Bioceramics Market

Bioceramics Market Size, Share & Trends Analysis Report by Source (Microbial, Mammalian, and Others) by Product Type (Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Gene Therapy, Cell Therapy and Others) by Application (Therapeutics, Diagnostics, Research Applications and Preventive), By Manufacturing Type (In-house Manufacturing, Contract Manufacturing) Forecast Period (2025-2035)

Industry Overview

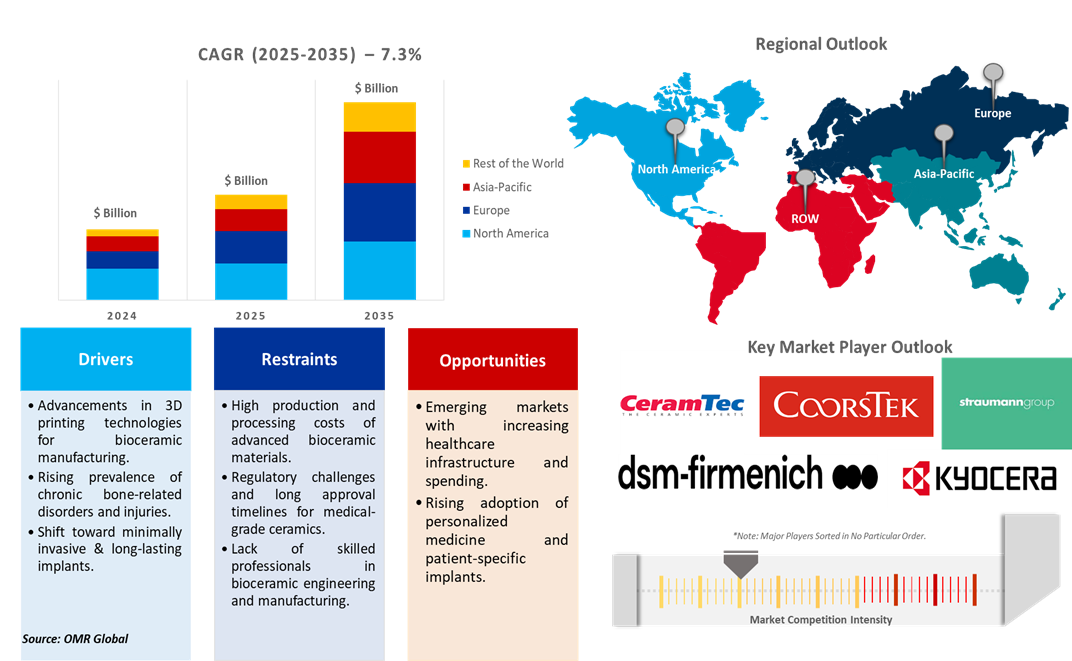

Bioceramics market was valued at $8.2 billion in 2024 and is projected to reach $15.8 billion by 2035, growing at a CAGR of 7.3% during the forecast period (2025–2035). The global bioceramics market is expanding at a fast pace owing to the aging global population & rising prevalence of bone and dental disorders, growing demand for orthopedic and dental implants, technological advancements & innovation, evolving healthcare infrastructure & market expansion in emerging regions. According to the American Academy of Orthopaedic Surgeons, more than 700,000 total knee replacements are performed annually, and approximately 1,000,000 individuals receive an artificial knee joint every year in the US.

Market Dynamics

Regulatory Support & Fast-Track Approvals

Supportive regulatory paths, including the FDA's fast track, accelerated approval programs, breakthrough therapy, priority review, and accelerated approval programs, have considerably accelerated bioceramics commercialization. These frameworks shorten development schedules, lower market entry obstacles, and promote continued investment in new medical treatments. Agencies such as the FDA/EMA offer priority review, breakthrough treatment, and rapid approval pathways for new bioceramics. For instance, in June 2022, the FDA confirmed that CeramTec’s novel ceramic total knee replacement device and proposed indication for use meet the criteria of a Breakthrough Device. CeramTec is encouraged by the regulatory authority's designation of the product as a Breakthrough Device. The FDA's Breakthrough Devices Program aims to offer patients and healthcare professionals timely access to new medical devices by accelerating their development, evaluation, and review. Breakthrough Device designation is only given to devices that have the potential to improve treatment and diagnostics for life-threatening or irreversibly disabling diseases or conditions.

