Architecture Design Software Market

Architecture Design Software Market Size, Share & Trends Analysis Report by Offering (Software and Services), by Deployment Model (On-Premises and Cloud-Based), by Pricing Model (One-Time Purchase and Subscription Model), and by End-User (Architects, Engineers, Construction Professionals, and Designers) Forecast Period (2025-2035)

Industry Overview

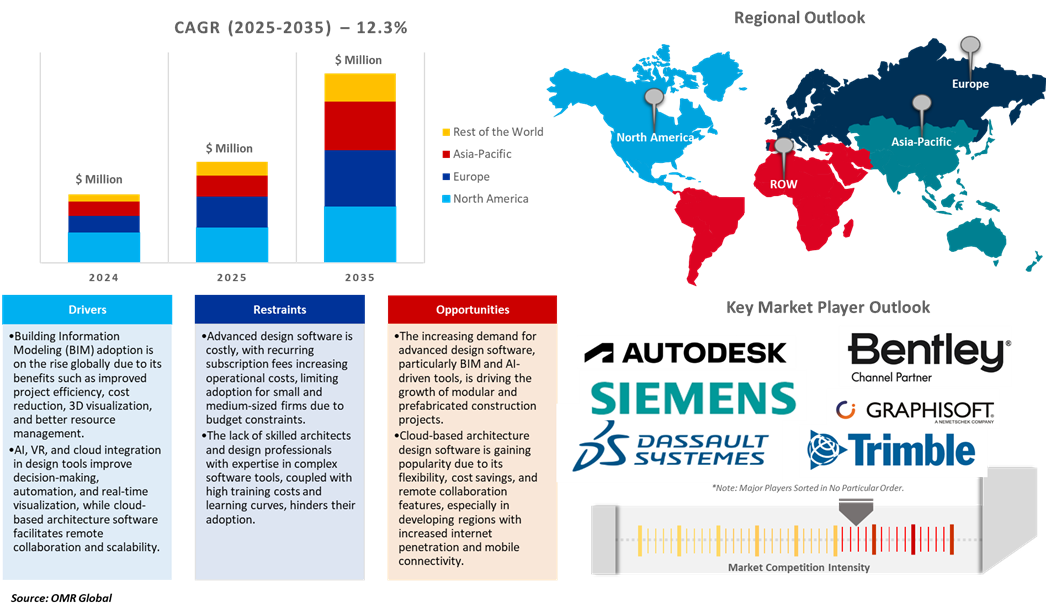

Architecture design software market was valued at $4.2 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2035, reaching an estimated $15.2 billion by 2035. Architecture design software market is expanding as a result of urbanization, smart infrastructure demand, and digitalization. The key drivers include increasing construction activities, BIM adoption, sustainable architecture, 3D/VR/AR technologies, remote collaboration, and government regulations for the use of BIM in public infrastructure.

Market Dynamics

Technological Advances in AR/VR

AR/VR technology advancements improve the capacity for visualization, and their application is required for client presentations and walk-throughs, stimulating market growth and affecting client presentations. In February 2025, Trimble added new visualization and interoperability features to SketchUp, enhancing the 3D modeling software. The software incorporates photorealistic materials and environment lighting features, improved interaction between SketchUp and other programs, and increased interoperability. These features allow designers to design, modify, and work on advanced projects more quickly with less labor and rework. The new visualization features include 360-degree HDRI or EXR image files, dynamic materials, and ambient occlusion.

Increasing Use of Building Information Modeling (BIM) Technology

BIM is an electronic procedure that regulates construction or infrastructure data from the inception stage to operational use. BIM uses a model-based 3D system and includes planning, designing, construction, and management functions that prove useful. BIM is a tool used by architectural design programs that provides a visual description of the building form, allowing one to effectively model a design simulation, enhance the construction management process, cost analysis, and structure calculation. Inherent tools such as Autodesk Revit and ArchiCAD enable real-time collaboration, early clash detection, and automation of parametric design. Excluding this, the changeover in the pattern of adoption from 2D to 3D modeling is fueling rising demand for BIM-based products, thus increasing market growth. For example, in October 2024, Siemens introduced BIMPOWER, a plug-in for Autodesk Revit that facilitates the design process for 3D BIM projects. BIMPOWER allows engineers and contractors to convert electrical system requirements into models and react to real-time design feedback. It also allows users to automatically create a bill of materials for all electrical equipment installed in the project, improve estimating productivity, accelerate submittal process times, and view budget pricing and lead times through Siemens' COMPAS quotation tool.

