Automotive Driving Simulators Market

Automotive Driving Simulators Market Size, Share & Trends Analysis Report by Product (Compact Driving Simulators, Full-Scale Driving Simulators, and Advanced Driving Simulators)and byApplication(Training Institutions, Research & Testing, Entertainment, and Others) Forecast Period (2024-2031)

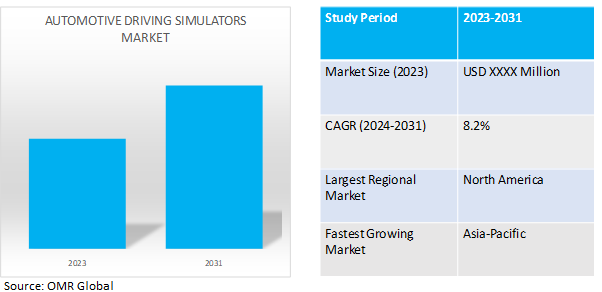

Automotive driving simulators market is anticipated to grow at a significant CAGR of 8.2% during the forecast period (2024-2031). Automotive driving simulators use advanced technology for training, research, and entertainment. They offer controlled environments for driver skill development, vehicle testing, and behavioral analysis, enhancing safety and innovation in the automotive industry. The growing need for road safety of passengers is a key factor driving the global market growth.

Market Dynamics

Stringent Safety Regulations: Fueling Simulator Adoption in Driver Training

Stringent regulations emphasizing driver safety propel the Automotive Driving Simulator market forward. These regulations mandate simulator use, particularly for operators of large vehicles, due to heightened risks associated with their operation. Simulators offer a controlled and safe environment for critical manoeuvre practice, hazard response, and decision-making skill development.For instance, in November 2023, motor training schools must install simulators per the Bengal (India) government mandate to maintain operations. Inspectors will evaluate schools, and licensing depends on simulator presence and facility conditions. Simulators, replicating real car controls, aid learner drivers. Compliance with Union ministry guidelines, mandating simulators in all driving schools, is enforced. Inspections also assess infrastructure, vehicles, and trainer qualifications to ensure compliance and quality training. They ensure standardized training and measurable outcomes, meeting regulatory requirements and fostering market expansion. Additionally, simulators enhance cost-effectiveness and reduce training-related liabilities, making them an indispensable tool for modern driver training programs.

VR Revolutionizes Driver Training: Redefining Realism and Broadening Horizons

Virtual reality (VR) innovations are reshaping the landscape of Automotive Driving Simulators, providing an unparalleled level of immersion and realism. Through high-resolution visuals and dynamic scenarios, trainees are exposed to lifelike driving conditions, resulting in enhanced retention of critical skills. Furthermore, the integration of gamification elements such as challenges and leaderboards enhance engagement, particularly among younger learners. For instance,in March 2024, Illinois State University and State Farm collaborate on a VR simulator project, "Teen Driver Safety," aiming to enhance young drivers' skills. The immersive simulator simulates real-world driving scenarios, facilitating post-session debriefings to assess performance. State Farm sees potential in reducing accidents and claims. This collaborative effort showcases the importance of partnerships in leveraging simulator technology to improve road safety for young drivers. These advancements not only widen the market reach but also render simulator-based training more accessible and effective.

Market Segmentation

Our in-depth analysis of the global automotive driving simulators market includes the following segments byand by application:

- Based on product, the market is sub-segmented into compact driving simulators, full-scale driving simulators, and advanced driving simulators.

- Based on application, the market is sub-segmented into training institutions, research & testing, entertainment, and others.

Driving Simulator Advancements: Catalysts for Accelerated Growth

The accelerated growth of advanced driving simulators is underpinned by several key factors. Firstly, technological advancements, including refined motion systems, high-fidelity graphics, and true-to-life physics engines, markedly elevate the simulation experience, appealing to automotive manufacturers and research institutions alike. Secondly, the escalating need for training in intricate driving scenarios, such as autonomous vehicle trials and emergency response drills, fuels the uptake of advanced simulators. For instance, in October 2023, Malmö University secured 4.8 million SEK to enhance police emergency driver training with driving simulators. Led by Martin Larsson, the program pioneer’s simulator training in the Nordic region, aims to optimize pedagogy and resources. The initiative integrates simulator-based teaching to address traffic accidents as a leading cause of officer fatalities. The funds support simulator acquisition, software development, and research advancement. Additionally, regulatory imperatives mandating safer and more effective driving methodologies contribute significantly to the burgeoning market for advanced driving simulators, including those utilized for research and development purposes.

Training Institutions Hold a Considerable Market Share

The training institutions segment is witnessing rapid growth due to several factors. The heightened awareness of the significance of thorough driver training programs, particularly in safety-critical industries like transportation and logistics.For instance, in May 2023, Daimler India Commercial Vehicles (DICV) introduced India's first truck driver training simulator for BharatBenz, enhancing heavy truck drivers' skills. The simulator offers a multi-sensory experience, replicating diverse road conditions and obstacles. CEO Satyakam Arya highlights its role in improving drivers' logistical efficiency and safety levels. The program, available in multiple languages, plans nationwide expansion, offering personalized training for different driving scenarios. Advanced driving simulators offer a controlled setting for trainees to practice diverse scenarios, enhancing skills and mitigating on-road risks. Furthermore, technological advancements in simulation, like realistic graphics and immersive environments, increase simulator effectiveness. Consequently, organizations increasingly embrace simulators for enhancing driver safety, reducing training expenses, and improving overall training efficacy, fueling the growth of this segment in training institutions.

