Carotenoids Market

Carotenoids Market Size, Share & Trends Analysis Report, By Product (Astaxanthin, Capsanthin, Lutein, Beta-carotene, Lycopene, and others), By Source (Synthetic and Natural), By Application (Nutraceutical, Pharmaceutical, Poultry Feed, Human Food, and Others) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global carotenoids market is expected to grow at a CAGR of 3.0% during the forecast period. The possesses huge potential as carotenoids are an essential antioxidant that plays a crucial role in human health. These are potent antioxidants that can help prevent some forms of cancer and heart disease and supports to enhance the immune response to infections. Most common carotenoids include astaxanthin, beta carotene, lutein, zeaxanthin, and lycopene. Certain carotenoids can be converted into vitamin A, such as ?-Carotene and ?-carotene, which is important for human growth, eye health, and immune system function. Due to these advantages, carotenoids are significantly used in nutraceutical, pharmaceutical, and human food. Carotenoid-rich foods can prevent the growth of cancerous cells and protect healthy cells in the eye. There are some factors primarily boosting the growth of the market, which includes rising demand for natural colorants and a significant rise in the awareness regarding the health benefits of carotenoids.

In addition, the rising demand for dietary supplements is further encouraging the growth of the global carotenoids market. For instance, as per Council for Responsible Nutrition (CRN), 78% of the US adults aged more than 55 take dietary supplements, followed by those aged 35–54 (77%) and 18–34 (69%). This rise in the demand for dietary supplements tends to drive the demand for carotenoids. Carotenoids are highly soluble in fat and highly insoluble in water. They circulate in lipoproteins, along with cholesterol and other fats. The most commonly used carotenoids in the human diet include astaxanthin, ?-carotene, zeaxanthin, lutein, and lycopene. As a result, these carotenoids are used in dietary supplements as a nutritional component to fulfill the everyday requirement of nutrition or reduce the risk of medical conditions, such as hypertension and cancer. However, stringent government regulations are a major factor that is restricting market growth.

Segment Outlook

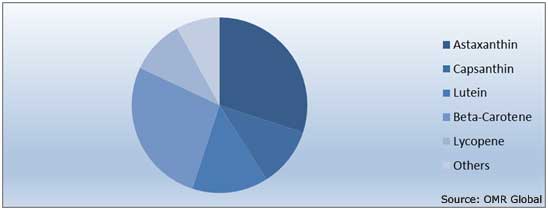

The global carotenoids market is segmented on the basis of product and application. Based on the product, the market is segmented into astaxanthin, capsanthin, lutein, beta-carotene, lycopene, and others. Based on the source, the market is bifurcated into synthetic carotenoids and natural carotenoids. Based on application, the market is segmented into nutraceutical, pharmaceutical, poultry feed, human food, and others.

Global Carotenoids Market: By Product Analysis

Astaxanthin accounted for a considerable market share in 2018. It is a major source of dietary supplement in humans and animals. As per National Center for Biotechnology Information (NCBI), astaxanthin has terminal carbonyl group that is conjugated to a polyene backbone and are more potent antioxidants and scavengers of free radicals than carotene carotenoids such as ?-carotene. Due to this, dietary supplements with astaxanthin has significant potential to offer antioxidant protection of cells and from atherosclerotic CVD. In addition, it is being associated with improved blood flow and lowering oxidative stress in overweight people and smokers and can be beneficial for people suffering from cancer. Astaxanthin is safe, with no side effects when it is consumed with food. Due to such health benefits, astaxanthin is being significantly adopted carotenoid in human food, nutritional supplements, and animal feed.

Global Carotenoids Market Share by Product, 2018 (%)

Regional Outlook

Geographically, the global carotenoids market is further segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. Rising adoption of nutritional supplements and increasing health awareness among the population are encouraging the market growth in these regions. Furthermore, a significant rise in the animal feed industry is further encouraging the growth of the market.

Global Carotenoids Market Growth by Region, 2019-2025

Asia-Pacific is Estimated to Witness Lucrative Growth in the Market During the Forecast Period

Asia-Pacific is anticipated to witness significant growth in the market owing to rising per capita income coupled with rising demand for dietary supplements in the region. For instance, as per the National Informatics Center (NIC), Per Capita Net National Income was estimated at nearly $1,590 and $1,726 for 2016-17 and 2017-18, respectively. Due to this significant rise in per capita income, the adoption of dietary supplements is on a continuous rise in the country. Additionally, the Indian population is getting aware of their fundamental needs for nutrition. As a result, proactive steps have been taken by the people to take steps to prevent chronic ailments. India is a country with a large number of younger people shifting towards an active lifestyle to prevent diabetes, CVD, and obesity problems. This, in turn, is increasing the demand for dietary supplements in India and thereby, encouraging the market growth in the region.

