Structural Adhesive Tapes Market

Global Structural Adhesive Tapes Market Size, Share & Trends Analysis Report By Resin Type (Silicone, Acrylic, Rubber, and Others), By Material Type (Paper, Polyvinyl Chloride, Polypropylene, and Others) , By End-User Industry (Building & Construction, Automotive, Healthcare, Electrical & Electronics, and Others) Forecast 2021-2027

The global structural adhesive tapes market is anticipated to grow at a CAGR of around 3.9% during the forecast period (2021-2027). The global structural adhesive tapes market is majorly driven by the prominent factors which include rising demand for structural adhesive tapes from end-user industries such as building & construction, automotive, healthcare, and electrical & electronics among others. The and growing government expenditure on large-scale infrastructure projects such as rail and highways is further contributing to the market growth. Apart from these, the increasing number of public-private infrastructure development collaborations have fuelled the growth of the construction industry, and thus the structural adhesive tapes industry. Structural adhesive tapes are used for sealing, bonding, and covering holes in internal glazing and partitioning systems.

The global market is also accelerated by the growing urbanization that contributed to the high demand for residential buildings. According to the US Nations, Department of Economic and Social Affairs, in 2018, around 55.0% of the world’s population lives in urban areas, a proportion that is expected to increase to 68.0% by 2050. In line with this as per the US UNCTAD, by 2050, an additional 2 billion people will live on earth. This increased population will increase the building and construction projects. Furthermore, the shortage in raw material supply and fluctuation in price are the challenges for the structural adhesive tapes market.

Impact of COVID-19 on Global Structural Adhesive Tapes Market

The structural adhesive tapes market was moderately impacted by the outbreak of the COVID-19 pandemic. The market growth was pumped by the surge in demand for PPE kits and medical devices from the healthcare sector. To expand the business and product offerings the major players operating in the global structural adhesive market have started aggressive marketing. The demand for structural adhesive tapes was lower inother sectors due to industrial shutdown regulations announced by the government. Due to delay in raw material supply chain and fluctuation in price due to less availability of tapes the end-user verticals except the healthcare sector has experienced a downfall in revenue. Among all the end-user industries, the automotive sector was highly impacted by the COVID-19 outbreak owing to the stringent regulation imposed by the government on mobility.

Segmental Outlook

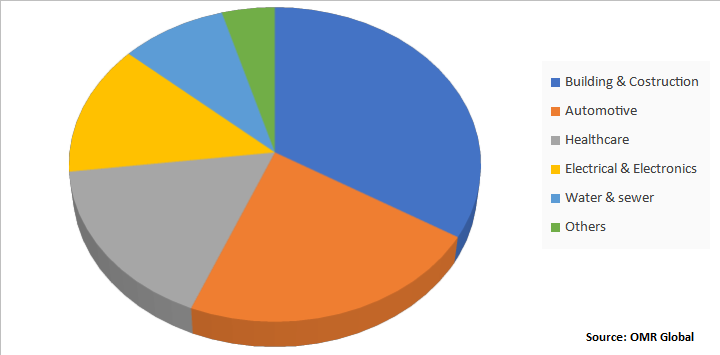

The global structural adhesive tapes market is segmented based on resin type, material type, and end-user industry. Based on resin type, the market is segregated into silicone, acrylic, rubber, and others. Among these, the acrylic segment is estimated to lead the market during the forecast period. Based on material type, the market is further analyzed into paper, polyvinyl chloride, polypropylene, and others. Based on the end-user industry, the market is categorized into building & construction, automotive, healthcare, electrical & electronics, water & sewer, and others.

Global Structural Adhesive Tapes Market Share by End-User, 2020 (%)

The Building and Construction Segment Holds the Significant Share in Global Structural Adhesive Tapes Market

Among end-users, the building and construction segment is projected to be the largest segment of structural adhesive tapes during the forecast period. The ongoing building and construction projects owing to the growth in industrialization and urbanization are the factors driving the scope of the structural adhesive market. For instance, Jubail II, an industrial city project in Saudi Arabia that began its second phase in 2014 with an $11 billion expansion budget is expected to finish in 2024, furthermore, the High-Speed Railway construction project in China began in 2015 is scheduled for the completion in 2029. These ongoing projects will generate the demand for structural adhesive tapes that will drive market growth. The structural adhesive tapes in the building and construction sector are used for bonding and mounting components on doors and windows, decorative trims or wall coverings, panels to frames, and protective bumper rails to furniture and walls. These products are used as carpet, duct, double-sided, UV resistant, and masking tapes. With a further increase in the number of construction projects globally, the market is expected to show a lucrative growth rate during the forecast period.

Regional Outlook

Geographically, the global structural adhesive tapes market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japanand Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America dominated the market by accounting highest share in the market in 2020. The US and Canada are the two major economies contributing significantly to the market growth. The presence of a robust manufacturing base in the U.S., coupled with the rapid growth of the automotive industry, development in healthcare infrastructure, and presence of structural adhesive tapes providers such as 3M Co., Avery Dennison Corp. are the factors boosting the market growth in the region.

