Absorption Chillers Market

Absorption Chillers Market Size, Share & Trends Analysis Report by Technology (Single Stage and Double Stage), by Absorber Type (Lithium Bromide and Ammonia), by Power Source (Direct Fired, Indirect Fired, and Water Driven), and by Application (Chemicals, Food & Beverages, Power, Paper & Pulp, Power & Energy and Others), Forecast Period (2025-2035)

Industry Outlook

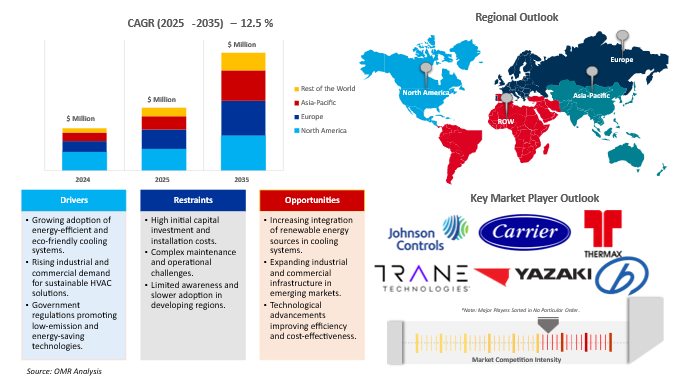

Absorption chillers market is anticipated to grow at a CAGR of 12.5% during the forecast period (2025-2035). The growth of the absorption chillers market is driven by the rising demand for energy-efficient and environmentally friendly cooling solutions across various industrial, commercial, and residential sectors. The rising global emphasis on reducing greenhouse gas emissions and enhancing sustainability, absorption chillers are gaining traction owing to their ability to utilize waste heat or renewable energy sources such as solar and geothermal energy. Furthermore, the integration of innovative technologies, including smart control systems, Internet of Things (IoT), and predictive maintenance tools, is enhancing the operational efficiency and reliability of absorption chillers, thereby supporting market expansion. The transition toward low Global Warming Potential (GWP) refrigerants and the adoption of green building standards are also contributing to the increased deployment of absorption chiller systems.

Segmental Outlook

- Based on the technology, the market is segmented into single-stage and double-stage.

- Based on the absorber type, the market is segmented into lithium bromide and ammonia.

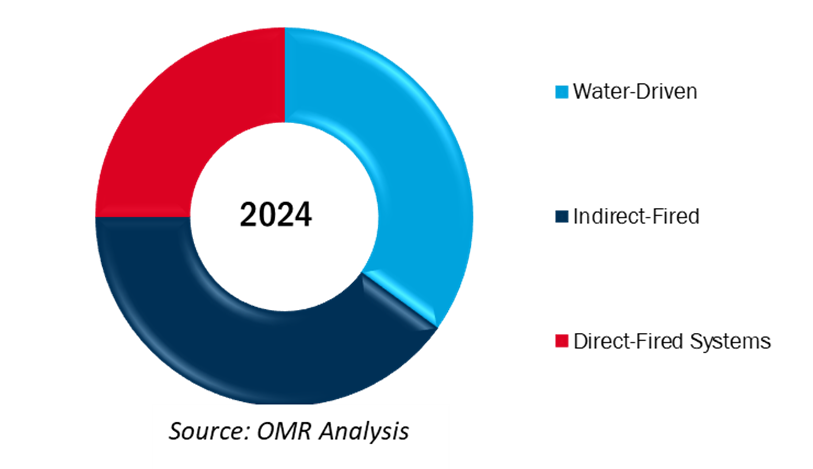

- Based on the power source, the market is segmented into direct fired, indirect fired, and water driven.

- Based on the application, the market is segmented into chemicals, food & beverages, power, paper & pulp, power & energy, and others (petroleum).

The Food & Beverages Sub-Segment is Anticipated to Hold a Considerable Share of the Global Absorption Chillers Market

The huge portions of the global absorption chillers market are going to be held by the food & beverages (F&B) sub-segment, as they have a high cooling demand in food processing, storage, and preservation areas. The industry gives preference to sustainable and energy-efficient cooling solutions, where using waste heat, steam, or natural gas by absorption of chillers instead of electricity facilitates clean development. Furthermore, the escalating demand for cold chain logistics, which is being propelled by the rising frozen and processed food consumption, is the major reason for the absorption of chillers to be the latest adoption in 2023. Government regulations requiring food safety and energy-efficient refrigeration solutions also make the market grow. Besides, the rapid growth of the beverage industry is one of the driving factors in the absorption of chillers for breweries and distilleries, which are used for fermentation or storage processes.

