Mobility on Demand Market

Mobility on Demand Market Size, Share & Trends Analysis Report by Product Type (Sharing, and Renting), by Vehicle (Passenger Vehicle, Commercial Vehicle, and Other (Two wheelers, Air Transport)), by Booking (Online, and Offline), and by Commute (Intracity, and Intercity). Forecast Period (2024-2031).

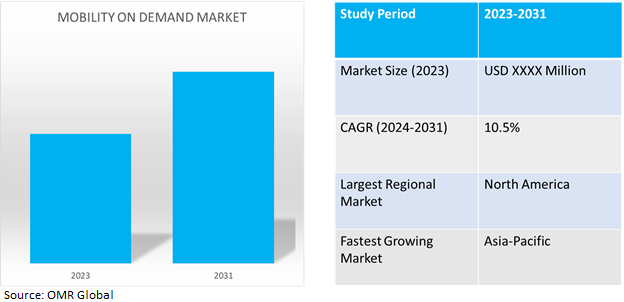

Mobility on demand market is anticipated to grow at a considerable CAGR of 10.5% during the forecast period (2024-2031). Mobility on-demand services is on the rise in various countries post government regulation, increasing environmental consciousness, and changing customer transport preferences. The services aim to provide consumers with on-demand transportation including public and private commuting options. The market is also expanding and innovating towards autonomous ride-sharing services, and on-demand air transport services with investment by big technology players such as Ford, Google, and many others.

Market Dynamics

Increasing Traffic Congestion Globally

The mobility on demand industry has seen a positive upward trend in recent years stimulated by degrading traffic conditions globally. With the increase in the number of private vehicles, most countries have recorded a rise in the rate of fatalities and intangible losses. For instance, according to the INRIX global traffic scorecard in 2022, most urban areas and the country overall saw increasing travel demand in 2022. Across the globe, 58.0% of urban areas analyzed saw increased traffic delays over the last year, while 38.0% saw delay decreases. Wherein, London remained the most congested area analyzed at 156 hours of delay per driver, up 5.0% over last year. Big movers include second-ranked Chicago, IL (155 hours, up 49.0%), Boston, MA (134 hours, up 72.0%) and Toronto, ON (118 hours, up 59.0%). Traffic in many North American cities came roaring back in 2022 from 2021, a bit behind Europe,

Expansion into Alternative Means of Shared Mobility

As traffic continues to increase, various market players have shifted their focus on offering alternative shared mobility options including two-wheelers, e-vehicles, and air mobility vehicles to provide faster and more flexible commutes, especially in high-traffic congestion areas. For instance, in October 2023, FlyBlade India (“BLADE India”), a joint venture between Hunch Ventures and BLADE Air Mobility, Inc. launched a shuttle service connecting Bangalore International Airport to Hosur Aerodrome as part of its expansion plan for its intra-city helicopter services. The on-demand service will be available every weekday at $72 per person. The onward journey from the airport shall start in the morning whereas the return flights will be in the evening. With the introduction of this route, BLADE India aims to simplify commuting between North and South Bangalore.

Market Segmentation

Our in-depth analysis of the global mobility on demand market includes the following segments by product type, vehicle, booking, and commute:

- Based on product type, the market is bifurcated into shared and rental services.

- Based on vehicles, the market is bifurcated into passenger vehicles, commercial vehicles, and others (two wheelers, air transport).

- Based on booking, the market is bifurcated into online, and offline modes.

- Based on commute, the market is bifurcated into intracity and intercity commute.

Shared Services to remains as the Largest Segment

Based on the product type, the global mobility on demand market is sub-segmented into rented and shared services. Wherein, ride-sharing sub-segment has a bigger market due to the growing demand for individual mobility as a result of rising urbanization, as well as the significant increase in the preference for carpool and bike pool services among regular office commuters. For instance, in March 2021, Europcar Mobility Group announced an expansion of its collaboration with ECO Rent a Vehicle in India and Shouqi Car Rental in China, both of which were popular vehicle rental businesses in their respective countries. This enabled Europcar to benefit from the large flood of consumers from India and China.

Passenger Vehicle Is the Largest Sub-Segment

Most of the global mobility on demand services are driven by car and bike pooling services including two, three, and four-wheelers across demographics. The market demand is mostly contributed by daily commuters, travelers, and tourists, preferring passenger vehicles for their transit. Apart from this, the rise in traffic congestion has created a sudden demand for two-wheeler commuters contributing to the dominance of passenger vehicle sub-segment.

Online booking is expected to Dominate Mobility on Demand Market

Major mobility on demand service providers either depend on their application or website for customer traffic, as tracking, sharing, and matching of vehicles and commuters possible mostly through location tracking, and other relevant software algorithms, which makes the application a suitable platform for booking on demand shared or rental vehicles. Also, online bookings enhance safety, convenience, and control over servicing for service providers as well as customers.

Intercity Commute Holds Major Market

Intercity commute has recorded more demand as compared to intracity commute contributed by daily office commuters, rising traffic congestions, and increasing population in urban areas, also, several services have launched on-demand air commute in metropolitan cities to cater to premium customers. For instance, in 2021, Airbus signed a Memorandum of Understanding (MoU) with FlyBlade India (BLADE) for the development of an on-demand helicopter services market in South Asia.

