Canned Wines Market

Canned Wines Market Size, Share & Trends Analysis by Product (Still Wine, Sparkling Wine, Fortified Wine, Vermouth), by Color (Red Wine, Rose Wine, White Wine), by Distribution Channel (Online, Offline), and Forecast Period (2025-2035)

Industry Overview

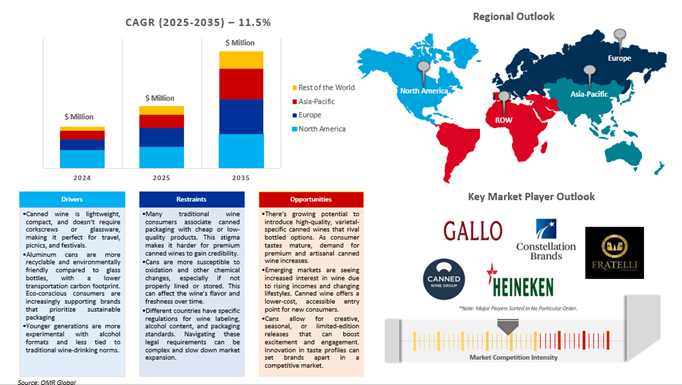

Canned wine market was valued at $580 million in 2024 and is projected to reach $1,915 million by 2035, with a growing CAGR of 11.5% during the forecast period (2025-2035). Wine is considered a luxury alcoholic drink that comes in a glass bottle with different flavors, and colors such as red, rose, and white. Thus, the increase in the consumption of wine over the past decade has significantly raised the demand and growth of the global canned wine market. According to the Wine Institute, in 2021, the US population consumed around 1.1 billion wine gallons. Additionally, as per the same source, each resident has been estimated to consume around 3.18 gallons of total wine. Canned wine provides the opportunity to pull new wine drinkers into the market. The canned wine movement is making wine more accessible, the designs on the cans look cool, and lower alcohol products, such as spritzers, answer the needs of the health and image concerned Gen Zs.

Market Dynamics

The Pros of Wine in a Can

Cans are more eco-friendly than glass bottles, they produce a much smaller carbon footprint as they are lighter to transport (generating less carbon emissions), and they are recyclable in various other products as well. Canned wines are sold in 187ml, 250ml, 375ml, or 500ml sizes which provides a flexible option to choose from, rather than buying a large ml of the glass of wine. In addition, canned wine offerings were diversifying beyond traditional still wines to include sparkling, rosé, red, white, and even wine cocktails. This diversification catered to a wide range of consumer preferences and occasions. Furthermore, customers are accepting on-the-go items, thereby enhancing canned wine's popularity. In coming years cans will act as gateway wines - introducing wine to non-wine drinkers, which will then open up the rest of the wine world to them.

Market Segmentation

- Based on the product, the market is segmented into still wine, sparkling wine, fortified wine, and vermouth.

- Based on the color, the market is segmented into red wine, rose wine, and white wine.

- Based on the end-user industry, the market is segmented into cloud providers, colocation providers, and enterprises.

- Based on the distribution channel, the market is segmented into online, and offline.

Sparkling Wine is expected to hold a Prominent Share in the Global Canned Wine Market.

The sparkling wine sub-segment is expected to hold a prominent share of the global canned wine market during the forecast period. Sparkling wine is widely consumed among the people due to which the production of sparkling wine has increased over the years. According to the Wine Institute, in 2021, a total of 36,479 (12 bottles of 750ml) sparkling wine was produced and imported across the globe. The inclination of the major market players toward launching sparkling wine products with new and innovative flavors to further propel the market growth. For instance, in August 2021, Heineken US launched a canned sparkling wine that is a modern take on traditional mead. Comb and Hive is a crisp wine made with wildflower honey and real sugar fermented with orange blossom flowers and a hint of fizz. Additionally, in November 2024, 90+ Cellars launched their first non-alcoholic wines. In response to growing consumer demand, 90+ Cellars enters the zero-proof space with the addition of two, dealcoholized sparkling wines from France.

Rose wine holds a considerable share in the canned market.