Global Absorption Chillers Market Share By Power Source, 2024 (%)

Regional Outlook

The global absorption chillers market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN economies, Australia and New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the high growth potential of the manufacturing sector, including food & beverages, petrochemical industries, pharmaceuticals, and others. Additionally, the region holds a strong presence of key manufacturing companies such as Hitachi Appliances, Inc., Ebara Refrigeration Equipment & Systems Co., Ltd., and others.

North America to Grow at a Significant CAGR in the Global Absorption Chillers Market

The North America absorption chillers market growth is attributed to technological advancements and increasing demand for absorption chillers. The rate of growth is increasing owing to high demand by industries, the reason being sudden climate change and unexpected heat and cold in the same season. The development of the area is further facilitated by the presence of important market participants, developments in technology, and rising investments in industrial infrastructure. The market for absorption chillers is expected to develop significantly in North America owing to consumers' growing desire for economical and environmentally friendly cooling systems.

Market Players Outlook

The major absorption chillers market includes major players in the industry, including Johnson Controls, Carrier Corp., Thermax Ltd., Trane Technologies, Yazaki Corp., Broad Air Conditioning Co. Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In August 2023, Bloom Energy launched an advanced CHP Solution for Zero Heating and Cooling. Bloom Energy is offering the Bloom Energy Server as a Combined Heat and Power (CHP) solution that utilizes a high temperature (>350°C) exhaust stream for industrial steam production and absorption chilling.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global absorption chillers market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Absorption Chillers Market Sales Analysis – Technology | Absorber Type |Power Source | Application ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Global Absorption Chillers Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Absorption Chillers: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Absorption Chillers: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Absorption Chillers Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Absorption Chillers Market by Technology ($ Million)

5.1. Single Stage

5.2. Double Stage

6. Global Absorption Chillers Market by Absorber Type ($ Million)

6.1. Lithium Bromide

6.2. Ammonia

7. Global Absorption Chillers Market by Power Source ($ Million)

7.1. Direct Fired

7.2. Indirect Fired

7.3. Water Driven

8. Global Absorption Chillers Market by Application ($ Million)

8.1. Chemicals

8.2. Food & Beverages

8.3. Power

8.4. Paper & Pulp

8.5. Power & Energy

8.6. Others (Petroleum)

9. Regional Analysis

9.1. North American Absorption Market Chillers Sales Analysis – Technology | Absorber Type |Power Source| Application | Country ($ Million)

9.1.1. United States

9.1.2. Canada

9.2. European Absorption Chillers Market Sales Analysis – Technology | Absorber Type |Power Source| Application | Country ($ Million)

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Absorption Chillers Market Sales Analysis – Technology | Absorber Type |Power Source| Application | Country ($ Million)

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Absorption Chillers Market Sales Analysis – Technology | Absorber Type |Power Source| Application | Country ($ Million)

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Berg Chilling Systems Inc.

10.2. BROAD Group

10.3. Carrier Corp.

10.4. Century Corp.

10.5. CNIM Group

10.6. Colibri B.V.

10.7. Daikin Industries, Ltd.

10.8. Ebara Refrigeration Equipment & Systems Co., Ltd.

10.9. Heinen & Hopman Engineering BV

10.10. Johnson Controls International Plc

10.11. Kirloskar Pneumatic Co. Ltd.

10.12. LG Electronics Inc.

10.13. Mitsubishi Electric Corp.

10.14. Panasonic Corp.

10.15. Robur S.p.A.

10.16. Shuangliang Eco-Energy Systems Co., Ltd.

10.17. Thermax Ltd.

10.18. Toshiba.Toshiba Corp.

10.19. Trane Inc.

10.20. Worldenergy Global Absorption Chillers Europe Ltd.

1. Global Absorption Chillers Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Single Stage Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Double Stage Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Absorption Chillers Market Research And Analysis By Absorber Type, 2024-2035 ($ Million)

5. Global Lithium Bromide Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Ammonia Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Absorption Chillers Market Research And Analysis By Power Source, 2024-2035 ($ Million)

8. Global Direct Fired Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Indirect Fired Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Water Driven Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Absorption Chillers Market Research And Analysis By Application, 2024-2035 ($ Million)

12. Global Absorption Chillers For Chemicals Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Absorption Chillers For Food & Beverages Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Absorption Chillers For Power Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Absorption Chillers For Paper & Pulp Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Absorption Chillers For Power & Energy Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Absorption Chillers For Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North America Absorption Chillers Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American Absorption Chillers Market Research And Analysis By Technology, 2024-2035 ($ Million)