Market Segmentation

- Based on the offering, the market is segmented into software (building information modeling (BIM) software, computer-aided design (CAD) software, 3D modeling software, rendering software, virtual reality (VR) and augmented reality (AR) software, project management software, and others) and services (managed services, and professional services).

- Based on the deployment model, the market is segmented into on-premise and cloud-based.

- Based on the pricing model, the market is segmented into the one-time purchase and a subscription model.

- Based on the end-user, the market is segmented into architects, engineers, construction professionals, and designers.

Software Segment to Lead the Market with the Largest Share

The expansion in the software market, fueled by the implementation of AI and machine learning technologies, is accelerating expenditure throughout the construction and architecture sectors. For instance, in January 2025, Motif raised $46 million in seeds and Series A capital from Alphabet's CapitalG and Redpoint Ventures to transform the AEC software market is to be revolutionized through the adoption of Cloud, AI, and 3D technology for architects, engineers, and construction experts.

Architects: A Key Segment in Market Growth

Architectural designing software helps architects convert ideas into exact, detailed plans, improving efficiency and accuracy. It facilitates conceptual design, BIM, structural and performance analysis, rendering and visualization, project documentation, automated design, AI integration, and VR and AR. These applications allow architects to produce high-quality 3D renderings, visualize projects, facilitate collaboration, and maximize space utilization.

Regional Outlook

The global architecture design software market is divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Government and Regulatory Support for Green Buildings in Asia-Pacific

India's government and regulatory support for green buildings, including Leadership in Energy and Environmental Design (LEED) certifications, is driving market growth by integrating compliance modules in architecture design software providers. According to the Green Business Certification Inc., in 2024, India's growth in LEED-certified projects was apparent, and LEED for Operations and Maintenance (O+M) dominated with 153 projects. Then came LEED for Interior Design and Construction (ID+C) with 102 projects, followed by LEED for Building Design and Construction (BD+C) with 61 projects. Notable certifications in LEED v4.1 O+M were 57 locations of Dmart. The year additionally witnessed Grade A office space taking the lead among sector expansion with 455 projects covering 185 million square feet, followed by retail, industrial manufacturing, housing, and hotel sectors with 80, 71, 33, and 22 projects respectively, and covering considerable square footage.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the US market due to which US market experiencing growth as a result of the growing emphasis on energy-efficient building structures, improved material use, and environmental impact studies. For instance, in February 2024, Autodesk launched Autodesk Informed Design, a cloud-based product that integrates design and manufacturing workflows to simplify the building design and construction process. The product enables architects to collaborate on customizable, pre-defined building products, allowing manufacturers to share their products with design stakeholders. Informed Design is part of Autodesk's Design and Make Platform environment, which aims to transform the architecture, engineering, construction, and operations (AECO) industry by applying manufacturing principles to the built environment. It’s available as a free add-in for two of Autodesk's industry solutions: Autodesk Informed Design for Revit and Autodesk Informed Design for Inventor. The tools enable seamless collaboration, powerful building information modeling content creation, and streamlined product documentation.

Market Players Outlook

The major companies operating in the global architecture design software market include Autodesk Inc., Bentley Systems Inc., Dassault Systèmes S.E., Siemens AG, Graphisoft SE, and Trimble Inc., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2025, Trimble launched Tekla Structural Designer and Tekla Tedds, both structural analysis programs for multi-material buildings. New versions enhance design ability and user experience, reinforcement design, in addition to the modeling of wall edge release. Easy simultaneous co-design across Trimble SketchUp, Autodesk Revit, and Tekla Structures is made possible by tools, making structural engineers more efficient and accurate.

