Syngas and Derivatives Market

Global Syngas and Derivatives Market Size, Share & Trends Analysis Report By Feedstock (Coal, Natural Gas, Biomass Petroleum By-Product and Other), By Technology (Steam Reforming, Autothermal Reforming, Biomass Gasification, Partial Oxidation, and Gasification) and By Gasifier (Fixed Or Moving Bed Gasifier, Entrained Flow Gasifier, Fluidized Bed Gasifier, and Others) Forecast Period (2021-2027)

The global syngas and derivatives market is anticipated to grow at a significant CAGR of 10.2% during the forecast period. The demand for syngas and derivatives is increasing due to their application in liquid fuels, gaseous fuel, chemical and power generation sectors. The use of syngas contributes a lot of ease to ecological protection due to its contribution to reducing waste pollution in landfills, urban and rural areas. Syngas is mostly used for electricity generation and the production of chemicals.

Impact of COVID-19 Pandemic on Global Syngas and Derivatives Market

COVID-19 pandemic created a light impact on end-users in the global syngas and derivatives market. The maximum number of syngas and their derivatives production plants are impacted due to disruption in the supply chain of the syngas and derivatives due to the low demand for fuel. Furthermore, the demand for plastic has been increased particularly in the healthcare sector and personal protection equipment which has increased the demand for syngas and derivatives market in the plastic sector.

Segmental Outlook

The global syngas and derivatives market is segmented based on feedstock, technology, and gasifier. Based on the feedstock, the market is segmented into coal, natural gas, biomass, petroleum by-product and other. Based on the technology, the market is sub-segmented into steam reforming, autothermal reforming, biomass gasification, partial oxidation, and gasification. Among this, biomass gasification is the most utilized technology for the production of syngas and derivatives. With this technology, the biomass and coal can be converted into syngas, hydrogen, and carbon dioxide. Based on the gasifier, the market is sub-segmented into the fixed or moving bed gasifier, entrained flow gasifier, fluidized bed gasifier, and others.

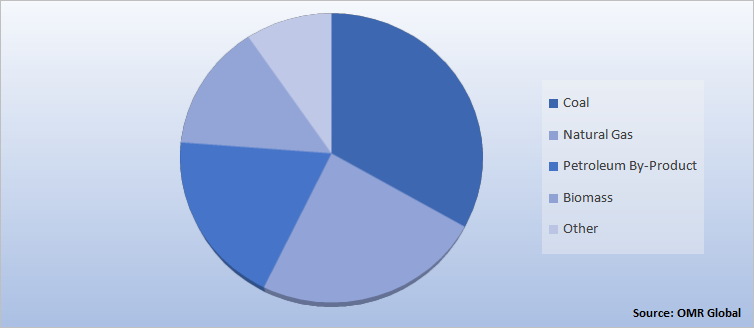

Global Syngas and Derivatives Market Share by Feedstock, 2020 (%)

The Coal Segment Holds the Major Share in the Global Syngas and Derivatives Market

Coal was the largest feedstock segment in manufacturing syngas & derivatives and is estimated to lead the market during the forecast period. The high accessibility of coal for producing energy and the excellent feedstock with various syngas production technologies drives the growth of the coal segment in the syngas & derivatives market. Furthermore, coal forms an ample energy resource in various regions such as India, China, Japan, and others, harnessing its energy requires a greener and cleaner approach. This is expected to instigate research for developing efficient and eco-friendly coal technologies.

Integration of UCG and GTL technologies is anticipated to add assistance to the processes such as carbon capture and sequestration, thereby minimizing production costs. Conversion of underground coal gasification (UCG) for growing FT liquid fuels offers sufficient opportunities for developing energy blends as a substitute for fuels. It also offers potential for greenhouse gas emissions’ sequestration in upstream activities, thereby providing remarkable life cycle reductions.

Regional Outlooks

The global syngas and derivatives market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). Among this China and India are majorly engaged in the production of coal-based syngas & derivatives.

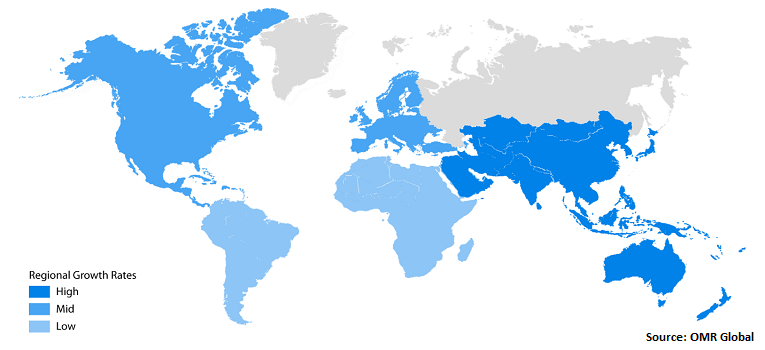

Global Syngas and Derivatives Market Growth, by Region 2021-2027

The Asia-Pacific Region Holds the Major Share in the Global Syngas and Derivatives Market

The syngas & derivatives market in the Asia-Pacific region is projected to grow at the highest rate. The development can be imputed to the high demand for syngas & derivatives in countries such as China, India, and Japan in utilization such as chemicals, fuel, and electricity. The region being the largest user in the chemical industry offers subsequent growth opportunities for chemical applications, fertilizers, and petrochemicals. In addition, the region is rapidly growing in fuel and electricity applications, with increasing demand for syngas & derivatives in liquid fuel, gaseous fuel, and hydrogen-based electricity. According to the NBS, China remains the world’s largest consumer and producer of coal.

