3D Printing Metal Market

3D Printing Metal Market Size, Share & Trends Analysis Report by Form (Powder, and Filament), By Technology (Powder Bed Fusion, Directed Energy Deposition, Binder Jetting, Metal Extrusion, and Others) By End-User (Titanium, Nickel, Stainless Steel, Aluminum, and Others) and by End-User (Aerospace & Defense, Automotive, Medical & Dental, and Others) Forecast Period (2025-2035)

Industry Overview

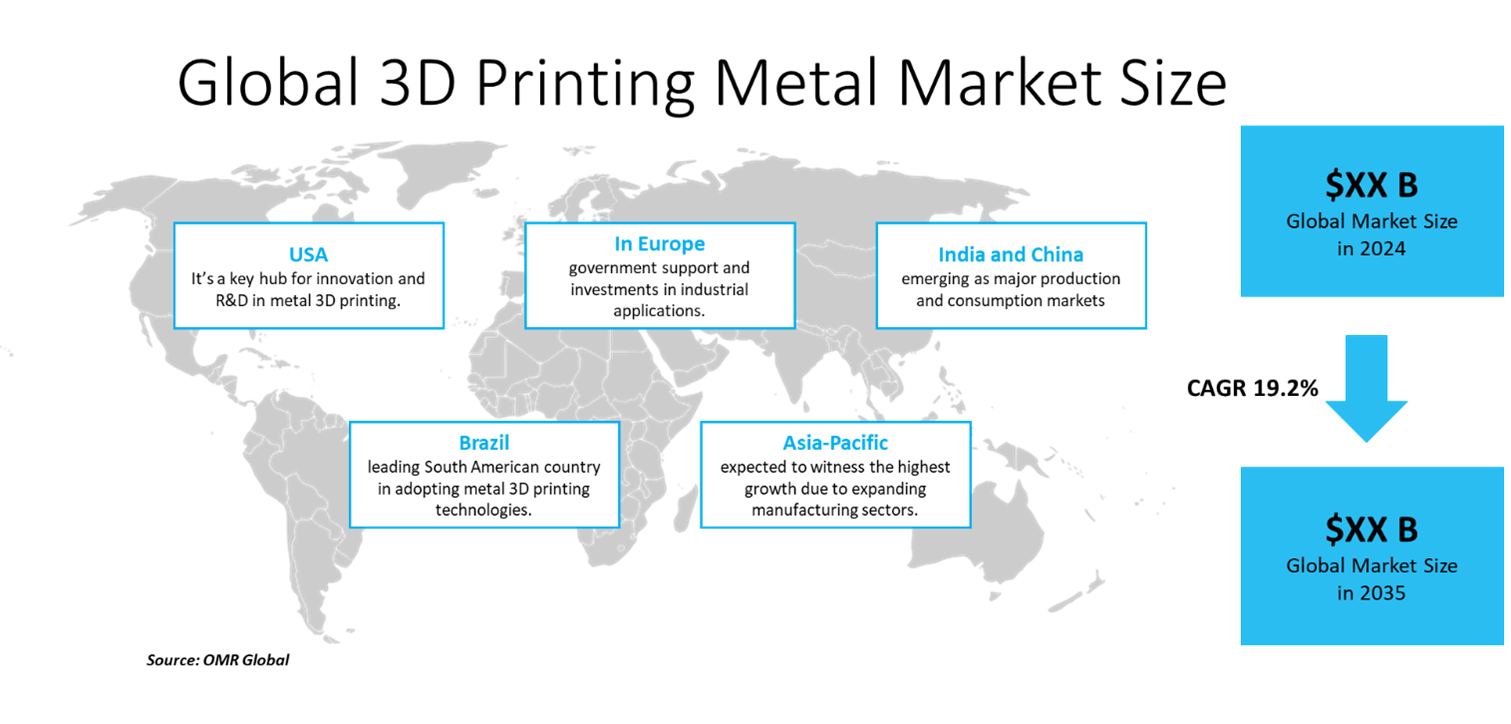

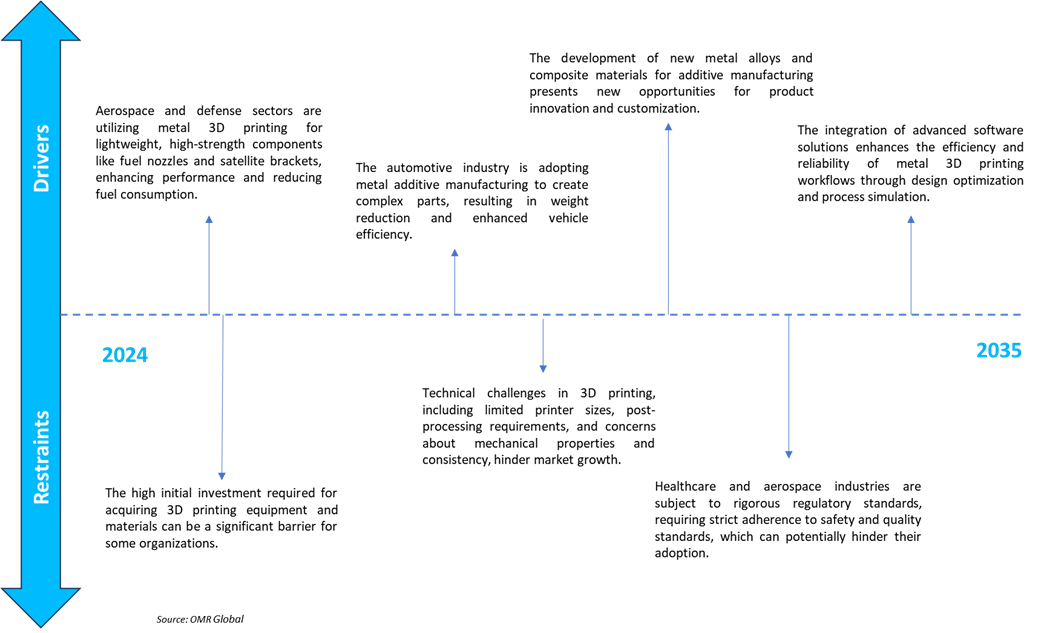

Global 3D printing metal market size was $2.8 billion in 2024 and is anticipated to grow at a CAGR of 19.2% during the forecast period (2025-2035). The demand for lightweight, high-performance aerospace and automotive parts, advancements in metal 3D printing technologies, and increased government and industry investments in additive manufacturing are driving 3D printing metal market growth.

Market Dynamics

Government and Institutional Support

The EU and individual governments are prioritizing the use of advanced manufacturing technologies, including metal additive manufacturing, as part of their Industry 4.0 strategies to boost market growth. For instance, in 2025, Luxembourg-based startup AM 4 AM secured $1.40 million in seed funding to improve its metal powder production capabilities. The funding supported the launch of a new production facility in Luxembourg. The facility increased the production capacity of its advanced aluminum alloys, ensuring high-quality materials for the aerospace and automotive industries.

Space Exploration & In-Orbit Manufacturing

Metal 3D printer projects are boosting demand for on-demand space manufacturing, reducing reliance on resupply missions, and driving market growth. For instance, in January 2024, ESA launched the first metal 3D printer to the International Space Station (ISS) on the Cygnus NG-20 resupply mission. The European-made printer uses stainless-steel wire, commonly used in medical implants and water treatment, to print objects. The printer uses a high-power laser to heat the wire, melting the end and adding metal. Four shapes were tested and compared to reference prints on the ground, with daily print time limited to four hours owing to noise regulations on the Space Station.

Market Segmentation

- Based on the form, the market is segmented into powder and filament.

- Based on the technology, the market is segmented into powder bed fusion, directed energy deposition, binder jetting, metal extrusion, and others (digital light projector, multi-jet fusion, and material jetting).

- Based on the components, the market is segmented into titanium, nickel, stainless steel, aluminum, and others (cobalt-chrome, copper, silver, gold, and bronze).

- Based on the end-user, the market is segmented into aerospace & defense, automotive, medical & dental, and others (marine, art & sculpture, jewelry, and architecture.