- In June 2024, Siemens introduced Innovator3D IC, a single design software for 3D IC design, verification, and manufacturing. The software provides an integrated cockpit to create a digital twin, enabling instant 'what-if' exploration and early detection of issues before detailed design is realized. It applies a hierarchical device planning strategy to manage intricate 2.5D/3D integrated designs with millions of pins. Innovator3D IC is part of Siemens' Xcelerator portfolio of industry software and is designed to integrate with third-party point solutions. It is compatible with industry standard formats and is a member of the Open Compute Project's Chiplet Design Exchange Working Group, allowing direct consumption of standardized chiplet models.

- In June 2024, Trimble launched its new asset lifecycle management software suite, Trimble Unity, that brings cloud-first capital project and infrastructure management together. The suite delivers connected digital workflows and centralized data to enable owners to efficiently plan, design, build, operate, and maintain assets through centralized data and connected digital workflows. Trimble Unity includes capabilities such as Trimble Unity Construct, Maintain, Permit, and Connect, that provide insights, streamline work activity, optimize resource allocation, and lower the total cost of asset ownership.

- In October 2024, Bentley Systems introduced OpenSite+, a generative AI-based civil design software, to enhance productivity and precision in civil engineering projects. The first application to leverage generative AI for site design, OpenSite+, eliminates repetitive tasks, enabling engineers to concentrate on intricate design elements. Based on Bentley's iTwin platform, it provides real-time collaboration and data-driven workflows.

- In November 2022, Bentley Systems launched iTwin Experience, iTwin Capture, and iTwin IoT to extend its iTwin Platform, allowing engineering companies and owner-operators to leverage digital twins in design, construction, and operations processes. These features will drive Bentley Infrastructure Cloud, a set of solutions for the entire infrastructure lifecycle.

- In December 2022, Bentley Systems supplemented its SYNCHRO construction management software with 4D/5D models, cost, and performance management to improve project planning, management, and execution. These solutions facilitate collaboration, control costs, monitor progress, and optimize profits in construction projects.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global architecture design software market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Architecture Design Software Market Sales Analysis – Offering| Deployment model| Pricing model| End-User ($ Million)

• Architecture Design Software Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Architecture Design Software Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Architecture Design Software Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Architecture Design Software Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Architecture Design Software Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Architecture Design Software Market Revenue and Share by Manufacturers

• Architecture Design Software Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Autodesk Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bentley Systems, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Dassault Systèmes S.E.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Siemens AG (Solid Edge and NX)

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Trimble Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Architecture Design Software Market Sales Analysis by Offering ($ Million)

5.1. Software

5.1.1. Building Information Modeling (BIM) Software

5.1.2. Computer-Aided Design (CAD) Software

5.1.3. 3D Modeling Software

5.1.4. Rendering software

5.1.5. Virtual Reality (VR) and Augmented Reality (AR) Software

5.1.6. Project Management Software

5.1.7. Others

5.2. Services

5.2.1. Managed Services

5.2.2. Professional Services

6. Global Architecture Design Software Market Sales Analysis by Deployment Model ($ Million)

6.1. On-Premises

6.2. Cloud-Based

7. Global Architecture Design Software Market Sales Analysis by Pricing Model ($ Million)

7.1. One-Time Purchase

7.2. Subscription Model

8. Global Architecture Design Software Market Sales Analysis by End-User ($ Million)

8.1. Architects

8.2. Engineers

8.3. Construction Professionals

8.4. Designers

9. Regional Analysis

9.1. North American Architecture Design Software Market Sales Analysis – Offering| Deployment Model| Pricing Model| End-User| Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Architecture Design Software Market Sales Analysis – Offering| Deployment Model| Pricing Model| End-User| Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Architecture Design Software Market Sales Analysis – Offering| Deployment Model| Pricing Model| End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Architecture Design Software Market Sales Analysis – Offering| Deployment Model| Pricing Model| End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Autodesk Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. AVEVA?Group Ltd.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Bentley Systems, Inc.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Bluebeam, Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Bricsys NV.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. CEDREO

