Automotive Metal Stamping Market

Automotive Metal Stamping Market Size, Share & Trends Analysis Report by Process (Blanking, Embossing, Coining, Flanging, Bending, and Others), and by End-User (Automobile Manufacturers, Commercial Vehicle Manufacturers, Recreational and Sports Vehicle Manufacturers, Agricultural and Construction Equipment Manufacturers, Electric Vehicle (EV) Manufacturers, and Others), Forecast Period (2023-2030)

Automotive metal stamping market is anticipated to grow at a CAGR of 4.9% during the forecast period (2023-2030). The market’s growth is attributed to material development across the globe. Lightweight materials and new material applications have been developed through research and development. These include the production of functional materials such as mild steel materials, vibration damping steel sheets, clad metals, and composite materials made of high-strength steel, aluminum, magnesium, and other materials. According to the MDPI, in January 2022, lightweight metal materials in 2019 was estimated to be 35.7 billion USD. Automakers across the globe are facing the challenge of reducing the body weight of vehicles by 35% relative to those in 2006, to comply with U.S. Corporate Average Fuel Economy (CAFE) regulations by 2025. To address this requirement, research and development of lightweight technologies for material application, functional materials such as mild steel materials, vibration damping steel sheets, and clad metals, as well as composite materials consisting of high-strength steel, aluminum (Al), magnesium (Mg) and other materials, are being conducted.

Furthermore, the use of lightweight materials in automobiles is essential for reducing the overall weight of the vehicle and improving fuel economy. Approximately 64% of materials used in conventional automobiles are steels, 9% are polymer and composite materials, and 8% are aluminums. Ultra-high-strength steel, Al, and carbon-fiber composites are lighter than mild steel by 20%, 40%, and 50% respectively, but Al and carbon-fiber-reinforced plastics (CFRP) are more expensive than general steel plates. Currently, various materials are being used in the industry to reduce the weights of transportation equipment, such as Al and CFRP.

Segmental Outlook

The global automotive metal stamping market is segmented on the process, and end-user . Based on the process, the market is sub-segmented into blanking, embossing, coining, flanging, bending, and others. Furthermore, based on the application, the market is sub-segmented automobile manufacturers, commercial vehicle manufacturers, recreational and sports vehicle manufacturers, agricultural and construction equipment manufacturers, EV manufacturers, and others. Among the process, the blanking sub-segment is expected to capture a significant portion of the market share. This is attributed to the increasing use of blanking in the vehicle industry owing to its ability to accommodate mass production lines.

Commercial Vehicle Manufacturers Sub-Segment is Anticipated to Hold a Considerable Share of the Global Automotive Metal Stamping Market

Among the end-user, the commercial vehicle manufacturers sub-segment is expected to hold a considerable share of the global automotive metal stamping market. The segmental growth is attributed to the growing commercial vehicle industry. The commercial vehicle manufacturing business is expanding globally owing to factors such as e-commerce, urbanization, and logistics. Rise in demand for light trucks and commercial vehicles, directly propels the demand for dependable and high-quality components. For instance, in September 2019, FAIST’s Commercial Vehicles Components launched a new line of structural sub-components for light trucks. Developing and manufacturing commercial vehicle components, in addition to high-quality proprietary or licensed assemblies for the automotive market.

Regional Outlook

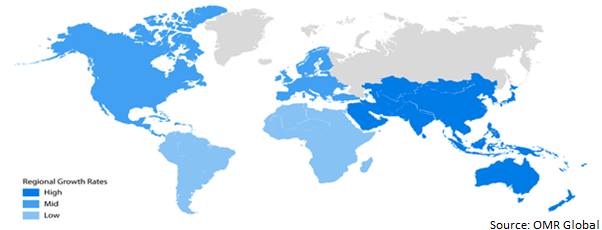

The global automotive metal stamping market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific region is anticipated to hold a prominent share of the market globally, owing to the increasing industrialization, infrastructure development, and growing defense industrial capabilities. Such factors are predicted to boost the demand for machinery and equipment in the region.

Global Automotive Metal Stamping Market Growth by Region 2023-2030

North America is Expected to Grow at a Significant CAGR in the Global Automotive Metal Stamping Market

Among all regions, the North America is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the increased demand for steel and aluminum across the region. There is a strong demand for steel and aluminum, with steel production reaching 1.4 billion tons annually and aluminum production exceeding 45 million tons per year. Metal forming plays an important role in the production of these products, as most of them are formed. The demand is driven by a variety of applications, from automotive components to structural materials. According to the National Institute of Health (NIH), in September 2022, the metal forming industry is one sector that essentially impacted by emerging technologies. This craft is used to produce approximately 90.0% of products made from metals, with over 160,000 engineering materials. Over the last two decades, computer-aided finite element (FE) simulations have been implemented into the metal forming sector to optimize the process and reduce the cost of prototyping. The utilization of FE models in various manufacturing sectors has the potential to increase the efficiency of the manufacturing system, including the metal forming industry. Steel and aluminum have seen demand rise to over 1.4 billion and 45 million tons per annum respectively, with approximately 90.0% and 67.0% of steel and aluminum products manufactured by at least one metal forming process.