Complex Manufacturing Processes in Bioceramics

Complex manufacturing processes are a key restraint for the bioceramics market owing as producing high-purity, defect-free implants requires advanced technologies such as high-temperature sintering, precision machining, and surface finishing. Achieving complex geometries, patient-specific designs, or fine micro-and macro-porosity often requires advanced forming methods. Traditional ceramic forming (pressing, slip casting) may not allow for highly complex internal geometries. Additive manufacturing (3D printing), stereolithography (SLA), digital light processing (DLP), selective laser sintering (SLS), etc., offer more flexibility but also introduce multiple new challenges.

Market Segmentation

- Based on the product type, the market is segmented into bio-inert, bio-active, and bio-resorbable.

- Based on the application, the market is segmented into dental, orthopedics, and others.

Bio-Inert: A Key Segment in Market Growth

The Bio-Inert segment currently holds the largest share of the global bioceramics market. Bio-inert ceramics such as alumina (Al?O?) and zirconia (ZrO?) have high compressive strength, wear resistance, and hardness, making them suitable for load-bearing implants (hip, knee, and dental prosthetics). Alumina and zirconia have been in clinical use for a long time, especially in orthopedic joint replacements and dental restorations. Furthermore, manufacturing of alumina and zirconia is well-optimized and scalable, reducing costs compared to some newer, specialized bioactive materials. CeramTec GmbH, Kyocera Corporation, and CoorsTek Inc. are among the leading Bio-Inert bioceramics manufacturers. These companies are known for their innovative material developments, strong presence in orthopedic and dental applications, and a proven track record of producing high-performance alumina and zirconia ceramics for medical usage.

The Dental Segment of the Bioceramics Market Is Expanding at the Highest Rate

Bioceramic materials are becoming more prevalent in dentistry, particularly in endodontics (root canal treatments), owing to their high biocompatibility, sealing ability, and moisture resistance. These materials are utilized to fill and seal root canals, heal root perforations, and serve as root-end fillers during procedures. Unlike conventional materials, bioceramics are chemically stable, connect well with natural tooth structure, and promote the production of hard tissue such as dentin and cementum. It is estimated that oral diseases affect nearly 3.7 billion individuals globally, and dental caries is the most common noncommunicable illness and a serious public health issue. It is prevalent throughout the life course and affects both permanent teeth and deciduous (first) teeth. It is estimated that there are 2 billion individuals with permanent teeth with caries and 510 million children with deciduous teeth with caries.

Regional Outlook

The global bioceramics is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Leading the Global Bioceramics Market Growth

The North America market growth is attributed to the advanced healthcare infrastructure & high R&D investment, growing demand in orthopedics & dentistry, favorable regulatory environment & early technology adoption, technological innovation & material advancements. Chronic conditions like osteoarthritis and degenerative joint and dental diseases are driving the demand for orthopedic implants (e.g., hip, knee replacements) and dental restorations using bioceramics. Dental implants are favored over other tooth replacement methods as they provide support for crowns, bridges, and dentures, acting much like natural tooth roots and promoting bone health and preservation. In 2024–2025, approximately 3 million Americans will have a dental implant, reflecting the growing acceptance of implantology across the country. A significant 12.9% of these implants are placed in individuals aged 65–74, highlighting the impact of an aging population on market demand. The average failure rate of dental implants is 6% in the US, suggesting a generally high success rate while highlighting the importance of advanced training and precision in implant placement to minimize failures. Leading dental implant companies in the US, including Straumann, Nobel Biocare, Zimmer Biomet, and Dentsply Sirona, offer a wide range of dental implant solutions.

