Virtual Private Cloud (VPC) Market

Virtual Private Cloud (VPC) Market Size, Share & Trends Analysis Report, By Vertical (Healthcare, BFSI, IT and Telecom, Government and Defense, Retail, Manufacturing, and Others), By Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)) Forecast, 2019-2025

The global virtual private cloud market is estimated to grow at a significant CAGR of 18.4% during the forecast period. The major factors boosting the growth of the market include rising demand for cloud-based services among small and medium enterprises (SMEs) coupled with increasing adoption of scalable, secure and flexible cloud solutions at an adequate cost. Moreover, rapid digitalization is further supporting to drive the adoption of VPC solutions across enterprises. Rapid digitalization has been attributed to the government and public-private organization efforts for digital transformation across industries. For instance, the World Economic Forum (WEF) introduced the Digital Transformation Initiative in 2015, in collaboration with Accenture, to serve as the focal point for new opportunities and themes arising from the latest developments in the digitalization of business and society.

These efforts to provide insights about the impact of digitalization on business are encouraging firms to significantly adopt cloud-based solutions that increase flexibility, efficiency and reduce the maintaining and managing of IT systems. This, in turn, is contributing to the adoption of virtual private cloud resources across enterprises that provide flexibility to control and scale the workloads. This model supports an enterprise to achieve the advantages of private cloud, including an isolated environment for sensitive workloads and more granular control over virtual networks. Additionally, the platform enables to increase the internet protocol (IP) space of any subnets without any workload downtime and shutdown, which in turn, provides the flexibility to meet the business requirements. VPCs offer the resource-sharing advantages of a public cloud, combined with the security and performance benefits of a private cloud. As a result, it is driving the growth of the virtual private cloud market.

Market Segmentation

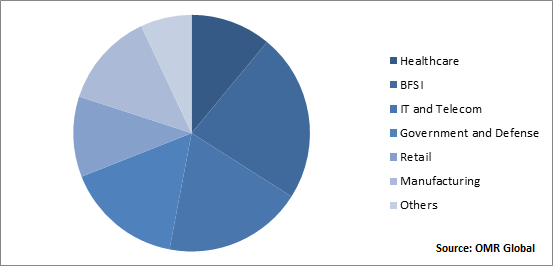

The global VPC market is segmented based on vertical and organization size. Based on vertical, the market is classified into healthcare, banking, financial services and insurance (BFSI), IT and telecom, government and defense, retail, manufacturing, and others. Based on organization size, the market is classified into large enterprises and SMEs.

Global Virtual Private Cloud Industry: By Vertical

BFSI is anticipated to hold a significant share in the market in 2018 owing to features provided by VPC in the BFSI industry such as its easy transition, safety, and affordability. With the use of a virtual private network, the IT infrastructure of the banks can be rapidly and easily moved over a single private network. It allows banks to operate at high transaction volumes without overloading the network and slowing the processes. The services become highly efficient owing to the dedicated resources of each unit and improve the customer experience. As banking sector applications are highly critical, VPS offers enhanced security to ensure that data is not lost or misplaced. It offers better control, flexibility, security and higher performance.

VPCs are just as virtual as the public cloud, while rather than sharing space and resources in public infrastructure, such clouds operate with a definite isolation level between customers. It is achieved with a Virtual Local-Area Network (VLAN) or private IP subnet on a per-customer basis, which offers a superior level of security. In addition, significant use of cloud computing in BFSI is further contributing to the adoption of VPC in the industry.

Global Virtual Private Cloud Market Share by Vertical, 2018 (%)

Regional Outlook

The global VPC market is segmented into four major regions, including North America, Europe, Asia-Pacific and Rest of the World (RoW). North America is anticipated to hold the major share in the market in 2018 owing to the well-developed IT infrastructure coupled with the considerable adoption of cloud-based services in the region. Increasing government initiatives to encourage the adoption of cloud-based services is driving the market growth in the region. For instance, Cloud Smart, which was released in October 2018, is a high-level, long-term strategy to boost the adoption of cloud in federal agencies. This offers a path forward for agencies to migrate to a safe and secure cloud infrastructure. This will encourage agencies to accomplish additional security, savings and will offer faster services. This, in turn, is likely to contribute to the adoption of VPS to achieve greater security, scalability, and flexibility in the operations.

Market Players Outlook

The major players in the market include IBM Corp., Microsoft Corp., Amazon Web Services, Inc. (AWS), CenturyLink Cloud, Alibaba Cloud International, VMware, Inc., and Google LLC. The market players are significantly focusing on product launches, mergers, and acquisitions, partnerships, and collaborations that can support to increase its market share. For instance, in August 2018, DXS Technology and AWS, Inc. partners to modernize IT services and leverage client migrations to AWS. The clients of DXS are global enterprises that are looking to increase their digital transformation. This new partnership will focus on digital transformation, application migration and industry-specific services that optimize intellectual property of DXC’s industry running on AWS. The integrated practice of DXC – AWS will provide secure, cloud-first solutions to the clients that integrate the breadth and depth of cloud services and advance their operations for a digital era.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global VPC market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Microsoft Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Amazon Web Services, Inc. (AWS)

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Alibaba Cloud International

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. VMware, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Virtual Private Cloud Market by Vertical

5.1.1. Healthcare

5.1.2. Banking, Financial Services and Insurance (BFSI)

5.1.3. IT and Telecom

5.1.4. Government and Defense

5.1.5. Retail

5.1.6. Manufacturing

5.1.7. Others (Energy and Media and Entertainment)

5.2. Global Virtual Private Cloud Market by Organization Size

5.2.1. Large Enterprises

5.2.2. Small and Medium Enterprises (SMEs)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abacus Data Systems, Inc.

7.2. Alibaba Cloud International

7.3. Amazon Web Services, Inc. (AWS)

7.4. AT&T, Inc.

7.5. Atos SE

7.6. CenturyLink Cloud

7.7. Cisco Systems, Inc.

7.8. Citrix Systems, Inc.

7.9. Dell, Inc.

7.10. DXC Technology Co.

7.11. Google LLC

7.12. HP Development Company, L.P.

7.13. Huawei Software Technologies Co., Ltd.

7.14. IBM Corp.

7.15. IONOS, Inc.

7.16. Microsoft Corp.

7.17. NetApp, Inc.

7.18. Node4

7.19. NTT Communications Corp.

7.20. Oracle Corp.

7.21. Rackspace US, Inc.

7.22. VMware, Inc.

7.23. Wolfram

1. GLOBAL VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

2. GLOBAL VIRTUAL PRIVATE CLOUD IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL VIRTUAL PRIVATE CLOUD IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL VIRTUAL PRIVATE CLOUD IN IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL VIRTUAL PRIVATE CLOUD IN GOVERNMENT AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL VIRTUAL PRIVATE CLOUD IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL VIRTUAL PRIVATE CLOUD IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL VIRTUAL PRIVATE CLOUD IN OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2018-2025 ($ MILLION)

10. GLOBAL VIRTUAL PRIVATE CLOUD IN LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL VIRTUAL PRIVATE CLOUD IN SMALL AND MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

15. NORTH AMERICAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2018-2025 ($ MILLION)

16. EUROPEAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

18. EUROPEAN VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2018-2025 ($ MILLION)

23. REST OF THE WORLD VIRTUAL PRIVATE CLOUD MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2018-2025 ($ MILLION)

1. GLOBAL VIRTUAL PRIVATE CLOUD MARKET SHARE BY VERTICAL, 2018 VS 2025 (%)

2. GLOBAL VIRTUAL PRIVATE CLOUD MARKET SHARE BY ORGANIZATION SIZE, 2018 VS 2025 (%)

3. GLOBAL VIRTUAL PRIVATE CLOUD MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

6. UK VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD VIRTUAL PRIVATE CLOUD MARKET SIZE, 2018-2025 ($ MILLION)