Autonomous Tractor Market

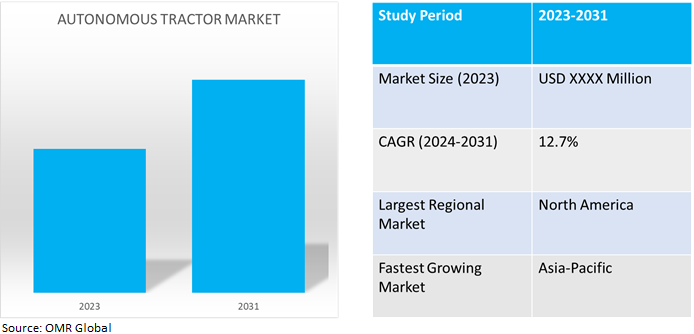

Autonomous Tractor Market Size, Share & Trends Analysis Report by Component (Lidar, Radar, GPS systems, Camera Vision Systems, Ultrasonic sensors, and Hand-Held Devices). by Power Output (Up to 30 HP, 30 HP to 100 HP and Above 100 HP). and by Farm Application (Tillage (Primary & Secondary Tillage), Seed Sowing and Harvesting). Forecast Period (2024-2031).

Autonomous tractor market is anticipated to grow at a significant CAGR of 12.7% during the forecast period (2024-2031). The market growth is attributed to the increased agricultural productivity with advanced technology globally. Advanced technology, such as GPS, sensors, cameras, and artificial intelligence algorithms, equip autonomous tractors to carry out a variety of activities without the need for human interaction. Plowing, sowing, spraying, and harvesting are a few examples of these tasks. The main benefit of autonomous tractors is their capacity to operate continuously, improving total agricultural productivity and efficiency.

Market Dynamics

Increasing Integration of Precision Agriculture

Autonomous tractors are innovative agricultural equipment outfitted with innovative technologies. These devices are made to work on farms without the assistance of a human, doing everything from planting and harvesting to plowing and planting. For smooth operation, they rely on a mix of sensors, GPS technology, artificial intelligence, and complex algorithms. Numerous sensors, including LiDAR, radar, and cameras, are installed in autonomous tractors to give them real-time information about their environment. As a result of this, they can move around and perform well in even the most complicated settings. With sophisticated software, farmers may remotely monitor and operate autonomous tractors. This capability is convenient and flexible, especially for large-scale agricultural operations management.

Growing Adoption of Electric and Hybrid Technologies

The adoption of modern farming techniques by the agricultural sector will be significantly aided by electric farm tractors. Making the switch to electric tractors is consistent with larger initiatives to mitigate climate change and cut greenhouse gas emissions. Agriculture is a major source of emissions, and switching to electric machinery can be extremely important to getting the industry carbon neutral. Electric farm tractors have supplanted conventional tractors as the preferred option for most farmers owing to their numerous advantages, including increased productivity and efficiency in the agricultural sector. Tractors that are most suited to a farmer's field operations might be chosen. In addition, manufacturers offer substitutes for lead-acid, lithium-ion, and other battery types. Hybrid electric, plug-in hybrid electric, and battery-electric powertrain types are available for electric farm tractors.

Market Segmentation

Our in-depth analysis of the global autonomous tractor market includes the following segments component, power output, and farm application.

- Based on the component, the market is sub-segmented into lidar, radar, GPS systems, camera vision systems, ultrasonic sensors, and hand-held devices.

- Based on power output, the market is sub-segmented into up to 30 HP, 30 HP to 100 HP, and above 100 HP.

- Based on farm application, the market is sub-segmented into tillage (primary & secondary tillage), seed sowing, and harvesting.

