Beauty Equipment Market

Beauty Equipment Market Size, Share & Trends Analysis Report by Product (Ultrasound Therapy, Light Therapy, Radiofrequency, Cryo Therapy, Laser Therapy, Electro Therapy, Vacuum Therapy, Micro-Needle Therapy System, and Others), by Application (Lifting/Tightening, Wrinkle Reduction, Whitening and Acne/Inflammation Improvement), and by End-User (Aesthetics Clinics and Spas, and Beauty Center), Forecast Period (2025-2035)

Industry Overview

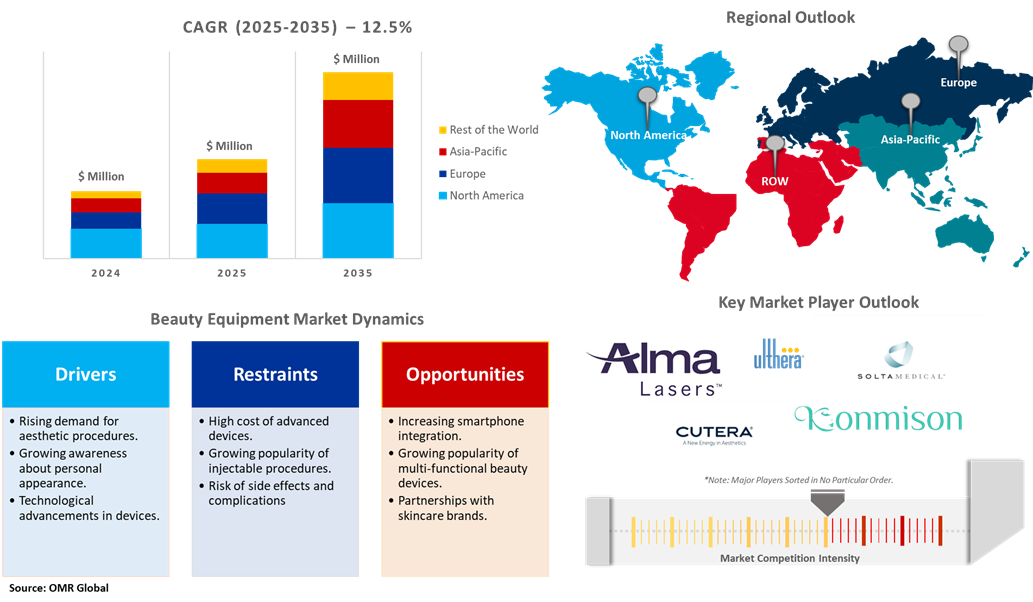

Beauty equipment market, valued at $5,225 million in 2025, is projected to reach $19,045 million by 2035, growing at a CAGR of 12.5% during the forecast period (2025–2035). The market is driven by the growing cosmetic procedures, rising middle-aged population, and increasing disposable income in the country. Further, the growing number of minimally invasive procedures has increased the number of cosmetic procedures such as face-lifts, wrinkle reduction, facial line correction treatment, and other treatments such as acne and scar treatment as the minimally invasive procedures provide quick recovery and better cosmetic results which are contributing to the market growth.

Market Dynamics

Increasing demand for anti-aging and skincare products

The market growth is driven by the rising demand for multi-functional cosmetic products such as anti-wrinkle creams by women. In addition, increasing consumer spending power on personal care products and changing lifestyles are fueling the demand for preventive anti-aging solutions. Furthermore, technological developments in the beauty industry coupled with newly formulated products with different flavors and essences have resulted in frequent product launches by the leading companies that further fuel the global market growth. For instance, in October 2022, Sofwave Ltd launched a device in Israel. The anti-aging technology of the SUPERB device Synchronous Ultrasound Parallel Beam based on ultrasound rays and approved by the FDA for firming facial and neck skin and for lifting the eyebrows and chin.

Emerging Technologies in the Beauty Industry

The beauty industry is undergoing a significant transformation, driven by the advent of emerging technologies. These advancements are not only revolutionizing the way products are manufactured and designed but also how consumers interact with brands and personalize their beauty experiences. From the integration of AI and AR to the adoption of sustainable manufacturing practices, the beauty sector is embracing a future where technology enhances every aspect of the industry. AI techniques such as ML and computer vision have been deployed across multiple domains, ranging from product development to personalized recommendations. Devices equipped with AI can customize treatment settings in real-time, improving effectiveness and safety in procedures such as radiofrequency or ultrasound therapy. For instance, in March 2024, L’Oréal introduced the Beauty Genius app, a virtual personal advisor. The app was designed for consumers to select skincare and makeup products.

