Catastrophe Insurance Market

Catastrophe Insurance Market Size, Share & Trends Analysis Report by Insurance Type (Catastrophic Health Insurance, Earthquake Insurance, Flood Insurance, Storm Insurance, Terrorism Insurance, Volcano Insurance, Wildfires Insurance, and Other Insurance), by Catastrophe Type (Man-made Events, and Natural Disasters), by End-User (Commercial, Personal, and Residential), and by Distribution Channel (Direct Insurance Providers, Brokers & Agents, Bancassurance (Bank-Assisted Insurance Sales), and Online Insurance Platforms) Forecast Period (2025-2035)

Industry Overview

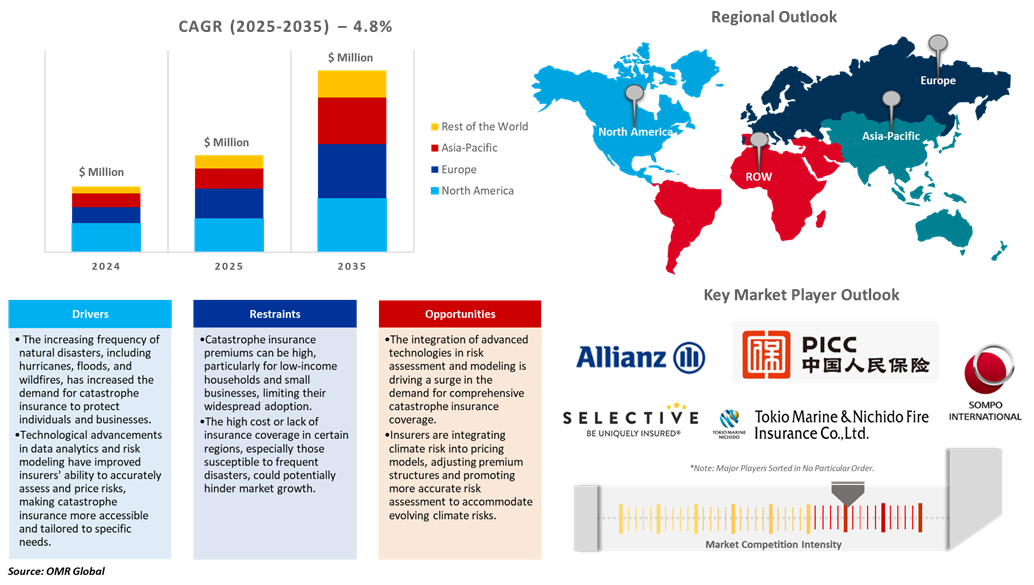

Catastrophe insurance market was valued at $215 billion and is projected to reach $360 billion by 2035, growing at a CAGR of 4.8% during the forecast period from 2025 to 2035. The catastrophe insurance demand is fueled by growing climate-related catastrophes, urbanization, infrastructure expansion, regulatory needs, AI and big data analytics, heightened reinsurance demand, increased awareness, and increasing economic losses as a result of the rising cost of disaster recovery.

