Coffee Pods and Capsules Market

Global Coffee Pods and Capsules Market Size, Share and Trends Analysis Report, By Type (Pods and Capsules), By Coffee Type (Decaffeinated and Caffeinated), By Distribution Channel (Online Retailing and Offline Retailing), Forecast Period (2022-2028)

The global coffee pods and capsules market is expected to grow at a CAGR of 6.5% during the forecast period. Coffee capsules and pods are pre-paCoffee capsules and pods are pre-packaged, measured doses of coffee that, once used and must be disposed of after use. In recent years, the demand for coffee pods and capsules among homeowners has significantly increased owing to the rising convenience and ease involved in brewing coffee through pods and capsules. Owing to the increasing demand for coffee capsules and pods to experience true flavors of coffee at home, the market players are focusing on introducing convenient and easy-to-use single-serve brewers for individual use. For instance, in 2021, Keurig Dr Pepper introduced Brew Over Ice K-Cup pods to provide convenient use to prepare iced coffee at home. The new line of K-Cup pods is particularly crafted to go perfectly with ice to deliver a café quality iced coffee in the comfort of home. The company launched the product in three flavours, such as Vanilla Caramel, Classic Black, and Hazelnut Cream. Moreover, the market has witnessed an increasing adoption of coffee capsules and pods among coffee producers owing to their suitability, comfort of use, and a wide range of coffee products and machinery.

Segmental Outlook

The global coffee pods and capsules market is segmented based on the type, coffee type, and distribution channel. Based on the type, the market is segmented into pods and capsules. Based on the coffee type, the market is segmented into decaffeinated and caffeinated. Further, based on the distribution channel, the market is categorized into online retailing and offline retailing.

Decaffeinated Segment To Witness Potential Share in the Global Coffee Pods and Capsules Market

The decaffeinated segment is anticipated to grow at the fastest CAGR during the forecast period owing to the changing preferences and increasing health concerns among consumers owing to which people are inclining toward limiting caffeine intake. FDA has cited 400 milligrams of coffee a day to limit caffeine consumption causing any negative effects on health. However, decaffeinated coffee is not completely caffeine free, however, it contains much less caffeine than the amount found in regular coffee. Caffeine quantity is removed from the beans before the process of roasting and grinding although the nutritional value of decaffeinated coffee is almost identical to regular coffee. Consumers are actively looking for caffeine-free coffee pods and capsules and moving towards caffeinated coffee alternatives. Therefore, the market players are introducing decaffeinated coffee capsules and pods that do not alter the coffee's natural quality. For instance, in January 2022, Peet's Coffee announced that the company has fully transitioned to water processing across its entire line of decaffeinated roasted beans, K-Cup pods, and handcrafted decaf coffee beverages. This process is chemical-free and naturally removes caffeine while ensuring the integrity, taste, and quality of the coffee beans for the finest drinking experience.

Regional Outlook

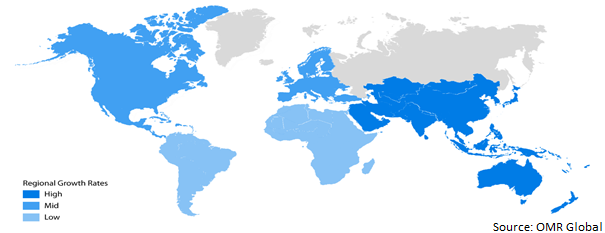

The global coffee pods and capsules market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The European region is expected to hold a prominent share in the global coffee pods and capsules market owing to the growing demand for specialty coffees and single-serve methods of brewing coffee in the region. The increasing consumption of coffee in countries such as UK, Germany, Italy and France is expected to drive the market growth in the region during the forecast period.

According to British Coffee Association, UK accounted for approximately 98 million cups of coffee per day and over 80% of UK households buy instant coffee for in-home consumption. This increasing demand for coffee in commercial use and household use is expected to rise at a considerably high rate in this region. Moreover, the high product and packaging innovations in the European region are likely to support the product demand in this region. For instance, in 2019, the Italian espresso giant, Lavazza launched its range of compostable one-cup pods to replace its entire range of aluminium capsules with new eco-friendly ones. Moreover, Nespresso launched more than 7,000 Collect Plus stores across the UK which offers a place for people to drop off recycling bags filled with used capsules.

