Car Audio Video Navigation Market

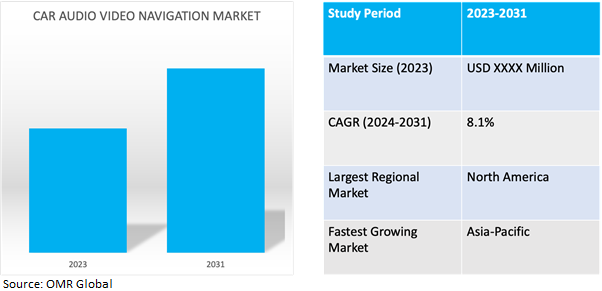

Car Audio Video Navigation Market Size, Share & Trends Analysis Report by Operating System (Android, Linux, QNX and Windows) and by Sales (OEM and Aftermarket) Forecast Period (2024-2031)

Car audio video navigation market is anticipated to grow at a considerable CAGR of 8.1% during the forecast period (2024-2031). Car audio video navigation refers to the segment of the automotive industry focused on providing entertainment, information, and navigation services within vehicles. It encompasses a range of technologies and products designed to enhance the in-car experience for drivers and passengers.

Market Dynamics

Global Vehicle Production Boom to Drive Global Market

The increasing production of vehicles globally is propelled by several factors contributing to the expansion of the automotive industry. As economies are growing and urbanization rates are rising, the demand for various types of vehicles, ranging from passenger cars to commercial and speciality vehicles has heightened demand and is particularly evident in emerging markets experiencing rapid development and improving standards of living. Furthermore, the integration of advanced technologies and features within vehicles, including audio, video, and navigation systems, has become increasingly standard. This trend reflects consumer preferences for enhanced driving experiences, safety features, and connectivity options, further stimulating vehicle production to meet evolving market demands. For instance, in June 2022, Sony introduced two new in-car media receivers including the XAV-AX6000 and the XAV-AX4000with wireless smartphone connectivityso that the drivers can use voice control for navigation or playing music on the road even with their device in their pocket.

Evolving Consumer Preferences Shapes the Rise of In-Car Infotainment Systems

The rising demand for infotainment systems in vehicles reflects a fundamental shift in consumer preferences towards enhanced in-car experiences. Consumers today increasingly prioritize vehicles equipped with sophisticated infotainment systems that offer a seamless blend of entertainment, connectivity, and convenience features. This trend stems from a desire for greater connectivity with smartphones and other digital devices, as well as a preference for intuitive user interfaces and advanced functionality. Infotainment systems play a crucial role in delivering these features, providing access to music streaming, video playback, internet browsing, and smartphone integration.

Additionally, safety considerations drive the integration of hands-free calling, voice-activated controls, and real-time navigation features, enhancing driver focus and reducing distractions on the road. For instance, in December 2021, Bosch developed a high-performance infotainment domain computing system built precisely for vehicles that feature in-car communication, in-car payment, video streaming, voice assistants and many more to vehicles quickly. The Information domain computer delivers support for multiple in-vehicle systems within a single solution, and provides vehicle manufacturers that is cost-effective, flexible, scalable and powerful control unit for the future of in-vehicle technology.

Market Segmentation

Our in-depth analysis of the global car audio video navigation market includes the following segments by operating system and sales:

- Based on operating system, the market is sub-segmented into android, linux, QNX and windows.'

- Based on sales, the market is sub-segmented into OEM and aftermarket.

Android is Projected to Emerge as the Largest Segment

Based on the operating system, the global car audio video navigation market is sub-segmented into Android, Linux, QNX and Windows. Among these, the Androidsub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the open-source nature of this operating system that allows for easy customization and integration into car infotainment systems, appealing to manufacturers seeking flexibility. Additionally, Android's familiarity with consumers from their smartphones ensures a seamless user experience across platforms. Integration with Google services such as Google Maps and Google Assistant enhances functionality that offers an extensive app ecosystem, diverse navigation, entertainment options and continuous updates. For instance, in September 2023, Google’s Android Auto launched Zoom and WebEx by Cisco that will be used for audio-only conference calls.

Aftermarket Sub-segment to Hold a Considerable Market Share

The aftermarket sub-segment holds a considerable market share due to flexibility and compatibility that offers a wide range of vehicles, including older models that may not have built-in navigation systems that allow consumers to upgrade their vehicles with navigation capabilities without needing to purchase a new car and also provide advanced features and customization options that may not be available in OEM (Original Equipment Manufacturer) systems, catering to consumers seeking enhanced functionality and personalization. Additionally, aftermarket systems can be more cost-effective compared to OEM options, making them an attractive choice for budget-conscious consumers or those looking for specific features at a lower price point.