Market Dynamics

Climate Change and Rising Frequency of Catastrophes

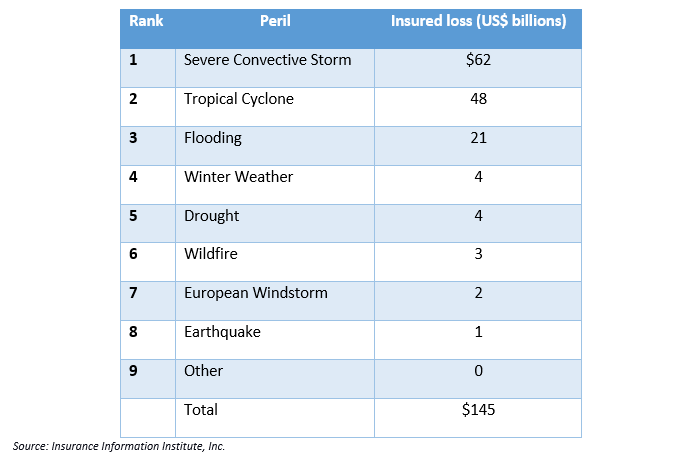

Climate change raises the frequency of natural disasters, generating greater demand for catastrophe insurance due to the intensity and uncertainty of these risks. The National Oceanic and Atmospheric Administration (NOAA) reports that, in 2024, natural disasters globally incurred total losses of $320 billion, with $140 billion covered, exceeding the inflation-adjusted averages of the last decade and 30 years. Weather-related catastrophes accounted for 93% of these total losses and 97% of insured losses, marking it as the third most expensive year for insured losses and the fifth for total losses since 1980. Non-peak perils such as floods, wildfires, and severe thunderstorms added substantially, with losses totalling $136 billion, of which $67 billion were insured, showing an increase from the decade's previous average. In contrast, tropical cyclones, with influence primarily in the US with large hurricanes, accounted for an additional $135 billion to the total losses and $52 billion to the insured losses. Although the economic cost, the number of deaths in 2024 was approximately 11,000, which was significantly lower than the historical mean.

World Natural Disaster Events Ranked by Insured Losses, 2024 (US$ billion)

Growing Natural Disaster Frequency and Severity

Climate change enhances extreme weather conditions that require increased insurance coverage and catastrophe policies for earthquake-risk areas such as Mexico, fueling market growth. For instance, in April 2024, the World Bank issued three catastrophe bonds worth $420 million to offer insurance to Mexico against named storms along its Atlantic coast and earthquake occurrences. The new cat bonds raise coverage by $60 million from the earlier ones. Approximately 40% of Mexico's area and around one-third of its population are vulnerable to natural disasters such as hurricanes, storms, floods, earthquakes, and volcanic activity, with 30% of the GDP at risk from three or more hazards and over 70% at risk from two or more hazards.

Market Segmentation

- Based on the insurance type, the market is segmented into catastrophic health insurance, earthquake insurance, flood insurance, storm insurance, terrorism insurance, volcano insurance, wildfire insurance, and other insurance.

- Based on the catastrophe type, the market is segmented into man-made events and natural disasters.

- Based on the end-user, the market is segmented into commercial, personal, and residential.

- Based on the distribution channel, the market is segmented into direct insurance providers, brokers & agents, bancassurance (bank-assisted insurance sales), and online insurance platforms.

Natural disasters Segment to Lead the Market with the Largest Share

Natural disasters, including earthquakes, hurricanes, floods, tsunamis, wildfires, and volcanic eruptions, are catastrophic events that result in extensive damage to life, property, and the environment. Climate change is leading to more intense natural disasters, increasing insurance coverage awareness, and propelling market growth as a result of possible financial losses. In October 2024, as reported by the Center for Disaster Philanthropy, the US saw 44 major floods, each worth over a billion dollars in damage, with a total average cost per year of $4.5 billion. The floods have claimed at least 738 lives reported in 2024 alone, mostly due to driving accidents. The economic cost of flooding in the US annually varies between $179.8 billion and $496 billion, emphasizing the need to invest in flood protection that can generate a high return by limiting future losses.

Storm Insurance: A Key Segment in Market Growth

Storm insurance ensures coverage of major storm-related damages to buildings, personal property, and uninhabitable properties against financial loss, repair, replacement, and living expenses. Storm insurance protects homeowners, businesses, farming producers, cars, marine and aviation sectors, and government projects from financial losses due to damage caused by storms. It secures business operations, guarantees crops, animals, vehicles, and cargoes, and protects large-scale development projects.

Regional Outlook

The global catastrophe insurance market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Government Investments and Modernization in Asia-Pacific

India's diverse climate and topography make it susceptible to frequent flooding, impacting livelihoods and driving market growth, especially for those without financial safety nets. For instance, in February 2024, India's WRMS Global collaborated with MIC Global to introduce a flood resilience insurance product for gig workers and merchants. The insurance, utilizing MIC Global's MiIncome digital reinsurance platform, seeks to reduce the financial effects of income loss due to floods. The Flood Resilience trigger addresses micro businesses, merchants, and gig workers in India, offering financial coverage against local flooding. The collaboration utilizes WRMS Global's experience to boost productivity, promote sustainable practices, and guarantee income reliability.

