Clean Label Ingredients Market

Clean Label Ingredients Market Size, Share & Trends Analysis Report by Type (Natural Colors, Natural Flavors, Starch & Sweetener, Preservatives, and Others), by Form (Dry and Liquid), and by Application (Food and Beverages) Forecast Period (2022-2028)

clean label ingredients market is anticipated to grow at a significant CAGR of 6.7% during the forecast period. The rising government participation in clean label ingredients is expected to accelerate the market growth during the forecast period. For instance, in December 2021, Environmental Protection Agency Region 5 announced the partnership with the Shakopee Mdewakanton Sioux Community to release a new video that describes how you can protect your family and the environment by looking for cleaning products with safer ingredients – such as products with the Safer Choice label. Moreover, in August 2021, EPA added 36 chemicals to the Safer Chemical Ingredients List (SCIL).

Furthermore, the COVID-19 pandemic impacted consumer behavior and is also helping to expand the definition of clean label. Consumers are more focused on personal health and are trying to consume natural and clean-label products which had impacted the market positively.

Segmental Outlook

The global clean label ingredients market is segmented based on the type, form, and Application. Based on the type, the market is augmented into natural colors, natural flavors, starch & sweetener, preservatives, and others. Based on the form, the market is sub-segmented into dry and liquid. Based on the application, the market is bifurcated into food and beverages. The natural flavors and colors segment is expected to provide lucrative growth to the market due to the increasing demand for naturally derived ingredients. For instance, according to the International Food Technologists (IFT), 19% of US consumers in 2018 said the phrase “no artificial colors/ flavors” influences their purchase decision when buying foods and beverages.

The Food Segment is Expected to Hold a Remarkable Share in the Global Clean Label Ingredients Market

Among the application segment, the food segment is expected to hold a remarkable share in the market during the forecast period, owing to the increasing demand for organic food coupled with the rising awareness of the side effects of artificial ingredients among consumers. Organic foods often have more beneficial nutrients, such as antioxidants, than their conventionally-grown counterparts and people with allergies to foods, chemicals, or preservatives may find their symptoms lessen.

Regional Outlooks

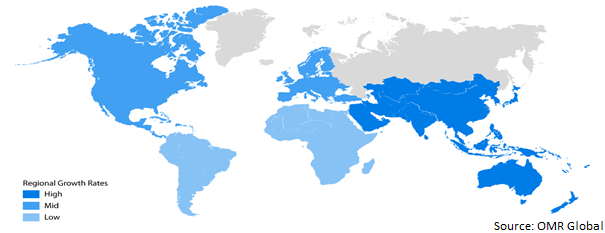

The global clean label ingredients market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Europe region is expected to hold a considerable share in the market over the forecast period. The growing spending abilities of consumers along with increasing consumer awareness of the negative effects of artificial colors are propelling the growth of the clean label ingredients market.

Global Clean Label Ingredients Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Significant Share in the Global Clean Label Ingredients Market

Among all regions, the Asia-Pacific region is expected to hold a significant market share due to the growing consumer preference for natural ingredients-based products. To gain the consumer’s trust and make sure the product is based on natural ingredients, the companies are launching a traceability tool, where consumers can trace their products by entering the product name and batch code to see the entire journey of the product down to the ingredient level. For instance, in May 2021, iTradeNetwork added new capabilities that instantly identify specific recalled products and simultaneously notify suppliers and buyers. These traceability tools help remove recalled products from the supply chain more quickly, whether they are en route from supplier to buyer, at a distribution center, or at the final point of sale/ consumption. These functions are unique in the industry and built on the strength of iTrade Network's 8,000 customers and integrated FDA/CDC alerts.

Moreover, according to the US Department of Agriculture, about 48 million episodes of foodborne illness and 3,000 deaths occur per year in the US. The most common foodborne pathogens cause an estimated annual burden of $14 billion to $36 billion.

Market Players Outlook

The major companies serving the global clean label ingredients market include Archer-Daniels-Midland Co., Brisan Group, Cargill, Inc., Chr. Hansen A/S, Corbion N.V., DuPont de Nemours, Inc., Ingredion Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2022, Ingredion launched the two functional native rice starches specifically to improve color and flavor release. The company stated that it enables natural flavors and color applications to shine through, even in white products. Moreover, Ingredion said the new starches also improve its supply chain resiliency and reduce environmental impact.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global clean label ingredients market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Clean Label Ingredients Market by Type

4.1.1. Natural Colors

4.1.2. Natural Flavors

4.1.3. Starch & Sweeteners

4.1.4. Natural Preservatives

4.1.5. Others

4.2. Global Clean Label Ingredients Market by Form

4.2.1. Dry

4.2.2. Liquid

4.3. Global Clean Label Ingredients Market by Application

4.3.1. Food

4.3.2. Beverages

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Archer-Daniels-Midland Co.

6.2. Brisan Group

6.3. Cargill, Inc.

6.4. Chr. Hansen A/S

6.5. Corbion N.V.

6.6. DuPont de Nemours, Inc.

6.7. Ingredion Inc.

6.8. International Flavors & Fragrances Inc.

6.9. Kerry Group Plc

6.10. Koninklijke DSM N.V.

6.11. Limagrain

6.12. Sensient Technologies Corp.

6.13. Tale & Lyle Plc

1. GLOBAL CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL CLEAN LABEL INGREDIENTS BY NATURAL FLAVORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CLEAN LABEL INGREDIENTS BY NATURAL COLORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CLEAN LABEL INGREDIENTS BY STARCH & SWEETENERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL CLEAN LABEL INGREDIENTS BY NATURAL PRESERVATIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CLEAN LABEL INGREDIENTS BY OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

8. GLOBAL DRY-BASED CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL LIQUID-BASED CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

11. GLOBAL CLEAN LABEL INGREDIENTS FOR FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CLEAN LABEL INGREDIENTS FOR BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. NORTH AMERICAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

21. EUROPEAN CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. REST OF THE WORLD CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CLEAN LABEL INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL CLEAN LABEL INGREDIENTS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL CLEAN LABEL INGREDIENTS BY NATURAL COLOR MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL CLEAN LABEL INGREDIENTS BY NATURAL FLAVORS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL CLEAN LABEL INGREDIENTS BY STARCH & SWEETENERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL CLEAN LABEL INGREDIENTS BY PRESERVATIVES MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL CLEAN LABEL INGREDIENTS BY OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL CLEAN LABEL INGREDIENTS MARKET SHARE BY FORM, 2021 VS 2028 (%)

8. GLOBAL DRY-BASED CLEAN LABEL INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL LIQUID-BASED CLEAN LABEL INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL CLEAN LABEL INGREDIENTS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL CLEAN LABEL INGREDIENTS FOR FOOD MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL CLEAN LABEL INGREDIENTS FOR BEVERAGES MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL CLEAN LABEL INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. US CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

16. UK CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD CLEAN LABEL INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)