Antioxidant Beverages Market

Global Antioxidant Beverages Market Size, Share & Trends Analysis Report, By Type (Red Wine, Green Tea, Antioxidant-Rich Fruits and Vegetable-Based Beverages, and Others), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global antioxidant beverages market is estimated to grow at a CAGR of nearly 9.0% during the forecast period. The major factors contributing to the growth of the market include health benefits associated with antioxidant beverages and significant youth population. Antioxidant drinks contain the fruits and vegetables that are rich in nutrients and available in a liquid form. It provides an appropriate amount of nutrients to the body and decreases the signs of aging, enabling skin rejuvenation. It offers energy that makes feel younger. In addition, they remove harmful substances from the body.

The rising preference for antioxidant beverages in the youth population is further supporting the demand for tea beverages. The young population, representing a major interest in antioxidant beverages owing to several health benefits. According to the World Youth Report (2018), there are 1.2 billion young people aged 15 to 24 years, accounting for 16% of the global population. The population of these age group are significantly suffering from obesity. As per the World Health Organization (WHO), in 2016, over 1.9 billion adults with the age of 18 years and older, were overweight. Of these more than 650 million were obese.

Obese individuals are more prone to develop chronic diseases than subjects with a healthy weight, and therefore an increase in dietary polyphenols could be of significant help in preventing such disease. The berry juices that are supposed to be rich in polyphenols include noni, acai, goji, and mangosteen. Other polyphenol-rich beverages include fruit and berry juices, such as pineapple, blueberry, and mango. The major advantages of antioxidant beverages in the prevention and management of several health conditions and increasing shift towards healthy lifestyle are primarily contributing to the growth of the market.

Market Segmentation

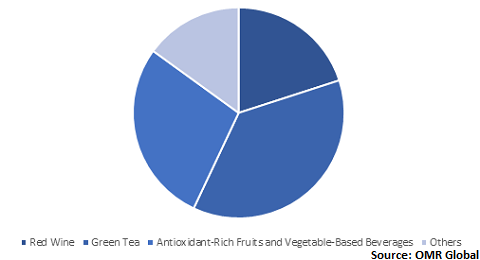

The global antioxidant beverages market is segmented based on type and distribution channel. Based on type, the market is classified into red wine, green tea, antioxidant-rich fruits and vegetable-based beverages, and others. Based on the distribution channel, the market is classified into specialty stores, supermarkets/hypermarkets, online retail stores, and others.

Green tea is anticipated to hold significant share in the type segment

Green tea is becoming highly popular antioxidant beverage that contains high polyphenol content. The consumption of green tea is rapidly emerging as it contains antioxidant properties and nutrients which has the potential impact to the body as it can reduce the occurrence of cancer and helps repair damaged cells in the body with avoiding any further damage to the cells. These comprise fat loss, improved brain function, reduced risk of cancer, and many other potential added advantages. The rising shift to a healthy lifestyle option has become an increasing contributing factor to the demand for green tea. As per the American Academy of Family Physicians (AAFP), the average American drinks nearly 155 cups of tea every year, along with this, the green tea extracts are regarded as a rapidly growing dietary supplement in the US. Apart from these, the consumption of green tea has also reported significant growth across the countries, including China, India, and UK.

Global Antioxidant Beverages Market Share by Type, 2019 (%)

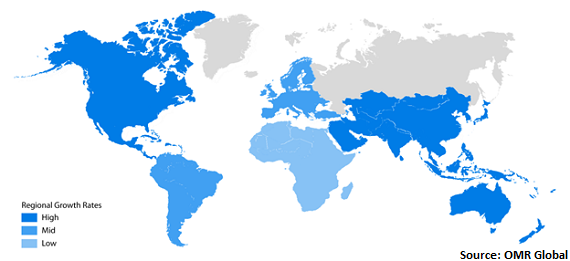

Regional Outlook

Geographically, the market is classified into North America, Europe, Asia-Pacific, and Rest of the World (RoW). Asia-Pacific is estimated to witness considerable growth in the market during the forecast period owing to the rising demand for antioxidant-rich beverages in the region. China is the center of origin for green tea production. It is significantly focusing on the production of green teas owing to its significant awareness regarding health benefits among the population in the country. As a result, companies are expanding the production of green tea in the country.

For instance, in May 2018, Lipton planned to sell black and green tea which is manufactured in Zunyi, Guizhou province, in China and later globally, which marks the first time the company has used purely Zunyi-produced tea. Lipton is a tea brand within Unilever, introduced the new product in Guiyang, the capital of Guizhou in May 2018 and the company planned to commence selling it in July 2018. This intends to fulfil the demand for green tea in the country and thereby contributing to the market growth in the region.

Global Antioxidant Beverages Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include Keurig Dr Pepper Inc., The Hain Celestial Group, Inc., Unilever Group, PepsiCo Inc., and Fresh Del Monte Produce Inc. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in January 2018, Dr Pepper Snapple Group, Inc. and Keurig Green Mountain, Inc. entered into a merger agreement for the development of Keurig Dr Pepper, a new beverage company that includes a portfolio of iconic consumer brands and unparalleled distribution capability which will support to access every point-of-sale in North America. The combination of both the companies joins together famous brands, such as Dr Pepper, A&W, Mott’s, 7UP, Sunkist, and Snapple, with the innovative Keurig single-serve coffee system and the major coffee brand Green Mountain Coffee Roasters, as well as over 75 licensed, owned, and partner brands in the Keurig system.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global antioxidant beverages market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Keurig Dr Pepper Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Hain Celestial Group, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Unilever Group

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. PepsiCo Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Fresh Del Monte Produce Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Antioxidant Beverages Market by Type

5.1.1. Red Wine

5.1.2. Green Tea

5.1.3. Antioxidant-Rich Fruits and Vegetable-based Beverages

5.1.4. Others

5.2. Global Antioxidant Beverages Market by Distribution Channel

5.2.1. Specialty Stores

5.2.2. Supermarkets/Hypermarkets

5.2.3. Online Retail Stores

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amorepacific Corp.

7.2. AriZona Beverages USA LLC

7.3. Basilur Tea India Pvt. Ltd.

7.4. Fresh Del Monte Produce Inc.

7.5. ITO EN (North America) Inc.

7.6. Keurig Dr Pepper Inc.

7.7. M/s. Golden Tips Tea Co. Pvt. Ltd.

7.8. Nature’s Touch Frozen Foods Inc.

7.9. Nestlé S.A.

7.10. PepsiCo Inc.

7.11. Pernod Ricard USA, Inc.

7.12. Tata Consumer Products Ltd.

7.13. The Coca-Cola Co.

7.14. The Hain Celestial Group, Inc.

7.15. The Kraft Heinz Co.

7.16. Tohi Ventures, LLC

7.17. Unilever Group

1. GLOBAL ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL RED WINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GREEN TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ANTIOXIDANT-RICH FRUITS AND VEGETABLE-BASED BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

7. GLOBAL ANTIOXIDANT BEVERAGES IN SPECIALTY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ANTIOXIDANT BEVERAGES IN SUPERMARKETS/HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ANTIOXIDANT BEVERAGES IN ONLINE RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ANTIOXIDANT BEVERAGES IN OTHER DISTRIBUTION CHANNELS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

15. EUROPEAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. REST OF THE WORLD ANTIOXIDANT BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL ANTIOXIDANT BEVERAGES MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL ANTIOXIDANT BEVERAGES MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL ANTIOXIDANT BEVERAGES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ANTIOXIDANT BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)