Carbon Fiber Market

Global Carbon Fiber Market Size, Share & Trends Analysis Report by Raw Material (Polyacrylonitrile (PAN), and Petroleum Pitch & Rayon), By Fiber Type (Virgin Carbon Fiber, and Recycled Carbon Fiber), By Industry Vertical (Aerospace and Defense, Automotive, Construction Infrastructure, and Others) and Forecast 2019-2025

The global carbon fiber market is estimated to grow at a CAGR of over 11% during the forecast period. Carbo fibers are promising materials for use in high-temperature structural applications. This class of materials offers high strength to density ratios. This benefit leads to simpler component designs and weight savings. These properties of carbon fiber are a prime factor that has increased its adoption rate in the recent past.

Carbon fibers are widely used in the aerospace & defense industry, automotive industry, construction infrastructure industry, and many others as a whole or as composites with other materials. The carbon fiber composites possess high porosity that makes it an ideal solution for electric insulations. In the case of carbide, oxide, and glass matrix carbon fiber composites, the matrix exhibits excellent high-temperature corrosion resistance. This feature makes it suitable for high-temperature structural applications, which include turbine airfoils and hypersonic thermal protection systems.

Segmental Outlook

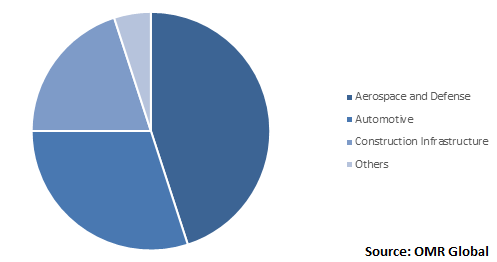

The global carbon fiber market is segmented on the basis of raw material, fiber type, industry vertical, and region. On the basis of raw material, the market is sub-segmented into PAN and petroleum pitch & rayon. Based on the fiber type, the market is classified into virgin carbon fiber and recycled carbon fiber. Based on the industry verticals, the market is classified into aerospace & defense, automotive, construction infrastructure, and others such as sporting goods.

Global Carbon Fiber Market Share by Industry Verticals, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global carbon fiber market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Kureha Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Nippon Carbon Co. Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Solvay SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Toray Industries Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Hexcel Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Carbon Fiber Market by Raw Material

5.1.1. Polyacrylonitrile (PAN)

5.1.2. Petroleum Pitch & Rayon

5.2. Global Carbon Fiber Market by Fiber Type

5.2.1. Virgin Carbon Fiber

5.2.2. Recycled Carbon Fiber

5.3. Global Carbon Fiber Market by Industry Verticals

5.3.1. Aerospace & Defense

5.3.2. Automotive

5.3.3. Construction Infrastructure

5.3.4. Others (Sporting Goods)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. DowAksa Advanced Composites Holdings BV

7.2. ELG Carbon Fibre Ltd.

7.3. Formosa Plastics Corp.

7.4. Hexcel Corp.

7.5. Hyosung Corp.

7.6. JEC Group (Jiangsu Hengshen Co. Ltd.)

7.7. Kureha Corp.

7.8. Mitsubishi Chemical Carbon Fiber and Composites Inc.

7.9. Muhr und Bender KG

7.10. Nippon Carbon Co. Ltd.

7.11. Osaka Gas Chemicals Co., Ltd.

7.12. RTP Co.

7.13. SGL Carbon SE

7.14. Solvay SA

7.15. Taekwang Industrial Co. Ltd.

7.16. Teijin Ltd.

7.17. Toray Industries Inc.

7.18. UMATEX, ROSATOM State Corp.

7.19. Weihai Guangwei Composites Co. Ltd.

7.20. Zhongfu Shenying Carbon Fiber Co. Ltd.

- GLOBAL CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

- GLOBAL PAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL PETROLEUM PITCH & RAYON CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2018-2025 ($ MILLION)

- GLOBAL VIRGIN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL RECYCLED CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICALS, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER IN AEROSPACE & DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER IN CONSTRUCTION INFRASTRUCTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER IN OTHER INDUSTRY VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

- NORTH AMERICAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

- EUROPEAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

- EUROPEAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2018-2025 ($ MILLION)

- EUROPEAN CARBON FIBER MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

- ASIA-PACIFIC CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

- ASIA-PACIFIC CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC CARBON FIBER MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

- REST OF THE WORLD CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2018-2025 ($ MILLION)

- REST OF THE WORLD CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD CARBON FIBER MARKET RESEARCH AND ANALYSIS BY INDUSTRY VERTICAL, 2018-2025 ($ MILLION)

- GLOBAL CARBON FIBER MARKET SHARE BY RAW MATERIAL, 2018 VS 2025 (%)

- GLOBAL CARBON FIBER MARKET SHARE BY FIBER TYPE, 2018 VS 2025 (%)

- GLOBAL CARBON FIBER MARKET SHARE BY INDUSTRY VERTICAL, 2018 VS 2025 (%)

- GLOBAL CARBON FIBER MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- UK CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- ROE CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD CARBON FIBER MARKET SIZE, 2018-2025 ($ MILLION)