Market Segmentation

- Based on the product, the market is segmented into ultrasound therapy, light therapy, radiofrequency, cryo therapy, laser therapy, electrotherapy, vacuum therapy, micro-needle therapy systems, and others.

- Based on the application, the market is segmented into lifting/tightening, wrinkle reduction, whitening, and acne/inflammation improvement.

- Based on the end-user, the market is segmented into aesthetics clinics spas, and beauty centers.

Laser Therapy leads the Cosmetic Equipment Market

Laser therapy holds the highest market share in the beauty equipment market, primarily due to its versatility and effectiveness in addressing a wide range of skin concerns. These treatments provide non-surgical options for skin rejuvenation, offering noticeable improvements in skin texture, tone, and overall appearance with minimal downtime. Laser technology is widely used to treat sun damage, pigmentation, broken blood vessels, and signs of aging such as wrinkles and acne scars. Its adaptability across multiple applications, including low-level laser therapy (LLLT) for reducing inflammation, promoting tissue repair, and preventing further skin damage, has driven its widespread adoption. Additionally, growing demand in Western countries driven by higher disposable incomes and societal beauty standards has further supported the dominance of laser therapy in the global beauty equipment landscape.

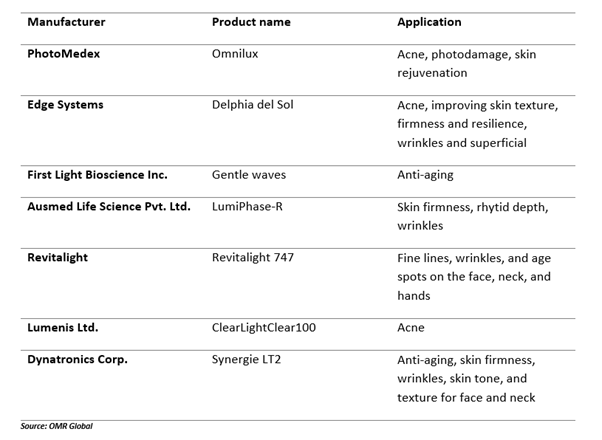

Laser Therapy Devices for Dermatological Applications

Ultrasound Therapy Driving Innovation in the Market

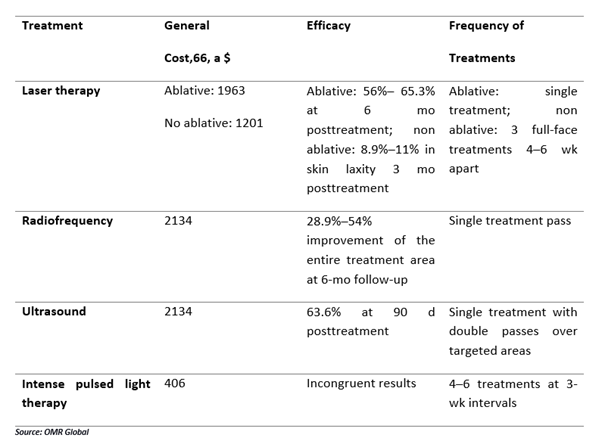

Ultrasound therapy is gaining traction in the beauty equipment market due to its non-invasive nature and effectiveness in enhancing circulation, promoting tissue healing, and reducing soft tissue dysfunction. The integration of high-frequency sound waves allows devices to target tissues up to 5 cm beneath the skin, producing thermotherapy effects that assist in swelling reduction and metabolic toxin removal. Advancements in ultrasound systems, such as the debut of Samsung’s Hera Z20 in the US in February 2025, further demonstrate the growing innovation in this market. Although the Hera Z20 was introduced for maternal-fetal care, its use of real-time AI features such as Live ViewAssist and 5D Follicle highlights the broader trend of AI integration across ultrasound platforms. These technologies enhance efficiency and precision while improving user ergonomics. ?