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Chaos Software GmbH

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Chief Architect, Inc.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Dassault Systèmes

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Graphisoft SE

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Lumion

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Nemetschek Group

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Oracle Corp.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Planner 5D

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Procore Technologies, Inc.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Revizto SA

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Robert McNeel & Associates (Rhinoceros)

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Siemens NX

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Trimble Inc.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Vectorworks, Inc.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

1. Global Architecture Design Software Market Research And Analysis By Offering, 2024-2035 ($ Million)

2. Global Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Building Information Modeling (BIM) Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Architecture Computer-Aided Design (CAD) Software Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Architecture 3D Modeling Software Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Architecture Rendering Software Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Architecture Virtual Reality (VR) and Augmented Reality (AR) Software Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Architecture Project Management Software Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Architecture Other Software Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Architecture Design Software Services Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Architecture Design Software Managed Services Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Architecture Design Software Professional Services Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Architecture Design Software Market Research And Analysis By Deployment Model, 2024-2035 ($ Million)

14. Global On-premises Based Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Cloud-Based Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Architecture Design Software Market Research And Analysis By Pricing Model, 2024-2035 ($ Million)

17. Global One-time purchase Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Subscription-Based Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Architecture Design Software Market Research And Analysis By End-User, 2024-2035 ($ Million)

20. Global Architecture Design Software For Architects Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Architecture Design Software For Engineers Market Research And Analysis By Region, 2024-2035 ($ Million)

22. Global Architecture Design Software For Construction Professionals Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Global Architecture Design Software For Designers Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Global Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

25. North American Architecture Design Software Market Research And Analysis By Country, 2024-2035 ($ Million)

26. North American Architecture Design Software Market Research And Analysis By Offering, 2024-2035 ($ Million)

27. North American Architecture Design Software Market Research And Analysis By Deployment Model, 2024-2035 ($ Million)

28. North American Architecture Design Software Market Research And Analysis By Pricing Model, 2024-2035 ($ Million)

29. North American Architecture Design Software Market Research And Analysis By End-User, 2024-2035 ($ Million)

30. European Architecture Design Software Market Research And Analysis By Country, 2024-2035 ($ Million)

31. European Architecture Design Software Market Research And Analysis By Offering, 2024-2035 ($ Million)

32. European Architecture Design Software Market Research And Analysis By Deployment Model, 2024-2035 ($ Million)

33. European Architecture Design Software Market Research And Analysis By Pricing Model, 2024-2035 ($ Million)

34. European Architecture Design Software Market Research And Analysis By End-User, 2024-2035 ($ Million)

35. Asia-Pacific Architecture Design Software Market Research And Analysis By Country, 2024-2035 ($ Million)

36. Asia-Pacific Architecture Design Software Market Research And Analysis By Offering, 2024-2035 ($ Million)

37. Asia-Pacific Architecture Design Software Market Research And Analysis By Deployment Model, 2024-2035 ($ Million)

38. Asia-Pacific Architecture Design Software Market Research And Analysis By Pricing Model, 2024-2035 ($ Million)

39. Asia-Pacific Architecture Design Software Market Research And Analysis By End-User, 2024-2035 ($ Million)

40. Rest Of The World Architecture Design Software Market Research And Analysis By Region, 2024-2035 ($ Million)

41. Rest Of The World Architecture Design Software Market Research And Analysis By Offering, 2024-2035 ($ Million)

42. Rest Of The World Architecture Design Software Market Research And Analysis By Deployment Model, 2024-2035 ($ Million)

43. Rest Of The World Architecture Design Software Market Research And Analysis By Pricing Model, 2024-2035 ($ Million)

44. Rest Of The World Architecture Design Software Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Architecture Design Software Market Research And Analysis By Offering, 2024 Vs 2035 (%)

