Connected Mining Market

Connected Mining Market Size, Share & Trends Analysis Report byType (Surface and Underground),bySolution (Asset Tracking and Optimization, Fleet Management, Industrial Safety and Security, Workforce Management, Analytics and Reporting, Process Control and Others (Operational performance, Quality optimization solutions), and by Application (Exploration, Processing & refining and Transportation)Forecast Period (2024-2031)

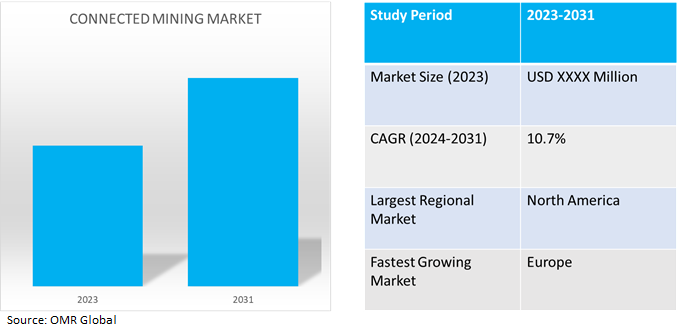

Connected mining market is anticipated to grow at a significant CAGR of 10.7% during the forecast period (2024-2031).The growth of the connected miningmarket is attributed to increasing investments in simulation technology and an increase in the use of the internet of things (IoT). Furthermore, connect mining is accelerated by the growing use of automation, data science, and artificial intelligence technologiesdriving the growth of the market.Connected mining solutions facilitate two-way communications for supervision and control, improve maintenance, and enable machine visibility. Utilizing information from stationary and mobile sensors concerning worker or staff position and environmental conditions enhances overall plant safety while providing vital cooperation and real-time actionable insight.

Market Dynamics

Increasing Adoption of Digital Twin Technology

Advances in technology have led to enhanced safety, operational efficacy, and maintenance protocols. Digital twins and simulation, which provide predictive maintenance and real-time network operation monitoring, are two revolutionary ideas. Using real-time data from sensors and Internet of Things (IoT) devices, the digital twin is an innovative technology that builds a virtual clone of a real-world system, process, or object. This gives mining professionals a comprehensive understanding of their assets and operations, empowering them to make informed decisions, strengthen safety procedures, increase operational effectiveness, and put proactive maintenance plans into place. A digital twin is a platform for other applications, including dashboard-based situational awareness, rather than an application that shows outcomes to users.

Data Analytics and Artificial Intelligence (AI)

The integration of advanced analytics and artificial intelligence into mining operations marks a transformative shift towards increased safety. These next-generation technologies are instrumental in removing human error, surfacing operational trends, and optimizing equipment maintenance.AI automates data mining and, as a result, reduces manual intervention and accelerates analysis. This frees up resources for other activities. Pattern recognition: AI algorithms, including machine learning and deep learning, recognize complex patterns and relationships within data.From exploration to extraction and processing, artificial intelligence can optimize the whole mining process. To identify the most likely locations for resource extraction, machine learning systems, for example, can evaluate geological data. Equipment for autonomous drilling and blasting can run continuously, boosting output.

Market Segmentation

Our in-depth analysis of the global connected mining market includes the following segments bytype, solution,and application.

- Based ontype, the market is sub-segmented intosurface and underground.

- Based on the solution, the market is sub-segmented into asset tracking and optimization, fleet management, industrial safety and security, workforce management, analytics and reporting, process control, and others (operational performance, quality optimization solutions).

- Based on application,the market is sub-segmented into exploration, processing & refining, and transportation.

Fleet Managementis Projected to Emerge as the Largest Segment

Among thesefleet management, the sub-segment is expected to hold the largest share of the market.The primary factors supporting the segment's growth include the increased demand for optimizing operations and enhancing safety to improve asset management and streamline workflows.Mining companies can monitor and manage their important assets, such as heavy machinery, vehicles, and equipment, in real time with the help of an efficient fleet management system. Businesses can ensure effective deployment, maximum utilization, and theft prevention by using GPS tracking technology to track the position, speed, and status of each asset. Timely decision-making, reduced downtime, and increased production are all made possible with real-time data.For instance, in December 2023, Komatsu acquired fleet management provider iVolve to increase its fleet management offerings for customers. iVolve is a technology company that provides fleet management solutions for small to mid-tier quarry, mining and construction operations.

Transportation Sub-segment to Hold a Considerable Market Share

Based ontheapplication,the global connected miningmarket is sub-segmented into exploration, processing & refining and transportation.Among these, the transportationsub-segment is expected to hold a considerable share of the market. The increasing demand for connected mine solutions in transport to utilize innovative digital technologies, such as data science and machine learning, data engineering, and artificial intelligence architecture, for intelligent asset management by connecting people, equipment, data, and insights across mine, process plant, and transportation. For instance, in November 2021, Newmont Corp. the gold mining company, announced a strategic alliance with Caterpillar Inc. (CAT), producer of the most comprehensive suite of mining equipment and technologies, to deliver a fully connected, automated, zero carbon emitting, end-to-end mining system for construction industries, resource industries, and energy & transportation – and providing financing and related services through our financial products segment.

Regional Outlook

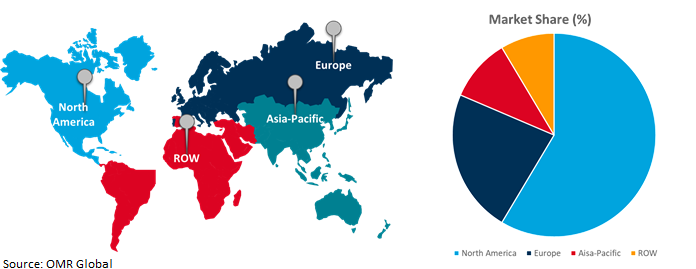

The globalconnected mining market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Connected Mining Adoptionin Europe

- In Europe, growing demand for data-driven insights across the entire mining value chainincluding pits, processing plants, ports, and transportation networks driving the growth of connected mining in the region.

- According to the European Commission (EC), in February 2024,The mining and quarrying sector in the EU generated €101.9 billion ($120.5 billion) of net turnover in 2021, an increase of almost 40.0% compared with the previous year.

Global Connected Mining Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and connected mining providers. The growth is attributed to the growing complexity and scale of mining operations resulting in the adoption of connected mining solutions for streamlined communication and cooperation. The Market player collaborated with the government for mining projects. For instance, in September 2023, DoD entered an agreement to expand domestic lithium mining for US battery supply chains. Through a $90.0 million investment in its manufacturing capability expansion and investment prioritization (MCEIP) office, entered an agreement with Albemarle Corporation to support the expansion of domestic mining and production of lithium.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global connected miningmarket includeHitachi Construction Machinery Co., Ltd., IBM Corp., SAP SE, Siemens AG, Telefonaktiebolaget LM Ericssonamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Albemarle Corp., in providing essential elements for mobility, energy, connectivity and health, collaborated with Caterpillar Inc. to support the full circular battery value chain and sustainable mining operations. The two companies will also explore opportunities to collaborate on research and development of battery cell technology and recycling techniques.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global connected mining market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Hitachi Construction Machinery Co., Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. IBM Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Telefonaktiebolaget LM Ericsson

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Connected Mining Market by Type

4.1.1. Surface

4.1.2. Underground

4.2. Global Connected Mining Market by Solution

4.2.1. Asset Tracking and Optimization

4.2.2. Fleet Management

4.2.3. Industrial Safety and Security

4.2.4. Workforce Management

4.2.5. Analytics and Reporting

4.2.6. Process Control

4.2.7. Others (Operational Performance, Quality Optimization Solutions)

4.3. Global Connected Mining Market by Application

4.3.1. Exploration

4.3.2. Processing & refining

4.3.3. Transportation

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABB Ltd.

6.2. Accenture plc

6.3. Advitech Pty Ltd.

6.4. Aspen Technology Inc.

6.5. AVEVA?Group Ltd.

6.6. Caterpillar Inc.

6.7. Cisco Systems, Inc.

6.8. Datamine Corp.

6.9. Dundee Precious Metals Inc.

6.10. Hexagon AB

6.11. IntelliSense.io Ltd.

6.12. Komatsu Ltd.

6.13. LTIMindtree Ltd.

6.14. Maptek Pty Ltd.

6.15. Micromine Pty Ltd.

6.16. Modular Mining Systems, Inc.

6.17. Motion Metrics International Corp.

6.18. RCT Global

6.19. Rockwell Automation, Inc.

6.20. Sandvik AB

6.21. SAP SE

6.22. Siemens AG

6.23. Trimble Inc.

6.24. Wenco International Mining Systems Ltd.

1. GLOBAL CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SURFACE CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL UNDERGROUND CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

5. GLOBAL CONNECTED MINING ASSET TRACKING AND OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CONNECTED MINING FLEET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CONNECTED MINING INDUSTRIAL SAFETY AND SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CONNECTED MINING WORKFORCE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONNECTED MINING ANALYTICS AND REPORTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONNECTED MINING PROCESS CONTROL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OTHER CONNECTED MINING SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. GLOBAL CONNECTED MINING FOR EXPLORATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CONNECTED MINING FOR PROCESSING & REFINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CONNECTED MINING FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. EUROPEAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

24. EUROPEAN CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD CONNECTED MINING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL CONNECTED MINING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL SURFACE CONNECTED MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL UNDERGROUND CONNECTED MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CONNECTED MINING MARKET SHARE BY SOLUTION, 2023 VS 2031 (%)

5. GLOBAL CONNECTED MINING ASSET TRACKING AND OPTIMIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CONNECTED MINING FLEET MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONNECTED MINING INDUSTRIAL SAFETY AND SECURITY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CONNECTED MINING WORKFORCE MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONNECTED MINING ANALYTICS AND REPORTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONNECTED MINING PROCESS CONTROL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL OTHER CONNECTED MINING SOLUTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CONNECTED MINING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

13. GLOBAL CONNECTED MINING FOR EXPLORATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CONNECTED MINING FOR PROCESSING & REFINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CONNECTED MINING FOR TRANSPORTATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

18. UK CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA CONNECTED MINING MARKET SIZE, 2023-2031 ($ MILLION)