Space Launch Services Market

Space Launch Services Market Size, Share & Trends Analysis Report by Payload Types (Satellites, Human Spacecraft, Cargo, Testing Probes, Stratollites), by Launch Platforms (Land, Air, Sea), and by Service Types (Pre launch, Post launch), by Launch Vehicles (Efficient and Reliable Reusable Launch Systems, Additive Manufacturing, AI and Machine Learning), by End-Use ( Forecast Period (2024-2031)

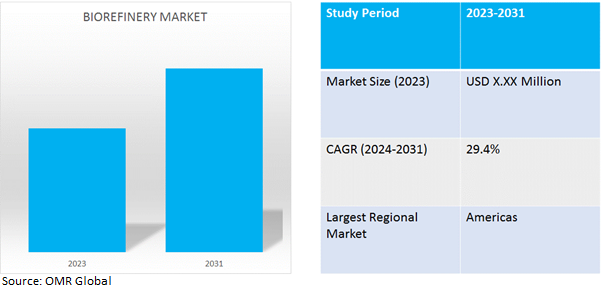

Space Launch services market is anticipated to grow at a CAGR of 14% during the forecast period (2024-2031). Space Launch services is a framework in which help the space stations for launching the satellites with different segments and major key drivers which will impact the demand of market.

Market Dynamics

Air Launch in lights for launching satellites in space stations

Air launch systems also allow for greater control over the launch trajectory, which can be advantageous for certain types of payloads. Air-launch is advantageous for the delivery of small payloads into space for a number of reasons. Launching from a higher altitude means the rocket will have to fly through a much thinner atmosphere. This translates into less drag which then means that only a small amount of fuel is required. Virgin Orbit works in launching satellites by air which will be used in small satellites, which will reduce cost, technological advancement and more benefits will be witnessed. LauncherOne System of Virgin Orbit, with headquarters in Long Beach, California, is a company within the Virgin Group which plans to provide launch services for small satellites.

AI steps in Space launch services

Globally, there is a trend of AI and Machine learning which is now emerging in space launch services. It is used to control large satellite constellations, to analyze the huge amounts of data that satellites collect, and to process data directly onboard satellites. In 2022, ESA Discovery funded 12 projects that explored whether we can apply the latest developments in AI and advanced computing paradigms to make satellites more reactive, agile and autonomous. They were selected through the Open Space Innovation Platform ‘Cognitive cloud computing in space’ call for ideas. A more recent study developed the idea further, focusing on the autonomous management of complex constellations to reduce the workload of ground operators.

Market Segmentation

Our in-depth analysis of the Space Launch services market includes the following segments by Payload type, launch platform, service types, Launch vehicles, End-use:

- Based on Market by Payload Type is sub-segmented into Satellites, Human Spacecraft, Cargo, Testing Probes, Stratollites

- Based on launch Platform, the market is bifurcated into Land, Air and Sea.

- Based on Service Types, the market is augmented into Commercial Tyes, Government driven, Technological Advancement

- Based on Launch vehicles, the market is bifurcated into Efficient and Reliable, Reusable Launch Systems, Additive Manufacturing, AI and Machine Learning.

- Based on End-Use, the market is augmented into Satellite Constellations, Commercial Space Activities, and Challenges.

Ai and Machine Learning in Space Launch Services holds big share in market

Based on the technology, the Global space launch services market is sub-segmented into different segments. Where in today’s world need of AI and Machine learning is in need and technological change is making the big impact. AI will be essential for managing the mega-constellations of commercial telecommunications satellites being deployed in LEO, Advancements in AI, in combination with increased availability of low-cost and secure cloud storage have also led to improvements in SDA while decreasing costs. As databases grow with an increased number of objects to track and characterize, companies and countries will employ AI to make timely, cost-effective assessments for SDA, while reducing the role of the human-in-the-loop.

Government Investment in Space Research increased

Governments are spending money on infrastructural support for space exploration missions and sponsorship. A lack of funding has occasionally constrained the space programs. In 2023, the investment in Indian Space Start-Ups has increased to $ 124.7 Million. In 2022, announced an additional investment of approximately $45 million in the Tronador SLV program, including associated experimental rockets (VEx-5, VEx-6) and auxiliary and launch infrastructure. Same with different countries. In 2022, Austria invested approximately $55 million. The government of countries

Regional Outlook

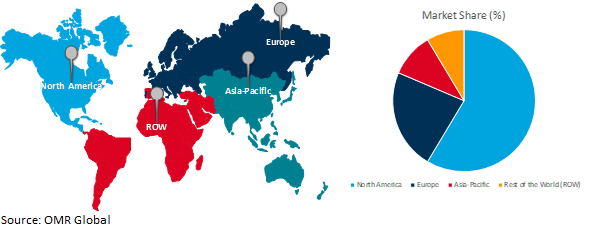

The global space launch services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries in Space launch services

- European Union is the key investor in space and research with huge allocation of funds as compared to other sectors.

- France is in 3rd in the race for space launch services and investments.

Global Space Launch Services Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share. Which is driven by technological advancement by government as NASA is working on virgin orbit and AI and ML in space launch service. Also, as we look into the budget of the US the country budget in 2024 is $24.9 billion and in 2025 its budgeted $25.4 billion.