21. North American Absorption Chillers Market Research And Analysis By Absorber Type, 2024-2035 ($ Million)

22. North American Absorption Chillers Market Research And Analysis By Power Source, 2024-2035 ($ Million)

23. North American Absorption Chillers Market Research And Analysis By Application, 2024-2035 ($ Million)

24. European Absorption Chillers Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European Absorption Chillers Market Research And Analysis By Technology, 2024-2035 ($ Million)

26. European Absorption Chillers Market Research And Analysis By Absorber Type, 2024-2035 ($ Million)

27. European Absorption Chillers Market Research And Analysis By Power Source, 2024-2035 ($ Million)

28. European Absorption Chillers Market Research And Analysis By Application, 2024-2035 ($ Million)

29. Asia-Pacific Absorption Chillers Market Research And Analysis By Country, 2024-2035 ($ Million)

30. Asia-Pacific Absorption Chillers Market Research And Analysis By Technology, 2024-2035 ($ Million)

31. Asia-Pacific Absorption Chillers Market Research And Analysis By Absorber Type, 2024-2035 ($ Million)

32. Asia-Pacific Absorption Chillers Market Research And Analysis By Power Source, 2024-2035 ($ Million)

33. Asia-Pacific Absorption Chillers Market Research And Analysis By Application, 2024-2035 ($ Million)

34. Rest Of The World Absorption Chillers Market Research And Analysis By Region, 2024-2035 ($ Million)

35. Rest Of The World Absorption Chillers Market Research And Analysis By Technology, 2024-2035 ($ Million)

36. Rest Of The World Absorption Chillers Market Research And Analysis By Absorber Type, 2024-2035 ($ Million)

37. Rest Of The World Absorption Chillers Market Research And Analysis By Power Source, 2024-2035 ($ Million)

38. Rest Of The World Absorption Chillers Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Absorption Chillers Market Share By Technology, 2024 Vs 2035 (%)

2. Global Single Stage Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

3. Global Double Stage Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

4. Global Absorption Chillers Market Share By Absorber Type, 2024 Vs 2035 (%)

5. Global Lithium Bromide Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

6. Global Ammonia Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

7. Global Absorption Chillers Market Share By Power Source, 2024 Vs 2035 (%)

8. Global Direct Fired Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

9. Global Indirect Fired Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

10. Global Water Driven Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

11. Global Absorption Chillers Market Share By Application, 2024 Vs 2035 (%)

12. Global Absorption Chillers For Chemicals Market Share By Region, 2024 Vs 2035 (%)

13. Global Absorption Chillers For Food & Beverages Market Share By Region, 2024 Vs 2035 (%)

14. Global Absorption Chillers For Power Market Share By Region, 2024 Vs 2035 (%)

15. Global Absorption Chillers For Paper & Pulp Market Share By Region, 2024 Vs 2035 (%)

16. Global Absorption Chillers For Power & Energy Market Share By Region, 2024 Vs 2035 (%)

17. Global Absorption Chillers For Other Application Market Share By Region, 2024 Vs 2035 (%)

18. Global Absorption Chillers Market Share By Region, 2024 Vs 2035 (%)

19. US Absorption Chillers Market Size, 2024-2035 ($ Million)

20. Canada Absorption Chillers Market Size, 2024-2035 ($ Million)

21. UK Absorption Chillers Market Size, 2024-2035 ($ Million)

22. France Absorption Chillers Market Size, 2024-2035 ($ Million)

23. Germany Absorption Chillers Market Size, 2024-2035 ($ Million)

24. Italy Absorption Chillers Market Size, 2024-2035 ($ Million)

25. Spain Absorption Chillers Market Size, 2024-2035 ($ Million)

26. Russia Absorption Chillers Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Absorption Chillers Market Size, 2024-2035 ($ Million)

28. India Absorption Chillers Market Size, 2024-2035 ($ Million)

29. China Absorption Chillers Market Size, 2024-2035 ($ Million)

30. Japan Absorption Chillers Market Size, 2024-2035 ($ Million)

31. South Korea Absorption Chillers Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Absorption Chillers Market Size, 2024-2035 ($ Million)

33. ASEAN Absorption Chillers Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Absorption Chillers Market Size, 2024-2035 ($ Million)

35. Rest Of The World Absorption Chillers Market Size, 2024-2035 ($ Million)

FAQS

The size of the Absorption Chillers market in 2024 is estimated to be around USD 3.61 billion.

North America holds the largest share in the Absorption Chillers market.

Leading players in the Absorption Chillers market include Johnson Controls, Carrier Corp., Thermax Ltd., Trane Technologies, Yazaki Corp., Broad Air Conditioning Co. Ltd., and others.

Absorption Chillers market is expected to grow at a CAGR of 12.5% from 2025 to 2035.

Rising demand for sustainable cooling solutions and energy efficiency is driving the growth of the Absorption Chillers Market.