Zero-Emission Aircraft Market

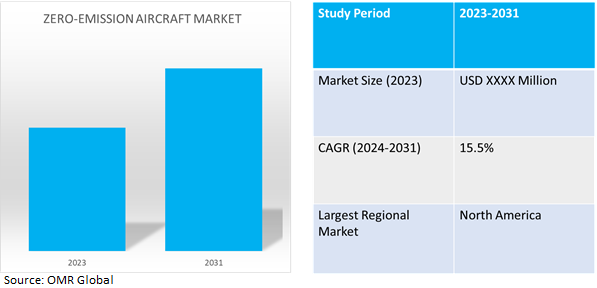

Zero-Emission Aircraft Market Size, Share & Trends Analysis Report by Type (Turboprop, Turbofan System, Blended-Wing Body (BWB), and Fully Electrical Concept), by Aircraft Type (Battery Electric Aircraft, Hydrogen Fuel Cell Aircraft, Hybrid Electric Aircraft, and Solar Electric Aircraft), by Range (Short-Haul, Medium-Haul, and Long-Haul), and by End-User (Commercial, Military, and General) Forecast Period (2024-2031)

Zero-emission aircraft market is anticipated to grow at a CAGR of 15.5% during the forecast period (2024-2031). Zero-emission aircraft refers to aircraft that produce no greenhouse gas emissions during operation, such as carbon dioxide or methane. It provides a sustainable alternative to conventional aircraft, reducing air travel’s carbon footprint.

Market Dynamics

Surge in aviation regulations

Annually reporting on aviation's progress towards net zero is crucial for transparency and accelerating decarbonization. Track Zero report provides industry-level data for airlines, governments, and investors. Individual airlines may use the aggregate data of the Track Zero report to benchmark their progress toward decarbonization. IATA came up with a new regulation. For instance, in July 2023, the International Air Transport Association (IATA) released the industry net zero tracking methodology, guiding airlines in reporting emissions. This development supports the aviation industry's commitment to achieving net-zero emissions. As airlines implement sustainable practices to adhere to these guidelines, they fuel the growth of zero-emission aircraft by fostering innovation and investments in eco-friendly aviation technologies & solutions which make it an easier and more sustainable process for development.

Increased focus on hydrogen fuel cell technology

Globally, the aviation industry is increasingly focusing on hydrogen fuel cell technology as a promising alternative for zero-emission aircraft propulsion. The only by-product of hydrogen fuel cells, which generate electricity with water vapor as the sole by-product, is clean and effective power. This increasing emphasis is a reflection of dedication to investigating various sustainable energy options and tackling the difficulties associated with long-range, zero-emission aviation through developments in hydrogen fuel cell integration. For instance, in November 2022, Airbus revealed it is developing a hydrogen-powered fuel cell for its zero-emission aircraft that will enter service by 2035. This propulsion system stands as a potential solution, emphasizing the company's commitment to developing and implementing sustainable technologies to achieve a carbon-neutral aviation future.

Market Segmentation

Our in-depth analysis of the global zero-emission aircraft market includes the following segments by type, aircraft type, range, and end-user:

- Based on type, the market is sub-segmented into turboprop, turbofan system, blended-wing body (BWB), and fully electrical concept.

- Based on aircraft type, the market is bifurcated into battery-electric aircraft, hydrogen fuel cell aircraft, hybrid electric aircraft, and solar-electric aircraft.

- Based on range, the market is augmented into short-haul, medium-haul, and long-haul.

- Based on end-user, the market is sub-segmented into commercial, military, and general.

Turboprop is Projected to Emerge as the Largest Segment

Based on the type, the global zero-emission aircraft market is sub-segmented into turboprop, turbofan system, blended-wing body (BWB), and fully electrical concept. Among these, the turboprop sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the manufacturer's focus on developing regional and short-haul aircraft, as turboprop configurations emerge as a viable choice for efficient & sustainable air travel. The turboprop segment is poised for market expansion due to advancements in electric propulsion systems and zero-emission technologies, catering to the demand for environmentally friendly regional air transport.