North America Region Dominates the Market with Major Share

North America holds a significant share because the hurricane model is a computer-based system that is utilized to forecast and simulate hurricane formation, intensity, path, and effect. It can be divided into physical models, statistical models, and hybrid models that are capable of utilizing atmospheric conditions, oceanic data, and past storm history. Hurricane simulations are applied in weather forecasting, disaster planning, climate change studies, energy applications, and crop impact studies, offering real-time forecasts, long-term trend identification, and protection planning. Additionally, natural disaster risks have increased insurance costs, rendering coverage more expensive, elevating uninsured property, and causing some insurers to leave markets. For instance, in August 2024, Aon unveiled an upgraded hurricane model designed to more effectively manage storm risk, as US hurricanes have caused $1.1 trillion in economic damage and $520 billion in insured losses since 2000. This new model, Impact Forecasting’s US Hurricane v3.0, includes real-time updates and enhancements such as an updated event set, refined hazard and vulnerability components, and a broader range of occupancy classes and modifiers to more accurately define exposure that is crucial for the reinsurance industry.

Market Players Outlook

The major companies operating in the global catastrophe insurance market include Allianz, People's Insurance Company of China Ltd., Selective Insurance Group, Inc., Sompo International Holdings Ltd., and Tokio Marine & Nichido Fire Insurance Co., Ltd., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In May 2025, State Farm helped California customers impacted by wildfires. As of May 12, State Farm has received approximately 12,700 total claims related to the fires and has paid over $3.5 billion to its customers.

- In November 2024, Insurity collaborated with ICEYE to bring real-time catastrophe information into its geospatial analytics platform. It supports P&C insurers to respond more quickly and effectively to catastrophes. ICEYE's SAR satellite constellation offers in-depth, real-time catastrophe information about any location worldwide, irrespective of weather or daylight hours. This integration helps insurers respond more efficiently, allocate better resources, and extend fast assistance to affected policyholders.

- In November 2024, Pacific Catastrophe Risk Insurance Company (PCRIC) reinsured its policies for governments and government-linked institutions in Pacific Island nations and territories with the assistance of WTW's Disaster Risk Finance and Alternative Risk Transfer teams. The reinsurance portfolio's renewal is designed to increase access to enhanced disaster risk insurance coverage for the region.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global catastrophe insurance market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Catastrophe Insurance Market Sales Analysis – Insurance Type| Catastrophe Type| End-User| Distribution Channel ($ Million)

• Catastrophe Insurance Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Catastrophe Insurance Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Catastrophe Insurance Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Catastrophe Insurance Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Catastrophe Insurance Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Catastrophe Insurance Market Revenue and Share by Manufacturers

• Catastrophe Insurance Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Allianz SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. People's Insurance Company of China Ltd.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Selective Insurance Group, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Sompo International Holdings Ltd.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Tokio Marine & Nichido Fire Insurance Co., Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Catastrophe Insurance Market Sales Analysis by Insurance Type ($ Million)