Global Coffee Pods and Capsules Market Growth by Region, 2022-2028

Market Players Outlook

The major companies operating in the global coffee pods and capsules market include Keurig Dr Pepper Inc., Nespresso S.A., Nestle S.A., The J.M Smucker Co., and The Kraft Heinz Co. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, new product launches, and collaborations, to stay competitive in the market. For instance, in May 2020, Nespresso announced the launch of the first coffee capsules made using 80% recycled aluminum to minimize waste and maximize the reuse of product materials. The company further announced its plans to have the full Original Line and Vertuo ranges of coffee capsules made using recycled aluminum.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global coffee pods and capsules market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Coffee Pods and Capsules Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Keurig Dr Pepper Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Development

3.1.2. Nespresso S.A.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Development

3.1.3. Nestle S.A.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Development

3.1.4. The J.M Smucker Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Development

3.1.5. The Kraft Heinz Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Development

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Coffee Pods and Capsules Market by Type

4.1.1. Pods

4.1.2. Capsules

4.2. Global Coffee Pods and Capsules Market by Coffee Type

4.2.1. Decaffeinated

4.2.2. Caffeinated

4.3. Global Coffee Pods and Capsules Market by Distribution Channel

4.3.1. Offline Retailing

4.3.2. Online Retailing

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agostani SRL

6.2. Belmoca Belgium

6.3. CaffèBorbone S.r.l.

6.4. Coffeeza

6.5. DD IP Holder LLC (The J.M Smucker Co.)

6.6. Dualit Ltd.

6.7. GAMA FOODS LLC (Italia-Espresso)

6.8. illycaffè S.p.A.

6.9. Jacobs Douwe Egberts AU Pty Ltd.

6.10. LUIGI LAVAZZA S.p.A.

6.11. Melitta USA Inc.

6.12. MERAVALLEY

6.13. Rave Coffee

6.14. Senseo Coffee Pods

6.15. Starbucks Corp.

6.16. The Folger Coffee Co. (The J.M Smucker Co.)

6.17. Vittoria Food & Beverage Corp.

1. GLOBAL COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBALCOFFEE PODSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBALCOFFEE CAPSULESMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COFFEE TYPE, 2021-2028 ($ MILLION)

5. GLOBAL Decaffeinated COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBALCAFFEINATED COFFEE PODS AND CAPSULESMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

8. GLOBAL COFFEE PODS AND CAPSULES by OFFLINE RETAILING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBALCOFFEE PODS AND CAPSULES by ONLINE RETAILINGMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COFFEE TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

15. EUROPEAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COFFEE TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COFFEE TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

23. REST OF THE WORLD COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. REST OF THE WORLD COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY COFFEE TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD COFFEE PODS AND CAPSULES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. GLOBAL COFFEE PODS AND CAPSULES MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL COFFEEPODSMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL COFFEE CAPSULESMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL COFFEE PODS AND CAPSULES MARKET SHARE BY COFFEE TYPE, 2021 VS 2028 (%)

5. GLOBAL DECAFFEINATED COFFEE PODS AND CAPSULESMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL CAFFEINATED COFFEE PODS AND CAPSULES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL COFFEE PODS AND CAPSULES MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

8. GLOBAL COFFEE PODS AND CAPSULESbyOFFLINE RETAILINGMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL COFFEE PODS AND CAPSULESbyONLINE RETAILINGMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL COFFEE PODS AND CAPSULES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. US COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

12. CANADA COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

13. UK COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

14. FRANCE COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

15. GERMANY COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

16. ITALY COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

17. SPAIN COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

18. REST OF EUROPE COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

19. INDIA COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

20. CHINA COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

21. JAPAN COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

22. SOUTH KOREA COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF ASIA-PACIFIC COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF THE WORLD COFFEE PODS AND CAPSULES MARKET SIZE, 2021-2028 ($ MILLION)