2. Global Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

3. Global Building Information Modeling (BIM) Software Market Share By Region, 2024 Vs 2035 (%)

4. Global Architecture Computer-Aided Design (CAD) Software Market Share By Region, 2024 Vs 2035 (%)

5. Global Architecture 3D Modeling Software Market Share By Region, 2024 Vs 2035 (%)

6. Global Architecture Rendering Software Market Share By Region, 2024 Vs 2035 (%)

7. Global Architecture Virtual Reality (VR) and Augmented Reality (AR) Software Market Share By Region, 2024 Vs 2035 (%)

8. Global Architecture Project Management Software Market Share By Region, 2024 Vs 2035 (%)

9. Global Architecture Others Software Market Share By Region, 2024 Vs 2035 (%)

10. Global Architecture Design Software Services Market Share By Region, 2024 Vs 2035 (%)

11. Global Architecture Design Managed Services Market Share By Region, 2024 Vs 2035 (%)

12. Global Architecture Design Professional Services Market Share By Region, 2024 Vs 2035 (%)

13. Global Architecture Design Software Market Research And Analysis By Deployment Model, 2024 vs 2035 (%)

14. Global On-premises Based Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

15. Global Cloud-Based Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

16. Global Architecture Design Software Market Research And Analysis By Pricing Model, 2024 Vs 2035 (%)

17. Global One-time purchase Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

18. Global Subscription-Based Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

19. Global Architecture Design Software Market Research And Analysis By End-User, 2024 Vs 2035 (%)

20. Global Architecture Design Software For Architects Market Share By Region, 2024 Vs 2035 (%)

21. Global Architecture Design Software For Engineers Market Share By Region, 2024 Vs 2035 (%)

22. Global Architecture Design Software For Construction Professionals Market Share By Region, 2024 Vs 2035 (%)

23. Global Architecture Design Software For Designers Market Share By Region, 2024 Vs 2035 (%)

24. Global Architecture Design Software Market Share By Region, 2024 Vs 2035 (%)

25. US Architecture Design Software Market Size, 2024-2035 ($ Million)

26. Canada Architecture Design Software Market Size, 2024-2035 ($ Million)

27. UK Architecture Design Software Market Size, 2024-2035 ($ Million)

28. France Architecture Design Software Market Size, 2024-2035 ($ Million)

29. Germany Architecture Design Software Market Size, 2024-2035 ($ Million)

30. Italy Architecture Design Software Market Size, 2024-2035 ($ Million)

31. Spain Architecture Design Software Market Size, 2024-2035 ($ Million)

32. Russia Architecture Design Software Market Size, 2024-2035 ($ Million)

33. Rest Of Europe Architecture Design Software Market Size, 2024-2035 ($ Million)

34. India Architecture Design Software Market Size, 2024-2035 ($ Million)

35. China Architecture Design Software Market Size, 2024-2035 ($ Million)

36. Japan Architecture Design Software Market Size, 2024-2035 ($ Million)

37. South Korea Architecture Design Software Market Size, 2024-2035 ($ Million)

38. ASEAN Architecture Design Software Market Size, 2024-2035 ($ Million)

39. Australia and New Zealand Architecture Design Software Market Size, 2024-2035 ($ Million)

40. Rest Of Asia-Pacific Architecture Design Software Market Size, 2024-2035 ($ Million)

41. Latin America Architecture Design Software Market Size, 2024-2035 ($ Million)

42. Middle East And Africa Architecture Design Software Market Size, 2024-2035 ($ Million)

FAQS

The size of the Architecture Design Software market in 2024 is estimated to be around $4.2 billion.

North American holds the largest share in the Architecture Design Software market.

Leading players in the Architecture Design Software market include Autodesk Inc., Bentley Systems Inc., Dassault Systèmes S.E., Siemens AG, Graphisoft SE, and Trimble Inc., among others.

Architecture Design Software market is expected to grow at a CAGR of 12.3% from 2025 to 2035.

The Architecture Design Software Market is growing due to rising demand for BIM integration, cloud-based solutions, sustainable design, and AI-powered design automation.