Unmanned Underwater Vehicles Market

Unmanned Underwater Vehicles Market Size, Share & Trends Analysis Report by UUV Type (Remotely Operated Vehicles (ROV), Autonomous Underwater Vehicles (AUV) and Hybrid Underwater Vehicles (HUV). by Application (Search & Salvage Operations, Archeological & Exploration, Oceanography, Environmental & Meteorological Research, Oil & Gas and Naval & Coastal Defense). Forecast Period (2024-2031).

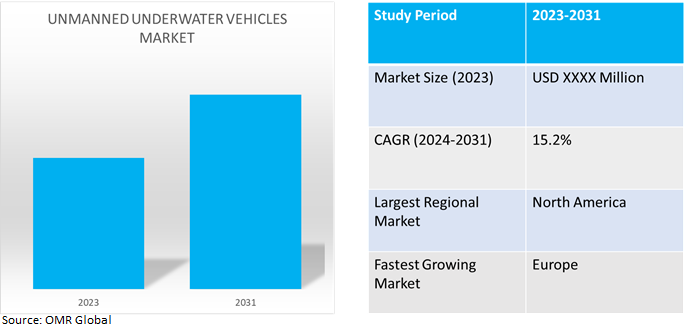

Unmanned underwater vehicles market is anticipated to grow at a significant CAGR of 15.2% during the forecast period (2024-2031). The growth of the unmanned underwater vehicles market is attributed to the increasing demand for advanced technologies to increase the autonomy of autonomous surface ships and underwater vehicles through artificial intelligence (AI) and machine learning globally. These technologies include energy resources, supply, sensing, location, propulsion, dive systems, control systems, and communication.

Market Dynamics

Increasing Advancements in Unmanned Underwater Vehicles

Advancements in unmanned underwater vehicles including propulsion systems, sensor fusion, underwater communication, fuel cells, batteries, and underwater communication are some of the major technological advancements. Increasing advancement resulting in sophisticated control and navigation will be needed for longer missions to maintain an exact position over a greater operational envelope, especially when there is a chance of encountering barriers like manned vehicles, pipelines, and undersea structures. The goal of the continuing research is to improve the autonomy of the undersea vehicle through improved communication design, increased power density, and more dependable navigation and control for deepwater operation.

Adoption of Remotely Operated Vehicles (ROV)

Increasing adoption of remotely operated vehicles (ROVs) in underwater installation, inspection, and maintenance jobs are the main uses. As it offer safer, can go deeper, have longer endurance, and require less support equipment than human divers, they are widely used in the offshore industry. Swivel-jointed propellers are another feature of some sophisticated ROVs used in deep-sea exploration and wreckage analysis. These are more expensive than their fixed equivalents and are seldom used. It is only necessary when the highest level of precision is needed. The basic foundation of the ROV's operation is comprised of sensors and appendages. The most often used devices include temperature sensors, depth gauges, cameras, and internal system sensors.

Market Segmentation

Our in-depth analysis of the global unmanned underwater vehicles market includes the following segments by UUV type and application.

- Based on UUV type, the market is sub-segmented into remotely operated vehicles (ROV), autonomous underwater vehicles (AUV), and hybrid underwater vehicles (HUV).

- Based on application, the market is sub-segmented into search & salvage operations, archeological & exploration, oceanography, environmental & meteorological research, oil & gas and naval & coastal defense.

Autonomous Underwater Vehicles (AUV) is Projected to Emerge as the Largest Segment

Among UUV type segments, autonomous underwater vehicles (AUV) sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the growing demand for autonomous underwater vehicles by the increasing capital expenditures of the offshore oil and gas industry. Autonomous underwater vehicles (AUVs) have the potential to significantly lower the cost of subsea facility inspections for a variety of purposes, such as pipeline and riser inspection, decommissioning structural surveys, and pre-and post-hurricane inspection. Large-crew support vessels are needed for diving and remote underwater video (ROV) operations to gather relatively easy visual inspection records. AUVs cut expenses by utilizing innovative technologies.

