Smart Sensors Market

Global Smart Sensors Market Size, Share & Trends Analysis Report by Type (Pressure Sensors, Temperature Sensors, Flow Sensors, Image Sensors, and Others) and Application (Aerospace and Defense, Healthcare, Industrial Automation, Automotive and Transportation, Consumer Electronics, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global smart sensors market is growing at a significant CAGR of around 18.2% during the forecast period (2020-2026). The market for smart sensors is driven by rising adoption of smart sensors across consumer electronics, security and surveillance, healthcare, and automotive industry. In addition, the rising trend for wearable devices, autonomous cars, and industrial automation are further offering growth opportunity to the global smart sensors market. With the ever-increasing demand in urban mobility and modern logistics sector, the vehicle population has been steadily growing over the past few decades. The ADAS image sensors improve driver safety, it assists the car to gather information about the outside world. ADAS embraces a number of technologies such as LIDAR (light detection and ranging), RADAR (radio detection and ranging), sensors and integrated cameras to provide an all-around image of the surrounding to the driver. However, the high installation and maintenance cost of smart sensors will affect the market growth during the forecast period.

Segmental Outlook

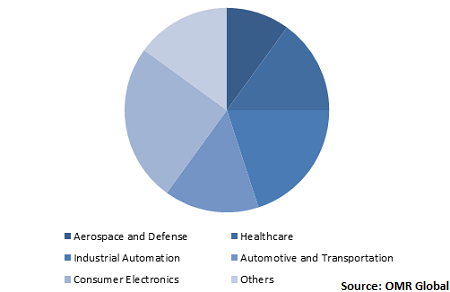

The smart sensors market is classified on the basis of type and application. Based on type, the market is segregated into pressure sensors, temperature sensors, flow sensors, image sensors, and others. Based on application, the market is segmented into aerospace and defense, healthcare, industrial automation, automotive and transportation, consumer electronics, and others.

Global Smart Sensors Market Share by Application, 2019 (%)

Global smart sensors market is driven by its demand for consumer electronics

The consumer electronics finds significant application of smart sensors. These are widely used in smartphones and other consumer electronics such as HD cameras and others. Due to rise in adoption rate of smartphones and continuous increase in the demand for high-quality images from smartphones is significantly driving the market growth in consumer electronics industry. Market players are intensively focusing on the R&D of smart sensors due to which sensing devices have become cost-effective and compact. This has fueled the adoption of smart sensors in consumer electronics products such as smartphones, tablets, DSLR cameras and mirrorless cameras, drones, and many others.

As per the International Telecommunication Union, in 2018 around 97% of the global population has to reach to mobile cellular and around 93% of the population is in the reach of at least 3G network. However, in comparison to this 52% of the total female population and 42% of the total male population are still not using the internet. This number is mostly from Asia-Pacific and Rest of the World region hence, further growth in the smartphone market will be witnessed in the near future. Moreover, in order to provide better camera quality and to remain competitive in the market, companies are introducing multiple camera smartphones which are further expected to augment the demand for smart sensors during the forecast period.

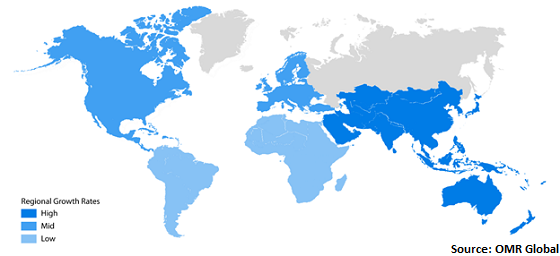

Regional Outlook

The global smart sensors market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is expected to project a considerable growth in the global smart sensors market during the forecast period. With the growth in advanced technologies in the region, demand for smart sensors is estimated to increase in the region during the forecast period. North American region is one of the most established and significantly growing markets in terms of consumer electronic products sale. Further, the region is projected to mount up the need for smart sensors in healthcare applications such as ultrasound, MRI, and others. Due to rapid growth in the health-conscious population in North America, companies are bringing wearable devices in their product portfolio which as a result is projected to contribute a huge share in the market.

Global Smart Sensors Market Growth, by Region 2020-2026

Asia-Pacific contributes significantly in the global smart sensors market

Asia-Pacific holds a significant share, in terms of revenue, in the global smart sensors market. Major economies of the region such as China, Japan, and South Korea home several consumer electronic products and automobile manufacturers that are addressing the demand for novel sensing technology and devices: thereby, supporting the regional business growth of the market. Smartphone manufacturers such as Huawei (China), Xiaomi (China), BKK Electronics (China), LG (South Korea), Samsung (South Korea) Hitachi (Japan), and many others are implementing smart sensors in their products to enhance the user experience regarding photography and videography. In addition to this, China, Japan, India, and South Korea are major global automotive manufacturers, and more than half of the global production outcomes are from these countries. Due to this, the region is expected to hold a major market share during the forecast period.

Market Players Outlook

The key players in the smart sensors market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global smart sensors market include NXP Semiconductors N.V., Samsung Electronics Co., Ltd., ABB Ltd., Siemens AG, Analog Devices, Inc., and Infineon Technologies AG. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in December 2019, Samsung Electronics Co., Ltd. released its 108-megapixel (Mp) ISOCELL Bright HMX, the industry’s first mobile image sensor to exceed 100 million pixels. This new image sensor enables the user to capture extremely sharp photos and allows them to do so in a wide range of adverse lighting conditions.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global smart sensors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. NXP Semiconductors N.V.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. ABB Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Siemens AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Analog Devices, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Infineon Technologies AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Smart Sensors Market by Type

5.1.1. Pressure Sensor

5.1.2. Temperature Sensor

5.1.3. Flow Sensor

5.1.4. Image Sensor

5.1.5. Others (Humidity Sensor and Position Sensor)

5.2. Global Smart Sensors Market by Application

5.2.1. Aerospace and Defense

5.2.2. Healthcare

5.2.3. Industrial Automation

5.2.4. Automotive and Transportation

5.2.5. Consumer Electronics

5.2.6. Others (Building Automation)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Analog Devices, Inc.

7.3. Eaton Corporation PLC

7.4. Honeywell International Inc.

7.5. Infineon Technologies AG

7.6. LEGRAND

7.7. NXP Semiconductors N.V.

7.8. OMRON Corp.

7.9. Renesas Electronics Corp.

7.10. Robert Bosch GmbH

7.11. Rockwell Automation, Inc.

7.12. Samsung Electronics Co., Ltd.

7.13. Siemens AG

7.14. Smart Sensors, Inc.

7.15. STMicroelectronics N.V.

7.16. TDK Corp.

7.17. TE Connectivity Ltd.

7.18. Vishay Technology Inc.

1. GLOBAL SMART SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL PRESSURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL TEMPERATURE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL FLOW SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER SMART SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL SMART SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL SMART SENSORS FOR AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL SMART SENSORS FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL SMART SENSORS FOR INDUSTRIAL AUTOMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL SMART SENSORS FOR AUTOMTIVE AND TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL SMART SENSORS FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

14. GLOBAL SMART SENSORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPEAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN SMART SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC SMART SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC SMART SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC SMART SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

24. REST OF THE WORLD SMART SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

25. REST OF THE WORLD SMART SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL SMART SENSORS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL SMART SENSORS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL SMART SENSORS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD SMART SENSORS MARKET SIZE, 2019-2026 ($ MILLION)