Chinese mines produced 357 million tonnes of coal in November 2021 up from 334 million tonnes in September. Moreover, according to National Development and Reform Commission (NDRC), China's daily coal production reached 11.93 million tons, its highest level in recent years. In November 2021, the average daily transmits of coal production reached 11.66 million tons, an increase of more than 1.2 million tons than that of the end of September 2021.

Market Players Outlook

The major companies serving the global syngas and derivatives market include Air Liquide, Air Products, Inc., BASF SE, Dow Chemical, General Electric Co., Haldor Topsoe A/S, and Linde plc. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2020, Nacero Inc. signed the agreement with Haldor Topsoe in Casa Grande, Arizona for basic engineering and license for a planned natural-gas-to gasoline service with a capacity of 35,000 barrels per day of finished gasoline.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global syngas and derivatives market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Syngas and Derivatives Market

• Recovery Scenario of Global Syngas and Derivatives Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Syngas and Derivatives Market by Feedstock

4.1.1. Coal

4.1.2. Natural Gas

4.1.3. Biomass

4.1.4. Petroleum By-Product

4.1.5. Other(Petcoke, Plastic Waste, and Medical Waste)

4.2. Global Syngas and Derivatives Market by Technology

4.2.1. Steam Reforming

4.2.2. Autothermal Reforming

4.2.3. Biomass Gasification

4.2.4. Partial Oxidation Gasification

4.3. Global Syngas and Derivatives Market by Gasifier

4.3.1. Fixed or moving gasifier

4.3.2. Entrained flow gasifier

4.3.3. Fluidized bed gasifier

4.3.4. Other (Downdraft, Crossdraft, and Molten Bath)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air Liquide

6.2. Air Products, Inc.

6.3. BASF SE

6.4. Caloric Anlagenbau GmbH

6.5. Chiyoda Corp.

6.6. Dow Chemical

6.7. General ElectricCo.

6.8. HaldorTopsoe A/S

6.9. KBRTechnology and Southern Company

6.10. Kinetics Technology SPA

6.11. Linde plc

6.12. McDermottInternational, Ltd.

6.13. Membrane Technology and Research, Inc.

6.14. METHANEX CORP.

6.15. Nutrien Ltd.

6.16. OQ Chemicals GmbH

6.17. SynGas Technology, LLC.

6.18. Synthesis Energy Systems, Inc.

1. GLOBAL SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY FEED STOCK, 2020-2027 ($ MILLION)

2. GLOBAL COAL SOURCED SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL NATURAL GAS SOURCE DSYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL BIOMASS SOURCED SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL PETROLEUM BY-PRODUCT SOURCE DSYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL OTHER SOURCED SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

8. GLOBAL SYNGAS AND DERIVATIVESBY STEAM REFORMINGMARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL SYNGAS AND DERIVATIVES BY AUTOTHERMAL REFORMINGMARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL SYNGAS AND DERIVATIVESBY BIOMASS GASIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL SYNGAS AND DERIVATIVESBY PARTIAL OXIDATION GASIFICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

13. GLOBAL FIXED OR MOVING BED GASIFIER FOR SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL ENTRAINED FLOW GASIFIER FOR SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL FLUIDIZED BED GASIFIER FOR SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL OTHERS FOR SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY FEED STOCK, 2020-2027 ($ MILLION)

20. NORTH AMERICAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

21. NORTH AMERICAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

22. EUROPEAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. EUROPEAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY FEED STOCK, 2020-2027 ($ MILLION)

24. EUROPEAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

25. EUROPEAN SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY FEED STOCK, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

30. REST OF THE WORLD SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

31. REST OF THE WORLD SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY FEEDSTOCK, 2020-2027 ($ MILLION)

32. REST OF THE WORLD SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

33. REST OF THE WORLD SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL SYNGAS AND DERIVATIVES MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL SYNGAS AND DERIVATIVES MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL SYNGAS AND DERIVATIVES MARKET, 2021-2027 (%)

4. GLOBAL SYNGAS AND DERIVATIVES MARKET SHARE BY FEEDSTOCK, 2020 VS 2027 (%)

5. GLOBAL COAL SOURCED SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL NATURAL GAS SOURCED SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL BIOMASS SOURCED SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL PETROLEUM BY-PRODUCT SOURCED SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL OTHERSOURCED SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL SYNGAS AND DERIVATIVESBY STEAM REFORMINGMARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL SYNGAS AND DERIVATIVES BY AUTOTHERMAL REFORMING MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL SYNGAS AND DERIVATIVES BY BIOMASS GASIFICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL SYNGAS AND DERIVATIVES BY PARTIAL OXIDATION GASIFICATION MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL SYNGAS AND DERIVATIVES MARKET RESEARCH AND ANALYSIS BY GASIFIER, 2020-2027 ($ MILLION)

16. GLOBAL FIXED OR MOVING BED GASIFIER FOR SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL ENTRAINED FLOW GASIFIER FOR SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. GLOBAL FLUIDIZED BED GASIFIER FOR SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

19. GLOBAL OTHERS FOR SYNGAS AND DERIVATIVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

20. GLOBAL SYNGAS AND DERIVATIVES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

21. US SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

22. CANADA SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

23. UK SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

24. FRANCE SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

25. GERMANY SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

26. ITALY SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

27. SPAIN SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF EUROPE SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

29. INDIA SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

30. CHINA SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

31. JAPAN SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

32. SOUTH KOREA SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF ASIA-PACIFIC SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)

34. REST OF THE WORLD SYNGAS AND DERIVATIVES MARKET SIZE, 2020-2027 ($ MILLION)