Automated Poultry Market

Global Automated Poultry Market Size, Share & Trends Analysis Report by Equipment (Cage System, Floor Management System, Environment Control System, Egg Handling and Processing System, Feeding System, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global automated poultry market is growing at a significant CAGR of around 7.1% during the forecast period (2020-2026). Automated poultry increases the productivity and controls the automation of the whole production process. Automated poultry systems are generally used in the big farms having production capacity of more than 4,000 birds. It is gradually becoming a need of the hour due to the constant decrease in the availability of labor along with the increase in labor cost. There are several pivotal factors that are driving the global automated poultry market, which includes rise in the consumption and production of meat across the globe. The global meat consumption has been tripled in the last four decades and increased 20% in just the last 10 years according to the World Watch Institute. The leading countries in the meat consumption are the US, China, Brazil, European countries. However, the labor has decreased in these economies in the recent past, owing to the urbanization and lack of interest towards poultry farming, which in turn, rising the need and trend for automated poultry farming.

Though, the outbreak of COVID-19 has certainly impacted the global automated poultry market, as the consumption of meat and dairy products has decreased during the outbreak. As per the Government of India, the demand for milk in India reduced by 20-25% during the lockdown. In addition, the sale of plant-based meat substitutes in the US has risen during the meantime. These factors will certainly impact the global automated poultry market growth in 2020. Though, the consumption of meat and dairy products are expected to get on track post 2020. These factors will offer a nominal growth to the automated poultry market across the globe. The US, China, Brazil, India, and Russia are the major consumers of the meat.

Segmental Outlook

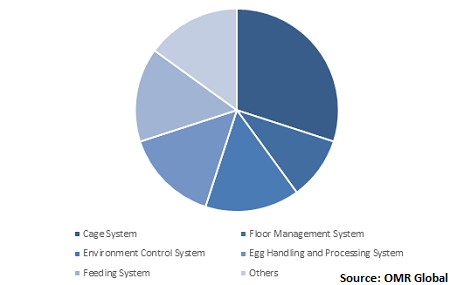

The automated poultry market is analyzed on the basis of revenue captured by all types of equipment available in the market. cage system, floor management system, environment control system, egg handling and processing system, feeding system, and others. Among this equipment, the cage systems are regarded as the significant share contributor in the automated poultry market. There are number of cage systems available in the market, such as layer cage, broiler cage, and breeding cage.

Global Automated Poultry Market Share by Equipment, 2019 (%)

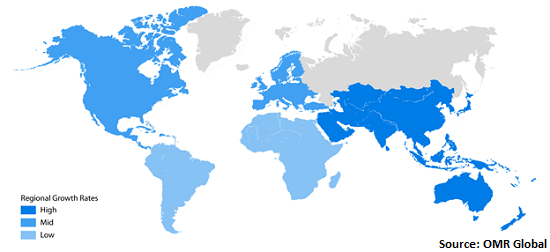

Regional Outlook

The global automated poultry market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America is expected to project a considerable growth in the global automated poultry market during the forecast period. The major economies of North America that contributes majorly in the automated poultry market is the US, followed by Canada. The major factors that contributes to the market growth includes the high consumption of meat and the adoption of advanced technologies, especially automation in the industrial sector. The US has relatively high production of meat, compared to Canada. As per Our World in Data, in 2018, around 46.8 million tons of meat was produced in the US, estimating to the last largest producer of meat across the globe. Along with the US, the growth of automated poultry market in Canada can be considered due to the rise in consumption of chicken and other animals. Although the production of chickens in Canada has witnessed a marginal increase, as around 4.9 million tons of meat was produced in 2018.

Global Automated Poultry Market Growth, by Region 2020-2026

Asia-Pacific contributes significantly in the global automated poultry market

Asia-Pacific holds a significant share, in terms of revenue, in the global automated poultry market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. China contributes significantly in Asia-Pacific automated poultry market. The potential growth offering factors for the market includes the increasing animal husbandry practices with an improvement in the management of farms. The large breeding companies in the region are increasingly inclining towards the adoption automated systems, in order to increase their production base. In addition, India is the third largest producer of egg and fourth largest producer of chicken across the globe. Poultry is one of the most organized sectors in animal husbandry in India. The country has a rich source of high-quality poultry products such as meat, eggs, and milk. This, in turn, offers a growth potential for the companies operating in the automated poultry market to expand their base in these emerging economies of Asia-Pacific.

Market Players Outlook

The key players in the automated poultry market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global automated poultry market include LiVi Machinery, TEXHA PA LLC, CTB Inc., Dynamic Poultry Ltd., and OFFICINE FACCO & C. SPA. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automated poultry market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. LiVi Machinery

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. TEXHA PA LLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. CTB Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Dynamic Poultry Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. OFFICINE FACCO & C. SPA

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automated Poultry Market by Equipment

5.1.1. Cage System

5.1.2. Floor Management System

5.1.3. Environment Control System

5.1.4. Egg Handling and Processing System

5.1.5. Feeding System

5.1.6. Others (Manure Handling System)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Big Dutchman AG

7.2. CTB Inc.

7.3. Dynamic Poultry Ltd.

7.4. Fancom BV

7.5. GARTECH EQUIPMENTS PVT. LTD.

7.6. Hebei Best Machinery And Equipment Co., Ltd.

7.7. Hotraco Group B.V.

7.8. Impex Barneveld BV

7.9. Jansen Poultry Equipment

7.10. Kutlusan Poultry Equipment Co. Inc.

7.11. LiVi Machinery

7.12. Marel hf.

7.13. OFFICINE FACCO & C. SPA

7.14. POLTEK

7.15. Reliance Poultry Equipment

7.16. SKA s.r.l.

7.17. TEXHA PA LLC

7.18. ZUCAMI POULTRY EQUIPMENT, SLU

1. GLOBAL AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

2. GLOBAL CAGE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL FLOOR MANAGEMENT SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ENVIRONMENT CONTROL SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL EGG HANDLING AND PROCESSING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL FEEDING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER AUTOMATED EUQIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

11. EUROPEAN AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

13. ASIA-PACIFIC AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

15. REST OF THE WORLD AUTOMATED POULTRY MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

1. GLOBAL AUTOMATED POULTRY MARKET SHARE BY EQUIPMENT, 2019 VS 2026 (%)

2. GLOBAL AUTOMATED POULTRY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

5. UK AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD AUTOMATED POULTRY MARKET SIZE, 2019-2026 ($ MILLION)