Telematics Market

Global Telematics Market Size, Share & Trends Analysis Report, By Type (Hardware and Software & Services), By Sales Channel (OEM and Aftermarket), By Connectivity Solution (Embedded Solution, Integrated Solution, and Tethered Solution) By Vehicle Type (Passenger Vehicle, Commercial Vehicle, Other) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The telematics market is anticipated to show a lucrative growth at a CAGR of around 17% during the forecast period 2020-2026. The telematics industry includes devices, software, and services to collect and transmit data on vehicle use, maintenance requirements, and automotive servicing. It is widely used to coordinate vehicle to manage the fitness, profitability, and productivity of a vehicle and the entire fleet. In a vehicle telematics system, a tracking device installed that allows the sending, receiving, and storing of telemetry data. The device is used to collect GPS data along with other vehicle-specific data and transmits it via different methods which include GPRS (General Packet Radio Service), cellular network, or satellite communication to a centralized server. The centralized server interprets the data and displays it to the end-users via websites and mobile applications.

High adoption of the telematics system for fleet management is one of the major factors for the growth of the market. It is used for vehicle tracking, trailer and asset tracking for the predictive maintenance, safety tracking, and insurance risk assessment due to its various advantages. The advantages of the telematics include a decrease in fuel cost, improved safety, elevated productivity, with overall better payroll management. With the introduction of 5G technologies and the increasing trend of the connected vehicle, telematics will find enormous opportunity in the near future. Besides, it is also expected to find a significant application in the autonomous vehicle for add-on service and safety operations. However, the mature automotive market and decreasing automotive sales are one of the major restraining factors for the market. Besides, due to COVID-19, an economic slowdown is expected which will further decrease the passenger and commercial vehicle demand all across the globe.

Market Segmentation

The global telematics market is segmented on the basis of type, sales channel, connectivity solution, and vehicle type. By type, the market is segmented into hardware and software & services. During the forecast period, software & services are expected to have a significant growth rate. By sales channel, the market is segmented into OEM and aftermarket. Aftermarket is expected to have a major market share however OEM is expected to showcase significant growth during the forecast period. OEMs such as Volvo, Mack, Hino, Ford, GM, Volkswagen, Daimler, Tata are partnering with telematics providers for a better end-user experience.

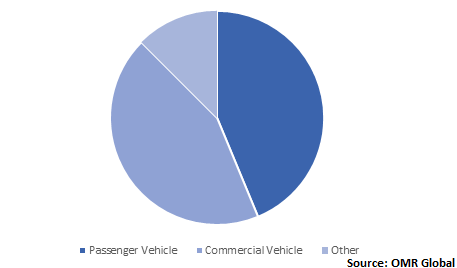

By connectivity solution, the market is further segmented into embedded solutions, integrated solutions, and tethered solution. Embedded telematics solutions are expected to showcase a significant growth rate during the forecast period as these are built within the vehicle to provide telematics connectivity and broadly adopted by major automotive companies. On the basis of vehicle type, the market is segmented into passenger vehicle, commercial vehicle, and other. As of now, the commercial vehicle segment has a major market share as it is widely used for the fleet management system. Moreover, significant growth in the passenger vehicle will be witnessed with the increasing trend of connected vehicles and rising ride-sharing and ride hailing market.

Global Telematics Market Share by Vehicle Type, 2019 (%)

Regional Outlook

The global telematics market is segmented into four major regions, including North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is expected to hold a major market share during the forecast period. The high cost of vehicles, government regulations, and the high percentage of connected cars of the total fleet are some of the major factors for the significant market share of the region. Moreover, Asia-Pacific is expected to show significant market growth during the forecast period. The telematics market is at the introduction stage in many emerging economies which will provide significant market growth to the region. For instance, in October 2018, Tata Motors becomes the first automotive OEM to install 100,000 telematics systems in its commercial vehicle in India.