Naval & Coastal Defense Sub-segment to Hold a Considerable Market Share

Among application segments, the naval & coastal defense sub-segment is expected to hold a considerable market share. Underwater vehicles that are unmanned (UUVs) have emerged as the best tools for surreptitiously gathering underwater environmental profiles. With variable buoyancy propulsion, these autonomous underwater vehicles travel across the ocean without being easily noticed. Unmanned underwater vehicles, or UUVs, are used extensively in coastal and naval defense missions. According to the Congressional Research Service, in December 2023, the navy’s proposed FY2024 budget requests $117.4 million in research and development (R&D) funding for the large unmanned surface vehicle (LUSV) program, $85.8 million in R&D funding for the MUSV program, $176.3 million in R&D funding for LUSV/MUSV enabling capabilities, $104.3 million in R&D funding for the XLUUV program, and $71.2 million in additional R&D funding for core technologies for UUVs including but not limited to XLUUV.

Regional Outlook

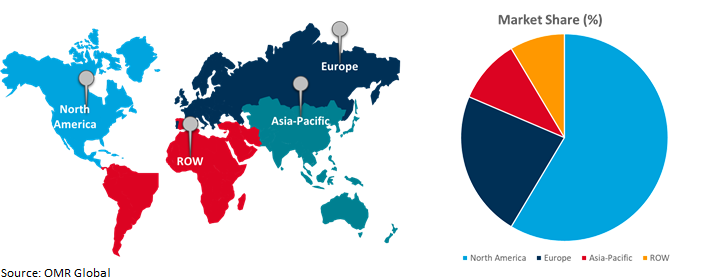

The global unmanned underwater vehicles market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Unmanned Underwater Vehicles Adoption in Europe

- The regional growth is attributed to the increasing demand for intelligence gathering, mine-hunting, scientific exploration, and ship-hull inspection in developed countries like Germany, France, and Italy driving the growth of the unmanned underwater vehicles market.

- According to the UK Defence Journal, in February 2023, the UK awarded contracts for several autonomous underwater vehicles, including drones able to submerge to 1,000 meters. The £6.0 million ($6.4 million) worth of orders include two 1,000 meter depth capable Gavia Offshore Surveyor AUVs and three IVER 4 580 AUVs.

Global Unmanned Underwater Vehicles Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and unmanned underwater vehicle providers. The growth is attributed to the increasing demand for significant investments in marine research and exploration and technological advancements in the region. The government in the region partnered with market players to advance the unmanned underwater vehicle systems. For instance, in February 2023, the US Fleet Forces Command (USFFC) navy and Hydroid, Inc. partnered for the complete production of MK 18 unmanned underwater vehicle systems. The navy awarded the medium unmanned undersea vehicle (MUUV) contract to Leidos to design, test, and manufacture the next-generation ExMCM MUUV, known as Viperfish. Viperfish improved upon the current MK18 Mod 2 UUVs by providing increased ExMCM capabilities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global unmanned underwater vehicles market include Boeing, Kongsberg Gruppen ASA, Lockheed Martin Corp., Northrop Grumman Corp., and Saab AB, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive. For instance, in May 2023, Navantia, SAES, and Perseo announced a collaboration to develop a line of unmanned underwater vehicles equipped with state-of-the-art sensors to deploy exploration and surveillance capabilities in increasingly demanding operational theatres. The collaboration is committed to promoting innovation in the field of autonomous underwater vehicles.

Recent Development

- In December 2022, Oceaneering International, Inc. announced that its Subsea Robotics segment won multiple contracts, with an anticipated aggregate revenue of $300.0 million. These contracts are primarily for remotely operated vehicle (ROV) services delivered from floating drilling rigs and vessels for subsea equipment support, subsea intervention, and construction. Also included among the contracted work scopes are ROV tooling, survey, positioning, and autonomous underwater vehicle (AUV) services.