Cost and Effectiveness Comparison of Key Beauty Equipment Treatments

Regional Outlook

The global beauty equipment fibers market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Clinical Applications in China

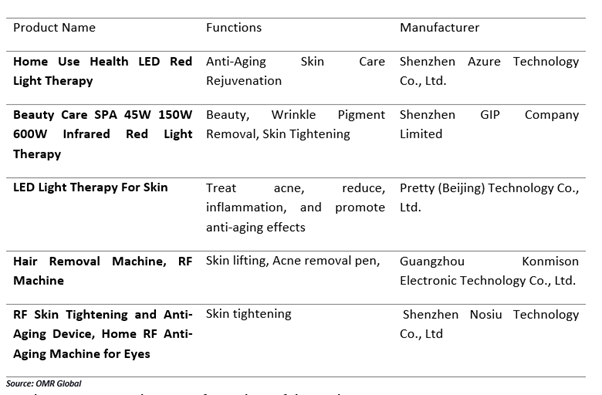

China dominates the Asia-Pacific beauty equipment market followed by India, Japan, South Korea, and the rest of the Asia-Pacific economies. The growth of the beauty equipment market in this country is attributed to various pivotal factors such as a rising disposable income, and the rinsing clinical use of beauty equipment by beauty centers and hospitals has increased the popularity of skin care treatment. For instance, in January 2020, Hainan Boao Super Hospital started the clinical use of the Ulthera System, an FDA-cleared, non-invasive procedure that lifted and tightened the skin on the neck, chin, and brow, and enhanced lines and wrinkles. The first group of patients with slack skin received 90-minute lifting treatments on the face and chin at the Medical Beauty Center. The ultrasound stimulator, designed for cosmetic procedures, is manufactured by Ulthera, Inc.

Key Beauty Equipment Products and Their Manufacturers

North America Region has a significant share of the Market.

The market is witnessing significant momentum in non-invasive procedures, particularly non-surgical skin tightening. According to the International Society of Aesthetic Plastic Surgery (ISAPS), in 2023, 831,583 skin tightening procedures were performed, accounting for 4.3% of all non-surgical aesthetic treatments in the country. This marked a 13.3% increase compared to 2022, emphasizing the growing consumer preference for treatments that deliver visible results without the risks or downtime associated with surgical interventions. This rising demand is contributing to the rapid adoption of advanced beauty equipment that uses technologies such as radiofrequency, ultrasound, and high-intensity focused energy to stimulate collagen production and firm the skin.

Market Players Outlook

The major companies operating in the global beauty equipment market include AlmaLaser, Solta Medical (Bausch Health), Ulthera, Inc. (Merz Pharma GmbH & Co. KgaA), Cutera, Inc., Guangzhou Konmison Electronic Technology Co., Ltd. among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In September 2024, Merz Aesthetics announced the launch of Ultherapy PRIME, a noninvasive treatment that provides a personalized and long-lasting lift of the skin in one session with zero downtime. The Ultherapy PRIME platform is the evolution of Ultherapy, which has been recognized as the Gold Standard for nonsurgical lifting and skin tightening.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global beauty equipment market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Beauty Equipment Market Sales Analysis – Product | Application | End-User ($ Million)

• Beauty Equipment Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Beauty Equipment Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Beauty Equipment Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Beauty Equipment Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Beauty Equipment Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Beauty Equipment Market Revenue and Share by Manufacturers

• Beauty Equipment Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1 AlmaLaser

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2 Solta Medical (Bausch Health)

4.2.1.6. Overview

4.2.1.7. Product Portfolio

4.2.1.8. Financial Analysis (Subject to Data Availability)

4.2.1.9. SWOT Analysis

4.2.1.10. Business Strategy

4.2.3 Ulthera, Inc. (Merz Pharma GmbH & Co. KgaA)

4.2.1.11. Overview

4.2.1.12. Product Portfolio

4.2.1.13. Financial Analysis (Subject to Data Availability)

4.2.1.14. SWOT Analysis

4.2.1.15. Business Strategy

4.2.4 Cutera, Inc.

4.2.1.16. Overview

4.2.1.17. Product Portfolio

4.2.1.18. Financial Analysis (Subject to Data Availability)

4.2.1.19. SWOT Analysis

4.2.1.20. Business Strategy

4.2.5 Guangzhou Konmison Electronic Technology Co., Ltd.

4.2.1.21. Overview

4.2.1.22. Product Portfolio

4.2.1.23. Financial Analysis (Subject to Data Availability)

4.2.1.24. SWOT Analysis

4.2.1.25. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Beauty Equipment Market Sales Analysis By Product ($ Million)