5.1. Catastrophic Health Insurance

5.2. Earthquake Insurance

5.3. Flood Insurance

5.4. Storm Insurance

5.5. Terrorism Insurance

5.6. Volcano Insurance

5.7. Wildfires Insurance

5.8. Other Insurance

6. Global Catastrophe Insurance Market Sales Analysis by Catastrophe Type ($ Million)

6.1. Man-made Events

6.2. Natural Disasters

7. Global Catastrophe Insurance Market Sales Analysis by End-User ($ Million)

7.1. Commercial

7.2. Personal

7.3. Residential

8. Global Catastrophe Insurance Market Sales Analysis by Distribution Channel ($ Million)

8.1. Direct Insurance Providers

8.2. Brokers & Agents

8.3. Bancassurance (Bank-Assisted Insurance Sales)

8.4. Online Insurance Platforms

9. Regional Analysis

9.1. North American Catastrophe Insurance Market Sales Analysis – Insurance Type| Catastrophe Type| End-User| Distribution Channel |Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Catastrophe Insurance Market Sales Analysis – Insurance Type| Catastrophe Type| End-User| Distribution Channel |Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Catastrophe Insurance Market Sales Analysis – Insurance Type| Catastrophe Type| End-User| Distribution Channel| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Catastrophe Insurance Market Sales Analysis – Insurance Type| Catastrophe Type| End-User| Distribution Channel| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Admiral Group plc

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Allianz SE

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Allstate Insurance Co.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. American International Group, Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Aon plc

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Assurant, Inc.

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Aviva PLC

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Berkshire Hathaway Specialty Insurance

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Brown & Brown, Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Chubb Group

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Cigna Health and Life Insurance Company (CHLIC)

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Factory Mutual Insurance Company

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Hannover Rück SE

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Hippo Enterprises Inc.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Kin Insurance Technology Hub, LLC.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. People's Insurance Company of China Ltd.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Pilot Catastrophe

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. PURE Insurance (Privilege Underwriters Inc)

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Progressive Casualty Insurance Co.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Prudential plc

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. RENFROE

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Selective Insurance Group, Inc.

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Sompo International Holdings Ltd.

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. Swiss Re

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

10.25. Tokio Marine & Nichido Fire Insurance Co., Ltd.

10.25.1. Quick Facts

10.25.2. Company Overview

10.25.3. Product Portfolio

10.25.4. Business Strategies

10.26. Zurich American Insurance Co.

10.26.1. Quick Facts

10.26.2. Company Overview

10.26.3. Product Portfolio

10.26.4. Business Strategies

1. Global Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024-2035 ($ Million)

2. Global Catastrophe Health Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Earthquake Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Flood Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Storm Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Terrorism Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Volcano Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Wildfires Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Other Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024-2035 ($ Million)

11. Global Man-Made Events Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Natural Disasters Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Catastrophe Insurance Market Research And Analysis By End-User, 2024-2035 ($ Million)

14. Global Commercial Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Personal Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Residential Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

18. Global Catastrophe Insurance Via Direct Insurance Providers Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Catastrophe Insurance Via Brokers & Agents Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global Catastrophe Insurance Via Bancassurance (Bank-Assisted Insurance Sales) Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global Catastrophe Insurance Via Online Insurance Platforms Market Research And Analysis By Region, 2024-2035 ($ Million)

22. Global Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

23. North American Catastrophe Insurance Market Research And Analysis By Country, 2024-2035 ($ Million)

24. North American Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024-2035 ($ Million)

25. North American Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024-2035 ($ Million)

26. North American Catastrophe Insurance Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. North American Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