- In July 2021, Teledyne Technologies Inc. announced that its subsidiary, Teledyne Brown Engineering, Inc., was awarded an indefinite-quantity/indefinite-delivery contract with a maximum base value of $27.4 million from the US Navy for the Littoral Battlespace Sensing-Glider (LBS-G) program. Teledyne Slocum gliders are long-endurance, buoyancy-driven autonomous underwater vehicles (AUVs) that provide a highly persistent means to sample and characterize the ocean water column properties

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global unmanned underwater vehicles market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Boeing

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kongsberg Gruppen ASA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lockheed Martin Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Unmanned Underwater Vehicles Market by UUV Type

4.1.1. Remotely Operated Vehicles (ROV)

4.1.2. Autonomous Underwater Vehicles (AUV)

4.1.3. Hybrid Underwater Vehicles (HUV)

4.2. Global Unmanned Underwater Vehicles Market by Application

4.2.1. Search & Salvage Operations

4.2.2. Archeological & Exploration

4.2.3. Oceanography

4.2.4. Environmental & Meteorological Research

4.2.5. Oil & Gas

4.2.6. Naval & Coastal Defense

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ATLAS ELEKTRONIK GmbH

6.2. BAE Systems plc

6.3. ECA Group

6.4. Forum Energy Technologies, Inc.

6.5. General Dynamics Mission Systems, Inc.

6.6. Huntington Ingalls Industries, Inc.

6.7. International Submarine Engineering Ltd.

6.8. Kraken Robotics Inc.

6.9. L3Harris Technologies, Inc.

6.10. Northrop Grumman Corp.

6.11. OCEAN INFINITY

6.12. Oceaneering International, Inc.

6.13. Saab AB

6.14. Saipem S.p.A.

6.15. SAIPEM SpA

6.16. Sonardyne International Ltd.

6.17. Subsea7 S.A.

6.18. Teledyne Marine Technologies Inc.

6.19. Thales Group

1. GLOBAL UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY UUV TYPE, 2023-2031 ($ MILLION)

2. GLOBAL UNMANNED UNDERWATER REMOTELY OPERATED VEHICLES (ROV) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL UNMANNED UNDERWATER AUTONOMOUS UNDERWATER VEHICLES (AUV) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL UNMANNED UNDERWATER HYBRID UNDERWATER VEHICLES (HUV) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

6. GLOBAL UNMANNED UNDERWATER VEHICLES FOR SEARCH & SALVAGE OPERATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL UNMANNED UNDERWATER VEHICLES FOR ARCHEOLOGICAL & EXPLORATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL UNMANNED UNDERWATER VEHICLES FOR OCEANOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL UNMANNED UNDERWATER VEHICLES FOR ENVIRONMENTAL & METEOROLOGICAL RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL UNMANNED UNDERWATER VEHICLES FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL UNMANNED UNDERWATER VEHICLES FOR NAVAL & COASTAL DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY UUV TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY UUV TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY UUV TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY UUV TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD UNMANNED UNDERWATER VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL UNMANNED UNDERWATER VEHICLES MARKET SHARE BY UUV TYPE, 2023 VS 2031 (%)

2. GLOBAL UNMANNED UNDERWATER REMOTELY OPERATED VEHICLES (ROV) MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL UNMANNED UNDERWATER AUTONOMOUS UNDERWATER VEHICLES (AUV) MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL UNMANNED UNDERWATER HYBRID UNDERWATER VEHICLES (HUV) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL UNMANNED UNDERWATER VEHICLES MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL UNMANNED UNDERWATER VEHICLES FOR SEARCH & SALVAGE OPERATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL UNMANNED UNDERWATER VEHICLES FOR ARCHEOLOGICAL & EXPLORATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL UNMANNED UNDERWATER VEHICLES FOR OCEANOGRAPHY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL UNMANNED UNDERWATER VEHICLES FOR ENVIRONMENTAL & METEOROLOGICAL RESEARCH MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL UNMANNED UNDERWATER VEHICLES FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL UNMANNED UNDERWATER VEHICLES FOR NAVAL & COASTAL DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

14. UK UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA UNMANNED UNDERWATER VEHICLES MARKET SIZE, 2023-2031 ($ MILLION)