Hydrogen Fuel Cell Aircraft Sub-segment to Hold a Considerable Market Share

The problem of long-range, zero-emission flying is addressed by the use of hydrogen fuel cell technology, which provides a productive and clean propulsion option. It is expected that the category will experience developments due to continuous research and development, increasing investments, and a dedication to sustainable aviation. These factors will propel the manufacturing and deployment of hydrogen fuel cell-powered aircraft and greatly expand the market. For instance, in February 2023, Honeywell initiated a European Clean Aviation project to launch advanced hydrogen fuel cells for the aviation sector. This collaborative effort aims to develop cutting-edge technology, contributing to the aviation industry's transition toward sustainable, hydrogen-based propulsion systems and reduced environmental impacts.

Regional Outlook

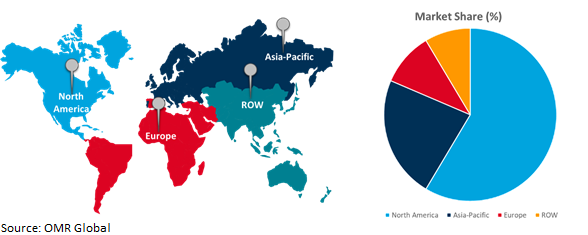

The global zero-emission aircraft market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in zero-emission aircraft market

- China, according to the latest government guideline, is making efforts in R&D of key technologies for hydrogen-powered aircraft, accelerating the R&D of key technologies such as hydrogen storage devices and power plants, and researching new structural layout technologies suitable for hydrogen-powered aircraft

- Japan is investing highly in the net zero-emission aircraft market and it has also announced a series of deals with global manufacturers of hydrogen-electric aircraft and engines to explore the feasibility of flying emissions-free passenger planes.

Global Zero-Emission Aircraft Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of various factors, including technical innovation, strong government backing, a big domestic aviation industry, environmental restrictions, and a solid research and development infrastructure. The demand for cleaner air travel coupled with a robust aerospace industry and collaboration between industries makes North America a key driver in fostering the development and adoption of zero-emission aircraft technologies.

For instance, in April 2022, Textron Inc., a US-based aircraft company acquired Pipistreld d.o. for $240 million. Through this acquisition, Pipistrel became part of Textron's newest business sector, Textron eAviation, which will pursue Textron's long-term strategy to offer a family of sustainable aircraft for civic air mobility. Pipistrel is a Slovenia-based aircraft manufacturing company that specializes in electric aircraft and is concentrated on sustainable flight for the future. Furthermore, through the Sustainable Flight National Partnership, NASA and the FAA are working with several industries to accelerate the development of more efficient aircraft and engine technologies with a 30-percent improvement in fuel savings compared to today’s planes, while also delivering substantial noise and emissions reduction benefits.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global zero-emission aircraft market include Lilium GmbH, Joby Aero, Inc., Rolls-Royce plc, THALES, Airbus, and Blue Origin Enterprises, L.P., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2021, UK-based Electric Vertical Take-off and Landing (eVTOL) aircraft manufacturer Vertical Aerospace and Special Purpose Acquisition Company (SPAC) Broadstone Acquisition Corp announced a merger agreement. The deal was designed to give Vertical Aerospace the money it needs to build and market its eVTOL aircraft. The transaction was completed in December 2021 and resulted in Vertical becoming a publicly traded company, with a pro forma equity value of approximately US$2.2 Billion. Vertical is now listed on the NYSE under the ticker EVTL.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global zero-emission aircraft market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Joby Aero, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. AirBus, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lilium GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Zero-Emission Aircraft Market by Type