Component is Projected to Emerge as the Largest Segment

,Among components segment, GPS system sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes increasing advancements in autonomous tractors. With the help of innovative sensors, complex algorithms, and global positioning systems (GPS), farmers may navigate and carry out a variety of chores with accuracy and efficiency. An autonomous tractor's GPS provides precise, real-time location data, which forms its foundation. The tractor can function with market precision thanks to the use of GPS, ADAS, and other technology. The GPS guiding system ensures that an autonomous tractor works within its predetermined parameters, reducing overlaps and offering consistent coverage, whether it is being used for tillage or row crop management. With the use of fleet management, real-time tracking, artificial intelligence (AI), GPS, and monitoring technologies, operators can keep an eye on their tractors from a distance.

Harvesting Sub-segment to Hold a Considerable Market Share

Based on farm applications, the global autonomous tractor market is sub-segmented into tillage (primary & secondary tillage), seed sowing, and harvesting. Among these, the harvesting sub-segment is expected to hold a considerable market share. With the use of modern technology, autonomous tractors can carry out various agricultural activities including planting and harvesting without the need for a human driver. Autonomous tractors have been used to transfer autonomous navigation, one of the more promising technologies, to the land. With the use of lasers, cameras, control systems, and GPS navigation, autonomous tractors can navigate around obstacles and carry out various tasks like planting, fertilizing, spraying pesticides, and harvesting. Tractors are useful for moving agricultural produce from the field to a processing or storage location.

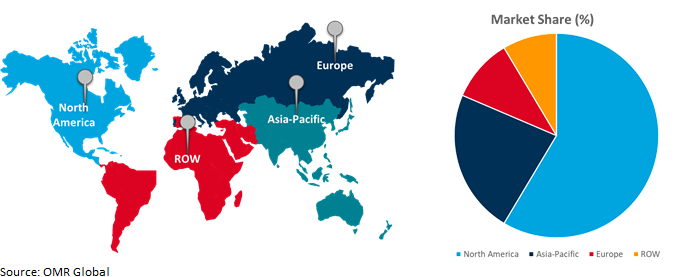

Regional Outlook

The global autonomous tractor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Adoption of Autonomous Tractors in Asia-Pacific

- The increasing adoption of advanced technology resulting in growth in the agricultural industry, increased emphasis on technology developments, and increased demand for agriculture drive the growth of autonomous tractors. According to the Asian Development Outlook 2021, Transforming Agriculture in Asia, in September 2021, agriculture increased by 1.7% year on year in the first half of 2021 owing to rising global demand for agriculture.

- In the region the driverless tractors will plant autonomously and with exceptional accuracy. As a result, the farmer would gradually see an increase in farm returns and profit.

Global Autonomous Tractor Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent agricultural technology companies and autonomous tractor providers in the region. The growth is mainly attributed to the increased adoption of modern farming techniques, precision agriculture, and increasing demand for higher productivity with increasing population further driving market growth. The market players offer various levels of automation features that can be unlocked, including auto-steering and other driving assistance capabilities, autonomous spraying, and fully autonomous driver-out functionality in line with rapidly evolving local autonomous driving regulations. For instance, in March 2023, Ouster, Inc., a provider of high-performance lidar sensors, and Fieldin, an AgTech company with a smart farming platform and autonomous technology, announced the largest known deployment of retrofit autonomy kits for autonomous tractors in the agricultural industry following the signing of their multi-year supply agreement.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global autonomous tractor market include CNH Industrial N.V., Deere & Company, Kubota Corp., Trimble Inc., and Yanmar Holdings Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, Trimble and Sabanto collaborated for the integration of Trimble BX992 Dual Antenna GNSS receivers with Trimble CenterPoint® RTX into Sabanto's autonomy solutions. Trimble acts as Sabanto's key autonomous technology provider, delivering high-accuracy positioning to its fleet. Trimble to provide advanced positioning systems to Sabanto for enhanced autonomous tractor performance.

Recent Development

- In December 2022, CNH Industrial introduced an electric tractor prototype with autonomous features. This product milestone is the latest development in the strategic plan for electrification. The prototype presented is branded New Holland Agriculture, while the commercial model will also extend to the Case IH Brand.

