Ablation Devices Market

Ablation Devices Market Size, Share & Trends Analysis Report, By Product Type (Radiofrequency, Microwave, Cryoablation, Ultrasound, and Others), By Application (Cancer, CVD, Ophthalmology, Gynecology, Orthopedics, Urology, and Others), and Forecast, 2019-2025

The global ablation devices market is estimated to grow at a CAGR of 10.6% during the forecast period. The major factors contributing to the growth of the market include the increasing prevalence of chronic diseases and rising demand for minimally invasive surgical procedures. There is an increasing prevalence of chronic diseases, such as cancer and CVD has been witnessed across the globe. For instance, as per the World Health Organization (WHO), The new incidences of cancer globally are estimated to have increased to 18.1 million new cases and 9.6 million deaths in 2018. One in 5 men and one in 6 women globally develop cancer during their lifetime. The total number of people who are alive within 5 years of a cancer diagnosis, referred to as 5-year prevalence, is estimated to be 43.8 million in 2018. Ablation techniques play a vital role in the treatment of such conditions as it is used to remove or destroy cancerous tissues. As a result, it is encouraging the demand for ablation techniques during minimally invasive procedures.

Several companies are taking a keen interest in developing new ablation methods, including Hologic Inc., Ethicon Inc. and Boston Scientific Corporation. For instance, In Feb 2017, Hologic, Inc. introduced next-generation technology named NovaSure ADVANCED global endometrial ablation system in the US. It is designed to decrease abnormal uterine bleeding by using RF energy to the endometrium for gently ablating the uterus lining in 2 minutes or less. The device provides a slimmer 6mm diameter intended for physicians’ ease of use and improving patients comfort by continuing the clinical efficiency of the trusted NovaSure system. It has a small sheath size needs less cervical dilation as compared to 8 mm NovaSure device.

The device is provided along with an acorn-like shaped cervical seal. It creates an enhanced sealing surface under the cervical canal and offers 13% higher working length compared to the previous device. Further enhancements comprise rounded smooth access tips to facilitate insertion as well as a blue handle that aids as a useful reminder regarding the device insertion. This advent of new ablation devices is supporting to drive the efficiency and reliability of ablation procedures and thereby is encouraging market growth.

Segment Outlook

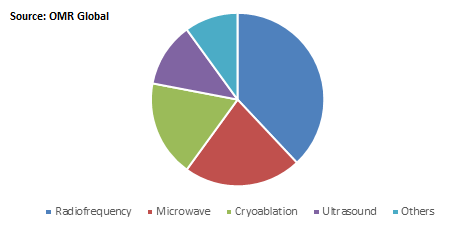

The global ablation devices market is segmented based on product type, application, and treatment. Based on product type, the market is classified into radiofrequency, microwave, cryoablation. ultrasound, and others. Based on application, the market is classified into cancer, CVD, ophthalmology, gynecology, orthopedics, urology, and others. Based on treatment, the market is classified into surgical ablation, percutaneous ablation, and laparoscopic ablation.

Radiofrequency ablation devices have witnessed significant share in the product type segment

Rising demand for radiofrequency ablation procedure for the treatment of cardiac arrhythmias and cancer is primarily driving the adoption of radiofrequency ablation devices. Radiofrequency ablation is the most commonly used procedure for the treatment of atrial fibrillation (AFib) and other arrhythmias. Other common arrhythmias which are treated by radiofrequency ablation include Atrial Flutter, Supraventricular Tachycardia (SVT), Ventricular Premature Beats, and Ventricular Tachycardia. Such abnormal heart rhythms result in the slow beating of the heart. Radiofrequency ablation enables to restore a regular heartbeat by destroying a small area of heart tissues that causes arrhythmia.