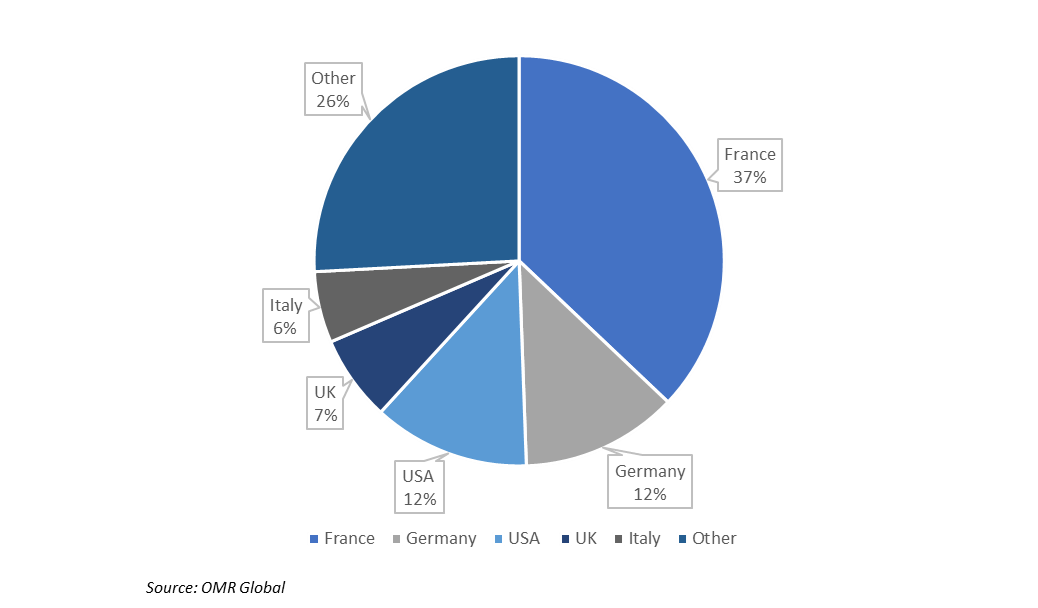

The rising popularity of rosé wine, especially in social and outdoor environments, establishes it as a market segment that is expanding at a rapid rate. Rose wine’s reduced skin contact gives rosé a pink hue and lighter flavor than that of red wine. Rosé is produced around the world, as it can be made from any red wine grape cultivated in any wine-growing region. Rosé's light and fragrant attributes, in conjunction with its convenient and portable, packaging, contribute to its popularity among consumers in search of a lively and practical wine-consuming experience. France is the world's largest producer of rosé wine, accounting for 35% of global production, followed by Spain with 20% and the United States with 10%.

Share of the biggest rosé-consuming countries out of global rosé wine consumption

Regional Outlook

The global canned wines market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American region is expected to hold a prominent share of the global canned wine market during the forecast period due to the presence of key market players. Furthermore, the Asia-Pacific region is expected to be the fastest-growing region in the global canned wine market.

North American Region is expected to hold a Prominent Share in the Global Canned Wines Market.

The North American region is expected to hold a prominent share in the growth of the global canned wines market during the forecast period due to the large presence of key market players. The presence of major key players and high product demand are driving the growth of the global canned wine market in this region. According to the Wine Institute, a total of 13,525 (in thousands of 9-liter cases) sparkling wine has been produced and imported into the US. Many key players launched their products in the US market which led to the growth of the global canned wine market. For instance, In August 2024, Archer Roose launched Sauvignon Blanc at Dave & Buster’s, a restaurant and sports-watching destination, bringing its Sauvignon Blanc cans to over 150 locations nationwide. This collaboration marks another milestone as Archer Roose leads the wine category into new places.

Market Players Outlook

The key players in the canned wine market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players in the market include Heineken USA Inc., Canned Wine Co., Constellation Brands, Inc., Fratelli Wines, E. & J. Gallo Winery, and others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in July 2024, Maker Wine, a female-founded craft canned wine company partnered with Regal Wine Company, The collaboration aims to expand Maker Wine's distribution reach in California, leveraging Regal's extensive network and reputation in the wine industry.

Recent Developments

- In November 2023, Canned Wine Co. launched two new lines into the UK online grocer, Ocado. The new launch aims to bring the canned wines to a wider audience. The premium single varietal range will focus strongly on their region of origin. From two key winemaking regions in Europe – a Verdejo from Rueda and a Gamay from the Loire – the wines will be sold in 250ml cans.

- In June 2023, NICE launched its first canned sparkling wine. The White Wine product comes in at 10% ABV and offers dry, crisp, and sparkling notes. It is a Spanish Airén from La Mancha, Spain, and comes packaged in a 200ml can.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global canned wines market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Canned Wines Market Sales Analysis – Product | Color| Distribution Channel |($ Million)

• Canned Wines Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Canned Wines Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Canned Wines Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Canned Wines Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Canned Wines Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Canned Wines Market Revenue and Share by Manufacturers

• Canned Wines Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Heineken USA Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Canned Wine Co.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Constellation Brands, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Canned Wines Market Sales Analysis by Product ($ Million)

5.1. Still Wine

5.2. Sparkling Wine

5.3. Fortified Wine

5.4. Vermouth

6. Global Canned Wines Market Sales Analysis by Color ($ Million)

6.1. Red Wine

6.2. Rose Wine

6.3. White Wine

7. Global Canned Wines Market Sales Analysis by Distribution Channel ($ Million)

7.1. Online

7.2. Offline

8. Regional Analysis

8.1. North American Canned Wines Market Sales Analysis – Product | Color | Distribution Channel | ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Canned Wines Market Sales Analysis – Product | Color | Distribution Channel | ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Canned Wines Market Sales Analysis – Product | Color | Distribution Channel | ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Canned Wines Market Sales Analysis – Product | Color | Distribution Channel | ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Archer Roose Wines.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. AVA Grace Vineyards

