Aircraft Synthetic Vision Market

Aircraft Synthetic Vision Market Size, Share & Trends Analysis Report by Application (Commercial, Military, General Aviation), and by Display System (Primary Flight Display, Navigation Display, Heads-up & Helmet-mounted Display Systems) Forecast Period (2025-2035)

Industry Outlook

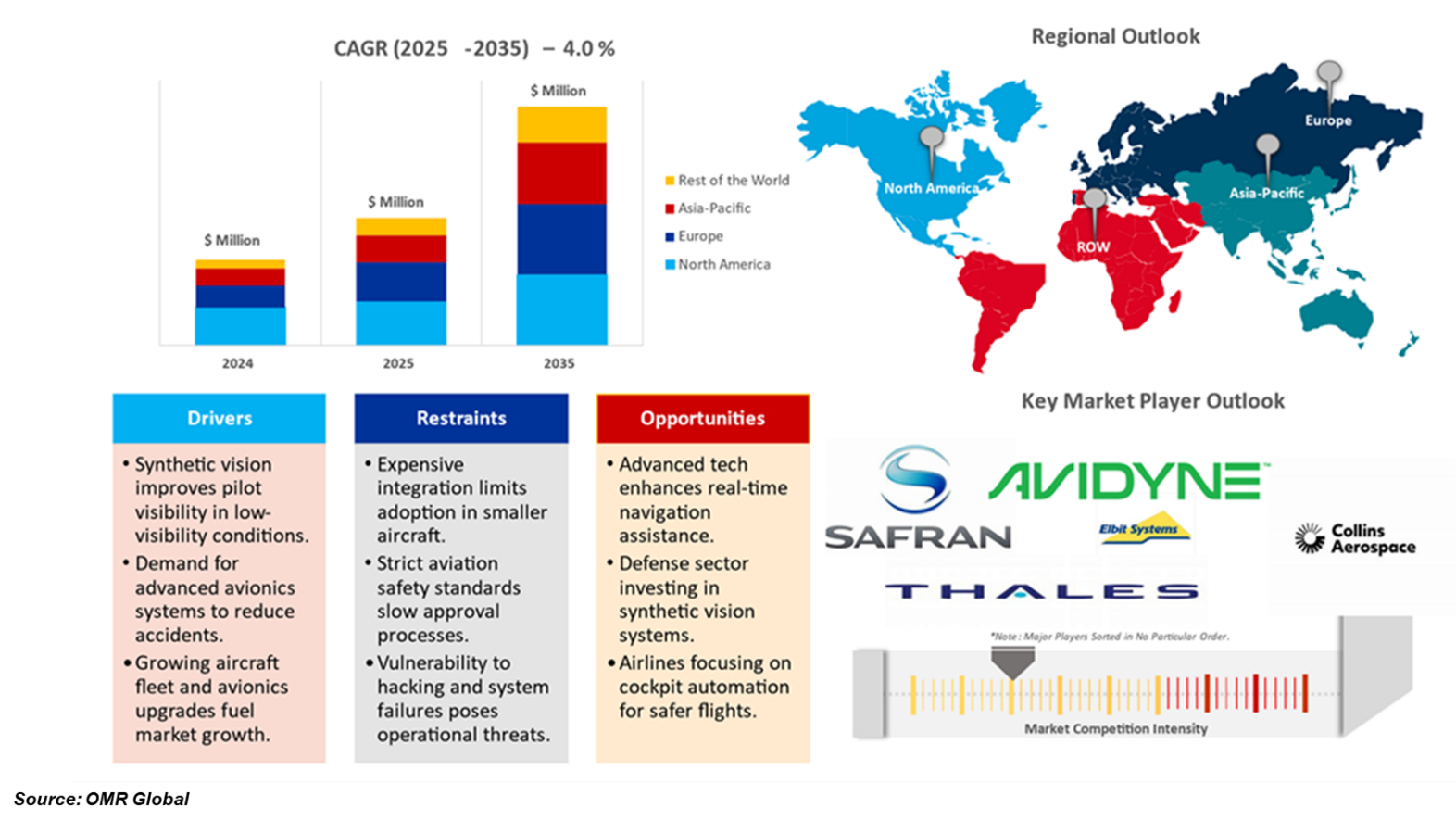

Aircraft synthetic vision market is projected to grow at a CAGR of 4.0% during the predicted period (2025-2035). This technology provides pilots with a virtual, computer-generated view of the external environment that enhances situational awareness during flight. It employs three-dimensional terrain, barriers, and various navigation information to generate a visual display on the flight deck screens, even in conditions of poor visibility. The military aviation industry has shown resilience and even experienced growth, as other nations have maintained their defense spending and continue to prioritize the enhancement of their military capabilities.

