Alcohol Ingredients Market

Global Alcohol Ingredients Market Size, Share & Trends Analysis Report by Ingredient Type (Yeast, Enzyme, Colors; Flavors; & Salts, and Others), By Beverage Type (Beer, Spirits, Wine, and Others), and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global alcohol ingredients market is projected to grow at a significant CAGR of around 8% during the forecast period. The key factors that drive the growth of the market include the introduction of a variety of alcohol-based drinks. The increased trends of alcohol consumption coupled with the increased purchasing power of peoples in both developed as well as developing countries and rising branding and marketing of alcoholic beverages that attract consumers tend to drive the growth of the global alcohol ingredients market over the forecast period.

Emerging demand for premium alcoholic beverages has increased the adoption of distilled spirits, craft beer, and wine, and the rising youth population is further creating the demand for alcoholic beverages. Increasing demand for alcoholic beverages is encouraging the manufacturers to focus on a range of flavors that can aid in increasing their customer base, which in turn, creates demands for alcohol ingredients and hence drives the growth of the market.

Segmental Outlook

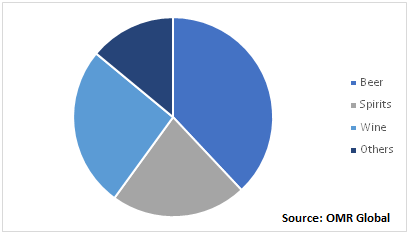

The global alcohol ingredients market is segmented on the basis of ingredient type and beverage type. Based on the ingredient type, the market is segmented into yeast, enzyme, colors; flavors; & salts, and others. Colors; flavors; & salts segment is estimated to hold a considerable share owing to the increasing demand for flavored drinks such as flavored beer and wine. Based on the beverage type, the market is segmented into beer, spirits, wine, and others. The beer segment is estimated to contribute a significant share.

Beer Segment to Hold the Key Share in the Global Alcohol Ingredients Market.

Amongst the beverage type, the beer segment is likely to hold the most significant share in the global alcohol ingredients market during the forecast period. Beer is brewed from cereal grains including barley, wheat, maize, cassava, sorghum, millet, and rice among others. The segmental growth of the market is attributed to the increased adoption of beer among the peoples. According to the WHO, the beer held 51% of share in the overall alcoholic beverage consumption in 2016. Beer is one of the most commonly consumed alcoholic beverages across the globe. Thus, this is likely to drive the segmental growth of the market over the forecast period.

Global Alcohol Ingredients Market by Beverage Type, 2019 (%)

Regional Outlook

The global alcohol ingredients market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is estimated to grow significantly during the forecast period. The growth of the region is attributed to the increased consumption of alcohol and the availability of raw materials as well as cheap labor in countries such as China and India. In the Asia-Pacific region, rice and wheat hold more than 60% of the share of raw material to be used for brewing purposes. In Europe, wheat is a majorly used raw material for beer production. More than half of the brewing is done with the use of wheat in Europe. In America, more than 50% of beers are produced by the use of maize as a raw material. Whereas, in Africa, wheat is a mainly used raw material for beer preparation.

Market Players Outlook

Some of the prominent players operating in the global alcohol ingredients market include Archer Daniels Midland Co., Sensient Technologies Corp., Cargill Inc., Kerry Global Plc, Ashland Inc., CHR Hansen Holding A/S, Koninklijke DSM N.V, Synergy Flavors Inc., and Treatt PLC. These companies adopting several growth strategies to strengthen their product portfolios and maintain a competitive position in the global alcohol ingredients market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global alcohol ingredients market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Sensient Technologies Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Cargill Inc.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Kerry Global Plc

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Archer Daniels Midland Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Alcohol Ingredients Market by Ingredient Type

5.1.1. Yeast

5.1.2. Enzyme

5.1.3. Colors, Flavors& Salts

5.1.4. Others

5.2. Global Alcohol Ingredients Market by Beverage Type

5.2.1. Beer

5.2.2. Spirits

5.2.3. Wine

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Angel Yeast Co. Ltd.

7.2. Archer Daniels Midland Co.

7.3. Ashland Global Holdings Inc.

7.4. Bio Springer SA

7.5. BioRigin

7.6. Cargill Inc.

7.7. CHR Hansen Holding A/S

7.8. DDW Inc.

7.9. Dohler Group

7.10. Kerry Group PLC

7.11. Koninklijke Dsm N.V

7.12. Kothari Fermentation and Biochem Ltd.

7.13. Lesaffre Group

7.14. MGP Ingredients Inc.

7.15. Novozymes A/S

7.16. Sensient Technologies Corp.

7.17. Synergy Flavors Inc.

7.18. Treatt PLC

1. GLOBAL ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ALCOHOL YEAST MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ALCOHOL ENZYME MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ALCOHOL COLOURS, FLAVORS & SALT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY BEVERAGE TYPE, 2019-2026 ($ MILLION)

7. GLOBAL BEER INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL SPIRITS INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL WINE INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL INGREDIENTS OTHER ALCOHOLIC BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY BEVERAGE TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY BEVERAGE TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY BEVERAGE TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY INGREDIENT TYPE, 2019-2026 ($ MILLION)

22. REST OF THE WORLD ALCOHOL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY BEVERAGE TYPE, 2019-2026 ($ MILLION)

1. GLOBAL ALCOHOL INGREDIENTS MARKET SHARE BY INGREDIENT TYPE, 2019 VS 2026 (%)

2. GLOBAL ALCOHOL INGREDIENTS MARKET SHARE BY BEVERAGE TYPE, 2019 VS 2026 (%)

3. GLOBAL ALCOHOL INGREDIENTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ALCOHOL INGREDIENTS MARKET SIZE, 2019-2026 ($ MILLION)