Aerospace & Defense: A Key Segment in Market Growth

Metal 3D printing is being utilized in the aerospace industry to create intricate, lightweight structures, boosting market growth by improving fuel efficiency and performance. According to the Aerospace Industries Association (AIA), in 2024, the US aerospace and defense industry achieved significant growth, with sales surpassing $955 billion, marking a 7.1% rise from the prior year. This growth highlights the sector's economic impact, as every million dollars in sales contributes to supporting manufacturing and the supply chain.

Regional Outlook

The global 3D printing metal market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Demand for Lightweighting in Europe

The market growth is driven by 3D printed metals such as aluminum, titanium, and high-strength alloys that are gaining popularity in electric vehicles owing to their ability to reduce weight while maintaining structural integrity. According to the ACEA (Association des Constructeurs Européens d’Automobiles), in 2024, new car registrations experienced a slight increase of 0.8%, reaching approximately 10.6 million units. Spain demonstrated strong growth with a 7.1% increase, while France, Germany, and Italy saw declines of 3.2%, 1%, and 0.5%, respectively. Battery-electric cars held a market share of 13.6% for the year, surpassing diesel's 11.9%, while petrol cars led at 33.3%, and hybrid-electric vehicles secured second place with a 30.9% share.

Asia-Pacific Region Dominates the Market with Major Share

Asia-Pacific holds a significant share, owing to the automotive industry embracing metal 3D printing for prototyping and producing lightweight, high-strength parts, enhancing vehicle performance and efficiency, driving market growth. According to the India Brand Equity Foundation (IBEF), in April 2025, the Indian passenger car market was valued at $32.70 billion and is projected to grow to US$ 54.84 billion by 2027. The global EV market, valued at approximately $250 billion in 2021, is expected to expand fivefold to $1,318 billion by 2028. By FY25, two-wheelers and passenger cars are anticipated to constitute 75.04% and 21.38% of market shares, respectively, with a total production of 15,622,388 units across various vehicle categories. India marked a milestone with 100,000 EV sales in CY24, up from 82,688 in CY23, highlighting a $206 billion opportunity for electric vehicles by 2030, requiring $180 billion for vehicle manufacturing and charging infrastructure.

