Thermoplastic Polyolefin Market

Thermoplastic Polyolefin Market Size, Share & Trends Analysis Report by Type (In-situ TPO, Compounded TPO, and Polyolefin Elastomers (POEs)). and by Application (Automotive, Building & Construction, Medical, Wire and cables, and Others).Forecast Period (2024-2031).

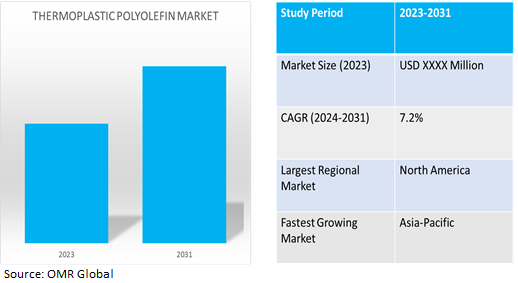

Thermoplastic polyolefin market is anticipated to grow at a considerable CAGR of 7.2% during the forecast period (2024-2031).The global thermoplastic polyolefin (TPO) market is driven by several factors, including the growth of the automotive industry, expansion of the construction sector, increasing demand for energy-efficient solutions, strict environmental regulations, advancements in material technology, shift towards lightweight materials, cost competitiveness, environmental resistance, growing focus on sustainable solutions, and geographical expansion and infrastructure development. The automotive industry is a major driver of the TPO market, with TPOs being widely used in automotive exterior and interior applications. The construction sector is a significant consumer of TPOs, particularly in emerging economies. TPOs are additionally favored for their energy-efficient properties, making them popular for residential, commercial, and industrial building applications. The shift towards sustainable practices and circular economy principles also drives the demand for TPOs.

Market Dynamics

Technological Advancements in Recycling

Technological developments in recycling, including mechanical, chemical, and upcycling, increase the viability and efficiency of recycling TPOs and other plastic materials, supporting the principles of the circular economy. According to the World Economic Forum, in June 2022, Globally, It produced about 400 million tons of plastic waste yearly. In recent years, the recycling rate for plastic waste in the US has shown a decline. Out of the 40 million tons of plastic waste generated in 2021, only 5.0% to 6.0% (approximately two million tons) were successfully recycled. Moreover, between 2019 and 2020, there was an overall decrease of 5.7% in plastics recovered for recycling, equivalent to 290 million.

Growing Demand For Construction Industry Trends

Investment in new housebuilding is influenced by broader construction industry trends, potentially reducing demand for materials such asTPOs in roofing membranes, insulation, and waterproofing. According to the European Union, in September 2023, the share of investment in new housebuilding as a percentage of total construction investment stood at 20.6% in 2021. While it was a major contributor to the overall growth in construction investment that year, it experienced a slight decline of 0.2% in 2022. This decrease can be attributed to weaker growth in France (+2.7%) and Italy (+4.5%), as well as a decline in Germany (-3.0%). Looking ahead to 2023, several countries, including some larger EU Member States, are expected to see a contraction in their markets, leading to a forecasted decrease of 3.2% in investment in new housebuilding. The largest drop is anticipated in Sweden (-42.4%), with significant decreases also projected for the Czech Republic (-25.8%) and Denmark (-20.3%).

Market Segmentation

Our in-depth analysis of the global thermoplastic polyolefin market includes the following segments by type and application:

- Based on type, the market is sub-segmented into in-situ TPO (TPOs produced in-situ during polymerization), compounded TPO (TPOs produced by compounding polyolefins with elastomers), POEs (polyolefin elastomers).

- Based on application, the market is bifurcated into automotive, building & construction, medical, wire and cables, and others (electrical and electronics, and industrial equipment).

Automotive is Projected to Emerge as the Largest Segment

Based on the product type, the global thermoplastic polyolefin market is sub-segmented into automotive, building & construction, medical, wire and cables, and others. Among these, the automotivesub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includesconsumer awareness of environmental issues influenceautomotive market decisions, leading to increased preference for eco-friendly vehicles with recycled polymers, influencing automakers' designs. For instance,in August 2023, Borouge PLC and Borealis launched two sustainable polymer products for the automotive industry, containing 70.0% recycled materials. These products demonstrate the automotive industry's commitment to sustainability and demonstrate how circular economy goals can be achieved with tangible results. The new polypropylene solutions reduce carbon emissions and energy consumption.

POEs (Polyolefin Elastomers) Sub-segment to Hold a Considerable Market Share

Consumer demand for environmentally friendly products, including sustainable plastics, is increasing, with the Bornewables line catering to this trend. Manufacturers and brand owners are likely to drive demand for TPOs. For instance, in May 2023, Borealis launched a Bornewables line of PolyolefinsPlastomers and Elastomers using renewable feedstock, such as vegetable oil and cooking oil. The line aims to reduce carbon emissions while maintaining performance. The program supports the plastic industry's transition to circular production, with Queo providing flexibility, sealability, processability, and compatibility properties.

