Almond Flour Market

Global Almond Flour Market Size, Share & Trends Analysis Report by Form (Blanched Almond Flour and Unblanched Almond Flour) by Application (Food and Beverages, Cosmetics, Dietary Supplements, and Others), and by Distribution Channel (Direct Sales (Offline) and Indirect Sales (Online)), Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The global almond flour market is projected to grow at a CAGR of 7.2% during the forecast period (2020-2026). The almond flour market is compelled by the rising demand for healthy food products with snacking options as well, specifically increasing preference for plant-based snacks. Food processing companies are coming up with diversified product offerings in terms of flavor profiles, shapes, and in particular healthier attributes, to gain customer’s attention. The market has been witnessing an unprecedented surge with growing consumer preference for healthy snacking choices including reduced fat and sodium content, in turn, increasing the demand for almond flour within food processing.

Further, with the growing consumer awareness regarding healthy snacking habits, consumers are looking for something that has more healthy substances than other snacks such as chips and candies. This has made way for the inclusion of protein-rich meals, in the regular diet, which, in turn, allows the market players to launch more almond flour-based food products. Conventionally, almond flour was typically sold in convenience stores/major retailing chains, but as more consumers are inclined towards a healthier lifestyle, more and more retail channels have started selling them.

However, due to the onset of the COVID-19 pandemic, the production volume and sales of almond flour has taken a serious hit. Food service processors all across the globe had to shut their operations, in compliance with the lockdown regulations. Although, the online sales channel witnessed a tremendous spike and recorded unprecedented sales for almond flour.

Segmental Outlook

The global almond flour market is segmented based on application, distribution channel, and form. Based on the application, the almond flour market is segmented into food and beverages, cosmetics, dietary supplements, and others (household). Almond flour-based bakery products have seen the most number of product launches with more than 1,500 in the last decade. The distribution channel segment includes direct sales (offline) and indirect sales (online). Based on form, the almond flour market includes blanched almond flour and unblanched almond flour.

Blanched Almond Flour Gaining Popularity in Bakery Products

Blanched almond flour is expected to be the fastest-growing form segment in the global almond flour market. Owing to their versatility and superior nutritional profiles, the blanched almond flour sub-segment has occupied one of the premium places in the market. There has been an emerging trend of ‘superfoods’ that have added health-promoting traits over and above their basic nutritional profiles. Blanched almond flour is increasingly being considered in the category of superfoods for its fine, smooth, fluffy texture, as well as its nutritional properties, thereby, driving its growth as base ingredients in bakery products. The concept of the paleo diet has also emphasized protein intake from nuts and seeds, such as almond. Bakery companies are increasingly launching products based on blanched almond flour that are in line with health and wellness trends.

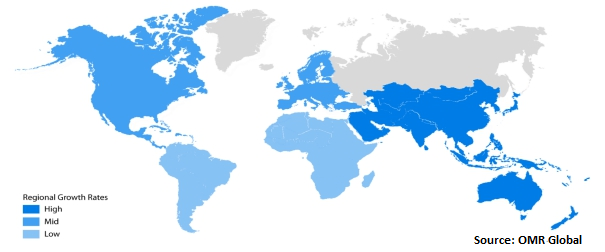

Regional Outlook

The global almond flour market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold a considerable share in the almond flour market in 2019 and is projected to sustain its growth dominance during the forecast period. The consumers in North America are increasingly trying to lead healthier lifestyles, hence, turning towards almond flour as an alternative to wheat flour, for obesity issues. More and more food service providers are producing and selling almond flour containing food products, that are increasingly preferred by the North American population.

Global Almond Flour Market Growth, by Region 2020-2026

Market Players Outlook

The report covers the portfolio of key almond flour market players including Anthony's Goods (Associated British Foods PLC), Austrade Inc., Blue Diamond Growers, Bob’s Red Mill Natural Foods, Inc., King Arthur Baking Company, Inc., Nature's Choice B.V., Nature's Eats, Inc., Treehouse California Almonds, LLC, Kirkland Signature (Costco Wholesale Corporation), and Rolling Hills Nut Company, among others. These key companies have implemented new product launch, continuous innovation, and acquisition as their key developmental strategies to cater to the rising demands for almond flour. There exists a huge opportunity among companies with new developments and innovations. Also, the regional players have been improving their marketing strategies and retail landscape to increase their market penetration.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global almond flour market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Anthony's Goods (Associated British Foods)

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Blue Diamond Growers

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Hodgson Mill

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Oleander Bio, SA

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. The King Arthur Baking Company

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Almond Flour Market by Form

5.1.1. Blanched Almond Flour

5.1.2. Unblanched Almond Flour

5.2. Global Almond Flour Market by Application

5.2.1. Food and Beverages

5.2.2. Cosmetics

5.2.3. Dietary Supplements

5.2.4. Others (Household)

5.3. Global Almond Flour Market by Distribution Channel

5.3.1. Direct Sales (Offline)

5.3.2. Indirect Sales (Online)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia Pacific

6.4. Rest of the World

7. Company Profiles

7.1. American Almond Products Company, Inc. (Barry Callebaut)

7.2. Anthony's Goods (Associated British Foods plc)

7.3. Alldrin Brothers.

7.4. Austrade Inc.

7.5. Barney Butter

7.6. Blue Diamond Growers

7.7. Bob's Red Mill Natural Foods, Inc.

7.8. Divine Organics (Transistion Nutrition)

7.9. Grain-Free JK Gourmet

7.10. Hodgson Mill

7.11. King Arthur Baking Company, Inc.

7.12. Kirkland Signature (Costco Wholesale Corporation)

7.13. Nature's Choice B.V.

7.14. Nature's Eats, Inc.

7.15. Oleander Bio, S.A.

7.16. Rolling Hills Nut Company

7.17. Sattvic Goa LLP

7.18. Shiloh Farms LLC

7.19. Simple Mills, Inc.

7.20. Treehouse California Almonds, LLC

7.21. Urban Platter

7.22. Weissmill

7.23. WellBees.com

7.24. Wellversed Health

7.25. Wonderland Foods

1. GLOBAL ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHERS (HOUSEHOLD) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

7. GLOBAL DIRECT SALES (OFFLINE)MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INDIRECT SALES (ONLINE) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

10. GLOBAL BLANCHED ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL UNBLANCHED ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

15. NORTH AMERICAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

16. EUROPEAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. EUROPEAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. EUROPEAN ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

24. REST OF THE WORLD ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

26. REST OF THE WORLD ALMOND FLOUR MARKET RESEARCH AND ANALYSIS BY FORM, 2019-2026 ($ MILLION)

1. GLOBAL ALMOND FLOUR MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL ALMOND FLOUR MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL ALMOND FLOUR MARKET SHARE BY FORM, 2019 VS 2026 (%)

4. GLOBAL ALMOND FLOUR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. THE US ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

7. UK ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD ALMOND FLOUR MARKET SIZE, 2019-2026 ($ MILLION)