Regional Outlook

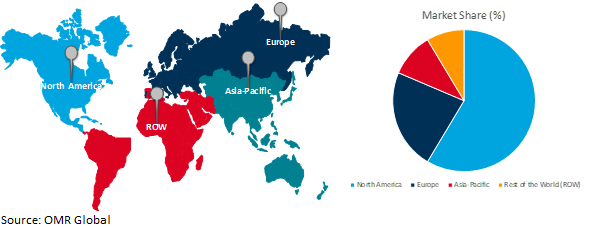

The global automotive driving simulators market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America: A Leader in the Automotive Driving Simulators Market

North America leads the Automotive Driving Simulators market due to several factors. Firstly, it boasts a robust automotive industry with significant investments in research and development. Secondly, the presence of major players like Ford, General Motors, and Tesla drives innovation and adoption of driving simulators for vehicle development. Additionally, the region's high disposable income and tech-savvy population contribute to the market's growth.For instance, according to the White House the robust growth in real GDP, rising at a 4.9%annual rate, reflects a thriving economy. This expansion is mirrored in American households, where disposable income increased by 3.8%. Furthermore, the entertainment aspect of simulators, catering to both professional training and recreational gaming, adds to their popularity in North America. This dual-purpose usage amplifies demand, making it the largest market for automotive driving simulators.

Global Automotive Driving Simulators Market Growth by Region 2024-2031

Asia-Pacific: The Fast Lane for Automotive Driving Simulator Growth

Asia-Pacific is rapidly becoming the leader in Automotive Driving Simulator growth. This surge is fueled by a booming car manufacturing industry creating a vast pool of drivers needing training.For instance in India, in the fiscal year 2022-23, total passenger vehicle sales rose from 3,069,523 to 3,890,114 units. Sales of passenger cars increased from 1,467,039 to 1,747,376 units, while utility vehicles surged from 1,489,219 to 2,003,718 units, and vans from 113,265 to 139,020 units, compared to the preceding year. Governments in the region are also pushing for electric and autonomous vehicles, and simulators provide a safe space to test these technologies. With a relatively new market compared to North America and Europe, there's immense potential for simulator adoption as regulations and training programs evolve. This confluence of factors positions Asia Pacific as the driving force behind the future of Automotive Driving Simulators.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Automotive Driving Simulatorsmarket includeECA- Group, Formula One Group, and Moog, Inc.among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, Formula 1 announces a new partnership with Playseat, a leading racing simulator brand, to develop exclusive F1 licensed gaming products. With over two decades of experience, Playseat will create premium equipment, replicating the authentic Formula 1 cockpit experience. This collaboration aims to engage a diverse audience by bringing the excitement of F1 racing into homes worldwide, bridging the gap between virtual and real-world motorsport.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive driving simulators market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ECA- Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Formula One Group

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Moog, Inc

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Driving Simulators by Product

4.1.1. Compact Driving Simulators

4.1.2. Full-Scale Driving Simulators

4.1.3. Advanced Driving Simulators

4.2. Global Automotive Driving Simulators by Application

4.2.1. Training Institutions

4.2.2. Research & Testing

4.2.3. Entertainment

4.2.4. Others (Driver Rehabilitation, Military Training, and Product Development)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. ADH Labs Private Limited.

6.2. Ansible Motion Limited

6.3. AutoSim AS

6.4. Cool Performance

6.5. Cruden B.V

6.6. Dallara

6.7. Hindustan Simulators

6.8. IPG Automotive GmbH

6.9. Isometiq Solutions Pvt. Ltd.

6.10. Mechanical Simulation Corporation

6.11. OKTAL SYDAC

6.12. Sunovatech

6.13. Teknotrove

6.14. TekSim Technologies

6.15. Teleios

6.16. Vertex Research Centre Pvt Ltd

6.17. Vesaro

1. GLOBAL AUTOMOTIVE DRIVING SIMULATORSMARKET RESEARCH AND ANALYSIS BYPRODUCT BY REGION, 2023-2031 ($ MILLION)

2. GLOBALCOMPACT DRIVING SIMULATORS MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FULL-SCALE DRIVING SIMULATORS MARKETRESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ADVANCED DRIVING SIMULATORSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AUTOMOTIVE DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY APPLICATION BY REGION, 2023-2031 ($ MILLION)

6. GLOBALTRAINING AUTOMOTIVE DRIVING SIMULATORS FOR INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR RESEARCH & TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBALAUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BYPRODUCT 2023-2031 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. EUROPEAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BYPRODUCT2023-2031 ($ MILLION)

16. EUROPEAN AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA- PACIFIC AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. ASIA- PACIFIC AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. REST OF THE WORLD AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL COMPACT DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL FULL-SCALE DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL ADVANCED DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL AUTOMOTIVE DRIVING SIMULATORS RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR TRAINING INSTITUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR RESEARCH & TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE DRIVING SIMULATORS FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL AUTOMOTIVE DRIVING SIMULATORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. US AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

13. UK AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)

25. THE MIDDLE EAST & AFRICA AUTOMOTIVE DRIVING SIMULATORS MARKET SIZE, 2023-2031 ($ MILLION)