- In February 2021, Yanmar Agribusiness Co., Ltd., a subsidiary of Yanmar Holdings announced the upgrades of its autonomous tractor series, which are capable of full or partially autonomous work. Yanmar’s upgraded robot/auto tractors utilize a multi-frequency antenna for stable connection and higher positioning accuracy towards a safer, even more efficient autonomous tractor.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global autonomous tractor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Deere & Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Kubota Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Trimble Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Autonomous Tractor Market by Component

4.1.1. Lidar

4.1.2. Radar

4.1.3. GPS systems

4.1.4. Camera Vision Systems

4.1.5. Ultrasonic sensors

4.1.6. Hand-Held Devices

4.2. Global Autonomous Tractor Market by Power Output

4.2.1. Up to 30 HP

4.2.2. 30 HP to 100 HP

4.2.3. Above 100 HP

4.3. Global Autonomous Tractor Market by Farm Application

4.3.1. Tillage (Primary & Secondary Tillage)

4.3.2. Seed Sowing

4.3.3. Harvesting

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. AGCO Corp.

6.2. Agro Intelligence A/S

6.3. Agro Tractors S.P.A

6.4. Autonomous Solutions, Inc. (ASI)

6.5. Autonomous Tractor Corp.

6.6. Autonxt

6.7. CLAAS KGaA mbH

6.8. CNH Industrial N.V.

6.9. Daedong

6.10. ISEKI & CO.,LTD.

6.11. J C Bamford Excavators Ltd.

6.12. Mahindra & Mahindra Ltd.

6.13. Monarch Tractor

6.14. Raven Industries, Inc.

6.15. SDF Group

6.16. Sonalika

6.17. TYM Corp.

6.18. YANMAR HOLDINGS CO., LTD.

1. GLOBAL AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL LIDAR AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL RADAR AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GPS SYSTEMS AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CAMERA VISION AUTONOMOUS TRACTOR SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ULTRASONIC SENSORS AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HAND-HELD DEVICES AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2023-2031 ($ MILLION)

9. GLOBAL UP TO 30 HP AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL 30 HP TO 100 HP AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ABOVE 100 HP AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY FARM APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL AUTONOMOUS TRACTOR FOR TILLAGE (PRIMARY & SECONDARY TILLAGE) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AUTONOMOUS TRACTOR FOR SEED SOWING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AUTONOMOUS TRACTOR FOR HARVESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2023-2031 ($ MILLION)

20. NORTH AMERICAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY FARM APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

23. EUROPEAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2023-2031 ($ MILLION)

24. EUROPEAN AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY FARM APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY FARM APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY POWER OUTPUT, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AUTONOMOUS TRACTOR MARKET RESEARCH AND ANALYSIS BY FARM APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AUTONOMOUS TRACTOR MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL LIDAR AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL RADAR AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GPS AUTONOMOUS TRACTOR SYSTEMS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CAMERA VISION SYSTEMS AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ULTRASONIC SENSORS AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HAND-HELD DEVICES AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTONOMOUS TRACTOR MARKET SHARE BY POWER OUTPUT, 2023 VS 2031 (%)

9. GLOBAL UP TO 30 HP AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL 30 HP TO 100 HP AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ABOVE 100 HP AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AUTONOMOUS TRACTOR MARKET SHARE BY FARM APPLICATION, 2023 VS 2031 (%)

13. GLOBAL AUTONOMOUS TRACTOR FOR TILLAGE (PRIMARY & SECONDARY TILLAGE) MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AUTONOMOUS TRACTOR FOR SEED SOWING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AUTONOMOUS TRACTOR FOR HARVESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL AUTONOMOUS TRACTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. US AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

18. CANADA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

19. UK AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

20. FRANCE AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

21. GERMANY AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

22. ITALY AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

23. SPAIN AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF EUROPE AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. INDIA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. CHINA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. JAPAN AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

28. SOUTH KOREA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF ASIA-PACIFIC AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

30. LATIN AMERICA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)

31. MIDDLE EAST AND AFRICA AUTONOMOUS TRACTOR MARKET SIZE, 2023-2031 ($ MILLION)