Unmanned Surface Vehicle (USV) Market

Global Unmanned Surface Vehicle (USV) Market Size, Share & Trends Analysis Report, By Application (Defense and Commercial), By Size (Small, Medium, and Large) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global unmanned surface vehicle (USV) market is estimated to grow at a CAGR of nearly 14.0% during the forecast period. Some key factors encouraging the market growth include rising defense contracts for unmanned surface vehicles, significant rise the demand for maritime security, and increasing investment in the oil and gas industry. As more than 80% of the global trade is conducted by sea, there is a significant chance of maritime crime. Therefore, the government is extensively focusing on maritime security to strengthen global peace, governance, and security, and promote global prosperity. In UK, Foreign & Commonwealth Office (FCO) aims to reinforce maritime security program which is invested by Official Development Assistance (ODA) and non-ODA funds.

A secure and stable maritime domain is crucial for the global economy. Maritime security relies on global co-operation to enforce and set proper standards of action and shared norms, consistent with international law. Maritime crime poses a severe threat to regional stability, international trade, and safety of seafarers. For the financial year 2019 to 2020, ODA offered nearly $1,218,724 to strengthen maritime security programme. In the US, $214 million budget is requested for the Maritime Security Program (MSP) in 2019. This, in turn, leads the demand for unmanned surface vehicles to protect the maritime operations.

The growing interest of USVs in maritime operations are well suited to perform a broad range of missions, including intelligence surveillance and reconnaissance (ISR)), mine countermeasures (MCM), and anti-submarine warfare (ASW). These are deployed from a range of host platforms and can be operated without onboard human operators. Thales, in collaboration with L3Harris Technologies, has demonstrated the increasing capability of USV to encourage maritime security operations with the French Navy and Royal Navy. This partnership was started in 2012 to design, build, and commission Halcyon USV which aims to counter maritime threat safely and quickly. Increasing global trade and defense spending has significantly led the demand for unmanned surface vehicles for maritime security and force protection operations, which in turn, is supporting to drive the market growth.

Market Segmentation

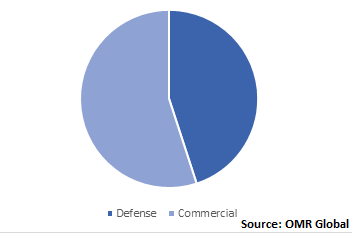

The global USV market is segmented based on application and size. Based on application, the market is classified into defense and commercial. Based on the size, the market is classified into small, medium, and large.

USVs is expected to find its significant application in the defense segment during the forecast period

USVs are anticipated to hold considerable application in the defense sector owing to its MCM, ISR, and ASW capabilities. The US Navy is significantly working to develop and acquire USVs as they can be less expensive to purchase as compared to the manned ships owing to its design which do not incorporate spaces and support equipment for onboard human operators. Therefore, the US Navy has been developing and experimenting with several kinds of unmanned vehicles for several years and has made some of these attempts into procurement programs.

The US Navy is requesting $579.9 million in FY 2021 in terms of R&D funding for large USVs, medium USVs, and extra-large unmanned undersea vehicles, and their enabling technologies. The US Navy wants to acquire the large unmanned vehicles which are a part of an effort to shift the Navy to a new fleet architecture that is more extensively distributed as compared to the current architecture of Navy. Further, Navy is awarding several contracts to manufacturers of unmanned surface vehicles to expand its operations. For instance, in January 2019, Austal USA gets a contract of a $16.3 million from the US Navy to carry out extended industrial post-delivery availability work at its Mobile, Alabama manufacturing facility.