Apart from this, government is working with SpaceX “NASA Artemis Mission Progresses with SpaceX Starship Test Flight”. Apart from this USA partnering with private players too for more better results such as: “Seven US Companies Collaborate with NASA to Advance Space Capabilities”.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global space launch service market include SpaceX, NASA, Blue Origin, United Launch Alliance, Rocket Lab among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, In January 2022, 13 Companies to Provide Venture Class Launch Services for NASA, In March 20233D printed materials comprised 85 percent of Relativity Space’s small-lift Terran 1 rocket.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Space launch services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Mitsubishi Heavy Industries, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Rocket Lab USA, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Virgin galactic

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Space Launch Services Market by Payload Type

4.1.1. Satellites

4.1.2. Human Spaceflights

4.1.3. Cargo

4.1.4. Space Probes

4.1.5. Stratolite

4.2. Global Space Launch Services Market by Orbit

4.2.1. Low Earth Orbit (LEO)

4.2.2. Medium Earth Orbit (MEO)

4.2.3. Geostationary Equatorial Orbit (GEO)

4.2.4. Beyond GEO

4.3. Global Space Launch Services Market by Service Type

4.3.1. Pre-Launch

4.3.2. Post Launch

4.4. Global Space Launch Services Market by Launch Vehicle Type

4.4.1. Small-Lift Launch Vehicle

4.4.2. Medium to Heavy Launch Vehicle

4.5. Global Space Launch Services Market by End-Use

4.5.1. Commercial

4.5.2. Military

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABL Space Systems

6.2. Agnikul Cosmos

6.3. Antrix Corporation Ltd.

6.4. Arianespace

6.5. Astra Space Inc

6.6. Axelspace

6.7. Bellatrix Aerospace

6.8. Boeing Defense, Space & Security

6.9. Galactic Energy:

6.10. ispace

6.11. LandSpace Technology Corp.

6.12. Northrop Grumman Corp.

6.13. Relativity Space Inc.

6.14. Rocket Lab

6.15. Sierra Nevada Corporation

6.16. Skyroot Aerospace

6.17. United Launch Alliance (ULA)

1. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY PAYLOAD TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SATELLITES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HUMAN SPACEFLIGHTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CARGO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL SPACING PROBES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL STRATOLLITES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY ORBIT, 2023-2031 ($ MILLION)

8. GLOBAL SPACE LAUNCH SERVICES FOR LEO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL SPACE LAUNCH SERVICES FOR MEO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL SPACE LAUNCH SERVICES FOR GEO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL SPACE LAUNCH SERVICES FOR BEYOND GEO MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

13. GLOBAL SPACE PRE-LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL SPACE POST-LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY LAUNCH VEHICLE TYPE, 2023-2031 ($ MILLION)

16. GLOBAL SMALL-LIFT LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL MEDIUM TO HEAVY LAUNCH VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

19. GLOBAL SPACE LAUNCH SERVICES IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL SPACE LAUNCH SERVICES IN MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY PAYLOAD TYPE, 2023-2031 ($ MILLION)

24. NORTH AMERICAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

25. NORTH AMERICAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY LAUNCH VEHICLE TYPE, 2023-2031 ($ MILLION)

26. NORTH AMERICAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

27. EUROPEAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. EUROPEAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY PAYLOAD TYPE, 2023-2031 ($ MILLION)

29. EUROPEAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

30. EUROPEAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY LAUNCH VEHICLE TYPE, 2023-2031 ($ MILLION)

31. EUROPEAN SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY PAYLOAD TYPE, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY LAUNCH VEHICLE TYPE, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY PAYLOAD TYPE, 2023-2031 ($ MILLION)

39. REST OF THE WORLD SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

40. REST OF THE WORLD SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY LAUNCH VEHICLE TYPE, 2023-2031 ($ MILLION)

41. REST OF THE WORLD SPACE LAUNCH SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY PAYLOAD TYPE, 2023 VS 2031 (%)

2. GLOBAL SATELLITES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HUMAN SPACEFLIGHTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CARGO MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL SPACING PROBES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL STRATOLLITES MARKET SHARE BY REGION, 2023 VS 2031 (%)GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY ORBIT, 2023 VS 2031 (%)

7. GLOBAL SPACE LAUNCH SERVICES FOR LEO MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL SPACE LAUNCH SERVICES FOR MEO MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL SPACE LAUNCH SERVICES FOR GEO MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL SPACE LAUNCH SERVICES FOR BEYOND GEO MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY SERVICE TYPE, 2023 VS 2031 (%)

12. GLOBAL SPACE PRE-LAUNCH SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SPACE POST-LAUNCH SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY LAUNCH VEHICLE TYPE, 2023 VS 2031 (%)

15. GLOBAL SMALL-LIFT LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL MEDIUM TO HEAVY LAUNCH VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY END-USE, 2023 VS 2031 (%)

18. GLOBAL SPACE LAUNCH SERVICES IN COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL SPACE LAUNCH SERVICES IN MILITARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL SPACE LAUNCH SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. US SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. CANADA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. UK SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. FRANCE SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. GERMANY SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. ITALY SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

27. SPAIN SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF EUROPE SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

29. INDIA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

30. CHINA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

31. JAPAN SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

32. SOUTH KOREA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

34. LATIN AMERICA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

35. THE MIDDLE EAST AND AFRICA SPACE LAUNCH SERVICES MARKET SIZE, 2023-2031 ($ MILLION)