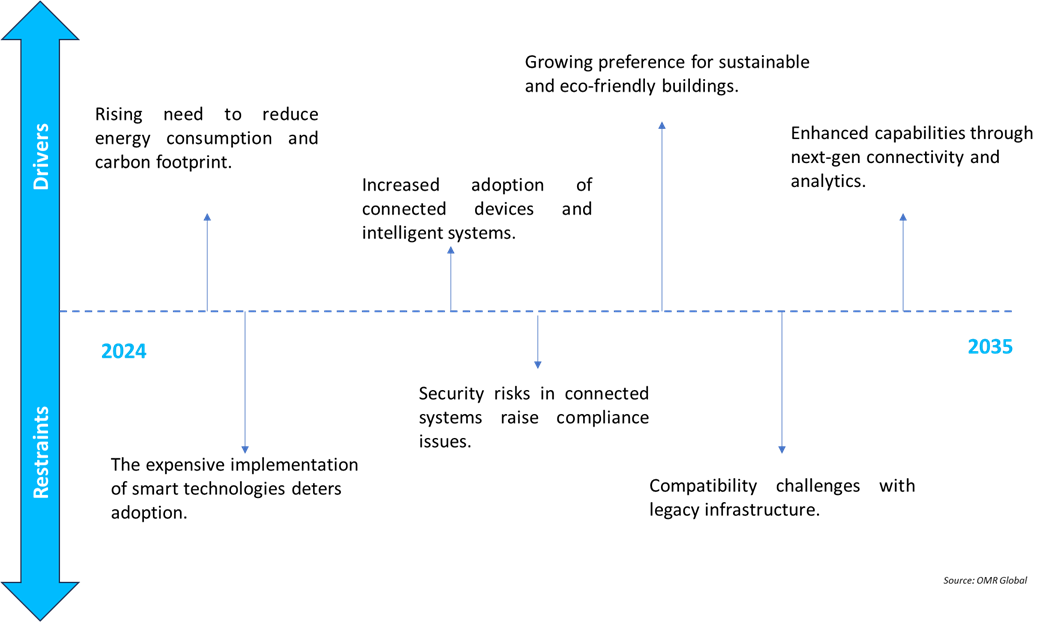

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Smart Buildings Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Smart Buildings Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Smart Buildings Market Revenue and Share by Manufacturers

• Smart Buildings Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Robert Bosch GmbH

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Hitachi Ltd.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Huawei Technologies Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. IBM Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Siemens AG

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Smart Buildings Market Sales Analysis by Building Type ($ Million)

5.1. Residential

5.2. Commercial

5.3. Industrial

6. Global Smart Buildings Market Sales Analysis by Solution ($ Million)

6.1. Safety & Security Management System

6.2. Energy Management System

6.3. Building Infrastructure Management System

6.4. Network Management

6.5. Integrated Workplace Management System (IWMS)

7. Global Smart Buildings Market Sales Analysis by Service ($ Million)

7.1. Consulting

7.2. Implementation

7.3. Support & Maintenance

8. Regional Analysis

8.1. North American Smart Buildings Market Sales Analysis – Building Type | Solution | Service | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Smart Buildings Market Sales Analysis – Building Type | Solution | Service | Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Smart Buildings Market Sales Analysis – Building Type | Solution | Service | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Smart Buildings Market Sales Analysis – Building Type | Solution | Service | Country ($ Million)

• Macroeconomic Factors for Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ABB Ltd.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Robert Bosch GmbH

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BrainBox AI Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Cisco Systems Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Delta Electronics, Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. ecobee Ltd.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. GridPoint, Inc.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Hitachi Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Honeywell International Inc.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Huawei Technologies Co., Ltd.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. IBM Corp.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Intel Corp.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Johnson Controls International plc

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Kieback&Peter GmbH & Co. KG

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Legrand SA

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Multi-Tech Systems Inc.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Nagarro

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Planon Group

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Schneider Electric SE

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Screening Eagle Technologies AG

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Semtech Corp. (Sierra Wireless)

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Screening Eagle Technologies