Market Players Outlook

The major companies operating in the global bioceramics Market include CeramTec GmbH, DSM-Firmenich AG, Institut Straumann AG, KYOCERA Medical Technologies, Inc., Zimmer Biomet Holdings, Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bioceramics market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Global Bioceramics Market Sales Analysis – Product Type | Application ($ Million)

- Bioceramics Market Sales Performance of Top Countries

- Research Methodology

- Primary Research Approach

- Secondary Research Approach

- Market Snapshot

- Market Overview and Insights

- Scope of the Study

- Analyst Insight & Current Market Trends

- Key Bioceramics Industry Trends

- Market Recommendations

- Porter's Five Forces Analysis for the Bioceramics Market

- Competitive Rivalry

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Market Determinants

- Market Drivers

- Drivers For Global Bioceramics Market: Impact Analysis

- Market Pain Points and Challenges

- Restraints For Global Bioceramics Market: Impact Analysis

- Market Opportunities

- Opportunities For Global Bioceramics Market: Impact Analysis

- Market Drivers

- Competitive Landscape

- Competitive Dashboard – Bioceramics Market Revenue and Share by Manufacturers

- Bioceramics Product Comparison Analysis

- Top Market Player Ranking Matrix

- Key Company Analysis

- CeramTec GmbH

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- DSM-Firmenich AG

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Institut Straumann AG

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- KYOCERA Medical Technologies, Inc.

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Zimmer Biomet Holdings, Inc.

- Overview

- Product Portfolio

- Financial Analysis (Subject to Data Availability)

- SWOT Analysis

- Business Strategy

- Top Winning Strategies by Market Players

- Merger and Acquisition

- Product Launch

- Partnership And Collaboration

- CeramTec GmbH

- Key Company Analysis

- Global Bioceramics Market Sales Analysis by Product Type ($ Million)

- Bio-Inert

- Alumina

- Zirconia

- Others (Silicon nitride, Titania)

- Bio-Active

- Bioglass

- Glass Ceramics

- Others (Hydroxyapatite, Calcium silicates)

- Bio-Resorbable

- ?-Tricalcium phosphate

- Calcium phosphate

- Bio-Inert

- Global Bioceramics Market Sales Analysis by Application($ Million)

- Dental

- Orthopedics

- Others

- Regional Analysis

- North American Bioceramics Market Sales Analysis – Product Type | Application| Country ($ Million)

- Macroeconomic Factors for North America

- United States

- Canada

- European Bioceramics Market Sales Analysis – Product Type | Application |Country ($ Million)

- Macroeconomic Factors for Europe

- UK

- Germany

- Italy

- Spain

- France

- Russia

- Rest of Europe

- Asia-Pacific Bioceramics Market Sales Analysis – Product Type | Application |Country ($ Million)

- Macroeconomic Factors for Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

- Rest of Asia-Pacific

- Rest of the World Bioceramics Market Sales Analysis – Product Type | Application | Country ($ Million)

- Macroeconomic Factors for the Rest of the World

- Latin America

- Middle East and Africa

- Company Profiles

- Baikowski

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- BONESUPPORT AB

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CAM Bioceramics

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CeramTec GmbH

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CoorsTek Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- CGbio

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Dentsply Sirona Inc

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies Dentsply Sirona Inc

- DSM-Firmenich AG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Innovative BioCeramix, Inc

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Institut Straumann AG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Kuraray Noritake Dental Inc

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- KYOCERA Medical Technologies, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Nobel Biocare Services AG

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Orbray Co., Ltd

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Regenity

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Sagemax

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Shandong Sinocera Functional Materials Co., Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Weiert Ceramics Technology Co., Ltd.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Zimmer Biomet Holdings, Inc.

- Quick Facts

- Company Overview

- Product Portfolio

- Business Strategies

- Baikowski

1. Global Bioceramics Market Research And Analysis By Product Type, 2024-2035 ($ Million)

2. Global Bio-Inert Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Alumina Bio-Inert Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Zirconia Bio-Inert Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Other Bio-Inert Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Bio-Active Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Bioglass Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Bio-Active Glass Ceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Other Bio-Active Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Bio-Resorbable Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global ?-Tricalcium phosphate Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Calcium phosphate Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Bioceramics Market Research And Analysis By Application, 2024-2035 ($ Million)

14. Global Bioceramics For Dental Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Bioceramics For Orthopedics Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Bioceramics For Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Bioceramics Market Research And Analysis By Region, 2024-2035 ($ Million)