Competitive Landscape

The major players in the market include BASF SE, Koninklijke DSM N.V., Chr. Hansen Holding A/S, and Kemin Industries, Inc. The growing awareness regarding the benefits of carotenoids and shift towards a healthy lifestyle are encouraging food, animal feed and nutritional supplements producers to use carotenoids to meet the appropriate nutrition in their products. The carotenoids manufacturers are focusing on expanding their carotenoids products to gain a competitive advantage over their competitors.

Recent Developments

- In March 2019, Kemin Industries, Inc. introduced Organic KEM GLO to its comprehensive line of carotenoids for North American Egg Producers. Organic KEM GLO is a USDA-certified organic additive that enables organic egg producers to intensify the color of egg yolks. Organic KEM GLO harnesses the natural characteristics of paprika to uniformly distribute color throughout the feed, delivering consistent egg color pigmentation and density. With the addition of Organic KEM GLO, the company will be able to reach producers with more high-quality options of carotenoids that fulfill both their consumers’ demand and operational needs.

- In August 2018, BASF Animal Nutrition introduced Lucantin NXT product line in the EU 28 market. The next generation of carotenoids is stabilized by propyl gallate (PG) and butylhydroxytoluene (BHT) or tocopherol. The introduction in other countries will gradually follow. Lucantin NXT products offer outstanding stability, longer shelf life, and high homogeneity, while maintaining the efficacy of egg yolk and broiler skin coloring. With the growing demand for animal nutrition, the adoption of Lucantin NXT products is estimated to grow significantly.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global carotenoids market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Koninklijke DSM N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Chr. Hansen Holding A/S

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Kemin Industries, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Recent Developments

3.3.4.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Carotenoids Market by Product

5.1.1. Astaxanthin

5.1.2. Lutein

5.1.3. Capsanthin

5.1.4. Beta-Carotene

5.1.5. Lycopene

5.1.6. Others

5.2. Global Carotenoids Market by Source

5.2.1. Natural

5.2.2. Synthetic

5.3. Global Carotenoids Market by Application

5.3.1. Nutraceutical

5.3.2. Pharmaceutical

5.3.3. Poultry Feed

5.3.4. Human Food

5.3.5. Others (Cosmetics)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allied Biotech Corp.

7.2. BASF SE

7.3. BioExtract

7.4. Carotec, Inc.

7.5. Chenguang Biotech Group Co., Ltd.

7.6. Chr. Hansen Holding A/S

7.7. Cyanotech Corp.

7.8. DDW The Color House

7.9. ExcelVite Sdn. Bhd.

7.10. FMC Corp.

7.11. Fuji Chemical Industries Co., Ltd.

7.12. Kemin Industries, Inc.

7.13. Koninklijke DSM N.V.

7.14. Novus International, Inc.

7.15. NOW Health Group, Inc.

7.16. Sensient Technologies Corp.

7.17. Valensa International

7.18. Vidya Herbs Pvt Ltd.

7.19. Vinayak Ingredients India Pvt Ltd.

7.20. Yigeda Bio-Technology Co., Ltd.

1. GLOBAL CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL ASTAXANTHIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL LUTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CAPSANTHIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025($ MILLION)

5. GLOBAL BETA-CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025($ MILLION)

6. GLOBAL LYCOPENE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025($ MILLION)

7. GLOBAL OTHER CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2018-2025 ($ MILLION)

9. GLOBAL NATURAL CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL SYNTHETIC CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. GLOBAL CAROTENOIDS IN NUTRACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL CAROTENOIDS IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL CAROTENOIDS IN POULTRY FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025

15. GLOBAL CAROTENOIDS IN HUMAN FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025

16. GLOBAL CAROTENOIDS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025

17. NORTH AMERICA CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICA CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

19. NORTH AMERICA CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2018-2025 ($ MILLION)

20. NORTH AMERICA CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

21. NORTH AMERICA CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

23. EUROPEAN CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2018-2025 ($ MILLION)

24. EUROPEAN CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

25. EUROPEAN CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

29. REST OF THE WORLD CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025($ MILLION)

30. REST OF THE WORLD CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY SOURCE, 2018-2025($ MILLION)

31. REST OF THE WORLD CAROTENOIDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025($ MILLION)

1. GLOBAL CAROTENOIDS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL CAROTENOIDS MARKET SHARE BY SOURCE, 2018 VS 2025 (%)

3. GLOBAL CAROTENOIDS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL CAROTENOIDS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD CAROTENOIDS MARKET SIZE, 2018-2025 ($ MILLION)