Western Europe e-commerce Retail Market

Western Europe E-Commerce Retail Market Size, Share & Trends Analysis Report By Type (Business to Consumer, Business to Business, and Customer to Customer), By Product (Electronics, Fashion, Books and Magazines, Home Décor, Healthcare, Automobile, Sports, Beauty and Personal Care, Kitchenware, and Others), By Device Used (Smartphone, Tablets, and Personal Computer) Forecast,2021-2027

The Western Europe e-commerce retail market is growing at a considerable CAGR of around 26.7% during the forecast period (2021-2027). The market growth is mainly augmented by a rise in internet users, an increase in online sales convenience of mobile e-commerce, and incremental trust in the logic of online purchases. According to Ecommerce Europe, there were more than 100,000 companies in Europe who are selling their products and services to customers online. The European Commission supports cross-border e-commerce for small and medium enterprises with standardized contract and consumer rules for providing more efficient and affordable parcel delivery. Moreover, the direct channel of distribution enables the e-commerce companies to cut costs compared to local retailor which results in increased sales. The Western European e-commerce sector has continuously improved itself over the last few years owing to the growing consumer confidence, as people prefer online purchasing to fulfill their requirements.

In addition to this, Western European countries have smooth road connectivity and logistics systems for promoting the growth of e-commerce retail. The region has smooth inter-country exchange of goods and along with the supportive government policies, the e-commerce retail market has shown significant growth across the region. However, the high cost of logistics and reverse logistics for the transfer of products and goods and expensive workforce are some of the constraints that are estimated to challenge the growth of the market in the forecast period. Most of the companies in the region face problems like high expenditure on employees, logistics, transport, delivery, and so forth, and the challenge of high cost for return and replacement of the products. Conversely, utilization of AI for personalized offers and recommendations, the rise of progressive web apps, and advancement in technologies are estimated as opportunities for the market players. However, Brexit had changed lots of regulations within the UK and other European Union countries that had restrained the effective market growth in the region.

Impact of COVID-19 on the Western Europe E-Commerce Retail Market

The impact COVID-19 showed high growth in sales in several countries. Many companies and retailers were forced to adopt digitalization prevented infection. COVID-19 has had a major impact on the e-commerce sector, providing growth for major parts of the B2C market, although challenging conditions in a much larger B2B market. Government-imposed restrictions limited access to store-based retailing early in the pandemic, which immediately fueled growth in e-commerce. Moreover, the second wave of COVID-19 cases in countries like Germany from October further strengthened e-commerce, especially in terms of Christmas sales. However, some of the sectors like the automotive and food and beverage industries were hit hard by the COVID-19 outbreak due to frequent imposition of lockdown.

Segmental Outlook

The Western Europe E-Commerce retail market is segmented based on end-users, products, and devices used. Based on the type segment, the market is segmented into business to consumer, business to business, and customer to customer. Based on the product segment, the market is segmented into electronics, fashion, books and magazines, home décor, healthcare, automobile, sports, beauty and personal care, kitchenware, others. Further, based on the device used to segment, the market is bifurcated into smartphones, tablets, and personal computer

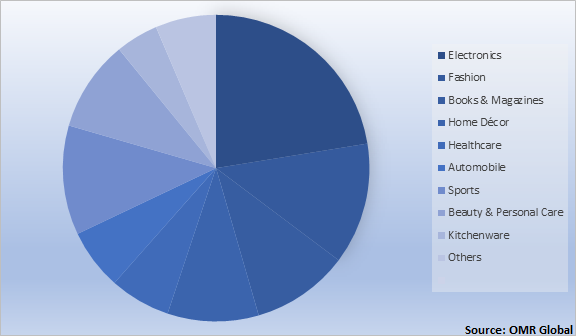

Western Europe E-Commerce Retail Market Share by Product Type, 2020 (%)

Electronics Segment to Hold a Lucrative Share in the Western Europe E-Commerce Retail Market

Amongst the product type segment of the western Europe e-commerce retail market, the electronics segment held one of the largest shares in the product type segment in 2020. There is a high penetration of large ticket electronics items such as large domestic appliances and probably also mobile phones. Many brand-new smartphones are first launched on the e-commerce sites which increases the customer's interest from buying through the sites and experience-related offers. E-commerce industries power consumer electronic sales. For instance, 250 eProcurement platforms are used in Italy by large enterprises to manage the electronic orders of clients and suppliers. In addition, the obligation of delivering electronic invoices to the Italian Public Administration (PA) has resulted in a push towards digitalization for both, private and State-owned companies. The electronics segment is also estimated to grow with the highest CAGR during the forecast period.

Regional Outlooks

The Western European e-commerce retail market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is segmented into Russia, Germany, the UK, France, Italy, and the rest of Western Europe. Germany was estimated to have one of the largest e-commerce retail shares in 2020. Germany is the largest online and offline economy in Europe. According to the reports of IFH Koln, it was estimated that over half of Germany’s gross domestic product (GDP) was e-commerce-related in 2017. UK and France are estimated to be one of the fastest-growing regions in this market owing to the increasing focus of companies on the digitalization of their sales platforms, growth in international trade, and high use of the internet. According to the European E-commerce Report, in 2019, the population of France was 65.4 million and the internet penetration was almost 90%. As per the E-Commerce Foundation, Sweden’s B2C e-commerce revenue reached $17.9 billion in 2018 from $11.9 billion in 2015, accounting for an increase of nearly 50% over the same period.