18. North American Bioceramics Market Research And Analysis By Country, 2024-2035 ($ Million)

19. North American Bioceramics Market Research And Analysis By Product Type, 2024-2035 ($ Million)

20. North American Bioceramics Market Research And Analysis By Application, 2024-2035 ($ Million)

21. European Bioceramics Market Research And Analysis By Country, 2024-2035 ($ Million)

22. European Bioceramics Market Research And Analysis By Product Type, 2024-2035 ($ Million)

23. European Bioceramics Market Research And Analysis By Application, 2024-2035 ($ Million)

24. Asia-Pacific Bioceramics Market Research And Analysis By Country, 2024-2035 ($ Million)

25. Asia-Pacific Bioceramics Market Research And Analysis By Product Type, 2024-2035 ($ Million)

26. Asia-Pacific Bioceramics Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Rest Of The World Bioceramics Market Research And Analysis By Product Type, 2024-2035 ($ Million

28. Rest Of The World Bioceramics Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Bioceramics Market Share By Product Type, 2024 Vs 2035 (%)

2. Global Bio-Inert Bioceramics Market Share By Region, 2024 Vs 2035 (%)

3. Global Alumina Bio-Inert Market Share By Region, 2024 Vs 2035 (%)

4. Global Zirconia Bio-Inert Market Share By Region, 2024 Vs 2035 (%)

5. Global Other Bio-Inert Market Share By Region, 2024 Vs 2035 (%)

6. Global Bio-Active Bioceramics Market Share By Region, 2024 Vs 2035 (%)

7. Global Bioglass Market Share By Region, 2024 Vs 2035 (%)

8. Global Bio-Active Glass Ceramics Market Share By Region, 2024 Vs 2035 (%)

9. Global Other Bio-Active Market Share By Region, 2024 Vs 2035 (%)

10. Global Bio-Resorbable Bioceramics Market Share By Region, 2024 Vs 2035 (%)

11. Global ?-Tricalcium phosphate Bioceramics Market Share By Region, 2024 Vs 2035 (%)

12. Global Calcium phosphate Bioceramics Market Share By Region, 2024 Vs 2035 (%)

13. Global Bioceramics Market Share By Application, 2024 Vs 2035 (%)

14. Global Bioceramics For Dental Market Share By Region, 2024 Vs 2035 (%)

15. Global Bioceramics For Orthopedics Market Share By Region, 2024 Vs 2035 (%)

16. Global Bioceramics For Other Application Market Share By Region, 2024 Vs 2035 (%)

17. Global Bioceramics Market Share By Region, 2024 Vs 2035 (%)

18. US Bioceramics Market Size, 2024-2035 ($ Million)

19. Canada Bioceramics Market Size, 2024-2035 ($ Million)

20. UK Bioceramics Market Size, 2024-2035 ($ Million)

21. France Bioceramics Market Size, 2024-2035 ($ Million)

22. Germany Bioceramics Market Size, 2024-2035 ($ Million)

23. Italy Bioceramics Market Size, 2024-2035 ($ Million)

24. Spain Bioceramics Market Size, 2024-2035 ($ Million)

25. Rest Of Europe Bioceramics Market Size, 2024-2035 ($ Million)

26. India Bioceramics Market Size, 2024-2035 ($ Million)

27. China Bioceramics Market Size, 2024-2035 ($ Million)

28. Japan Bioceramics Market Size, 2024-2035 ($ Million)

29. South Korea Bioceramics Market Size, 2024-2035 ($ Million)

30. Rest Of Asia-Pacific Bioceramics Market Size, 2024-2035 ($ Million)

31. Rest Of The World Bioceramics Market Size, 2024-2035 ($ Million)

FAQS

The size of the Bioceramics market in 2024 is estimated to be around $8.2 billion.

North America holds the largest share in the Bioceramics market.

Leading players in the Bioceramics market include CeramTec GmbH, DSM-Firmenich AG, Institut Straumann AG, KYOCERA Medical Technologies, Inc., Zimmer Biomet Holdings, Inc., among others.

Bioceramics market is expected to grow at a CAGR of 7.3% from 2025 to 2035.

Rising demand for dental and orthopedic implants, technological advancements, and increasing geriatric population are driving the Bioceramics Market growth.