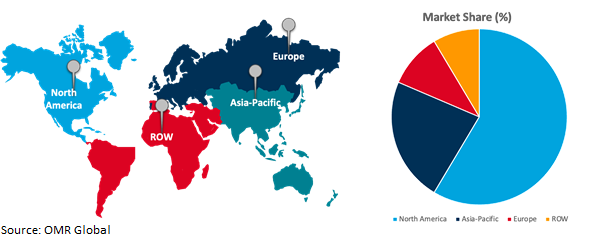

Regional Outlook

The global car audio video navigation market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Countries to Invest in Audio-Video Navigation

Asia-Pacific countries are attractive investment destinations for the global car audio-video navigation due to factors such as rapid urbanization and a growing middle class have led to increased demand for vehicles equipped with advanced navigation and entertainment systems. Rising disposable incomes have made these technologies more accessible to a larger consumer base. Additionally, the region's increasing vehicle ownership rates and technological advancements contribute to a fertile market environment.

Global Car Audio Video Navigation Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a major market share in the global car audio-video navigation market due to a high level of consumer demand for advanced in-car entertainment and navigation systems, driven by a tech-savvy population and a strong automotive culture. Additionally, leading automotive manufacturers and technology companies in North America continually innovate and introduce cutting-edge navigation technologies, attracting consumers seeking the latest features and functionalities.

Additionally, the region's robust infrastructure and extensive road networks make navigation systems a necessity for efficient travel, further driving market growth also the favorable economic conditions and higher purchasing power in North America allow consumers to invest in premium car audio-video navigation systems, contributing to the region's dominant market share. For instance, in March 2023, Alps Alpine North America, Inc. (“Alpine”) shipped the Next-Generation R-Series R2-A60F 4-Channel Amplifier that has features such as Hi-Res Audio Certified and canreproduce up to 40kHz frequency response for music that is closer to the original source and also features Alpine’s Class D Amplifier circuit that will provide 100W x 4 @ 4? or 150W x 4 @ 2?.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Car Audio Video Navigationmarket includeDenso CORP., Continental AG, Robert Bosch GmbH, Aisin, HARMAN International and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2023, AISIN Collaborated with Toyota to empower advanced Cloud-Based Navigation that will have user-friendly featuresand many advantages over previous generations of in-vehicle navigation, ranging from more up-to-date maps/traffic information to faster processing speeds.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global car audio video navigation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Continental AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Denso Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robert Bosch GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Car Audio Video Navigation Market by Operating System

4.1.1. Android

4.1.2. Linux

4.1.3. QNX

4.1.4. Windows

4.2. Global Car Audio Video Navigation Market by Sales

4.2.1. OEM

4.2.2. Aftermarket

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADAYO (Huizhou Foryou General Electronics Co. Ltd.)

6.2. Aisin Corp.

6.3. Alpine

6.4. Clarion (Faurecia Clarion Electronics)

6.5. Desay SV

6.6. FlyAudio

6.7. Fujitsu Ltd.

6.8. Garmin Ltd.

6.9. Hangsheng (Hangsheng Electronics Co., Ltd.)

6.10. Harman (HARMAN International)

6.11. Kenwood (JVCKENWOOD Group)

6.12. Mitsubishi Electric Corp.

6.13. Panasonic Holdings Corp.

6.14. Pioneer (Pioneer India Electronics Private Ltd.)

6.15. Roadrover (Shenzhen RoadRover Technology Co., Ltd.)

6.16. Skypine (SKYPINE Electronics(ShenZhen) Co., Ltd.)

6.17. Sony Corp.

6.18. Visteon Corp.

1. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

2. GLOBAL ANDROID CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL LINUX CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL QNX CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL WINDOWS CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY SALES, 2023-2031 ($ MILLION)

7. GLOBAL CAR AUDIO VIDEO NAVIGATION FOR OEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALCAR AUDIO VIDEO NAVIGATION FOR AFTERMARKET MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

12. NORTH AMERICAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY SALES, 2023-2031 ($ MILLION)

13. EUROPEAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

15. EUROPEAN CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY SALES, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFICCAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

18. ASIA-PACIFICCAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY SALES, 2023-2031 ($ MILLION)

19. REST OF THE WORLD CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY OPERATING SYSTEM, 2023-2031 ($ MILLION)

21. REST OF THE WORLD CAR AUDIO VIDEO NAVIGATION MARKET RESEARCH AND ANALYSIS BY SALES, 2023-2031 ($ MILLION)

1. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKETSHARE BY OPERATING SYSTEM, 2023 VS 2031 (%)

2. GLOBAL ANDROIDCAR AUDIO VIDEO NAVIGATION MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL LINUXCAR AUDIO VIDEO NAVIGATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL QNXCAR AUDIO VIDEO NAVIGATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL WINDOWS CAR AUDIO VIDEO NAVIGATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKET SHAREBY SALES, 2023 VS 2031 (%)

7. GLOBAL CAR AUDIO VIDEO NAVIGATION FOR OEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBALCAR AUDIO VIDEO NAVIGATION FOR AFTERMARKET MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CAR AUDIO VIDEO NAVIGATION MARKETSHARE BY REGION, 2023 VS 2031 (%)

10. US CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

12. UK CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA CAR AUDIO VIDEO NAVIGATION MARKET SIZE, 2023-2031 ($ MILLION)