Global Structural Adhesive Tapes Market Growth, By Region 2021-2027

Asia-Pacific is projected to be the Fastest Growing Region in Global Structural Adhesive Tapes Market

Geographically, Asia-Pacific is anticipated to grow at the fastest CAGR during the forecast period. The Asia-Pacific region is the hub for the key automotive players. Due large population base the production of automobile vehicles is increasing at a rapid pace which is simultaneously accelerating the need for structural adhesive tapes. Besides, the Government of China has introduced 1 million EVs in 2020, which has augmented the market growth in the country. Apart from these, the market is majorly driven by the availability of low labor at low cost, low raw material prices, and increasing retail industry in major economies in the region. Moreover, battery-operated vehicles are gaining huge popularity in the region which in turn are expected to positively impact the market growth. Furthermore, technological advancements, performance enhancements in vehicles have led to the installation of specialized components, that will be further projected to have a positive impact on market growth.

Market Players Outlook

The key players in the structural adhesive tapes market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include 3M Co., Ashland Inc., Avery Dennison Corp., Henkel AG & Co., Lintec Corp., and Nitto Denko Corp.among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in February 2019, Intertape Polymer expanded its manufacturing plant in Midland, North Carolina, by adding its second water-activated tape line. This expansion will increase the company’s production of tapes by two folds.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global structural adhesive tapes market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Structural Adhesive Tapes Industry

• Recovery Scenario of Global Structural Adhesive Tapes Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Structural Adhesive Tapes Market, By Resin Type

5.1.1. Silicone

5.1.2. Acrylic

5.1.3. Rubber

5.1.4. Others

5.2. Global Structural Adhesive Tapes Market, By Material Type

5.2.1. Paper

5.2.2. Polyvinyl Chloride

5.2.3. Polypropylene

5.2.4. Others

5.3. Global Structural Adhesive Tapes Market, By End-User Industry

5.3.1. Building &Construction

5.3.2. Automotive

5.3.3. Healthcare

5.3.4. Electrical & Electronics

5.3.5. Others (Renewable Energy,Aviation & Aerospace)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. 3M Co.

7.2. Ashland Inc.

7.3. Avery Dennison Corp.

7.4. Berry Global Inc.

7.5. Bostik, Inc.

7.6. H.B. Fuller Co.

7.7. Henkel AG & Co.

7.8. Huntsman International LLC

7.9. Illinois Tool Works Inc.

7.10. Intertape Polymer Group, Inc.

7.11. Lintec Corp.

7.12. Lord Corp.

7.13. Nitto Denko Corp.

7.14. Saint-Gobain Performance Plastics Corp.

7.15. Scapa Group Ltd.

7.16. Scott Bader Co.

7.17. Sika AG

7.18. Tesa SE

7.19. The Dow Chemical Company

1. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

2. GLOBAL SILICONE BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ACRYLIC BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL RUBBER BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHER RESIN BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

7. GLOBAL PAPER BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL POLYVINYL CHLORIDE BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL POLYPROPYLENE BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OTHERS MATERIAL BASED STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

12. GLOBAL STRUCTURAL ADHESIVE TAPES FOR BUILDING & CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL STRUCTURAL ADHESIVE TAPES FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL STRUCTURAL ADHESIVE TAPES FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL STRUCTURAL ADHESIVE TAPES FOR ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL STRUCTURAL ADHESIVE TAPES FOR OTHERS (RENEWABLE ENERGY, AVIATION & AEROSPACE) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. NORTH AMERICAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE,2020-2027 ($ MILLION)

19. NORTH AMERICAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

21. EUROPEAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. EUROPEAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE,2020-2027 ($ MILLION)

23. EUROPEAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

24. EUROPEAN STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION

25. ASIA-PACIFIC STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE,2020-2027 ($ MILLION)

27. ASIA-PACIFIC STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BYMATERIAL TYPE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

29. REST OF THE WORLD STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD STRUCTURAL ADHESIVE TAPES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL STRUCTURAL ADHESIVE TAPES MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL STRUCTURAL ADHESIVE TAPES MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL STRUCTURAL ADHESIVE TAPES MARKET, 2020-2027 (%)

4. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET SHARE BY RESIN TYPE,2020 VS 2027 (%)

5. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET SHARE BY MATERIAL TYPE, 2020 VS 2027 (%)

6. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET SHARE BY END-USER INDUSTRY, 2020 VS 2027 (%)

7. GLOBAL STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL SILICONE BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL ACRYLIC BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL RUBBER BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL OTHER RESIN BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL PAPER BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL POLYVINYL CHLORIDE BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL POLYPROPYLENE BASED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL OTHERS FOR STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL PACKAGING STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL MASKING STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL SPECIALIZED STRUCTURAL ADHESIVE TAPES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL STRUCTURAL ADHESIVE TAPES FOR BUILDING & CONSTRUCTION MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. GLOBAL STRUCTURAL ADHESIVE TAPES FOR AUTOMOTIVE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. GLOBAL STRUCTURAL ADHESIVE TAPES FOR HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

22. GLOBAL STRUCTURAL ADHESIVE TAPES FOR ELECTRICAL & ELECTRONICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

23. GLOBAL STRUCTURAL ADHESIVE TAPES FOR WATER & SEWER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

24. GLOBAL STRUCTURAL ADHESIVE TAPES FOR OTHERS (RENEWABLE ENERGY, AVIATION & AEROSPACE) MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

25. US STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

26. CANADA STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

27. UK STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

28. FRANCE STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

29. GERMANY STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

30. ITALY STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

31. SPAIN STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF EUROPE STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

33. INDIA STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

34. CHINA STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

35. JAPAN STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

36. REST OF ASIA-PACIFIC STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2020-2027 ($ MILLION)

37. REST OF THE WORLD STRUCTURAL ADHESIVE TAPES MARKET SIZE, 2021-2027($ MILLION