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BROC CELLARS

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. CanaWine.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Canned Wine Group.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Constellation Brands, Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. E. & J. Gallo Winery

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. FIREHOUSE CAN CO.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Fratelli Wines

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Heineken USA Inc.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Jasper Winery

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Kiss of Wine

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Lubanzi Wines

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Maker Wine Company

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Nomadica

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Original House Wine

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. RAMONA.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Sans Wine Co.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Sula Vineyards Limited

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. The Family Coppola

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Uncommon Ltd.

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. Union Wine Company

1.1.1. Quick Facts

1.1.2. Company Overview

1.1.3. Product Portfolio

1.1.4. Business Strategies

1. Global Canned Wines Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Still Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Sparkling Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Fortified Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Vermouth Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Canned Wines Market Research And Analysis By Color, 2024-2035 ($ Million)

7. Global Red Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Rose Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global White Canned Wine Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Canned Wines Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

11. Global Online Canned Wines Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Offline Canned Wines Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Canned Wines Market Research And Analysis By Geography, 2024-2035 ($ Million)

14. North American Canned Wines Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Canned Wines Market Research And Analysis By Product, 2024-2035 ($ Million)

16. North American Canned Wines Market Research And Analysis By Color, 2024-2035 ($ Million)

17. North American Canned Wines Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

18. European Canned Wines Market Research And Analysis By Country, 2024-2035 ($ Million)

19. European Canned Wines Market Research And Analysis By Product, 2024-2035 ($ Million)

20. European Canned Wines Market Research And Analysis By Color, 2024-2035 ($ Million)

21. European Canned Wines Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

22. Asia-Pacific Canned Wines Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Asia-Pacific Canned Wines Market Research And Analysis By Product, 2024-2035 ($ Million)

24. Asia-Pacific Canned Wines Market Research And Analysis By Color, 2024-2035 ($ Million)

25. Asia-Pacific Canned Wines Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

26. Rest Of The World Canned Wines Market Research And Analysis By Country, 2024-2035 ($ Million)

27. Rest Of The World Canned Wines Market Research And Analysis By Product, 2024-2035 ($ Million)

28. Rest Of The World Canned Wines Market Research And Analysis By Color, 2024-2035 ($ Million)

29. Rest Of The World Canned Wines Market Research And Analysis By Distribution Channel, 2024-2035 ($ Million)

1. Global Canned Wines Market Share By Product, 2024 Vs 2035 (%)

2. Global Still Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

3. Global Sparkling Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

4. Global Fortified Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

5. Global Vermouth Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

6. Global Canned Wines Market Share By Color, 2024 Vs 2035 (%)

7. Global Red Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

8. Global Rose Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

9. Global White Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

10. Global Canned Wines Market Share By Distribution Channel, 2024 Vs 2035 (%)

11. Global Online Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

12. Global Offline Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

13. Global Canned Wines Market Share By Geography, 2024 Vs 2035 (%)

14. US Canned Wines Market Size, 2024-2035 ($ Million)

15. Canada Canned Wines Market Size, 2024-2035 ($ Million)

16. UK Canned Wines Market Size, 2024-2035 ($ Million)

17. France Canned Wines Market Size, 2024-2035 ($ Million)

18. Germany Canned Wines Market Size, 2024-2035 ($ Million)

19. Italy Canned Wines Market Size, 2024-2035 ($ Million)

20. Spain Canned Wines Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Canned Wines Market Size, 2024-2035 ($ Million)

22. India Canned Wines Market Size, 2024-2035 ($ Million)

23. China Canned Wines Market Size, 2024-2035 ($ Million)

24. Japan Canned Wines Market Size, 2024-2035 ($ Million)

25. South Korea Canned Wines Market Size, 2024-2035 ($ Million)

26. Rest Of Asia-Pacific Canned Wines Market Size, 2024-2035 ($ Million)

27. Rest Of The World Canned Wines Market Size, 2024-2035 ($ Million)

FAQS

The size of the Canned Wines market in 2024 is estimated to be around $580 million.

North America holds the largest share in the Canned Wines market.

Leading players in the Canned Wines market include Heineken USA Inc., Canned Wine Co., Constellation Brands, Inc., Fratelli Wines, E. & J. Gallo Winery, and others.

Canned Wines market is expected to grow at a CAGR of 11.5% from 2025 to 2035.

The Canned Wines Market is growing due to rising demand for convenient, eco-friendly packaging and the increasing popularity of ready-to-drink alcoholic beverages among younger consumers.