28. European Catastrophe Insurance Market Research And Analysis By Country, 2024-2035 ($ Million)

29. European Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024-2035 ($ Million)

30. European Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024-2035 ($ Million)

31. European Catastrophe Insurance Market Research And Analysis By End-User, 2024-2035 ($ Million)

32. European Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

33. Asia-Pacific Catastrophe Insurance Market Research And Analysis By Country, 2024-2035 ($ Million)

34. Asia-Pacific Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024-2035 ($ Million)

35. Asia-Pacific Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024-2035 ($ Million)

36. Asia-Pacific Catastrophe Insurance Market Research And Analysis By End-User, 2024-2035 ($ Million)

37. Asia-Pacific Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

38. Rest Of The World Catastrophe Insurance Market Research And Analysis By Region, 2024-2035 ($ Million)

39. Rest Of The World Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024-2035 ($ Million)

40. Rest Of The World Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024-2035 ($ Million)

41. Rest Of The World Catastrophe Insurance Market Research And Analysis By End-User, 2024-2035 ($ Million)

42. Rest Of The World Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

1. Global Catastrophe Insurance Market Research And Analysis By Insurance Type, 2024 Vs 2035 (%)

2. Global Catastrophe Health Insurance Market Share By Region, 2024 Vs 2035 (%)

3. Global Earthquake Insurance Market Share By Region, 2024 Vs 2035 (%)

4. Global Flood Insurance Market Share By Region, 2024 Vs 2035 (%)

5. Global Storm Insurance Market Share By Region, 2024 Vs 2035 (%)

6. Global Terrorism Insurance Market Share By Region, 2024 Vs 2035 (%)

7. Global Volcano Insurance Market Share By Region, 2024 Vs 2035 (%)

8. Global Wildfires Insurance Market Share By Region, 2024 Vs 2035 (%)

9. Global Other Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

10. Global Catastrophe Insurance Market Research And Analysis By Catastrophe Type, 2024 Vs 2035 (%)

11. Global Man-Made Events Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

12. Global Natural Disasters Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

13. Global Catastrophe Insurance Market Research And Analysis By End-User, 2024 Vs 2035 (%)

14. Global Commercial Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

15. Global Personal Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

16. Global Residential Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

17. Global Catastrophe Insurance Market Research And Analysis By Distribution Channel, 2024 Vs 2035 (%)

18. Global Catastrophe Insurance Via Direct Insurance Providers Market Share By Region, 2024 Vs 2035 (%)

19. Global Catastrophe Insurance Via Brokers & Agents Market Share By Region, 2024 Vs 2035 (%)

20. Global Catastrophe Insurance Via Bancassurance (Bank-Assisted Insurance Sales) Market Share By Region, 2024 Vs 2035 (%)

21. Global Catastrophe Insurance Via Online Insurance Platforms Market Share By Region, 2024 Vs 2035 (%)

22. Global Catastrophe Insurance Market Share By Region, 2024 Vs 2035 (%)

23. US Catastrophe Insurance Market Size, 2024-2035 ($ Million)

24. Canada Catastrophe Insurance Market Size, 2024-2035 ($ Million)

25. UK Catastrophe Insurance Market Size, 2024-2035 ($ Million)

26. France Catastrophe Insurance Market Size, 2024-2035 ($ Million)

27. Germany Catastrophe Insurance Market Size, 2024-2035 ($ Million)

28. Italy Catastrophe Insurance Market Size, 2024-2035 ($ Million)

29. Spain Catastrophe Insurance Market Size, 2024-2035 ($ Million)

30. Russia Catastrophe Insurance Market Size, 2024-2035 ($ Million)

31. Rest Of Europe Catastrophe Insurance Market Size, 2024-2035 ($ Million)

32. India Catastrophe Insurance Market Size, 2024-2035 ($ Million)

33. China Catastrophe Insurance Market Size, 2024-2035 ($ Million)

34. Japan Catastrophe Insurance Market Size, 2024-2035 ($ Million)

35. South Korea Catastrophe Insurance Market Size, 2024-2035 ($ Million)

36. ASEAN Catastrophe Insurance Market Size, 2024-2035 ($ Million)

37. Australia and New Zealand Catastrophe Insurance Market Size, 2024-2035 ($ Million)

38. Rest Of Asia-Pacific Catastrophe Insurance Market Size, 2024-2035 ($ Million)

39. Latin America Catastrophe Insurance Market Size, 2024-2035 ($ Million)

40. Middle East And Africa Catastrophe Insurance Market Size, 2024-2035 ($ Million)

FAQS

The size of the Catastrophe Insurance market in 2024 is estimated to be around $215 billion.

North American holds the largest share in the Catastrophe Insurance market.

Leading players in the Catastrophe Insurance market include Allianz, People's Insurance Company of China Ltd., Selective Insurance Group, Inc., Sompo International Holdings Ltd., and Tokio Marine & Nichido Fire Insurance Co., Ltd., among others.

Catastrophe Insurance market is expected to grow at a CAGR of 4.8% from 2025 to 2035.

The Catastrophe Insurance Market is growing due to the rising frequency of natural disasters, increasing asset vulnerability, and advancements in risk modeling technologies.