Regional Outlook

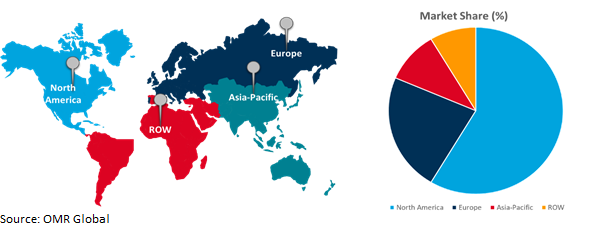

The globalthermoplastic polyolefin market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Infrastructure Development Initiatives In the Aisa-Pacific Region

Investments in infrastructure projects like the National Infrastructure Pipeline (NIP) increase demand for construction materials such asTPOs, used in roofing membranes, waterproofing, and insulation. According to Invest India,inFebruary 2021, the construction industry in India is projected to reach $1.4 trillion by 2025. By 2030, it is expected that cities contribute 70.0% of India's GDP, creating significant growth opportunities. With an estimated 600 million people residing in urban areas by 2030, there will be a demand for 25 million additional mid-end and affordable housing units. The National Infrastructure Pipeline (NIP) has allocated a budget of $1.4 trillion for various sectors, including renewable energy, roads and highways, urban infrastructure, and railways. Initiatives such asthe Smart City Mission and the Technology Sub-Mission of PMAY-U aim to enhance quality of life through modernized and technology-driven urban planning. Additionally, the development of 35 Multimodal Logistics Parks (MMLPs) will greatly facilitate freight movement, with a total capital cost of $6.1 billion.

Global Thermoplastic Polyolefin Market Growth by Region 2024-2031

North America Holds Major Market Share

The market for TPOs is anticipated to rise significantly as a result of the construction industry's expansion, specifically in the areas of automobile parts and roofing membranes.According to theCensus.gov,in March 2024, the seasonally adjusted annual rate of privately-owned housing units authorized by building permits in February was 1,518,000, which represents a 1.9%increase from the revised January rate of 1,489,000 and a 2.4%increase from the rate of 1,482,000. Single-family authorizations in February stood at a rate of 1,031,000, indicating a 1.0%increase from the rate of 1,021,000. Additionally, authorizations of units in buildings with five units or more reached a rate of 429,000.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global thermoplastic polyolefin market includeExxon Mobil Corp., LyondellBasell Industries N.V., Mitsui Chemicals, Inc.,Sumitomo Chemical Co., Ltd., and, Saudi Basic Industries Corp., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2023, Avient Corp. introduced two reSound REC Recycled Content Thermoplastic Elastomers (TPEs) for automotive interior applications. These grades, formulated with post-consumer recycled content, offer a sustainable option with comparable performance to traditional TPEs. The reSound REC 7310 product series aims to meet OEM standards for volatile organic compounds and fogging. The grades can be customized and injection moldedto polypropylene.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global thermoplastic polyolefin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Exxon Mobil Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. LyondellBasell Industries N.V.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mitsui Chemicals, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Thermoplastic Polyolefin Market by Type

4.1.1. In-situ TPO (TPOs produced in-situ during polymerization)

4.1.2. Compounded TPO (TPOs produced by compounding polyolefins with elastomers)

4.1.3. POEs (Polyolefin Elastomers)

4.2. Global Thermoplastic Polyolefin Market by Application

4.2.1. Automotive

4.2.2. Building & Construction

4.2.3. Medical

4.2.4. Wire and cables

4.2.5. Others (Electrical and Electronics, and Industrial Equipment)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Arkema

6.2. Asahi Kasei Corp.

6.3. Aurora Material Solutions, LLC

6.4. BASF SE

6.5. Berkshire Hathaway Inc.

6.6. Borealis AG

6.7. China Petrochemical Corp.

6.8. Formosa Plastics Corp.

6.9. HEXPOL AB

6.10. INEOS AG

6.11. Johns Manville

6.12. LG Chem, Ltd.

6.13. LyondellBasell Industries N.V.

6.14. Noble Polymers

6.15. RTP Company

6.16. Reliance Industries Ltd.

6.17. Saudi Basic Industries Corp.

6.18. Sumitomo Chemical Co., Ltd.

6.19. The Dow Chemical Co.

6.20. Versalis S.p.A.

1. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL IN-SITU TPO THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL COMPOUNDED TPO THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL POES THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL THERMOPLASTIC POLYOLEFIN IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL THERMOPLASTIC POLYOLEFIN IN BUILDING & CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL THERMOPLASTIC POLYOLEFIN IN MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL THERMOPLASTIC POLYOLEFIN IN WIRE AND CABLES ANALYSIS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL THERMOPLASTIC POLYOLEFIN IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD THERMOPLASTIC POLYOLEFIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL IN-SITU TPO THERMOPLASTIC POLYOLEFIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL COMPOUNDED TPO THERMOPLASTIC POLYOLEFIN MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL POES THERMOPLASTIC POLYOLEFIN MARKET SERVICES SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL THERMOPLASTIC POLYOLEFIN IN AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL THERMOPLASTIC POLYOLEFIN IN BUILDING & CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL THERMOPLASTIC POLYOLEFIN IN MEDICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL THERMOPLASTIC POLYOLEFIN IN WIRE AND CABLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL THERMOPLASTIC POLYOLEFIN IN OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL THERMOPLASTIC POLYOLEFIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

14. UK THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA THERMOPLASTIC POLYOLEFIN MARKET SIZE, 2023-2031 ($ MILLION)