5.1. Ultrasound Therapy

5.2. Light Therapy

5.3. Radiofrequency

5.4. Cryo Therapy

5.5. Laser Therapy

5.6. Electro Therapy

5.7. Vacuum Therapy

5.8. Micro-Needle Therapy System

5.9. Others

6. Global Beauty Equipment Market Sales Analysis by Application ($ Million)

6.1. Lifting/Tightening

6.2. Wrinkle Reduction

6.3. Whitening and Acne/Inflammation Improvement

7. Global Beauty Equipment Market Sales Analysis by End-User ($ Million)

7.1. Aesthetics Clinics and Spas

7.2. Beauty Center

8. Regional Analysis

8.1. North American Beauty Equipment Market Sales Analysis – Product | Application | End-User| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Beauty Equipment Market Sales Analysis – Product | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Beauty Equipment Market Sales Analysis – Product | Application | End-User| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Beauty Equipment Market Sales Analysis – Product | Application | End-User| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1 Aesthetics Biomedical

9.1.1 Quick Facts

9.1.2 Company Overview

9.1.3 Product Portfolio

9.1.4 Business Strategies

9.2 Alma Laser

9.2.1 Quick Facts

9.2.2 Company Overview

9.2.3 Product Portfolio

9.2.4 Business Strategies

9.3 AMI, Inc.

9.3.1 Quick Facts

9.3.2 Company Overview

9.3.3 Product Portfolio

9.3.4 Business Strategies

9.4 Beijing ADSS Development Co. Ltd.

9.4.1 Quick Facts

9.4.2 Company Overview

9.4.3 Product Portfolio

9.4.4 Business Strategies

9.5 BluRay Aesthetics

9.5.1 Quick Facts

9.5.2 Company Overview

9.5.3 Product Portfolio

9.5.4 Business Strategies

9.6 BTL Group of Companies

9.6.1 Quick Facts

9.6.2 Company Overview

9.6.3 Product Portfolio

9.6.4 Business Strategies

9.7 Candela Medical

9.7.1 Quick Facts

9.7.2 Company Overview

9.7.3 Product Portfolio

9.7.4 Business Strategies

9.8 CLASSYS Inc.

9.8.1 Quick Facts

9.8.2 Company Overview

9.8.3 Product Portfolio

9.8.4 Business Strategies

9.9 Deleo Ltd

9.9.1 Quick Facts

9.9.2 Company Overview

9.9.3 Product Portfolio

9.9.4 Business Strategies

9.10 Guangzhou Konmison Electronic Technology Co., Ltd.

9.10.1 Quick Facts

9.10.2 Company Overview

9.10.3 Product Portfolio

9.10.4 Business Strategies

9.11 HMS Medical Systems

9.11.1 Quick Facts

9.11.2 Company Overview

9.11.3 Product Portfolio

9.11.4 Business Strategies

9.12 Iskra MEDICAL

9.12.1 Quick Facts

9.12.2 Company Overview

9.12.3 Product Portfolio

9.12.4 Business Strategies

9.13 Marc Salon Furniture

9.13.1 Quick Facts

9.13.2 Company Overview

9.13.3 Product Portfolio

9.13.4 Business Strategies

9.14 NEWPONG Co., Ltd.

9.14.1 Quick Facts

9.14.2 Company Overview

9.14.3 Product Portfolio

9.14.4 Business Strategies

9.15 Pretty (Beijing) Technology Co., Ltd.

9.15.1 Quick Facts

9.15.2 Company Overview

9.15.3 Product Portfolio

9.15.4 Business Strategies

9.16 Rohrer Aesthetics, Inc.

9.16.1 Quick Facts

9.16.2 Company Overview

9.16.3 Product Portfolio

9.16.4 Business Strategies

9.17 Solta Medical (Bausch Health)

9.17.1 Quick Facts

9.17.2 Company Overview

9.17.3 Product Portfolio

9.17.4 Business Strategies

9.18 The Global Beauty Group

9.18.1 Quick Facts

9.18.2 Company Overview

9.18.3 Product Portfolio

9.18.4 Business Strategies

9.19 Zemits

9.19.1 Quick Facts

9.19.2 Company Overview

9.19.3 Product Portfolio

9.19.4 Business Strategies

1. Global Beauty Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Cosmetic Ultrasound Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Cosmetic Light Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Cosmetic Radiofrequency Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Cosmetic Cryo Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Cosmetic Laser Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Cosmetic Electro Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Cosmetic Vacuum Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Cosmetic Micro-Needle Therapy Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Other Cosmetic Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Beauty Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

12. Global Beauty Equipment For Lifting/Tightening Market Research And Analysis by Region, 2024-2035 ($ Million)

13. Global Beauty Equipment For Wrinkle Reduction Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Beauty Equipment For Whitening Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Beauty Equipment For Acne/Inflammation Improvement Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Beauty Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