Segmental Outlook

The global aircraft synthetic vision market is segmented by technology and airport terminal type. By application, the market is sub-segmented into commercial, military, and general aviation. By display system, the market is sub-segmented into primary flight display, navigation display, and heads-up & helmet-mounted display systems. The rapid growth in the aviation sector increases the demand for a synthetic vision system. The demand for synthetic display systems in the aviation sector is increasing owing to the growth of commercial aircraft and technology advancements. With rapid growth, market players are also focusing on technological advancements in primary flight displays and collaboration with aviation companies.

The Military Industry is Expected to Contribute Significantly to the Global Aircraft Synthetic Vision Industry.

Military aircraft require enhanced situational awareness, navigation in low-visibility conditions, and improved operational safety, making SVS a critical technology. Rising defense budgets, advancements in avionics systems, and the integration of AI and augmented reality (AR) are further accelerating adoption. This subsequent increase in defense also aims to boost the procurement programs for new-generation platforms. For example, in August 2023, the US Navy avionics team obtained two production batches of third-generation helmet-mounted displays for the Lockheed Martin F-35 joint strike fighter. This cutting-edge helmet-mounted display was created through a partnership between Collins Aerospace and Elbit Systems of America, serving as the main display system for the pilot.

Global Aircraft Synthetic Vision Market Share By Display System, 2024 (%)

Regional Outlook

The global aircraft synthetic vision market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia & New Zealand, ASEAN Countries and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

The North American Region is Expected to Grow at a Significant CAGR in the Global Aircraft Synthetic Vision Market

The North American region is expected to see sufficient growth with the highest CAGR among other regional segments for the forecast period. The region holds a significant share and presence in the global aircraft synthetic vision industry. The rapid growth in the commercial aviation sector focuses on the expansion which is further expected to drive the synthetic vision system market globally. Also, military expenditures are growing significantly and are focusing on R&D and procurement of advanced equipment that has synthetic vision systems by collaboration with regional defense companies.

Market Players Outlook

The major companies serving the global aircraft synthetic vision market are Thales S.A., Safran SA, Aspen Avionics Inc., Avidyne Corp., Collins Aerospace (Raytheon Technologies Corp.), and, Elbit Systems Ltd., among others. The companies are increasingly focusing on mergers and acquisitions and R&D to cater growing demand for synthetic vision systems in the aviation industry.

Recent Development

- In November 2023, CubCrafters' Thermal Infrared Imaging System was introduced for Garmin G3X-equipped aircraft. These collaborations with Hood Tech Aero enhance the crew's situational awareness in reduced visibility or low-light conditions. These synthetic vision displays provide pilots an enhanced infrared imagery on the G3X screen and maintain the same scale of vision.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aircraft synthetic vision market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Aircraft Synthetic Vision Market Sales Analysis – Application | Display System ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Global Aircraft Synthetic Vision Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Aircraft Synthetic Vision Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Aircraft Synthetic Vision Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Aircraft Synthetic Vision Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Aircraft Synthetic Vision Market by Application ($ Million)

5.1. Commercial

5.2. General Aviation

5.3. Military

6. Global Aircraft Synthetic Vision Market by Display System ($ Million)

6.1. Heads-up & Helmet-mounted Display Systems

6.2. Navigation Display

6.3. Primary Flight Display

7. Regional Analysis

7.1. North American Aircraft Synthetic Vision Market Sales Analysis – Application | Display System ($ Million)

7.1.1. United States

7.1.2. Canada

7.2. European Aircraft Synthetic Vision Market Sales Analysis Application | Display System ($ Million)

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Aircraft Synthetic Vision Market Sales Analysis Application | Display System ($ Million)

