Citric Acid Market

Global Citric Acid Market Size, Share & Trends Analysis Report By Form (Liquid, and Anhydrous), By Application (Food and Beverage, Pharmaceutical, Personal Care, and Others) Forecast Period 2022-2028

The global market for citric acid is projected to have a considerable CAGR of around 4.5% during the forecast period. Citric acid is a weak and highly soluble organic acid found mostly in citrus fruits such as lemons. It is a natural preservative due to its ability to inhibit bacterial growth in foods. Citric acid is most commonly used as a chelating, a flavouring, and an acidifying agent. Citric acid's market continues to expand, owing to the ingredient's growing use as a preservative, acidulant, binding and buffering agent, an antioxidant in both food and non-food applications. Citric acid is also increasingly finding use as a cleaning agent after the ban imposed on phosphates in several regions. Citric acid-based products are being introduced into a variety of market segments, including confectionery, diabetic baked goods, ice creams, low-calorie jellies, low-calorie sugar, nutritional beverages and snacks, and low-fat dairy products. The increased demand for these products is likely to boost consumer demand.

Impact of COVID-19 on Citric acid market

The COVID-19 pandemic has had a positive impact on the market. The COVID-19 pandemic caused a supply-demand mismatch, and people all over the world continued to stockpile food supplies to preserve them, with citric acid playing a key part. As a result, citric acid was in high demand during the COVID-19 pandemic.

Segmental Outlook

The global citric acid market is segmented based on form, and applications. Based on the form, the market is further classified into liquid, and anhydrous. Further, based on the application the market is classified into food and beverage, pharmaceutical, personal care, and other applications.

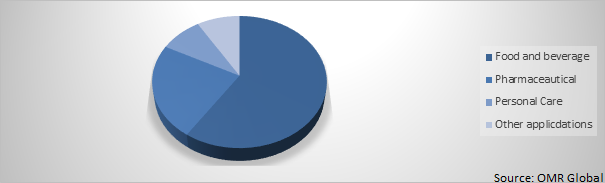

Global Citric Acid Market Share by Application, 2021(%)

The Food And Beverage Segment Dominated the Global Citric Acid Market.

Among applications, the food and beverage dominate the market in 2021, and it is estimated to be on dominating position during the forecast period owing to factors such as rising demands from RTD beverages and RTE foods. Citric acid outperforms phosphoric, tartaric, and lactic acids in terms of shelf-life extension, pH buffering, and flavours and tartness. The robust demands for ready-to-drink (RTD) healthy beverages and soft drinks are facilitating the usage of citric acid. Citric acid is also commonly used to impart foods and beverages a pleasant, acidic flavour. It's also used as a pH adjuster in the production of gelatine sweets, jellies, and jams, among other things. Fruits, berries, and other ingredients used in the production of foods and candies benefit from it as flavours enhancers. As a result, factors such as these are propelling the segment's growth.

Regional Outlook

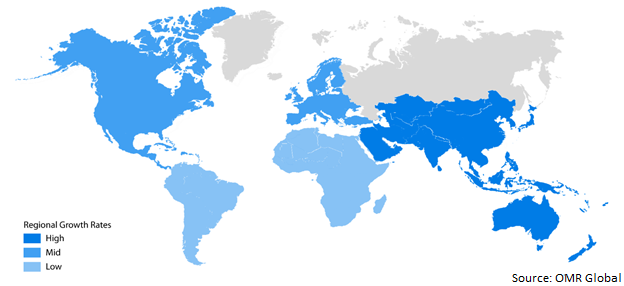

Geographically, the global citric acid market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant CAGR in the Citric acid market. Over the forecast period, the Chinese citric acid market is expected to develop at the fastest rate in the Asia Pacific. Factors such as the growing geriatric population and the prevalence of lifestyle disorders such as cardiovascular disease, mental health challenges, and gut health-related issues are driving the market.

Global Citric acid Market Growth, by region 2022-2028

Europe to hold a Considerable Share in the Global Citric Acid Market

Geographically, Europe is projected to hold a significant CAGR global Citric acid market. The factors that are contributing to the growth of the market include increasing demand for citric acid across European countries such as Germany and the UK. Citric acid is in high demand among German food and pharmaceutical producers due to its low toxicity when compared to other acidulants used mostly in the pharmaceutical and food industries. Citric acid is occasionally added to Belgian-style witbier by craft brewers, and it is projected to increase demand for citric acid in the food and beverage industry in the UK and throughout Europe.

Market Players Outlook

The key players in the Citric acid market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include - Jungbunzlauer Suisse AG, Cofco Biochemical, Archer Daniels Midland Co, Cargill, Inc, Gadot Biochemical Industries Ltd. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In May 2019, Gadot Biochemical expands the magnesium citrate product line. The use of magnesium, especially magnesium citrate, is rapidly growing, which has prompted Israel-based Gadot Biochemical Industries to expand its product line of magnesium citrates for food and beverage manufacturing. Gadot developed and expanded its product line of magnesium citrates for food and beverage fortification in response to a growing awareness of the need for increased magnesium consumption to maintain good health, especially sports activities.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Citric acid market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Citric acid Industry

• Recovery Scenario of Global Citric acid Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Citric acid Market by Form

5.1.1. Liquid

5.1.2. Anhydrous

5.2. Global Citric acid Market by Application

5.2.1. Food and beverage

5.2.2. Pharmaceutical

5.2.3. Personal Care

5.2.4. Other (Household Detergents and Cleaners)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Archer Daniels Midland (ADM) Company

7.2. Cargill, Inc

7.3. Cofco Biochemical

7.4. Foodchem International Corporation

7.5. Gadot Biochemical Industries

7.6. Hawkins Pharmaceutical Group

7.7. Huangshi Xinghua Biochemical Co. Ltd.

7.8. Jungbunzlauer Suisse AG

7.9. Kenko Corp

7.10. Merck KGaA

7.11. Metagenics

7.12. MP Biomedicals, Inc

7.13. Pfizer, Inc.

7.14. Posy Pharmachem Pvt Ltd

7.15. RZBC Group Co. Ltd.

7.16. S.A. Citrique Belge N.V.

7.17. Saudi Bio-Acids Company

7.18. Tate & Lyle plc

7.19. TTCA Co., Ltd

7.20. Ensign Industry Co., Ltd.

1. GLOBAL CITRIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

2. GLOBAL LIQUID CITRIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ANHYDROUS CITRIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CITRIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL CITRIC ACID IN FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CITRIC ACID IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CITRIC ACID IN PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CITRIC ACID IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CITRIC ACID MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

12. NORTH AMERICAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

15. EUROPEAN CITRIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC CITRIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC CITRIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC CITRIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD CITRIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

20. REST OF THE WORLD CITRIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL CITRIC ACID MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL CITRIC ACID MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL CITRIC ACID MARKET, 2021-2028 (%)

4. GLOBAL CITRIC ACID MARKET SHARE BY FORM, 2020 VS 2027 (%)

5. GLOBAL CITRIC ACID MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL CITRIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL LIQUID CITRIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL ANHYDROUS CITRIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL CITRIC ACID IN FOOD AND BEVERAGES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL CITRIC ACID IN PHARMACEUTICAL MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL CITRIC ACID IN PERSONAL CARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL CITRIC ACID IN OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. US CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

15. UK CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

20. ROE CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

24. ASEAN CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD CITRIC ACID MARKET SIZE, 2021-2028 ($ MILLION)