4.1.1. Turboprop

4.1.2. Turbofan System

4.1.3. Blended-Wing Body (BWB)

4.1.4. Fully Electrical Concept

4.2. Global Zero-Emission Aircraft Market by Aircraft Type

4.2.1. Battery Electric Aircraft

4.2.2. Hydrogen Fuel Cell Aircraft

4.2.3. Hybrid Electric Aircraft

4.2.4. Solar Electric Aircraft

4.3. Global Zero-Emission Aircraft Market by Range

4.3.1. Short-Haul

4.3.2. Medium-Haul

4.3.3. Long-Haul

4.4. Global Zero-Emission Aircraft Market by End-User

4.4.1. Commercial

4.4.2. Military

4.4.3. General

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AeroDelft

6.2. Blue Origin Enterprises, L.P.

6.3. Bye Aerospace

6.4. BETA Technologies, Inc.

6.5. Eviation Aircraft Ltd.

6.6. Evektor, spol. S r.o.

6.7. Pipistrel

6.8. Rolls-Royce plc

6.9. Reaction Engines Limited

6.10. SpaceX

6.11. THALES Group

6.12. Volocopter GmbH

6.13. Wright Electric Inc.

6.14. ZeroAvia, Inc.

1. GLOBAL ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL TURBOPROP ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TURBOFAN SYSTEM ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BWB ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FULLY ELECTRICAL CONCEPT ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

7. GLOBAL ZERO-EMISSION BATTERY-ELECTRIC AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ZERO-EMISSION HYDROGEN FUEL CELL AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ZERO-EMISSION HYBRID ELECTRIC AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ZERO-EMISSION SOLAR ELECTRIC AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY RANGE, 2023-2031 ($ MILLION)

12. GLOBAL ZERO-EMISSION AIRCRAFT IN SHORT-HAUL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ZERO-EMISSION AIRCRAFT IN MEDIUM-HAUL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ZERO-EMISSION AIRCRAFT IN LONG-HAUL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. GLOBAL ZERO-EMISSION AIRCRAFT FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ZERO-EMISSION AIRCRAFT FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ZERO-EMISSION AIRCRAFT FOR GENERAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. NORTH AMERICAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY RANGE, 2023-2031 ($ MILLION)

24. NORTH AMERICAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. EUROPEAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. EUROPEAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. EUROPEAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

28. EUROPEAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY RANGE, 2023-2031 ($ MILLION)

29. EUROPEAN ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY RANGE, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

35. REST OF THE WORLD ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

36. REST OF THE WORLD ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

37. REST OF THE WORLD ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY AIRCRAFT TYPE, 2023-2031 ($ MILLION)

38. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY RANGE, 2023-2031 ($ MILLION)

39. ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ZERO-EMISSION AIRCRAFT MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL TURBOPROP ZERO-EMISSION AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL TURBOFAN SYSTEM ZERO-EMISSION AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BWB ZERO-EMISSION AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FULLY ELECTRICAL CONCEPT ZERO-EMISSION AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ZERO-EMISSION AIRCRAFT MARKET SHARE BY AIRCRAFT TYPE, 2023 VS 2031 (%)

7. GLOBAL ZERO-EMISSION BATTERY ELECTRIC AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ZERO-EMISSION HYDROGEN FUEL CELL AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ZERO-EMISSION HYBRID ELECTRIC AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ZERO-EMISSION SOLAR ELECTRIC AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ZERO-EMISSION AIRCRAFT MARKET SHARE BY RANGE, 2023 VS 2031 (%)

12. GLOBAL ZERO-EMISSION AIRCRAFT IN SHORT-HAUL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ZERO-EMISSION AIRCRAFT IN MEDIUM-HAUL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ZERO-EMISSION AIRCRAFT IN LONG-HAUL MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL ZERO-EMISSION AIRCRAFT MARKET SHARE BY END-USER, 2023 VS 2031 (%)

16. GLOBAL ZERO-EMISSION AIRCRAFT FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ZERO-EMISSION AIRCRAFT FOR MILITARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ZERO-EMISSION AIRCRAFT FOR GENERAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL ZERO-EMISSION AIRCRAFT MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. US ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

21. CANADA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

22. UK ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA ZERO-EMISSION AIRCRAFT MARKET SIZE, 2023-2031 ($ MILLION)