Market Player Outlook

The key players of the Western Europe e-commerce retail market include FedEx Corp., Alibaba Group Holding Ltd, Next plc, John Lewis Plc., Otto GmbH & Co KG, Carrefour, Ocado Group, and DHL International GmbH, among others. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. For instance, in March 2021, Carrefour announced the acquisition of Supersol stores in Spain. The acquisition involved 172 convenience stores and supermarkets and the transaction deal was $94.6 million. The acquisition leads to an increase in presence of Carrefour in Spain by diversifying its store network.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Western Europe e-commerce retail market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Western Europe e-commerce Retail Market Industry

• Recovery Scenario of Western Europe e-commerce Retail Market Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Western Europe E-Commerce Retail Market by End-Users

5.1.1. Business to Consumer

5.1.2. Business to Business

5.1.3. Customer to Customer

5.2. Western Europe E-Commerce Retail Market by Products

5.2.1. Electronics

5.2.2. Fashion

5.2.3. Books and Magazines

5.2.4. Home Decor

5.2.5. Healthcare

5.2.6. Automobile

5.2.7. Sports

5.2.8. Beauty and Personal Care

5.2.9. Kitchenware

5.2.10. Others

5.3. Western Europe E-Commerce Retail Market by Device Used

5.3.1. Smartphone

5.3.2. Tablets

5.3.3. Personal Computer

6. Regional Analysis

6.1. Russia

6.2. Germany

6.3. United Kingdom

6.4. France

6.5. Italy

6.6. Rest of Western Europe

7. Company Profiles

7.1. Alibaba Group Holding Ltd

7.2. Apple Inc.

7.3. Auchan Retail International S.A.

7.4. Carrefour Group

7.5. Ceconomy AG

7.6. DHL International GmbH

7.7. Dixons Carphone plc

7.8. Etsy, Inc.

7.9. FedEx Corp.

7.10. J Sainsbury plc

7.11. John Lewis Plc.

7.12. Marks and Spencer Group plc

7.13. Next plc

7.14. Ocado Group

7.15. Otto GmbH & Co KG

7.16. Staples.co.uk.,

7.17. SEKO Logistics

7.18. Tesco plc

7.19. Wildberries

7.20. Zalando SE

1. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SIZE, 2020-2027 ($MILLION)

2. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($MILLION)

3. WESTERN EUROPEAN BUSINESS TO CUSTOMER IN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

4. WESTERN EUROPEAN BUSINESS TO BUSINESS IN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

5. WESTERN EUROPEAN CUSTOMER TO CUSTOMER IN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

6. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY PRODUCTS 2020-2027 ($ MILLIONS)

7. WESTERN EUROPEAN ELECTRONICS PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

8. WESTERN EUROPEAN FASHION PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS 2020-2027 ($ MILLIONS)

9. WESTERN EUROPEAN RETAIL BOOKS & MAGAZINES PRODUCTS FOR E-COMMERCE MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

10. WESTERN EUROPEAN RETAIL HOME DECOR PRODUCTS FOR E-COMMERCE MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

11. WESTERN EUROPEAN HEALTHCARE PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

12. WESTERN EUROPEAN AUTOMOBILE PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS 2020-2027, ($ MILLIONS)

13. WESTERN EUROPEAN SPORTS PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

14. WESTERN EUROPEAN BEAUTY AND PERSONAL CARE PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

15. WESTERN EUROPEAN KITCHENWARE PRODUCTS FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

16. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY DEVICE USED, 2020-2027 ($ MILLIONS)

17. WESTERN EUROPEAN SMARTPHONE FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

18. WESTERN EUROPEAN TABLET FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

19. WESTERN EUROPEAN PERSONAL COMPUTER FOR E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

1. IMPACT OF COVID-19 ON WESTERN EUROPE E-COMMERCE RETAIL MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON WESTERN EUROPE E-COMMERCE RETAIL MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF WESTERN EUROPE E-COMMERCE RETAIL MARKET, 2021-2027 (%)

4. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SHARE BY END-USERS, 2020 VS 2027 (%)

5. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

6. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SHARE BY DEVICE USED, 2020 VS 2027 (%)

7. WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($ MILLIONS)

8. WESTERN EUROPEAN BUSINESS TO CUSTOMER IN E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

9. WESTERN EUROPEAN BUSINESS TO BUSINESS IN E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

10. WESTERN EUROPEAN CUSTOMER TO CUSTOMER IN E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

11. WESTERN EUROPEAN ELECTRONICS PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

12. WESTERN EUROPEAN FASHION PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

13. WESTERN EUROPEAN RETAIL BOOKS & MAGAZINES PRODUCTS FOR E-COMMERCE MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

14. WESTERN EUROPEAN RETAIL HOME DECOR PRODUCTS FOR E-COMMERCE MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

15. WESTERN EUROPEAN HEALTHCARE PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

16. WESTERN EUROPEAN AUTOMOBILE PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

17. WESTERN EUROPEAN SPORTS PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

18. WESTERN EUROPEAN BEAUTY AND PERSONAL CARE PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

19. WESTERN EUROPEAN KITCHENWARE PRODUCTS FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

20. WESTERN EUROPEAN SMARTPHONE FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

21. WESTERN EUROPEAN TABLET FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

22. WESTERN EUROPEAN PERSONAL COMPUTER FOR E-COMMERCE RETAIL MARKET SHARE BY COUNTRY, 2020 VS 2027 (%)

23. RUSSIA E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)

24. GERMANY E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)

25. UK E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)

26. FRANCE E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)

27. ITALY E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)

28. REST OF THE WESTERN EUROPEAN E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLION)