Collision Avoidance Sensors Market

Collision Avoidance Sensors Market Size, Share & Trends Analysis Report by Technology (Radar, Camera, Ultrasound, and LiDAR), by Application (Adaptive Cruise Control (ACC), Blind Spot Detection (BSD), Forward Collision Warning System (FCWS), Lane Departure Warning System (LDWS), Parking Assistance, and Others), and by End-Use Industry (Automotive, Rail, Marine, Aerospace & Defence, and Others) Forecast Period (2022-2028)

Collision avoidance sensors market is anticipated to grow at a considerable CAGR of 11.5% during the forecast period. The major factor driving the demand for collision avoidance sensors includes the rising integration of technological advancements in sensor along with the rise in the adoption of collision avoidance sensors in various military equipment’s and other end-use industries. For instance, in June 2021, SMS Equipment Inc. collaborated with Wabtec to supply and support the Wabtec Collision Awareness System (CAS) for Canadian mining companies. The company has infrastructure and support capabilities within all major mining areas across Canada to promote improving safety. The Wabtec CAS system uses multiple GPS constellations to provide equipment operators with visual situational awareness of all the traffic around them and warning alarms of potential interactions with other vehicles. In addition, Wabtec CAS also includes redundant receivers, antenna, and continuous self-tests to increase the system's reliability.

Segmental Outlook

The global collision avoidance sensors market is segmented based on its technology, application, and end-use industry. Based on technology, the market is sub-segmented into radar, camera, ultrasound, and LiDAR. Based on the application, the market is categorized into adaptive cruise control (ACC), blind spot detection (BSD), forward collision warning system (FCWS), lane departure warning system (LDWS), parking assistance, and others. Further, based on the end-use industry, the market is sub-segmented into the automotive, rail, marine, aerospace & defense, and others. Among the application, the adaptive cruise control (ACC) sub-segment is anticipated to register significant growth during the forecast period.

Among the end-use industry, the automotive sub-segment is anticipated to register significant growth for the forecast period. The segmental growth includes the growing integration of advanced technologies in automotive and increasing adoption of collision avoidance technology for safety features among automotive industries. For instance, in January 2020, Airbus Helicopters selected the Lynx® Multilink Surveillance System from ACSS, an L3Harris Technologies and Thales Company, for its H135 and H145 platforms. Under the minimum five-year agreement, ACSS will develop and supply a modified version of its Lynx NGT-9000R+ with an integrated ADS-B, Traffic Collision Avoidance System (TCAS) specifically optimized for helicopters, providing advanced safety and situational awareness features.

Regional Outlooks

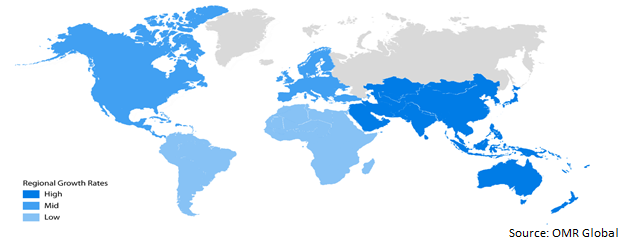

The global collision avoidance sensors market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, North America is expected to grow at a considerable CAGR over the forecast period. However, the Asia-Pacific region is anticipated to witness considerable growth in the collision avoidance sensors market.

Global Collision Avoidance Sensors Market Growth, by Region 2022-2028

The European Region is Expected to Hold a Prominent Share of the Global Collision Avoidance Sensors Market

Among these regions, the European region is anticipated to account for the prominent growth in market share over the forecast period. The growth is primarily driven by factors including the well-established automotive industry along with the rising launch of new and innovative solutions by market players. For instance, in July 2022, the Munich-based high-tech startup Toposens launched its first commercial Toposens 3D Collision Avoidance System for mobile robots based on the proprietary toposens 3D ultrasonic echolocation technology for the unmet demand for higher safety of mobile robots in industrial settings.

Market Players Outlook

The major companies serving the global collision avoidance sensors market include Robert Bosch GmbH, DENSO Corp, Aptiv Global Operations Ltd., Autoliv Inc., General Electric Company, Raytheon Technologies Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2021, DENSO Corp. partnered with the US-based LiDAR and perception systems company, Aeva, to develop next-generation sensing and perception systems. Both companies focus on developing a Frequency Modulated Continuous Wave (FMCW) LiDAR solution that measures velocity, depth, and reflectivity. LiDAR systems use the Time of Flight (TOF) method to operate. This method accurately detects the distance and direction of objects by emitting pulse laser beams and measuring the time taken to receive the beams reflected by the objects. It can detect the positions of objects around a vehicle with high resolution and is expected to provide high-performance detection.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global collision avoidance sensors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Collision Avoidance Sensors Market by Technology

4.1.1. Radar

4.1.2. Camera

4.1.3. Ultrasound

4.1.4. LiDAR

4.2. Global Collision Avoidance Sensors Market by Application

4.2.1. Adaptive Cruise Control (ACC)

4.2.2. Blind Spot Detection (BSD)

4.2.3. Forward Collision Warning System (FCWS)

4.2.4. Lane Departure Warning System (LDWS)

4.2.5. Parking Assistance

4.2.6. Others

4.3. Global Collision Avoidance Sensors Market by End-Use Industry

4.3.1. Automotive

4.3.2. Rail

4.3.3. Marine

4.3.4. Aerospace & Defence

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Robert Bosch GmbH

6.2. DENSO Corp

6.3. Aptiv Global Operations Ltd.

6.4. Autoliv Inc.

6.5. General Electric Co.

6.6. Raytheon Technologies Corp.

6.7. Honeywell International Inc.

6.8. ALSTOM Holdings

6.9. Siemens AG

6.10. Mobileye Vision Technologies Ltd.

6.11. L3Harris Technologies, Inc. (ACSS, LLC)

6.12. SAAB AB

6.13. Backer Mining System AG

6.14. Hexagon AB

6.15. Wabtec Corp.

1. GLOBAL COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

2. GLOBAL COLLISION AVOIDANCE SENSORS IN RADAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COLLISION AVOIDANCE SENSORS IN CAMERA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL COLLISION AVOIDANCE SENSORS IN ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL COLLISION AVOIDANCE SENSORS IN LiDAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL COLLISION AVOIDANCE SENSORS FOR ADAPTIVE CRUISE CONTROL (ACC) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL COLLISION AVOIDANCE SENSORS FOR BLIND SPOT DETECTION (BSD) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL COLLISION AVOIDANCE SENSORS FOR FORWARD COLLISION WARNING SYSTEM (FCWS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL COLLISION AVOIDANCE SENSORS FOR LANE DEPARTURE WARNING SYSTEM (LDWS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL COLLISION AVOIDANCE SENSORS FOR FORWARD COLLISION WARNING SYSTEM (FCWS) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL COLLISION AVOIDANCE SENSORS FOR PARKING ASSISTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL COLLISION AVOIDANCE SENSORS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

15. GLOBAL COLLISION AVOIDANCE SENSORS FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL COLLISION AVOIDANCE SENSORS FOR RAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL COLLISION AVOIDANCE SENSORS FOR MARINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL COLLISION AVOIDANCE SENSORS FOR AEROSPACE & DEFENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL COLLISION AVOIDANCE SENSORS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. NORTH AMERICAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. NORTH AMERICAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

23. NORTH AMERICAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. NORTH AMERICAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

25. EUROPEAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

27. EUROPEAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. EUROPEAN COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

35. REST OF THE WORLD COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

36. REST OF THE WORLD COLLISION AVOIDANCE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2021-2028 ($ MILLION)

1. GLOBAL COLLISION AVOIDANCE SENSORS MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

2. GLOBAL COLLISION AVOIDANCE SENSORS IN RADAR MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL COLLISION AVOIDANCE SENSORS IN CAMERA MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL COLLISION AVOIDANCE SENSORS IN ULTRASOUND BY MARKET SHARE REGION, 2021 VS 2028 (%)

5. GLOBAL COLLISION AVOIDANCE SENSORS IN LiDAR BY MARKET SHARE REGION, 2021 VS 2028 (%)

6. GLOBAL COLLISION AVOIDANCE SENSORS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL COLLISION AVOIDANCE SENSORS FOR ADAPTIVE CRUISE CONTROL (ACC) MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL COLLISION AVOIDANCE SENSORS FOR BLIND SPOT DETECTION (BSD) MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL COLLISION AVOIDANCE SENSORS FOR FORWARD COLLISION WARNING SYSTEM (FCWS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL COLLISION AVOIDANCE SENSORS FOR LANE DEPARTURE WARNING SYSTEM (LDWS) MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL COLLISION AVOIDANCE SENSORS FOR PARKING ASSISTANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL COLLISION AVOIDANCE SENSORS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL COLLISION AVOIDANCE SENSORS MARKET SHARE BY END-USE INDUSTRY, 2021 VS 2028 (%)

14. GLOBAL COLLISION AVOIDANCE SENSORS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL COLLISION AVOIDANCE SENSORS FOR RAIL MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL COLLISION AVOIDANCE SENSORS FOR MARINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL COLLISION AVOIDANCE SENSORS FOR AEROSPACE & DEFENCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. GLOBAL COLLISION AVOIDANCE SENSORS FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

19. GLOBAL COLLISION AVOIDANCE SENSORS MARKET SHARE BY REGION, 2021 VS 2028 (%)

20. US COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

21. CANADA COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

22. UK COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

23. FRANCE COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

24. GERMANY COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

25. ITALY COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

26. SPAIN COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF EUROPE COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

28. INDIA COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

29. CHINA COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

30. JAPAN COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

31. SOUTH KOREA COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

32. REST OF ASIA-PACIFIC COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD COLLISION AVOIDANCE SENSORS MARKET SIZE, 2021-2028 ($ MILLION)