Global Unmanned Surface Vehicle (USV) Market Share by Application, 2018 (%)

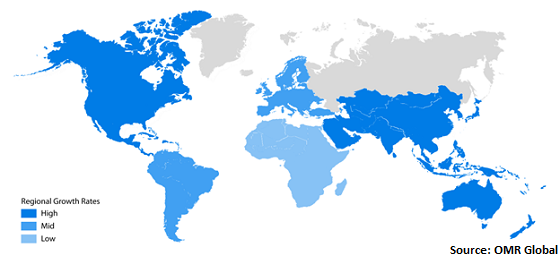

Regional Outlook

The global USV market is segmented based on four major regions, including North America, Europe, Asia-Pacific, and Rest of the World. In 2018, North America held the largest share in the market owing to the increasing defense spending which allows to advance their defense capabilities. As per the Stockholm International Peace Research Institute (SIPRI), the US holds the first position in military spending with $649 billion in 2018. The US Navy shift towards manned vehicles to unmanned vehicles are primarily encouraging the demand for USVs in the region. In addition, increasing environmental studies and shale oil and gas production are anticipated to drive the growth of the market in the region.

Global Unmanned Surface Vehicle (USV) Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include L3Harris Technologies, Inc., Teledyne Technologies Inc., thyssenkrupp AG, Textron Systems Corp., and Ocean Aero Inc. These market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in February 2020, Textron Systems Corp. declared that the US Navy's program has achieved a Milestone C decision. It is referred to as Unmanned Influence Sweep System (UISS) Program, rely on its Common Unmanned Surface Vehicle (CUSV).

UISS is the first USV program of the US Navy, intended for the challenging maritime environment. It offers unmanned mine countermeasure and capabilities with the use of advanced sensors and interchangeable payloads. UISS is part of a broad Mine Counter Measure Unmanned Surface Vehicle (MCM USV) mission and Textron Systems is the prime system integrator and contractor for this program. As a result, such kinds of defense contract will enable the company to increase its market share.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global USV market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. L3Harris Technologies, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Teledyne Technologies Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. thyssenkrupp AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Textron Systems Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Ocean Aero Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Unmanned Surface Vehicle (USV) Market by Application

5.1.1. Defense

5.1.2. Commercial

5.2. Global Unmanned Surface Vehicle (USV) Market by Size

5.2.1. Small

5.2.2. Medium

5.2.3. Large

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 5G International Inc.

7.2. Austal Ltd.

7.3. BAE Systems plc

7.4. Clearpath Robotics Inc.

7.5. Deep Ocean Engineering, Inc.

7.6. ECA Group (Groupe Gorgé Co.)

7.7. Elbit Systems Ltd.

7.8. Gibbs & Cox, Inc.

7.9. L3Harris Technologies, Inc.

7.10. Liquid Robotics, Inc. (Boeing Co.)

7.11. Marine Advanced Research Inc.

7.12. Maritime Tactical Systems (MARTAC), Inc.

7.13. Ocean Aero

7.14. Ocius Technologies

7.15. QinetiQ Group

7.16. Rafael Advanced Defense Systems Ltd.

7.17. SeaRobotics Corp.

7.18. Teledyne Technologies Inc.

7.19. Textron Systems Corp.

7.20. thyssenkrupp AG

1. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL UNMANNED SURFACE VEHICLE (USV) IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL UNMANNED SURFACE VEHICLE (USV) IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY SIZE, 2018-2025 ($ MILLION)

5. GLOBAL SMALL UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL MEDIUM UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL LARGE UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

11. NORTH AMERICAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2018-2025 ($ MILLION)

12. EUROPEAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2018-2025 ($ MILLION)

18. REST OF THE WORLD UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. REST OF THE WORLD UNMANNED SURFACE VEHICLE (USV) MARKET RESEARCH AND ANALYSIS BY PAYLOAD, 2018-2025 ($ MILLION)

1. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET SHARE BY SIZE, 2018 VS 2025 (%)

3. GLOBAL UNMANNED SURFACE VEHICLE (USV) MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

6. UK UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD UNMANNED SURFACE VEHICLE (USV) MARKET SIZE, 2018-2025 ($ MILLION)