Global Telematics Market Growth, by Region 2020-2026

Market Players Outlook

The global telematics market is fragmented market and a large number of hardware, software, and service provider are working in the industry for OEM and in aftermarket. Some of the major players operating in the market include AT&T Inc., Geotab Inc., Verizon Wireless Inc., Cisco Systems, Inc., CalAmp Corp., HERE Global B.V., WirelessCar AB among others. The market players are adopting growth strategies, including mergers and acquisitions, product launches, and partnerships & collaborations, to gain a competitive advantage in the market. For instance, in December 2018 Volkswagen AG takeover WirelessCar AB from Volvo by purchasing 75.1% stakes in the company. The aim of the acquisition is to further develop mobility solutions for the connected fleet.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Telematics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. AT&T Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Geotab Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Verizon Wireless Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Cisco Systems, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. CalAmp Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Telematics Market by Type

5.1.1. Hardware

5.1.2. Software & Services

5.2. Global Telematics Market by Sales Channel

5.2.1. OEM

5.2.2. Aftermarket

5.3. Global Telematics Market by Connectivity Solution

5.3.1. Embedded Solution

5.3.2. Integrated Solution

5.3.3. Tethered Solution

5.4. Global Telematics Market by Vehicle Type

5.4.1. Passenger Vehicle

5.4.2. Commercial Vehicle

5.4.3. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Actsoft, Inc.

7.2. Agero Inc.

7.3. BSM Technologies Inc.

7.4. CalAmp Corp.

7.5. Daimler AG

7.6. Cisco Systems, Inc.

7.7. Geotab Inc.

7.8. Masternaut Ltd.

7.9. Mix Telematics Ltd.

7.10. HERE Global B.V.

7.11. Octo Group S.p.A

7.12. Omnitracs, LLC

7.13. OnStar Corp.

7.14. ORBCOMM Inc.

7.15. Tantalum Corp.

7.16. Telit IoT Platforms, LLC

7.17. Tomtom International BV

7.18. Trimble Inc.

7.19. WirelessCar AB

7.20. Verizon Wireless Inc.

7.21. Wex Inc.

1. GLOBAL TELEMATICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL HARDWARE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL SOFTWARE & SERVICES MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL TELEMATICS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

5. GLOBAL OEM MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

6. GLOBAL AFTERMARKET MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL TELEMATICS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY SOLUTION, 2019-2026 ($ MILLION)

8. GLOBAL EMBEDDED SOLUTION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

9. GLOBAL INTEGRATED SOLUTION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

10. GLOBAL TETHERED SOLUTION MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

11. GLOBAL TELEMATICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

12. GLOBAL PASSENGER VEHICLE TELEMATICS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

13. GLOBAL COMMERCIAL VEHICLE TELEMATICS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

14. GLOBAL OTHER VEHICLE TELEMATICS MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

15. NORTH AMERICAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. NORTH AMERICAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

18. NORTH AMERICAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY SOLUTION, 2019-2026 ($ MILLION)

19. NORTH AMERICAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. EUROPEAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. EUROPEAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

23. EUROPEAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY SOLUTION, 2019-2026 ($ MILLION)

24. EUROPEAN TELEMATICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

25. ASIA PACIFIC TELEMATICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

26. ASIA PACIFIC TELEMATICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. ASIA PACIFIC TELEMATICS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

28. ASIA PACIFIC TELEMATICS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY SOLUTION, 2019-2026 ($ MILLION)

29. ASIA PACIFIC TELEMATICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

30. REST OF THE WORLD TELEMATICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

31. REST OF THE WORLD TELEMATICS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

32. REST OF THE WORLD TELEMATICS MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY SOLUTION, 2019-2026 ($ MILLION)

33. REST OF THE WORLD TELEMATICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL TELEMATICS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL TELEMATICS MARKET SHARE BY SALES CHANNEL, 2019 VS 2026 (%)

3. GLOBAL TELEMATICS MARKET SHARE BY CONNECTIVITY SOLUTION, 2019 VS 2026 (%)

4. GLOBAL TELEMATICS MARKET SHARE BY CONNECTIVITY VEHICLE TYPE, 2019 VS 2026 (%)

5. GLOBAL TELEMATICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. US TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

7. CANADA TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

8. UK TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

9. FRANCE TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

10. GERMANY TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ITALY TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

12. SPAIN TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

13. REST OF EUROPE TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

14. INDIA TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

15. CHINA TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

16. JAPAN TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF ASIA-PACIFIC TELEMATICS MARKET SIZE, 2019-2026 ($ MILLION)