Market Players Outlook

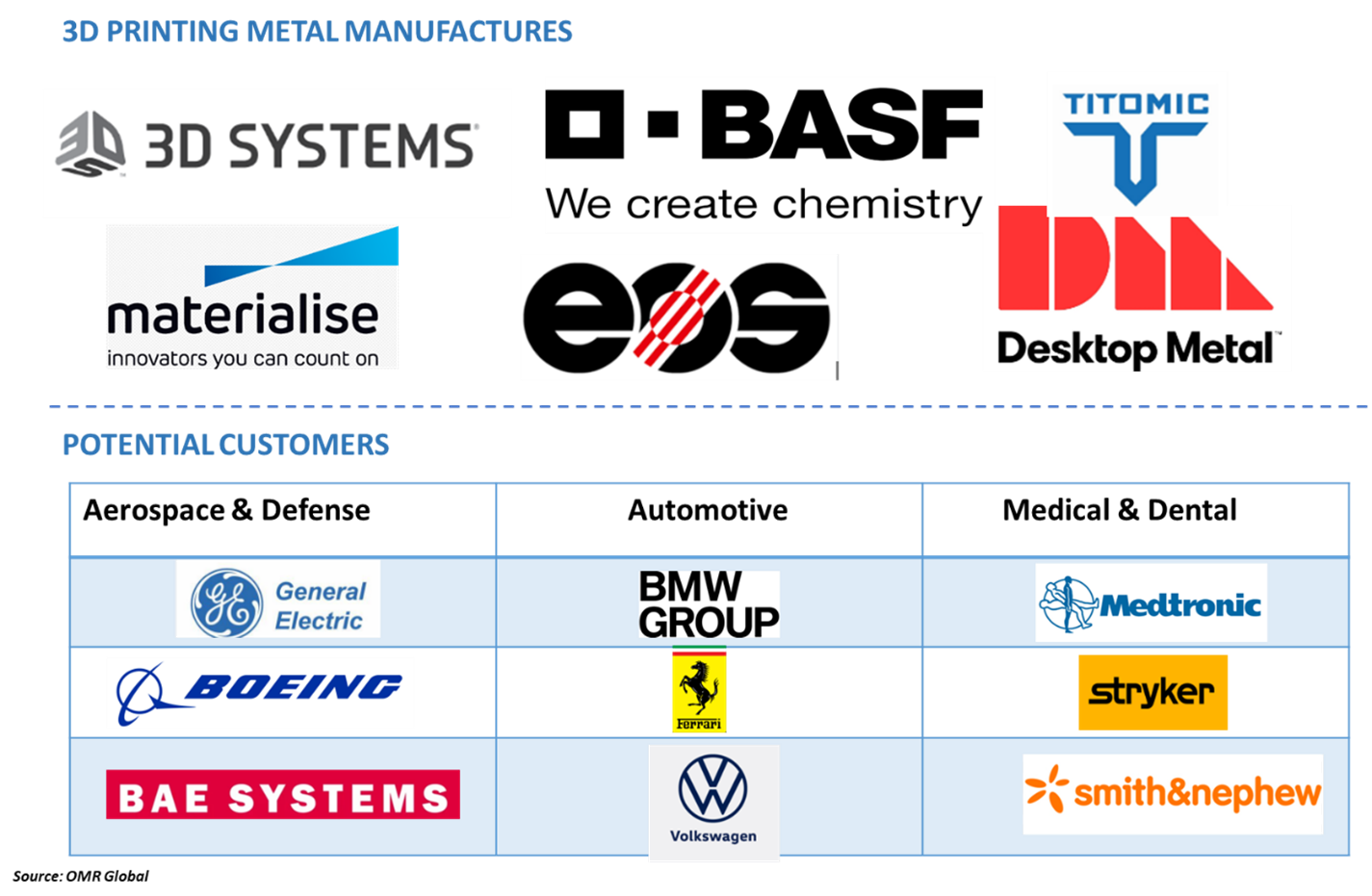

The major companies operating in the global 3D printing metal market include 3D Systems, Inc., BASF SE, EOS GmbH, and Materialise N.V. among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In April 2025, Nano Dimension completed its acquisition of Desktop Metal, the additive manufacturing M&A saga. The merger is expected to generate over $200 million in annual revenue in 2024.

- In January 2024, AddUp and Airbus delivered the first metal 3D printer to operate in space to the European Space Agency. The printer, developed by Airbus Defence and Space, was launched by NASA Mission NG-20 toward the International Space Station. The goal is to make extraterrestrial metal 3D printing viable for spare part manufacturing.

- In February 2024, the Northrop Grumman Cygnus mission, launched by SpaceX Falcon 9, features a 180-kilogram 3D metal printer. The printer, named 3D Metal, uses stainless steel wire heated to create small parts. It features filters to capture fumes from the printing process, preventing contamination of the space station's air.

- In February 2024, Mitsubishi Electric launched two models of its AZ600 wire-laser 3D metal printer, that uses digital additive-manufacturing technology to create high-quality 3D structures. Innovative technology reduces energy consumption, saves resources, and supports the maintenance of specialist parts for vehicles, ships, and aircraft.

- In April 2024, VDM Metals partnered with metal 3D printing service provider Rosswag Engineering to manufacture function-optimized components using the Laser Powder Bed Fusion process. This partnership aims to identify new applications for VDM Powder Alloy 699 XA, a highly corrosion-resistant material used in petrochemical processes.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 3D printing metal market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global 3D Printing Metal Market Sales Analysis – Form | Technology | Type | End-User ($ Million)

• 3D Printing Metal Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key 3D Printing Metal Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the 3D Printing Metal Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global 3D Printing Metal Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global 3D Printing Metal Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – 3D Printing Metal Market Revenue and Share by Manufacturers

• 3D Printing Metal Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. 3D Systems, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. BASF SE

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. EOS GmbH

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Materialise N.V.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global 3D Printing Metal Market Sales Analysis by Form ($ Million)