17. Global Beauty Equipment In Aesthetics Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global Beauty Equipment In Spas And Beauty Centers Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global Beauty Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

20. North American Beauty Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

21. North American Beauty Equipment Market Research And Analysis By Therapy, 2024-2035 ($ Million)

22. North American Beauty Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

23. North American Beauty Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

24. European Beauty Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

25. European Beauty Equipment Market Research And Analysis By Therapy, 2024-2035 ($ Million)

26. European Beauty Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

27. European Beauty Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

28. Asia-Pacific Beauty Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific Beauty Equipment Market Research And Analysis By Therapy, 2024-2035 ($ Million)

30. Asia-Pacific Beauty Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

31. Asia-Pacific Beauty Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

32. Rest Of The World Beauty Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

33. Rest Of The World Beauty Equipment Market Research And Analysis By Therapy, 2024-2035 ($ Million)

34. Rest Of The World Beauty Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

35. Rest Of The World Beauty Equipment Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Beauty Equipment Market Share By Products, 2024 Vs 2035 (%)

2. Global Cosmetic Ultrasound Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

3. Global Cosmetic Light Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

4. Global Cosmetic Radiofrequency Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

5. Global Cosmetic Cryo Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

6. Global Cosmetic Laser Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

7. Global Cosmetic Electro Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

8. Global Cosmetic Vacuum Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

9. Global Cosmetic Micro-Needle Therapy Equipment Market Share By Region, 2024 Vs 2035 (%)

10. Global Other Beauty Equipment Market Share By Region, 2024 Vs 2035 (%)

11. Global Beauty Equipment Market Share By Application, 2024 Vs 2035 (%)

12. Global Beauty Equipment For Lifting/Tightening Market Share By Region, 2024 Vs 2035 (%)

13. Global Beauty Equipment For Wrinkle Reduction Market Share By Region, 2024 Vs 2035 (%)

14. Global Beauty Equipment For Whitening Market Share By Region, 2024 Vs 2035 (%)

15. Global Beauty Equipment For Acne/Inflammation Improvement Market Share By Region, 2024 Vs 2035 (%)

16. Global Beauty Equipment Market Share Analysis By End-User, 2024 Vs 2035 (%)

17. Global Beauty Equipment In Aesthetics Clinics Market Share By Region, 2024 Vs 2035 (%)

18. Global Beauty Equipment In Spas And Beauty Centers Market Share By Region, 2024 Vs 2035 (%)

19. Global Beauty Equipment Market Share By Region, 2024 Vs 2035 (%)

20. US Beauty Equipment Market Size, 2024-2035 ($ Million)

21. Canada Beauty Equipment Market Size, 2024-2035 ($ Million)

22. UK Beauty Equipment Market Size, 2024-2035 ($ Million)

23. France Beauty Equipment Market Size, 2024-2035 ($ Million)

24. Germany Beauty Equipment Market Size, 2024-2035 ($ Million)

25. Italy Beauty Equipment Market Size, 2024-2035 ($ Million)

26. Spain Beauty Equipment Market Size, 2024-2035 ($ Million)

27. Rest Of Europe Beauty Equipment Market Size, 2024-2035 ($ Million)

28. India Beauty Equipment Market Size, 2024-2035 ($ Million)

29. China Beauty Equipment Market Size, 2024-2035 ($ Million)

30. Japan Beauty Equipment Market Size, 2024-2035 ($ Million)

31. South Korea Beauty Equipment Market Size, 2024-2035 ($ Million)

32. Australia and New Zealand Beauty Equipment Market Size, 2024-2035 ($ Million)

33. ASEAN Economies Beauty Equipment Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific Beauty Equipment Market Size, 2024-2035 ($ Million)

35. Rest Of The World Beauty Equipment Market Size, 2024-2035 ($ Million)

FAQS

The size of the Beauty Equipment market in 2024 is estimated to be around $5,225 million.

North America holds the largest share in the Beauty Equipment market.

Leading players in the Beauty Equipment market include AlmaLaser, Solta Medical (Bausch Health), Ulthera, Inc. (Merz Pharma GmbH & Co. KgaA), Cutera, Inc., Guangzhou Konmison Electronic Technology Co., Ltd. among others.

Beauty Equipment market is expected to grow at a CAGR of 12.5% from 2025 to 2035.

The Beauty Equipment Market is growing due to rising demand for advanced skincare solutions, anti-aging treatments, and at-home beauty devices.