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Aircraft Synthetic Vision Market Sales Analysis – Application | Display System ($ Million)

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Arizona Board of Regents

8.2. Aspen Avionics Inc.

8.3. Astronics Corp.

8.4. Avidyne Corp.

8.5. BAE Systems

8.6. Collins Aerospace (Raytheon Technologies Corporation)

8.7. Dynon Avionics

8.8. Elbit Systems Ltd

8.9. ENSCO Avionics, Inc.

8.10. ForeFlight LLC (Boeing Co.)

8.11. Garmin Ltd

8.12. Genesys AeroSystems (Moog Inc.)

8.13. Hilton Software

8.14. Honeywell International Inc.

8.15. L3Harris Technologies Inc.

8.16. Mercury Systems Inc.

8.17. Safran SA

8.18. Thales S.A.

8.19. Universal Avionics System

1. Global Aircraft Synthetic Vision Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global Commercial Aircraft Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Military Aircraft Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global General Aviation Aircraft Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Aircraft Synthetic Vision Market Research And Analysis By Display System, 2024-2035 ($ Million)

6. Global Aircraft Primary Flight Display Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Aircraft Navigation Display Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Aircraft Heads-Up & Helmet-Mounted Display Systems Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Aircraft Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

10. North American Aircraft Synthetic Vision Market Research And Analysis By Country, 2024-2035 ($ Million)

11. North American Aircraft Synthetic Vision Market Research And Analysis By Application, 2024-2035 ($ Million)

12. North American Aircraft Synthetic Vision Market Research And Analysis By Display System, 2024-2035 ($ Million)

13. European Aircraft Synthetic Vision Market Research And Analysis By Country, 2024-2035 ($ Million)

14. European Aircraft Synthetic Vision Market Research And Analysis By Application, 2024-2035 ($ Million)

15. European Aircraft Synthetic Vision Market Research And Analysis By Display System, 2024-2035 ($ Million)

16. Asia-Pacific Aircraft Synthetic Vision Market Research And Analysis By Country, 2024-2035 ($ Million)

17. Asia-Pacific Aircraft Synthetic Vision Market Research And Analysis By Application, 2024-2035 ($ Million)

18. Asia-Pacific Aircraft Synthetic Vision Market Research And Analysis By Display System, 2024-2035 ($ Million)

19. Rest Of The World Aircraft Synthetic Vision Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Rest Of The World Aircraft Synthetic Vision Market Research And Analysis By Application, 2024-2035 ($ Million)

21. Rest Of The World Aircraft Synthetic Vision Market Research And Analysis By Display System, 2024-2035 ($ Million)

1. Global Aircraft Synthetic Vision Market Share By Application, 2024 Vs 2035 (%)

2. Global Commercial Aircraft Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

3. Global Military Aircraft Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

4. Global General Aviation Aircraft Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

5. Global Aircraft Synthetic Vision Market Share By Display System, 2024 Vs 2035 (%)

6. Global Aircraft Primary Flight Display Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

7. Global Aircraft Navigation Display Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

8. Global Aircraft Heads-Up & Helmet-Mounted Display Systems Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

9. Global Aircraft Synthetic Vision Market Share By Region, 2024 Vs 2035 (%)

10. US Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

11. Canada Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

12. UK Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

13. France Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

14. Germany Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

15. Italy Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

16. Spain Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

17. Russia Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

18. Rest Of Europe Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

19. India Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

20. China Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

21. Japan Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

22. South Korea Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

23. Australia & New Zealand Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

24. ASEAN Countries Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

25. Rest Of Asia-Pacific Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

26. Rest Of The World Aircraft Synthetic Vision Market Size, 2024-2035 ($ Million)

FAQS

The size of the Aircraft Synthetic Vision market in 2024 is estimated to be around USD 1.5 billion.

North American holds the largest share in the Aircraft Synthetic Vision market.

Leading players in the Aircraft Synthetic Vision market include Thales S.A., Safran SA, Aspen Avionics Inc., Avidyne Corp., Collins Aerospace (Raytheon Technologies Corp.), and, Elbit Systems Ltd., among others.

Aircraft Synthetic Vision market is expected to grow at a CAGR of 4.0% from 2025 to 2035.

Increasing demand for flight safety, situational awareness, and advanced avionics drives the growth of the Aircraft Synthetic Vision Market.