5.1. Powder

5.2. Filament

6. Global 3D Printing Metal Market Sales Analysis by Technology ($ Million)

6.1. Powder Bed Fusion

6.2. Directed Energy Deposition

6.3. Binder Jetting

6.4. Metal Extrusion

6.5. Others (Digital Light Projector, Multi-jet Fusion, and Material Jetting)

7. Global 3D Printing Metal Market Sales Analysis by Type ($ Million)

7.1. Titanium

7.2. Nickel

7.3. Stainless Steel

7.4. Aluminum

7.5. Others (Cobalt-Chrome, Copper, Silver, Gold, and Bronze)

8. Global 3D Printing Metal Market Sales Analysis by End-User ($ Million)

8.1. Aerospace & Defense

8.2. Automotive

8.3. Medical & Dental

8.4. Others (Marine, Art & Sculpture, Jewelry, and Architecture

9. Regional Analysis

9.1. North American 3D Printing Metal Market Sales Analysis – Form | Technology | Type | End-User| Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European 3D Printing Metal Market Sales Analysis – Form | Technology | Type | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific 3D Printing Metal Market Sales Analysis – Form | Technology | Type | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World 3D Printing Metal Market Sales Analysis – Form | Technology | Type | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. 3D Systems, Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. BASF SE

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. CNPC POWDER

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. CRS Holdings, LLC.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Desktop Metal, Inc.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. EOS GmbH

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Eplus3D

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. GKN Powder Metallurgy

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Höganäs AB

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Markforged

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Materialise N.V.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. OC Oerlikon Management AG

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Pollen AM Inc.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Proto Labs, Inc.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Rio Tinto

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Sandvik AB

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Stratasys Ltd.

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Titomic Ltd.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

1. Global 3D Printing Metal Market Research And Analysis By Form, 2024-2035 ($ Million)

2. Global 3D Printing Metal Powder Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global 3D Printing Metal Filament Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global 3D Printing Metal Market Research And Analysis By Technology, 2024-2035 ($ Million)

5. Global 3D Printing Metal For Powder Bed Fusion Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global 3D Printing Metal For Directed Energy Deposition Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global 3D Printing Metal For Binder Jetting Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global 3D Printing Metal For Metal Extrusion Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global 3D Printing Metal For Other Technology Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global 3D Printing Metal Market Research And Analysis By Type, 2024-2035 ($ Million)

11. Global Titanium 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Nickel 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Stainless Steel 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Aluminum 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Other Type 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global 3D Printing Metal Market Research And Analysis By End-User, 2024-2035 ($ Million)

17. Global 3D Printing Metal For Aerospace & Defense Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global 3D Printing Metal For Automotive Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global 3D Printing Metal For Medical & Dental Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global 3D Printing Metal For Other End-User Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

22. North American 3D Printing Metal Market Research And Analysis By Country, 2024-2035 ($ Million)

23. North American 3D Printing Metal Market Research And Analysis By Form, 2024-2035 ($ Million)

24. North American 3D Printing Metal Market Research And Analysis By Technology, 2024-2035 ($ Million)

25. North American 3D Printing Metal Market Research And Analysis By Type, 2024-2035 ($ Million)

26. North American 3D Printing Metal Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. European 3D Printing Metal Market Research And Analysis By Country, 2024-2035 ($ Million)

28. European 3D Printing Metal Market Research And Analysis By Form, 2024-2035 ($ Million)

29. European 3D Printing Metal Market Research And Analysis By Technology, 2024-2035 ($ Million)

30. European 3D Printing Metal Market Research And Analysis By Type, 2024-2035 ($ Million)

31. European 3D Printing Metal Market Research And Analysis By End-User, 2024-2035 ($ Million)

32. Asia-Pacific 3D Printing Metal Market Research And Analysis By Country, 2024-2035 ($ Million)

33. Asia-Pacific 3D Printing Metal Market Research And Analysis By Form, 2024-2035 ($ Million)

34. Asia-Pacific 3D Printing Metal Market Research And Analysis By Technology, 2024-2035 ($ Million)

35. Asia-Pacific 3D Printing Metal Market Research And Analysis By Type, 2024-2035 ($ Million)

36. Asia-Pacific 3D Printing Metal Market Research And Analysis By End-User, 2024-2035 ($ Million)

37. Rest Of The World 3D Printing Metal Market Research And Analysis By Region, 2024-2035 ($ Million)

38. Rest Of The World 3D Printing Metal Market Research And Analysis By Form, 2024-2035 ($ Million)

39. Rest Of The World 3D Printing Metal Market Research And Analysis By Technology, 2024-2035 ($ Million)

40. Rest Of The World 3D Printing Metal Market Research And Analysis By Type, 2024-2035 ($ Million)

41. Rest Of The World 3D Printing Metal Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global 3D Printing Metal Market Research And Analysis By Form, 2024 Vs 2035 (%)