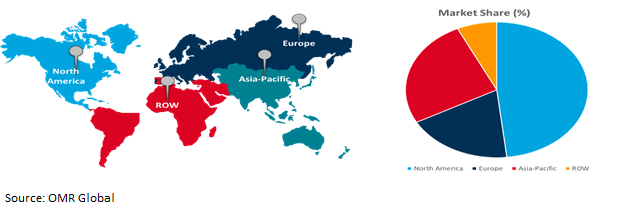

Regional Outlook

The global mobility on demand market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest Share in Global Mobility on Demand Market

North America holds the highest share of the global mobility on demand market share. The key factors contributing to the growth are investments in public transport systems, the presence of major rental service providers, government policies to support shared mobility, rising adoption of shared mobility among daily commuters, innovation and development of autonomous transit infrastructure, and increasing demand for e-hailing services. For instance, in April 2023, May Mobility, a company in the research and implementation of autonomous vehicle (AV) technology, announced the introduction of Arizona's first on-demand public transit service employing AVs, which will operate in the retirement town of Sun City. The service will be powered by via, a global leader in transit technology. This launch marks May Mobility's first deployment in the Western US and underscores Arizona's reputation as a testing ground and pioneer for AV technologies.

Global Mobility on Demand Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing in Mobility on Demand Market

- The Asia-Pacific mobility on-demand market will dominate this market due to its increased demand for advanced IT infrastructure, and the growing population in urban areas.

- Asia-Pacific countries have recorded significant demand for two-wheeler, and three-wheeler on-demand motility services including countries such as India, China, Thailand, Vietnam, and others attributed to congested transport infrastructure, and two-wheeler inclined markets of Asian countries.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global mobility on demand market include DiDi Global Inc., ANI Technologies Pvt. Ltd. (OLA), Via Transportation, Inc., Maxi Mobility S.L. (Cabify), and Uber Technologies, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive. For instance, in January 2023, Cabify announced that it has extended its partnership with Mobilize, to offer all-inclusive mobility solutions for fleets and drivers across the country. The joint venture will see Cabify’s platform provide full access to Mobilize Driver Solutions, the mobility services of Mobilize. Mobilize Drive Solutions features an all-inclusive package, with maintenance, warranty, insurance, and assistance, along with the vehicle designed for the service itself, the Mobilize Limo.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global mobility on demand market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ANI Technologies Pvt. Ltd. (OLA)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DiDi Global Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Maxi Mobility S.L.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Uber Technologies, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Via Transportation, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Mobility on Demand Market by Type

4.1.1. Sharing

4.1.2. Renting

4.2. Global Mobility on Demand Market by Vehicle

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Other (Two wheelers, Air Transport)

4.3. Global Mobility on Demand Market by Booking

4.3.1. Online

4.3.2. Offline

4.4. Global Mobility on Demand Market by Commute

4.4.1. Intracity

4.4.2. Intercity

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Bird Global, Inc.

6.2. BlaBlaCar

6.3. BluSmart Tech Pvt. Ltd

6.4. Bolt Technology OÜ

6.5. BUSUP TECHNOLOGIES, S.L.

6.6. Delphi Automotive PLC

6.7. Zauba Technologies Pvt Ltd.

6.8. Europcar Mobility Group SA

6.9. Ford Motor Co.

6.10. General Motors

6.11. Getaround Inc.

6.12. Grab Holdings Ltd.

6.13. Lyft, Inc.

6.14. Mahindra Logistics Ltd.

6.15. Zeelo LTD.

1. GLOBAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SHARED MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RENTAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

5. GLOBAL MOBILITY ON DEMAND FOR PASSENGER VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MOBILITY ON DEMAND FOR COMMERCIAL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL MOBILITY ON DEMAND FOR OTHER VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY BOOKING, 2023-2031 ($ MILLION)

9. GLOBAL ONLINE MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OFFLINE MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COMMUTE, 2023-2031 ($ MILLION)

12. GLOBAL INTRACITY MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL INTERCITY MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY BOOKING, 2023-2031 ($ MILLION)

19. NORTH AMERICAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COMMUTE, 2023-2031 ($ MILLION)

20. EUROPEAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

23. EUROPEAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY BOOKING, 2023-2031 ($ MILLION)

24. EUROPEAN MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COMMITE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY BOOKING, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC MOBILITY ON DEMAND MARKET RESEARCH AND ANALYSIS BY COMMUTE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD MOBILITY ON-DEMAND MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD MOBILITY ON-DEMAND MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD MOBILITY ON-DEMAND MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD MOBILITY ON-DEMAND MARKET RESEARCH AND ANALYSIS BY BOOKING, 2023-2031 ($ MILLION)

34. REST OF THE WORLD MOBILITY ON-DEMAND MARKET RESEARCH AND ANALYSIS BY COMMUTE, 2023-2031 ($ MILLION)

1. GLOBAL MOBILITY ON DEMAND MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL SHARED MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL RENTAL MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MOBILITY ON DEMAND MARKET SHARE BY VEHICLE, 2023 VS 2031 (%)

5. GLOBAL MOBILITY ON DEMAND FOR PASSENGER VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MOBILITY ON DEMAND FOR COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL MOBILITY ON DEMAND MARKET SHARE BY BOOKING, 2023 VS 2031 (%)

8. GLOBAL ONLINE MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL OFFLINE MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL MOBILITY ON DEMAND MARKET SHARE BY COMMUTE, 2023 VS 2031 (%)

11. GLOBAL INTRACITY MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL INTERCITY MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL MOBILITY ON DEMAND MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

16. UK MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)

28. THE MIDDLE EAST AND AFRICA MOBILITY ON DEMAND MARKET SIZE, 2023-2031 ($ MILLION)