The procedure starts with an electrophysiology (EP) study, which is referred to as a catheter-based test that assesses the electrical activity of the heart and maps the heart areas that are triggering the arrhythmia. Later on, the professionals mapped heart tissue with the use of heat energy transferred using the catheter threaded through the blood vessel. It is used as a minimally invasive procedure for cancer treatment. This involves using heat and electrical energy to eliminate or destroy cancerous cells. It is frequently used for the treatment of cancers in the breast, liver, bone, lung, adrenal gland, kidney, thyroid, and pancreas. This, in turn, results in the demand for radiofrequency ablation devices in order to deliver thermal energy to tissue and destroy cancerous cells.

Global Radiofrequency Ablation Devices Market Share by Product Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ablation devices market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Medtronic plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. AngioDynamics, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Abbott Laboratories, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Johnson & Johnson Services, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Ablation Devices Market by Product Type

5.1.1. Radiofrequency

5.1.2. Microwave

5.1.3. Cryoablation

5.1.4. Ultrasound

5.1.5. Others (Laser and Electrical)

5.2. Global Ablation Devices Market by Application

5.2.1. Cancer

5.2.2. CVD

5.2.3. Ophthalmology

5.2.4. Gynecology

5.2.5. Orthopedics

5.2.6. Urology

5.2.7. Others (Aesthetics and Pain Management)

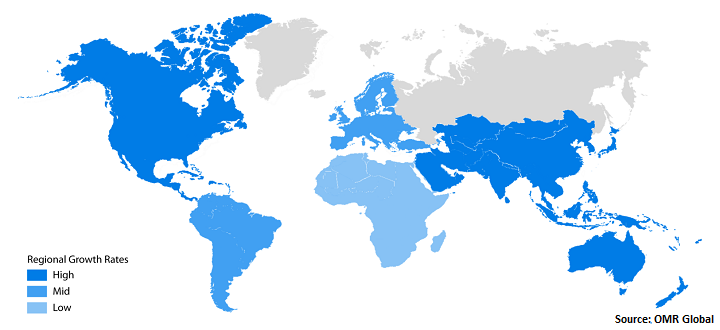

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories, Inc.

7.2. Alcon Laboratories, Inc.

7.3. AngioDynamics, Inc.

7.4. AtriCure, Inc.

7.5. Boston Scientific Corp.

7.6. BVM Medical Ltd.

7.7. C. R. Bard, Inc. (a part of Becton, Dickinson & Co.)

7.8. CONMED Corp.

7.9. EDAP TMS SA

7.10. HealthTronics, Inc.

7.11. Hologic, Inc.

7.12. Integra LifeSciences Holdings Corp.

7.13. Japan Lifeline Co., Ltd.

7.14. Johnson & Johnson Services, Inc.

7.15. Medtronic plc

7.16. Merit Medical Systems, Inc.

7.17. Misonix, Inc.

7.18. Olympus Corp.

7.19. Smith & Nephew plc

7.20. Stryker Corp.

7.21. Teleflex, Inc.

7.22. Terumo Corp.

7.23. Varian Medical Systems, Inc.

1. GLOBAL ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL RADIOFREQUENCY ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL MICROWAVE ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CRYOABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ULTRASOUND ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

8. GLOBAL ABLATION DEVICES FOR CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ABLATION DEVICES FOR CVD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ABLATION DEVICES FOR OPHTHALMOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL ABLATION DEVICES FOR GYNECOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ABLATION DEVICES FOR ORTHOPEDICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL ABLATION DEVICES FOR UROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL ABLATION DEVICES FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

18. NORTH AMERICAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. NORTH AMERICAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

20. EUROPEAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. EUROPEAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

22. EUROPEAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

28. REST OF THE WORLD ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

29. REST OF THE WORLD ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD ABLATION DEVICES MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

1. GLOBAL ABLATION DEVICES MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL ABLATION DEVICES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL ABLATION DEVICES MARKET SHARE BY TREATMENT, 2018 VS 2025 (%)

4. GLOBAL ABLATION DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. UK ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD ABLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)