Market Players Outlook

The major companies serving the global automotive metal stamping market include Batesville Tool & Die, Inc., Clow Stamping Co., D&H Industries, DBA Shiloh Industries LLC, Goshen Stamping Co. Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2021, Amsted Automotive Group’s Burgess-Norton Mfg. Co., Inc. acquired SMW Manufacturing Company, with an aim of expanding its footprint as a leading supplier of engineered and net formed products for vehicular, energy, and Infrastructure markets.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive metal stamping market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies. Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AISIN CORP.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Alcoa Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. American Industrial Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Metal Stamping Market by Process

4.1.1. Blanking

4.1.2. Embossing

4.1.3. Coining

4.1.4. Flanging

4.1.5. Bending

4.1.6. Others (Roll Forming, and Spot Welding)

4.2. Global Automotive Metal Stamping Market by End-User

4.2.1. Automobile Manufacturers

4.2.2. Commercial Vehicle Manufacturers

4.2.3. Recreational and Sports Vehicle Manufacturers

4.2.4. Agricultural and Construction Equipment Manufacturers

4.2.5. Electric Vehicle (EV) Manufacturers

4.2.6. Others (Government and Defense Agencies, and Specialty Vehicle Manufacturers)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Batesville Tool & Die, Inc.

6.2. Clow Stamping Co.

6.3. D&H Industries

6.4. DBA Shiloh Industries LLC

6.5. Goshen Stamping Co. Inc.

6.6. Interplex Holdings Pte. Ltd.

6.7. LINDY International Ltd.

6.8. Magna International Inc.

6.9. Manor Tool & Manufacturing Co.

6.10. MARTINREA INTERNATIONAL INC.

6.11. PDQ Tool & Stamping Co.

6.12. Tempco Manufacturing

6.13. Wisconsin Metal Parts, Inc.

1. GLOBAL AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2022-2030 ($ MILLION)

2. GLOBAL AUTOMOTIVE METAL STAMPING BY BLANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AUTOMOTIVE METAL STAMPING BY EMBOSSING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AUTOMOTIVE METAL STAMPING BY COINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL AUTOMOTIVE METAL STAMPING BY FLANGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL AUTOMOTIVE METAL STAMPING BY BENDING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL AUTOMOTIVE METAL STAMPING BY OTHER PROCESSES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

9. GLOBAL AUTOMOTIVE METAL STAMPING FOR AUTOMOBILE MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL AUTOMOTIVE METAL STAMPING FOR COMMERCIAL VEHICLE MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL AUTOMOTIVE METAL STAMPING FOR RECREATIONAL AND SPORTS VEHICLE MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL AUTOMOTIVE METAL STAMPING FOR AGRICULTURAL AND CONSTRUCTION EQUIPMENT MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL AUTOMOTIVE METAL STAMPING FOR EV MANUFACTURERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL AUTOMOTIVE METAL STAMPING FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2022-2030 ($ MILLION)

18. NORTH AMERICAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

19. EUROPEAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. EUROPEAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2022-2030 ($ MILLION)

21. EUROPEAN AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2022-2030 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE METAL STAMPING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL AUTOMOTIVE METAL STAMPING MARKET SHARE BY PROCESS, 2022 VS 2030 (%)

2. GLOBAL AUTOMOTIVE METAL STAMPING BY BLANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AUTOMOTIVE METAL STAMPING BY EMBOSSING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AUTOMOTIVE METAL STAMPING BY COINING MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL AUTOMOTIVE METAL STAMPING BY FLANGING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL AUTOMOTIVE METAL STAMPING BY BENDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AUTOMOTIVE METAL STAMPING BY OTHER PROCESSES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL AUTOMOTIVE METAL STAMPING MARKET SHARE BY END-USER, 2022 VS 2030 (%)

9. GLOBAL AUTOMOTIVE METAL STAMPING FOR AUTOMOBILE MANUFACTURERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL AUTOMOTIVE METAL STAMPING FOR COMMERCIAL VEHICLE MANUFACTURERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL AUTOMOTIVE METAL STAMPING FOR RECREATIONAL AND SPORTS VEHICLE MANUFACTURERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL AUTOMOTIVE METAL STAMPING FOR AGRICULTURAL AND CONSTRUCTION EQUIPMENT MANUFACTURERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL AUTOMOTIVE METAL STAMPING FOR EV MANUFACTURERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL AUTOMOTIVE METAL STAMPING FOR OTHER END-USERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL AUTOMOTIVE METAL STAMPING MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. US AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

18. UK AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD AUTOMOTIVE METAL STAMPING MARKET SIZE, 2022-2030 ($ MILLION)