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Siemens AG

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

9.24. Softdel Systems Pte. Ltd.

9.24.1. Quick Facts

9.24.2. Company Overview

9.24.3. Product Portfolio

9.24.4. Business Strategies

9.25. Spacewell International NV

9.25.1. Quick Facts

9.25.2. Company Overview

9.25.3. Product Portfolio

9.25.4. Business Strategies

9.26. Telit Cinterion (Telit IoT Solutions Holding Ltd.)

9.26.1. Quick Facts

9.26.2. Company Overview

9.26.3. Product Portfolio

9.26.4. Business Strategies

1. Global Smart Buildings Market Research and Analysis by Building Type, 2024–2035 ($ Million)

2. Global Residential Smart Buildings Market Research and Analysis by Region, 2024–2035 ($ Million)

3. Global Commercial Smart Buildings Market Research and Analysis by Region, 2024–2035 ($ Million)

4. Global Industrial Smart Buildings Market Research and Analysis by Region, 2024–2035 ($ Million)

5. Global Smart Buildings Market Research and Analysis by Solution, 2024–2035 ($ Million)

6. Global Smart Buildings Safety & Security Management System Market Research and Analysis by Region, 2024–2035 ($ Million)

7. Global Smart Buildings Energy Management System Market Research and Analysis by Region, 2024–2035 ($ Million)

8. Global Smart Buildings Building Infrastructure Management System Market Research and Analysis by Region, 2024–2035 ($ Million)

9. Global Smart Buildings Network Management Market Research and Analysis by Region, 2024–2035 ($ Million)

10. Global Smart Buildings Integrated Workplace Management System (IWMS) Market Research and Analysis by Region, 2024–2035 ($ Million)

11. Global Smart Buildings Market Research and Analysis by Service, 2024–2035 ($ Million)

12. Global Smart Buildings Consulting Service Market Research and Analysis by Region, 2024–2035 ($ Million)

13. Global Smart Buildings Implementation Service Market Research and Analysis by Region, 2024–2035 ($ Million)

14. Global Smart Buildings Support & Maintenance Service Market Research and Analysis by Region, 2024–2035 ($ Million)

15. Global Smart Buildings Market Research and Analysis by Region, 2024–2035 ($ Million)

16. North American Smart Buildings Market Research and Analysis by Country, 2024–2035 ($ Million)

17. North American Smart Buildings Market Research and Analysis by Building Type, 2024–2035 ($ Million)

18. North American Smart Buildings Market Research and Analysis by Solution, 2024–2035 ($ Million)

19. North American Smart Buildings Market Research and Analysis by Service, 2024–2035 ($ Million)

20. European Smart Buildings Market Research and Analysis by Country, 2024–2035 ($ Million)

21. European Smart Buildings Market Research and Analysis by Building Type, 2024–2035 ($ Million)

22. European Smart Buildings Market Research and Analysis by Solution, 2024–2035 ($ Million)

23. European Smart Buildings Market Research and Analysis by Service, 2024–2035 ($ Million)

24. Asia-Pacific Smart Buildings Market Research and Analysis by Country, 2024–2035 ($ Million)

25. Asia-Pacific Smart Buildings Market Research and Analysis by Building Type, 2024–2035 ($ Million)

26. Asia-Pacific Smart Buildings Market Research and Analysis by Solution, 2024–2035 ($ Million)

27. Asia-Pacific Smart Buildings Market Research and Analysis by Service, 2024–2035 ($ Million)

28. Rest of the World Smart Buildings Market Research and Analysis by Region, 2024–2035 ($ Million)

29. Rest of the World Smart Buildings Market Research and Analysis by Building Type, 2024–2035 ($ Million)

30. Rest of the World Smart Buildings Market Research and Analysis by Solution, 2024–2035 ($ Million)

31. Rest of the World Smart Buildings Market Research and Analysis by Service, 2024–2035 ($ Million)

FAQS

The size of the Smart Buildings market in 2024 is estimated to be around $110.4 billion.

Asia-Pacific holds the largest share in the Smart Buildings market.

Leading players in the Smart Buildings market include ABB Ltd., Honeywell International Inc., Johnson Controls International plc, Schneider Electric SE, and Siemens AG, among others.

Smart Buildings market is expected to grow at a CAGR of 15.5% from 2025 to 2035.

Rising demand for energy efficiency, smart city development, and IoT-based automation is driving the growth of the Smart Buildings Market.