2. Global 3D Printing Metal Powder Market Share By Region, 2024 Vs 2035 (%)

3. Global 3D Printing Metal Filament Market Share By Region, 2024 Vs 2035 (%)

4. Global 3D Printing Metal Market Research And Analysis By Technology, 2024 Vs 2035 (%)

5. Global 3D Printing Metal For Powder Bed Fusion Market Share By Region, 2024 Vs 2035 (%)

6. Global 3D Printing Metal For Directed Energy Deposition Market Share By Region, 2024 Vs 2035 (%)

7. Global 3D Printing Metal For Binder Jetting Market Share By Region, 2024 Vs 2035 (%)

8. Global 3D Printing Metal For Other Technology Market Share By Region, 2024 Vs 2035 (%)

9. Global 3D Printing Metal Market Research And Analysis By Type, 2024 Vs 2035 (%)

10. Global Titanium 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

11. Global Nickel 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

12. Global Stainless Steel 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

13. Global Aluminum 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

14. Global Other Type 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

15. Global 3D Printing Metal Market Research And Analysis By End-User, 2024 Vs 2035 (%)

16. Global 3D Printing Metal For Aerospace & Defense Market Share By Region, 2024 Vs 2035 (%)

17. Global 3D Printing Metal For Automotive Market Share By Region, 2024 Vs 2035 (%)

18. Global 3D Printing Metal For Medical & Dental Market Share By Region, 2024 Vs 2035 (%)

19. Global 3D Printing Metal For Other End-User Market Share By Region, 2024 Vs 2035 (%)

20. Global 3D Printing Metal Market Share By Region, 2024 Vs 2035 (%)

21. US 3D Printing Metal Market Size, 2024-2035 ($ Million)

22. Canada 3D Printing Metal Market Size, 2024-2035 ($ Million)

23. UK 3D Printing Metal Market Size, 2024-2035 ($ Million)

24. France 3D Printing Metal Market Size, 2024-2035 ($ Million)

25. Germany 3D Printing Metal Market Size, 2024-2035 ($ Million)

26. Italy 3D Printing Metal Market Size, 2024-2035 ($ Million)

27. Spain 3D Printing Metal Market Size, 2024-2035 ($ Million)

28. Russia 3D Printing Metal Market Size, 2024-2035 ($ Million)

29. Rest Of Europe 3D Printing Metal Market Size, 2024-2035 ($ Million)

30. India 3D Printing Metal Market Size, 2024-2035 ($ Million)

31. China 3D Printing Metal Market Size, 2024-2035 ($ Million)

32. Japan 3D Printing Metal Market Size, 2024-2035 ($ Million)

33. South Korea 3D Printing Metal Market Size, 2024-2035 ($ Million)

34. ASEAN 3D Printing Metal Market Size, 2024-2035 ($ Million)

35. Australia and New Zealand 3D Printing Metal Market Size, 2024-2035 ($ Million)

36. Rest Of Asia-Pacific 3D Printing Metal Market Size, 2024-2035 ($ Million)

37. Latin America 3D Printing Metal Market Size, 2024-2035 ($ Million)

38. Middle East And Africa 3D Printing Metal Market Size, 2024-2035 ($ Million)

FAQS

The size of the 3D Printing Metal market in 2024 is estimated to be around $2.8 billion.

Asia-Pacific holds the largest share in the 3D Printing Metal market.

Leading players in the 3D Printing Metal market include 3D Systems, Inc., BASF SE, EOS GmbH, and Materialise N.V. among others.

3D Printing Metal market is expected to grow at a CAGR of 19.2% from 2025 to 2035.

The 3D Printing Metal Market is growing due to rising demand in aerospace and healthcare, advancements in printing technology, and increased need for customized, lightweight components.